- Japan

- /

- Professional Services

- /

- TSE:2124

Asian Market Opportunities: Stocks Estimated Up To 38.3% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets grapple with economic uncertainty and inflation concerns, Asian stocks have shown resilience amid a challenging environment. With consumer sentiment at historic lows and trade tensions impacting major economies, investors are increasingly seeking opportunities in undervalued stocks that could offer potential value. Identifying such stocks involves assessing their intrinsic value relative to current market conditions, making them attractive for those looking to navigate the complexities of today's financial landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| DIP (TSE:2379) | ¥2299.00 | ¥4583.89 | 49.8% |

| Zhejiang Cfmoto PowerLtd (SHSE:603129) | CN¥183.48 | CN¥362.32 | 49.4% |

| Consun Pharmaceutical Group (SEHK:1681) | HK$8.95 | HK$17.64 | 49.3% |

| Chison Medical Technologies (SHSE:688358) | CN¥31.17 | CN¥61.74 | 49.5% |

| RACCOON HOLDINGS (TSE:3031) | ¥965.00 | ¥1899.85 | 49.2% |

| S Foods (TSE:2292) | ¥2544.00 | ¥5084.09 | 50% |

| Tongqinglou Catering (SHSE:605108) | CN¥20.67 | CN¥40.51 | 49% |

| Siam Wellness Group (SET:SPA) | THB4.58 | THB9.14 | 49.9% |

| Digital China Holdings (SEHK:861) | HK$2.83 | HK$5.55 | 49% |

| Akeso (SEHK:9926) | HK$74.60 | HK$146.79 | 49.2% |

Let's uncover some gems from our specialized screener.

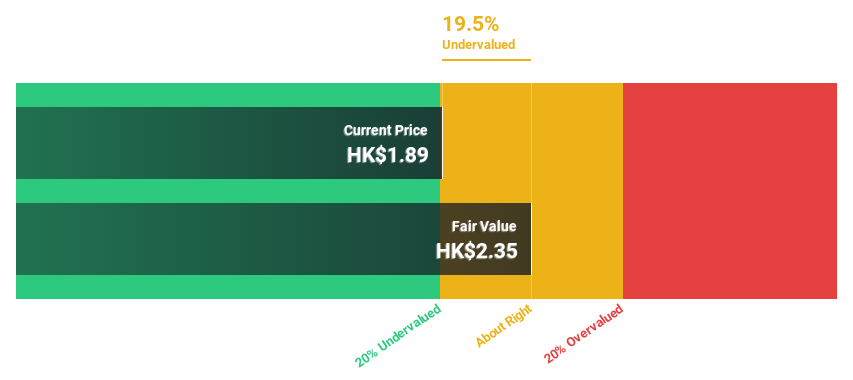

JS Global Lifestyle (SEHK:1691)

Overview: JS Global Lifestyle Company Limited is involved in the R&D, design, production, marketing, distribution, and sale of small household appliances across Mainland China, North America, Europe, and other international markets with a market cap of approximately HK$6.88 billion.

Operations: The company's revenue segments include Joyoung at $1.22 billion and Sharkninja Apac at $381.12 million.

Estimated Discount To Fair Value: 15.8%

JS Global Lifestyle is trading at HK$1.98, below its estimated fair value of HK$2.35, indicating it is undervalued based on discounted cash flow analysis. Despite this, profit margins have decreased significantly from the previous year. Revenue growth is expected to outpace the Hong Kong market at 9.2% annually, with earnings projected to grow substantially by 75.5% per year over the next three years, despite recent volatility in share price and large one-off items affecting financial results.

- Our earnings growth report unveils the potential for significant increases in JS Global Lifestyle's future results.

- Dive into the specifics of JS Global Lifestyle here with our thorough financial health report.

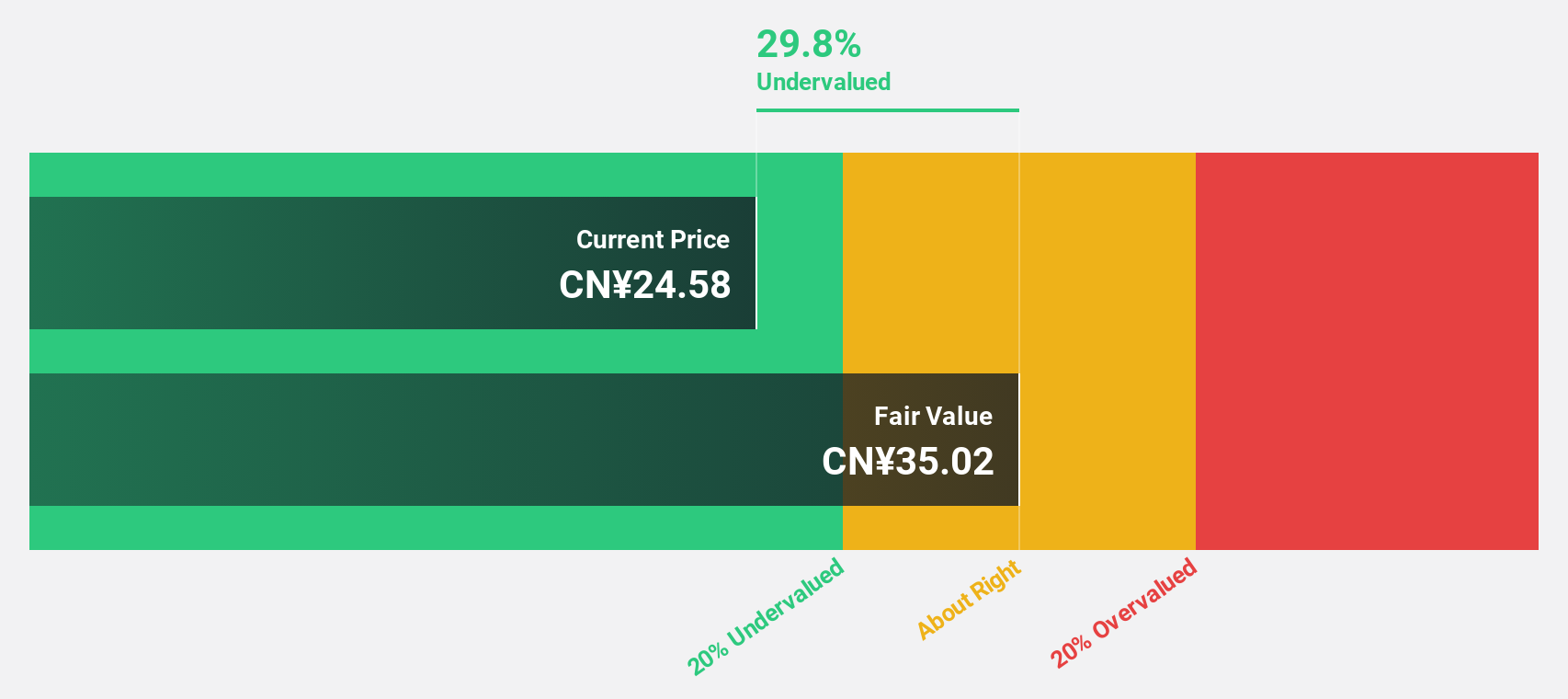

Zhejiang Lante Optics (SHSE:688127)

Overview: Zhejiang Lante Optics Co., Ltd. manufactures and sells optical products in China, with a market cap of CN¥11.21 billion.

Operations: The company's revenue primarily comes from its Photographic Equipment & Supplies segment, which generated CN¥1.03 billion.

Estimated Discount To Fair Value: 17.1%

Zhejiang Lante Optics is trading at CN¥27.8, below its estimated fair value of CN¥33.55, suggesting undervaluation based on discounted cash flow analysis. Earnings are projected to grow significantly at 26.39% annually over the next three years, outpacing the Chinese market's growth rate of 24.8%. Despite recent share price volatility, revenue for 2024 increased to CN¥1.03 billion from CN¥754.46 million in 2023, with net income rising to CN¥218.59 million from CN¥179.91 million.

- Our growth report here indicates Zhejiang Lante Optics may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Zhejiang Lante Optics stock in this financial health report.

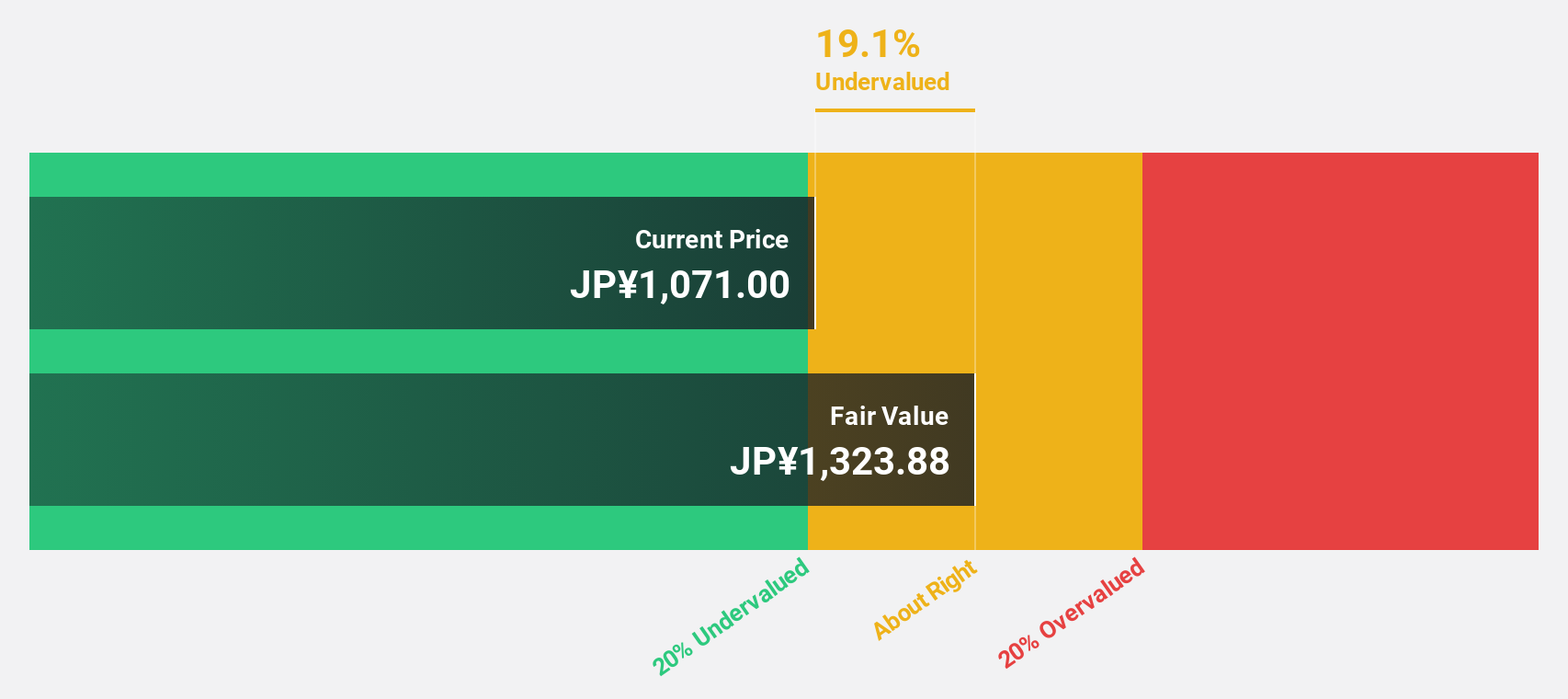

JAC Recruitment (TSE:2124)

Overview: JAC Recruitment Co., Ltd. offers recruitment consultancy services in Japan and has a market cap of ¥128.40 billion.

Operations: The company generates revenue from its Domestic Recruitment Business (¥35.07 billion), Overseas Business (¥3.77 billion), and Domestic Job Offer Advertising Business (¥417 million).

Estimated Discount To Fair Value: 38.3%

JAC Recruitment's stock, trading at ¥812, is undervalued compared to its estimated fair value of ¥1,316.96. The company expects earnings growth of 21.5% annually over the next three years, surpassing Japan's market average of 8%. Despite recent share price volatility, JAC anticipates net sales of ¥44.9 billion and operating income of ¥10 billion for 2025. A high dividend yield and reliable payouts further enhance its investment appeal amidst robust cash flow projections.

- Our comprehensive growth report raises the possibility that JAC Recruitment is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of JAC Recruitment.

Next Steps

- Unlock more gems! Our Undervalued Asian Stocks Based On Cash Flows screener has unearthed 268 more companies for you to explore.Click here to unveil our expertly curated list of 271 Undervalued Asian Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade JAC Recruitment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2124

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives