- Japan

- /

- Trade Distributors

- /

- TSE:9934

Does Inaba Denki SangyoLtd (TSE:9934) Deserve A Spot On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Inaba Denki SangyoLtd (TSE:9934), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Inaba Denki SangyoLtd

How Quickly Is Inaba Denki SangyoLtd Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Inaba Denki SangyoLtd grew its EPS by 12% per year. That's a good rate of growth, if it can be sustained.

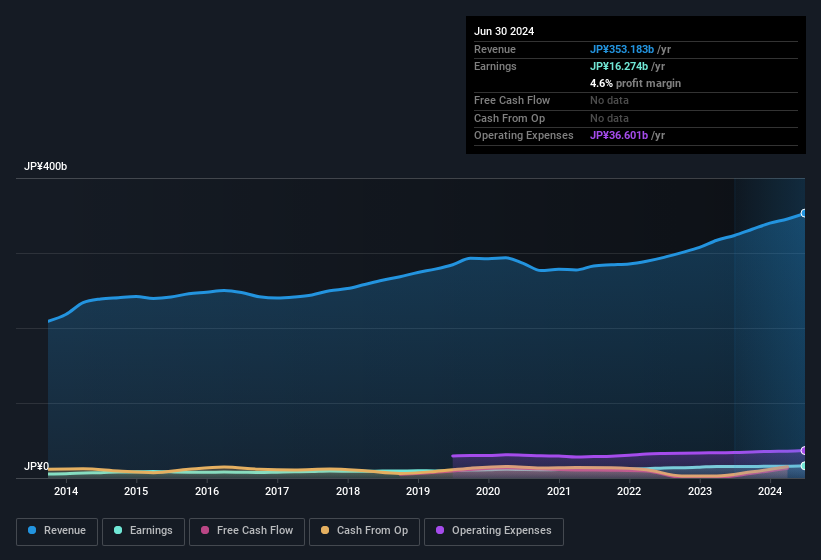

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Inaba Denki SangyoLtd achieved similar EBIT margins to last year, revenue grew by a solid 9.2% to JP¥353b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Inaba Denki SangyoLtd's balance sheet strength, before getting too excited.

Are Inaba Denki SangyoLtd Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Shareholders will be pleased by the fact that insiders own Inaba Denki SangyoLtd shares worth a considerable sum. As a matter of fact, their holding is valued at JP¥4.0b. This considerable investment should help drive long-term value in the business. Even though that's only about 1.9% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is Inaba Denki SangyoLtd Worth Keeping An Eye On?

One important encouraging feature of Inaba Denki SangyoLtd is that it is growing profits. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. The combination definitely favoured by investors so consider keeping the company on a watchlist. We should say that we've discovered 1 warning sign for Inaba Denki SangyoLtd that you should be aware of before investing here.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Japanese companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9934

Inaba Denki SangyoLtd

Provides electrical equipment and materials, industrial automation, and proprietary products in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives