- Japan

- /

- Professional Services

- /

- TSE:2124

Undervalued Japanese Stocks To Watch In August 2024

Reviewed by Simply Wall St

Japan’s stock markets have shown modest gains recently, with the Nikkei 225 Index rising 0.8% and the broader TOPIX Index up 0.2%, amid speculation about the Bank of Japan's monetary policy stance. As economic indicators remain supportive of a hawkish shift, investors are keenly observing opportunities for undervalued stocks that could benefit from these market conditions. In this environment, identifying undervalued stocks involves looking at companies with strong fundamentals and growth potential that may not yet be fully recognized by the market. Here are three such Japanese stocks to watch in August 2024.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Link and Motivation (TSE:2170) | ¥565.00 | ¥1065.54 | 47% |

| Hagiwara Electric Holdings (TSE:7467) | ¥3495.00 | ¥6712.56 | 47.9% |

| Shin Maint HoldingsLtd (TSE:6086) | ¥1498.00 | ¥2839.02 | 47.2% |

| Hottolink (TSE:3680) | ¥336.00 | ¥660.46 | 49.1% |

| West Holdings (TSE:1407) | ¥2578.00 | ¥5011.50 | 48.6% |

| BayCurrent Consulting (TSE:6532) | ¥4344.00 | ¥8584.01 | 49.4% |

| SHIFT (TSE:3697) | ¥12320.00 | ¥23262.92 | 47% |

| Visional (TSE:4194) | ¥8610.00 | ¥17124.22 | 49.7% |

| TORIDOLL Holdings (TSE:3397) | ¥3676.00 | ¥7046.94 | 47.8% |

| Nxera Pharma (TSE:4565) | ¥1731.00 | ¥3461.43 | 50% |

We're going to check out a few of the best picks from our screener tool.

West Holdings (TSE:1407)

Overview: West Holdings Corporation, with a market cap of ¥102.24 billion, operates in the renewable energy sector both within Japan and internationally through its subsidiaries.

Operations: West Holdings Corporation's revenue segments (in millions of ¥) are: Renewable Energy Business ¥null.

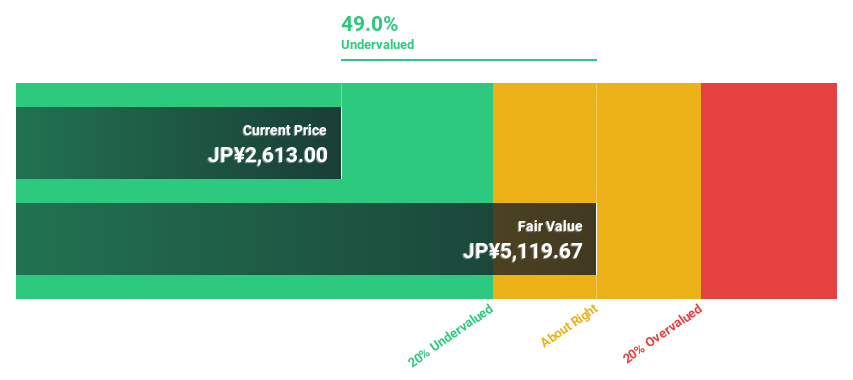

Estimated Discount To Fair Value: 48.6%

West Holdings is trading at ¥2578, significantly below its estimated fair value of ¥5011.5, indicating potential undervaluation. Despite a volatile share price recently, the company's earnings are forecast to grow 22.5% annually over the next three years, outpacing the broader Japanese market's growth rate of 8.5%. However, debt coverage by operating cash flow remains a concern. Recent buybacks totaling ¥2.79 billion for 1 million shares may signal management’s confidence in future performance.

- Our earnings growth report unveils the potential for significant increases in West Holdings' future results.

- Click here to discover the nuances of West Holdings with our detailed financial health report.

JAC Recruitment (TSE:2124)

Overview: JAC Recruitment Co., Ltd. operates as a recruitment consultancy business in Japan with a market cap of ¥116.21 billion.

Operations: JAC Recruitment Co., Ltd. generates revenue primarily through its recruitment consultancy services in Japan.

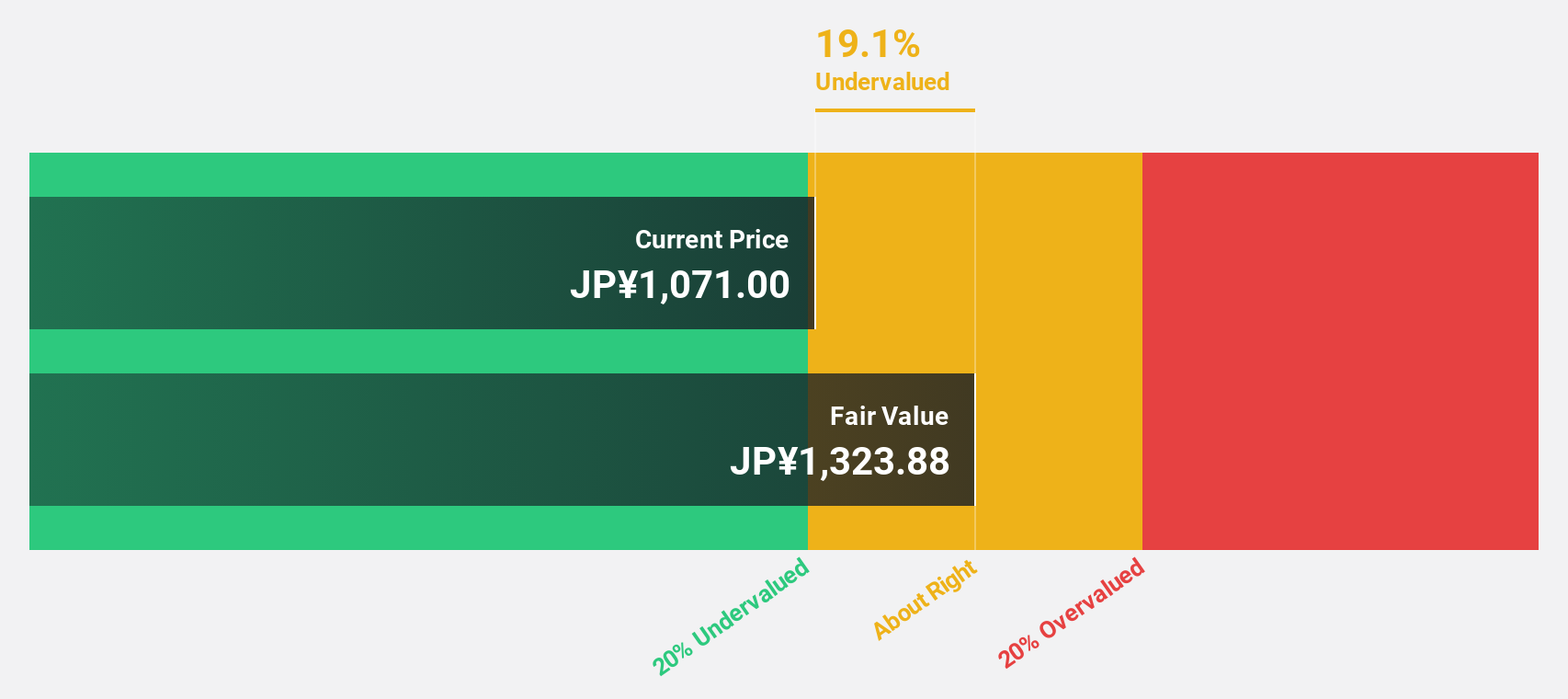

Estimated Discount To Fair Value: 40.2%

JAC Recruitment is trading at ¥728, well below its estimated fair value of ¥1217.48, suggesting undervaluation based on cash flows. The company has announced a share repurchase program worth ¥2 billion to improve capital efficiency and shareholder returns. Despite recent downward revisions in earnings guidance due to lower-than-expected job placements, earnings are forecast to grow significantly at 20.9% annually over the next three years, outpacing the Japanese market's growth rate of 8.5%.

- According our earnings growth report, there's an indication that JAC Recruitment might be ready to expand.

- Get an in-depth perspective on JAC Recruitment's balance sheet by reading our health report here.

Nxera Pharma (TSE:4565)

Overview: Nxera Pharma Co., Ltd. develops and sells biopharmaceutical products in Japan, Switzerland, the United States, Bermuda, and the United Kingdom with a market cap of ¥155.62 billion.

Operations: Nxera Pharma Co., Ltd. generates revenue from biopharmaceutical product sales across Japan, Switzerland, the United States, Bermuda, and the United Kingdom.

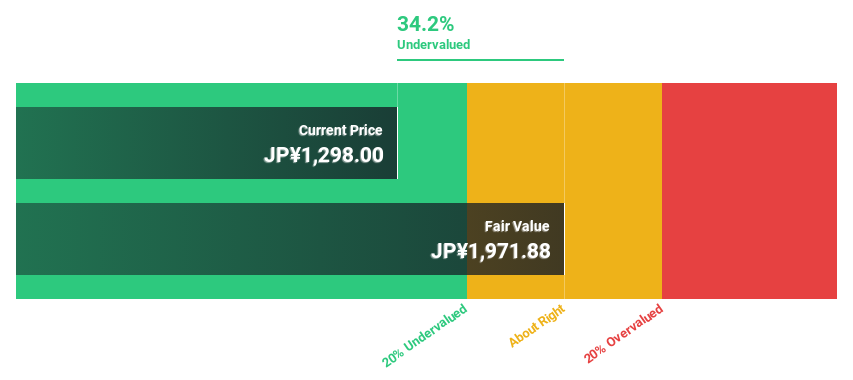

Estimated Discount To Fair Value: 50%

Nxera Pharma, trading at ¥1731, is significantly undervalued with an estimated fair value of ¥3461.43. The company is expected to become profitable within three years and achieve above-average market growth. Recent milestones include a $10 million payment from AbbVie for neurological disease research and a $4.6 million milestone from Centessa Pharmaceuticals for its orexin receptor agonist program. Despite past shareholder dilution, Nxera's revenue is forecast to grow faster than the Japanese market at 13.1% annually.

- Upon reviewing our latest growth report, Nxera Pharma's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Nxera Pharma's balance sheet health report.

Key Takeaways

- Click this link to deep-dive into the 79 companies within our Undervalued Japanese Stocks Based On Cash Flows screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2124

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives