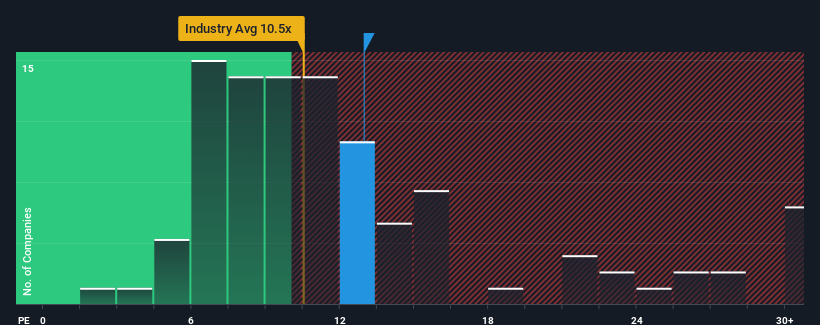

It's not a stretch to say that Inaba Denki Sangyo Co.,Ltd.'s (TSE:9934) price-to-earnings (or "P/E") ratio of 13x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 15x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Earnings have risen firmly for Inaba Denki SangyoLtd recently, which is pleasing to see. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

View our latest analysis for Inaba Denki SangyoLtd

How Is Inaba Denki SangyoLtd's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Inaba Denki SangyoLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 8.0% gain to the company's bottom line. The latest three year period has also seen an excellent 40% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 11% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

In light of this, it's understandable that Inaba Denki SangyoLtd's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Inaba Denki SangyoLtd revealed its three-year earnings trends are contributing to its P/E, given they look similar to current market expectations. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

It is also worth noting that we have found 1 warning sign for Inaba Denki SangyoLtd that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Inaba Denki SangyoLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9934

Inaba Denki SangyoLtd

Provides electrical equipment and materials, industrial automation, and proprietary products in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives