As global markets navigate the early days of 2025, U.S. stocks are reaching record highs fueled by optimism around potential trade deals and AI investments, while economic indicators show a mixed picture with rebounding manufacturing activity but dampened consumer sentiment. In this context, dividend stocks stand out as a compelling option for investors seeking stability and income amid market volatility, offering the potential for regular returns even when broader market conditions fluctuate.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.93% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.07% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.54% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

Click here to see the full list of 1971 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

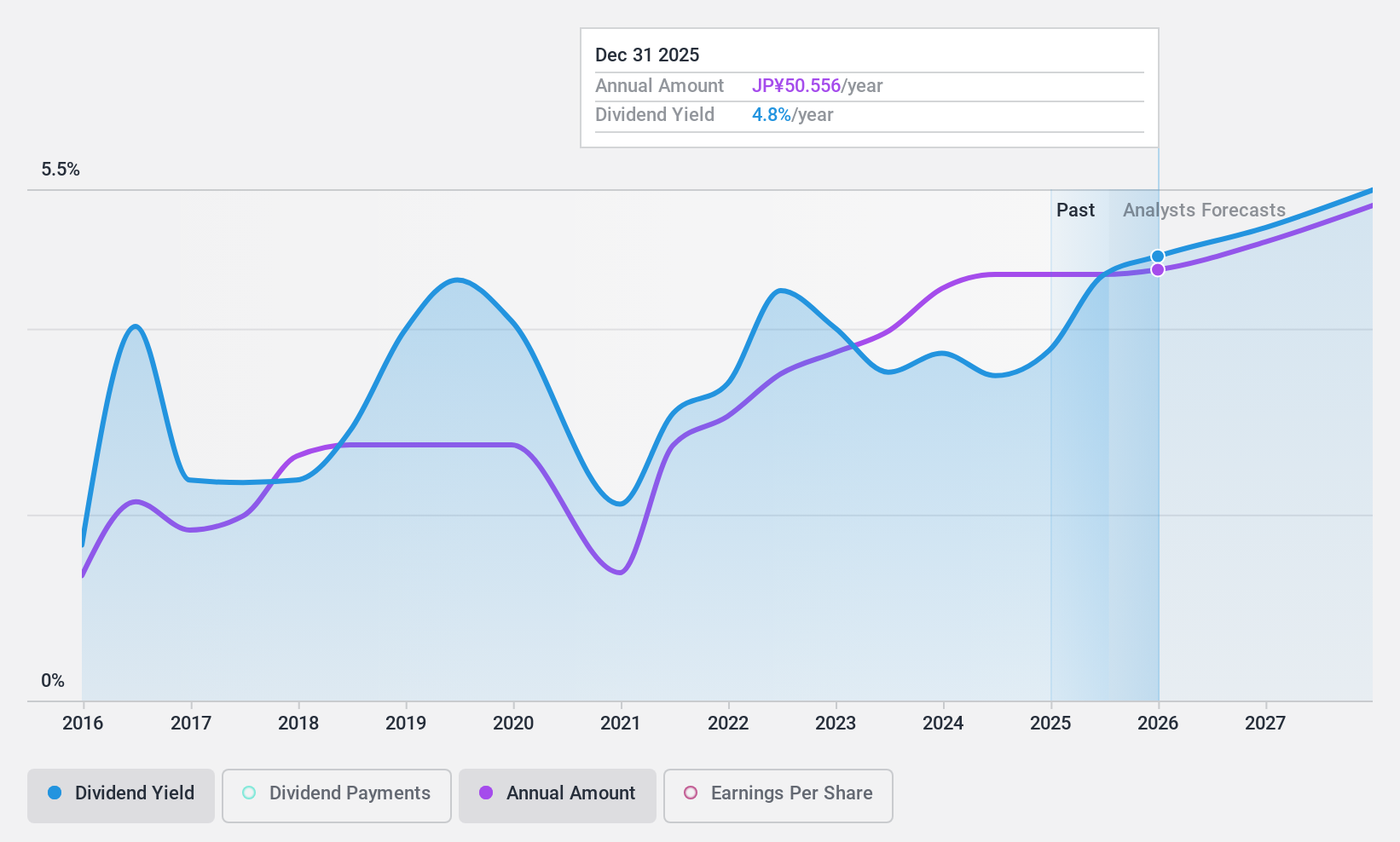

JAC Recruitment (TSE:2124)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: JAC Recruitment Co., Ltd. offers recruitment consultancy services in Japan and has a market capitalization of ¥110.38 billion.

Operations: JAC Recruitment Co., Ltd. generates revenue from its Domestic Recruitment Business (¥33.46 billion), Overseas Business (¥3.74 billion), and Domestic Job Offer Advertising Business (¥390 million).

Dividend Yield: 3.7%

JAC Recruitment offers a reliable dividend yield of 3.72%, supported by stable and growing payments over the past decade. The company's dividends are well-covered by both earnings, with a payout ratio of 60.7%, and cash flows, at 61.5%. Trading at 34.7% below its estimated fair value, it presents a potential value opportunity despite having a lower yield compared to the top quartile in Japan's market (3.8%). Earnings have grown consistently by 15.2% annually over five years, enhancing dividend sustainability prospects further.

- Unlock comprehensive insights into our analysis of JAC Recruitment stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of JAC Recruitment shares in the market.

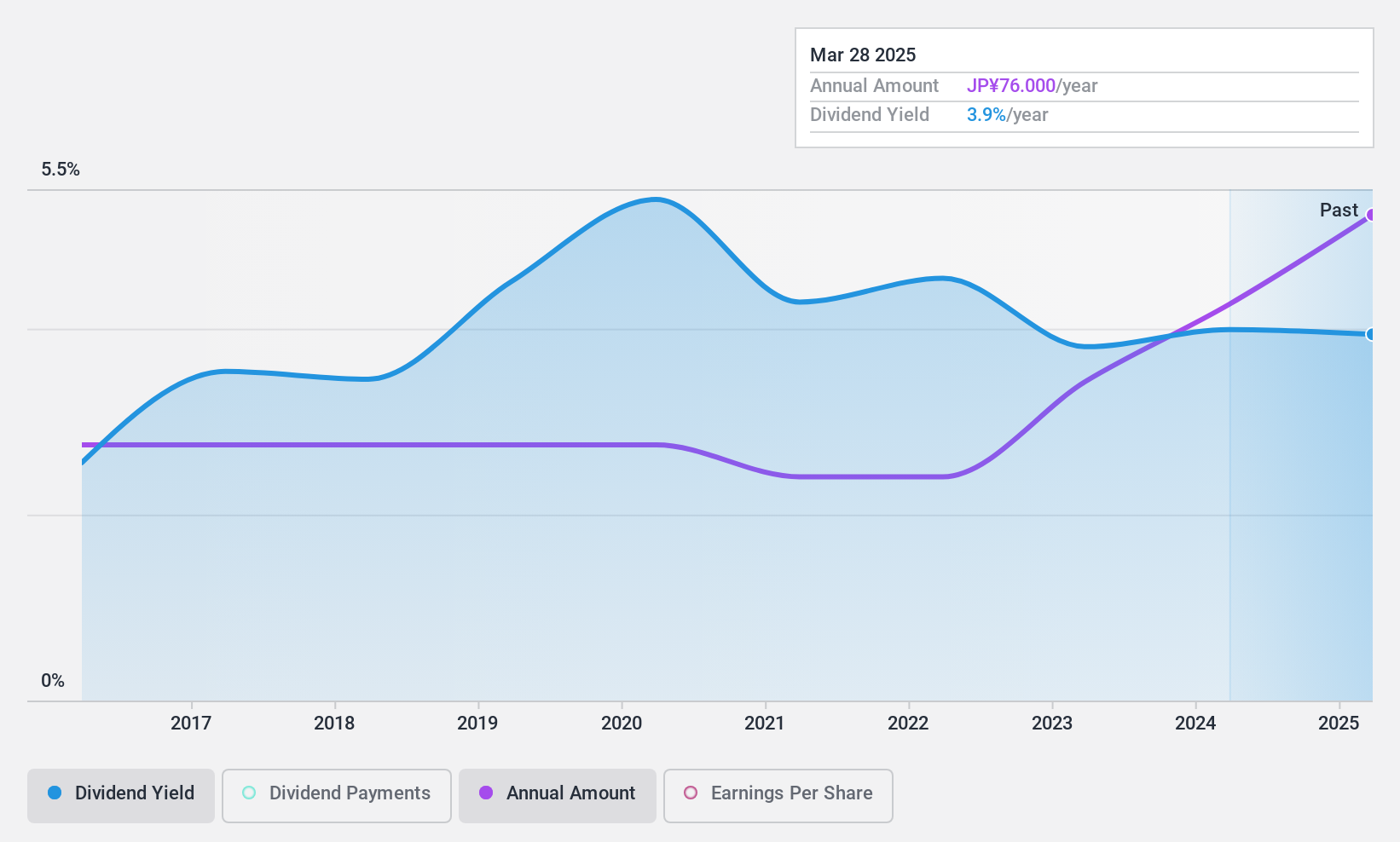

Hard Off CorporationLtd (TSE:2674)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hard Off Corporation Co., Ltd. operates reuse shops in Japan and has a market cap of ¥26.56 billion.

Operations: Hard Off Corporation Co., Ltd.'s revenue primarily comes from its Secondhand Business, generating ¥30.29 billion, followed by the FC Business with ¥2.20 billion.

Dividend Yield: 4%

Hard Off Corporation Ltd. offers a dividend yield of 3.98%, ranking in the top 25% among Japanese dividend payers. However, its dividend payments have been volatile over the past decade and are not well covered by cash flows, with a high cash payout ratio of 127.4%. Despite this, dividends are reasonably covered by earnings due to a low payout ratio of 44.8%. The stock trades slightly below its estimated fair value.

- Click here and access our complete dividend analysis report to understand the dynamics of Hard Off CorporationLtd.

- The valuation report we've compiled suggests that Hard Off CorporationLtd's current price could be quite moderate.

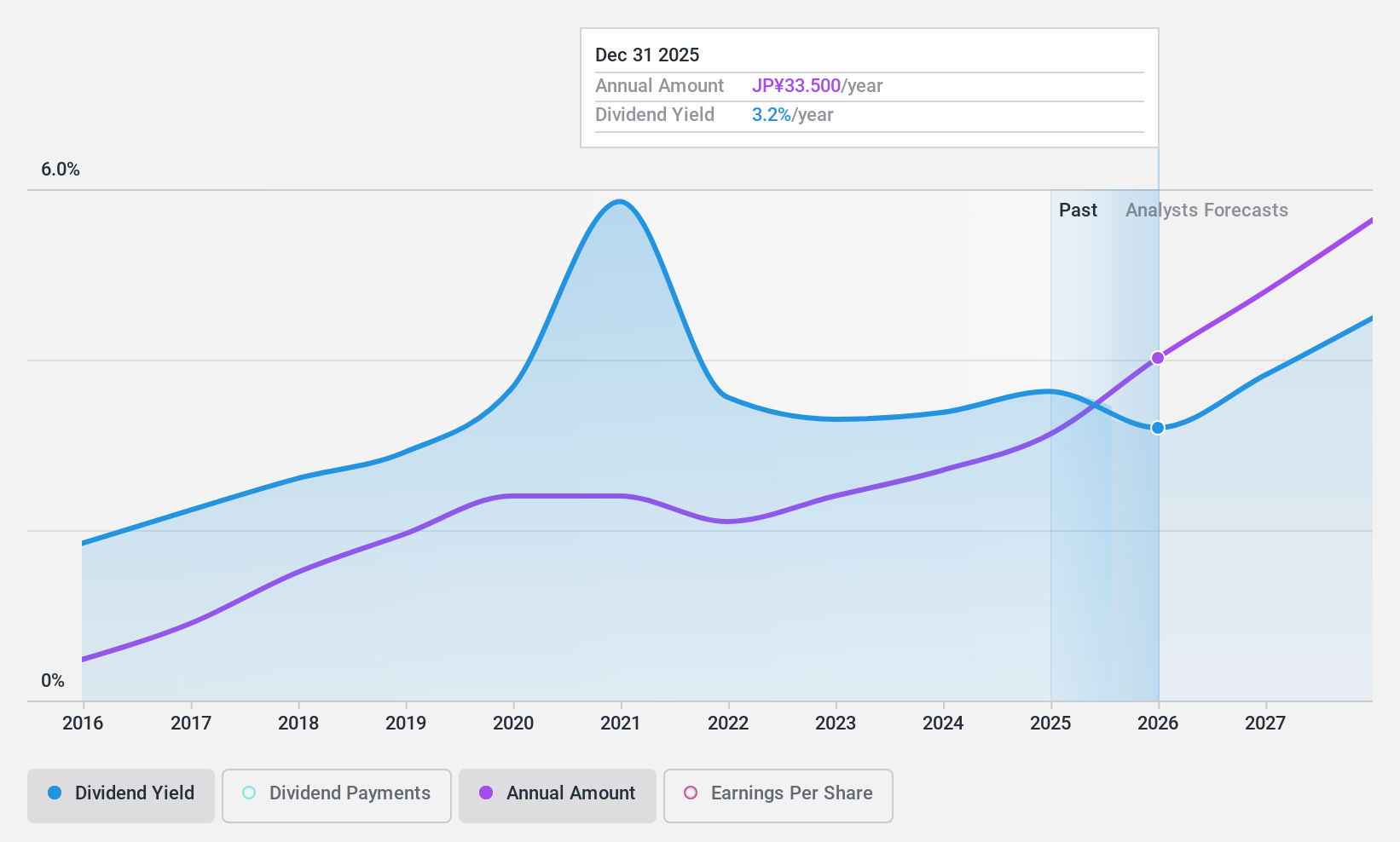

Yamaha Motor (TSE:7272)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yamaha Motor Co., Ltd. operates in land mobility, marine products, robotics, financial services, and other sectors across Japan and globally, with a market cap of ¥1.31 trillion.

Operations: Yamaha Motor Co., Ltd.'s revenue is primarily derived from its land mobility segment at ¥1.71 billion, followed by marine products at ¥531.65 million, robotics at ¥108.26 million, and financial services contributing ¥109.32 million.

Dividend Yield: 3.7%

Yamaha Motor's dividend yield of 3.74% falls short of the top quartile in Japan, but its dividends are well-covered by earnings with a payout ratio of 32.1%. However, cash flow coverage is tighter at an 87.4% cash payout ratio, and past dividend payments have been volatile. Despite these challenges, Yamaha trades significantly below its estimated fair value and has shown commitment to innovation through strategic acquisitions like Torqeedo to enhance electric propulsion offerings.

- Delve into the full analysis dividend report here for a deeper understanding of Yamaha Motor.

- According our valuation report, there's an indication that Yamaha Motor's share price might be on the cheaper side.

Key Takeaways

- Delve into our full catalog of 1971 Top Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7272

Yamaha Motor

Engages in the land mobility, marine products, robotics, financial services, and others businesses in Japan, North America, Europe, Asia, and internationally.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives