- United Arab Emirates

- /

- Food

- /

- ADX:AGTHIA

3 Top Dividend Stocks Offering Yields Between 3% And 5%

Reviewed by Simply Wall St

As global markets show signs of resilience with U.S. indexes approaching record highs and positive sentiment driven by strong labor market reports, investors are increasingly seeking stable income sources amid geopolitical uncertainties and economic fluctuations. In this environment, dividend stocks offering yields between 3% and 5% can be attractive for those looking to balance growth potential with reliable income streams, especially as sectors like utilities gain attention due to rising demand for clean energy.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.56% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.67% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.38% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.10% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.90% | ★★★★★★ |

Click here to see the full list of 1978 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Agthia Group PJSC (ADX:AGTHIA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Agthia Group PJSC is a company that produces and sells food and beverage products in the United Arab Emirates and internationally, with a market cap of AED5.44 billion.

Operations: Agthia Group PJSC's revenue segments include AED1.45 billion from the Consumer Business Division (CBD) - Snacks, AED1.05 billion from CBD - Protein and FV, AED1.12 billion from CBD - Water and Food, and AED1.42 billion from the Agri Business Division (ABD) - Flour and Animal Feed.

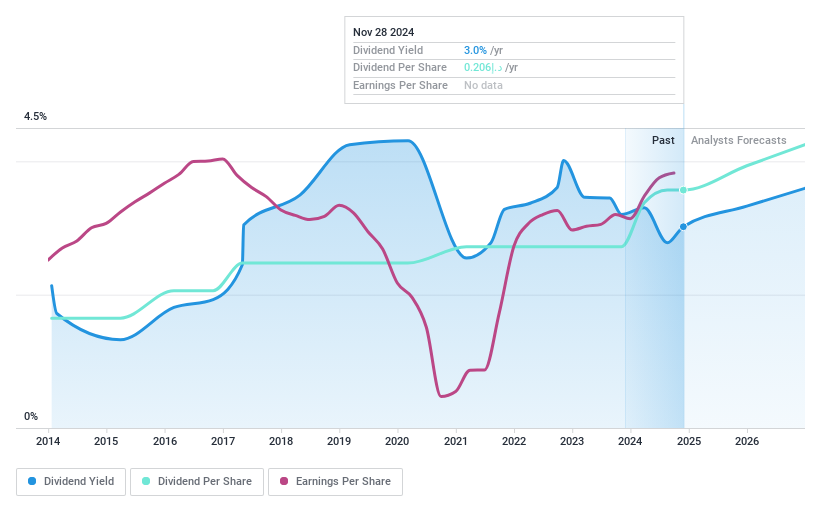

Dividend Yield: 3%

Agthia Group PJSC has demonstrated a stable and growing dividend profile, with dividends per share increasing over the past decade. The recent 25% year-on-year dividend increase aligns with its strong financial performance, as evidenced by rising sales and net income. With a payout ratio of 52.5% and cash payout ratio of 32.1%, dividends are well-covered by earnings and cash flows, though the yield remains below top-tier levels in the AE market at 3.02%.

- Click here to discover the nuances of Agthia Group PJSC with our detailed analytical dividend report.

- Our valuation report here indicates Agthia Group PJSC may be overvalued.

Lenovo Group (SEHK:992)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services with a market capitalization of approximately HK$112.76 billion.

Operations: Lenovo Group's revenue is primarily derived from its Intelligent Devices Group (IDG) at $47.76 billion, followed by the Solutions and Services Group (SSG) at $7.89 billion, and the Infrastructure Solutions Group (ISG) contributing $11.47 billion.

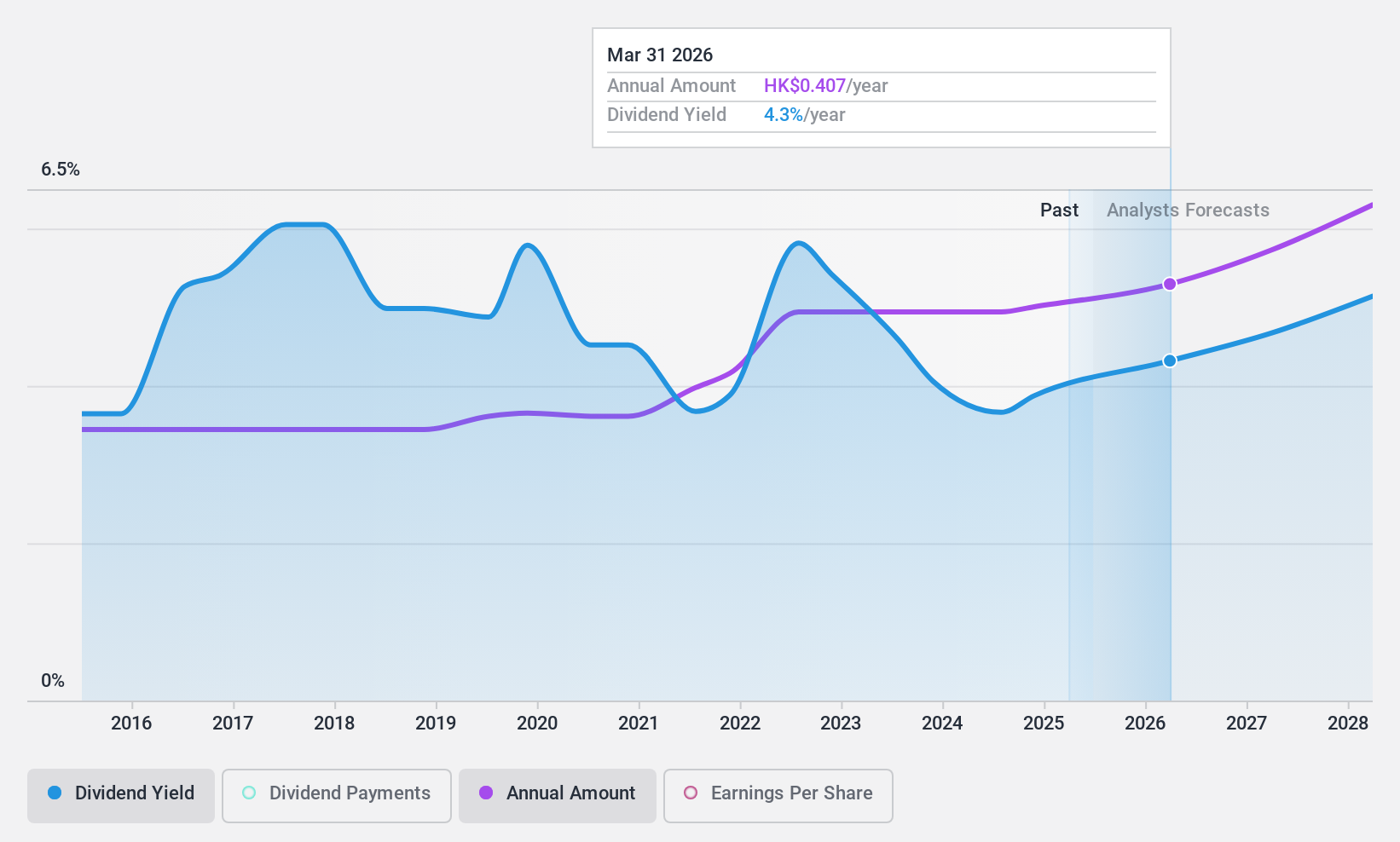

Dividend Yield: 4.1%

Lenovo Group offers a stable dividend yield of 4.13%, supported by a sustainable payout ratio of 50.6% from earnings and 40.2% from cash flows, indicating reliable coverage. Recent earnings growth of 21.5% enhances its ability to maintain dividends, while trading at an estimated 58.2% below fair value suggests good relative value for investors seeking income stability amidst potential stock price appreciation opportunities in the Hong Kong market.

- Click to explore a detailed breakdown of our findings in Lenovo Group's dividend report.

- The analysis detailed in our Lenovo Group valuation report hints at an deflated share price compared to its estimated value.

UT GroupLtd (TSE:2146)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UT Group Co., Ltd. operates in Japan, focusing on the dispatch and outsourcing of permanent employees across sectors such as manufacturing, design and development, and construction, with a market cap of ¥80.69 billion.

Operations: UT Group Co., Ltd. generates revenue through the provision of employee dispatch and outsourcing services in Japan's manufacturing, design and development, and construction industries.

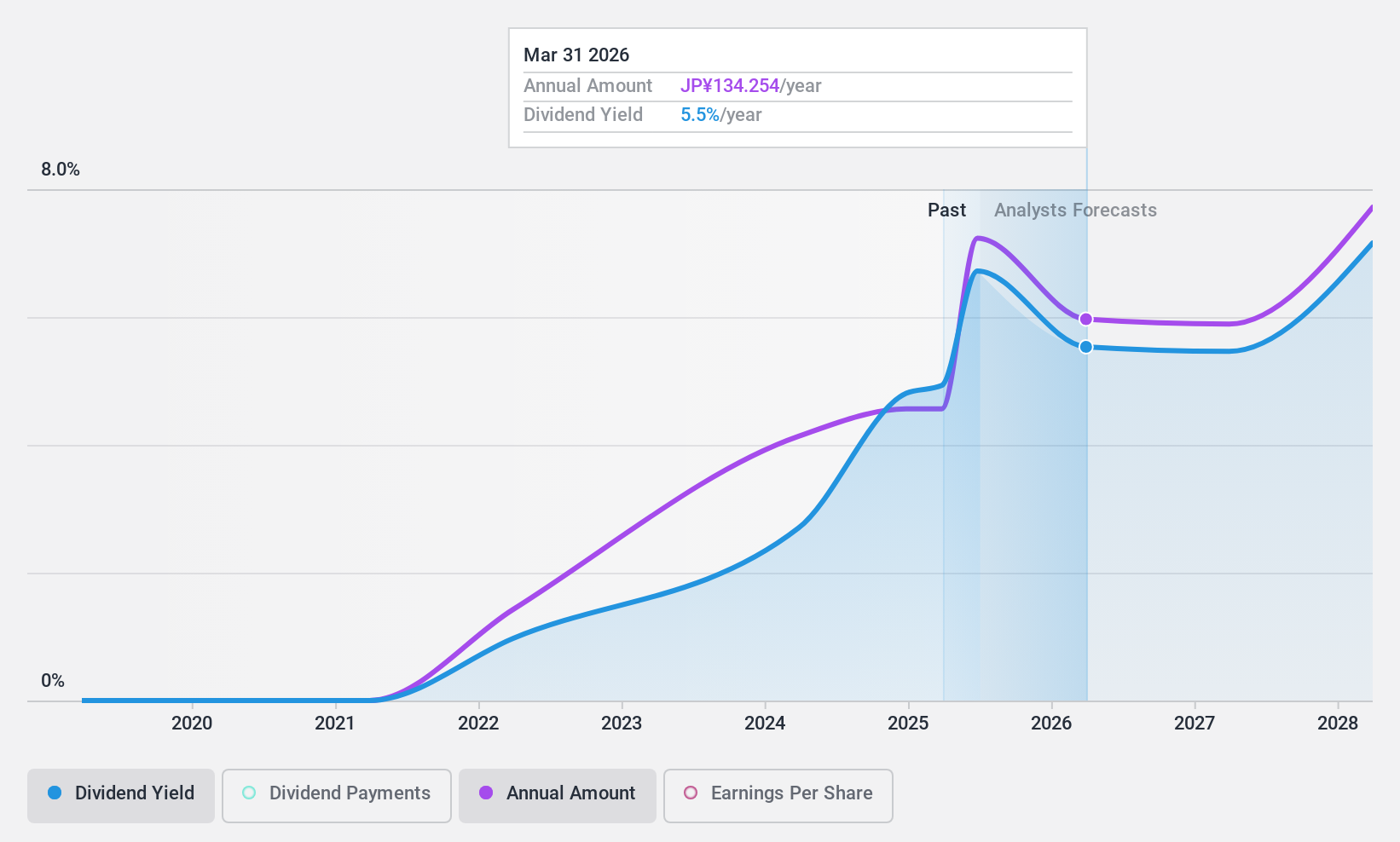

Dividend Yield: 5%

UT Group's dividend yield of 5.01% ranks in the top 25% in Japan but is not well covered by cash flows, with a high cash payout ratio of 103.5%. Despite a low price-to-earnings ratio of 8.8x, indicating good relative value, earnings are forecasted to decline by an average of 14.2% annually over the next three years. Recent dividend guidance was revised downward from ¥164.81 to ¥102.66 per share for FY2025 due to lower-than-expected earnings and sales projections amidst hiring challenges and sector-specific demand fluctuations.

- Dive into the specifics of UT GroupLtd here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that UT GroupLtd is trading behind its estimated value.

Seize The Opportunity

- Unlock our comprehensive list of 1978 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:AGTHIA

Agthia Group PJSC

Produces and sells food and beverage products in the United Arab Emirates and internationally.

Excellent balance sheet with proven track record and pays a dividend.