- Japan

- /

- Trade Distributors

- /

- TSE:9845

February 2025's Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a landscape marked by volatile corporate earnings and geopolitical tensions, investors are keeping a close eye on central bank policies and inflation trends. With the Federal Reserve holding rates steady amid solid economic activity in the U.S. and the European Central Bank cutting rates to boost sentiment, dividend stocks remain an attractive option for those seeking stability and income in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.05% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.25% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★☆ |

Click here to see the full list of 1950 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

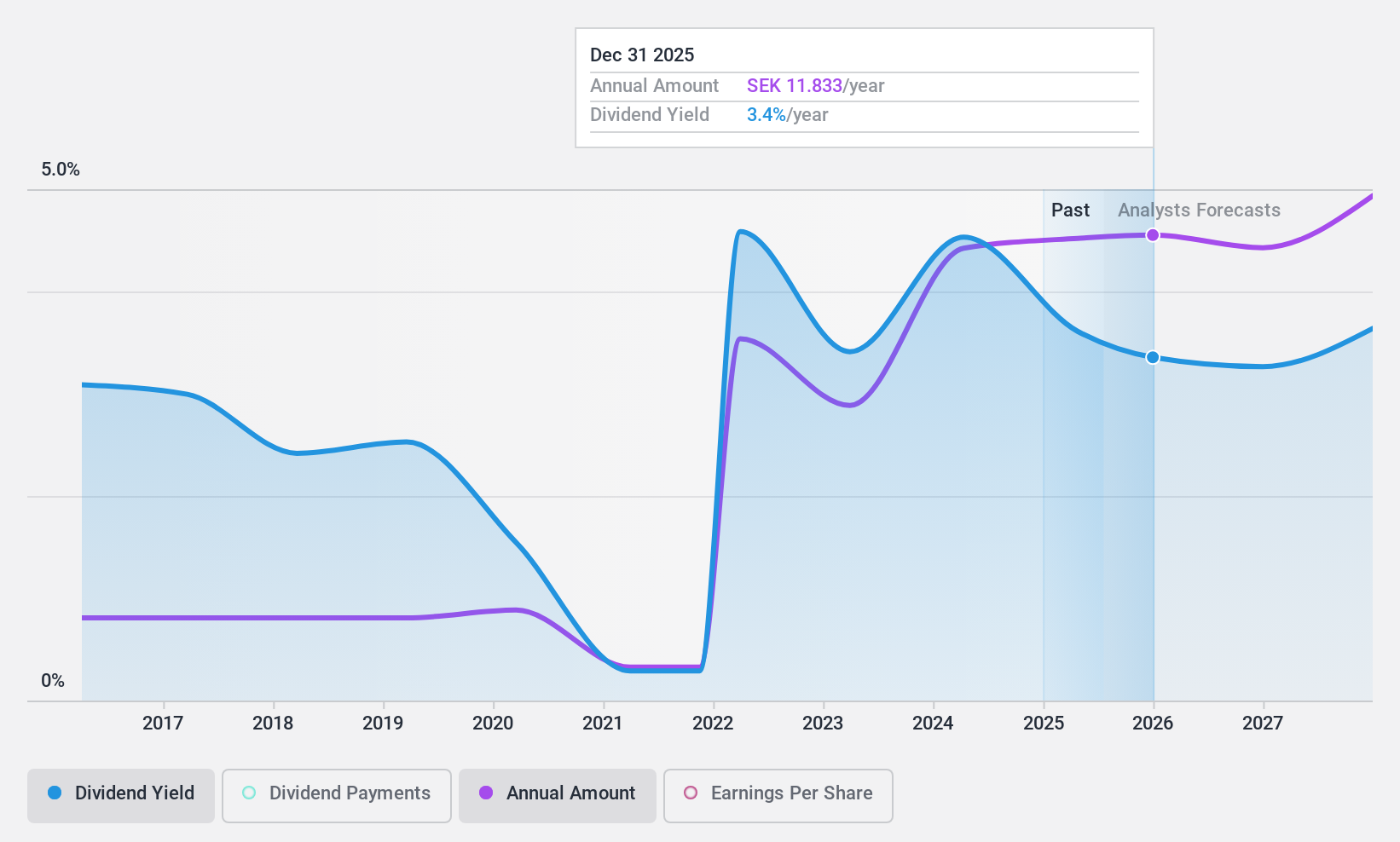

Avanza Bank Holding (OM:AZA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Avanza Bank Holding AB (publ) operates in Sweden, providing savings, pension, and mortgage products through its subsidiaries, with a market capitalization of approximately SEK52.55 billion.

Operations: Avanza Bank Holding AB generates revenue of SEK4.30 billion from its commercial operations segment.

Dividend Yield: 3.5%

Avanza Bank Holding's recent earnings report showed a net income increase to SEK 2.25 billion, supporting its proposed dividend of SEK 11.75 per share, which is 82% of profits. Despite a history of volatile dividends over the past decade, current payments are well-covered by both earnings and cash flows with payout ratios at sustainable levels. However, its dividend yield remains lower than the top tier in Sweden's market.

- Click here and access our complete dividend analysis report to understand the dynamics of Avanza Bank Holding.

- Our expertly prepared valuation report Avanza Bank Holding implies its share price may be too high.

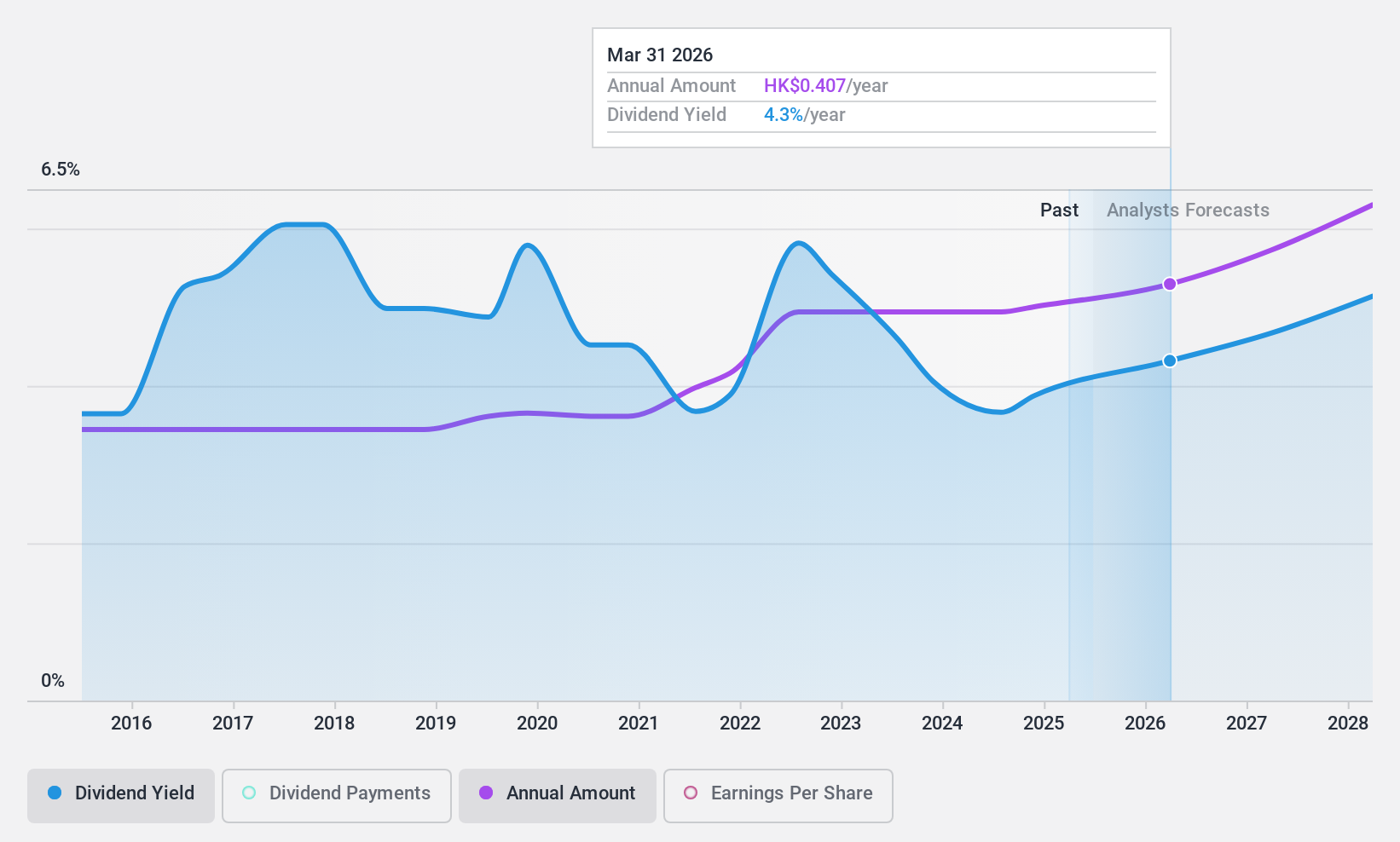

Lenovo Group (SEHK:992)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services with a market cap of approximately HK$115.24 billion.

Operations: Lenovo Group Limited's revenue is primarily derived from its Intelligent Devices Group (IDG) at $47.76 billion, followed by the Infrastructure Solutions Group (ISG) at $11.47 billion, and the Solutions and Services Group (SSG) at $7.89 billion.

Dividend Yield: 3.9%

Lenovo Group's dividend yield of 3.91% is lower than the top 25% in Hong Kong but remains reliable, with stable growth over the past decade. Recent earnings growth supports sustainable dividend payouts, covered by a payout ratio of 50.6% and a cash payout ratio of 40.2%. Despite trading below its estimated fair value, Lenovo's strategic product innovations and recent HKD 15.55 billion convertible bond issuance could bolster future financial flexibility and shareholder returns.

- Delve into the full analysis dividend report here for a deeper understanding of Lenovo Group.

- Our valuation report unveils the possibility Lenovo Group's shares may be trading at a discount.

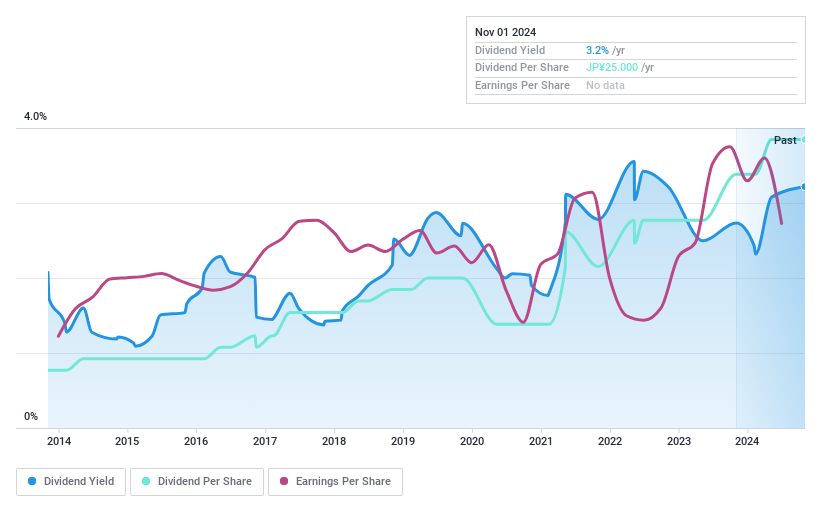

Parker (TSE:9845)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Parker Corporation engages in product development, manufacturing, sales, and technical services across various industries including automobiles, electrical machinery, chemicals, steel, electronics, and food with a market cap of ¥20.74 billion.

Operations: Parker Corporation's revenue segments include the Chemicals Division at ¥6.63 billion, Chemicals Department at ¥20.27 billion, Industrial Materials at ¥17.30 billion, Machinery Department at ¥2.65 billion, and Chemical Products Department at ¥20.56 billion.

Dividend Yield: 2.9%

Parker Corporation's dividend payments are well covered by earnings and cash flows, with payout ratios of 22.6% and 23.9%, respectively. However, the dividends have been volatile over the past decade despite recent growth. The current yield of 2.93% is below Japan's top quartile dividend payers, but the stock trades at a significant discount to its estimated fair value, suggesting potential for capital appreciation alongside dividends.

- Get an in-depth perspective on Parker's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Parker is trading behind its estimated value.

Taking Advantage

- Click this link to deep-dive into the 1950 companies within our Top Dividend Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9845

Parker

Provides product development, manufacturing, sales, and technical services for the automobiles, electrical machinery, chemicals, steel, electronics, food, etc.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives