- Japan

- /

- Trade Distributors

- /

- TSE:9824

Asian Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a landscape marked by dovish signals from central banks and mixed economic data, Asian indices have shown resilience with notable gains in key regions such as Japan and China. In this dynamic environment, dividend stocks in Asia can offer investors a potential source of steady income while providing exposure to the region's diverse economic growth.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.86% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.48% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.99% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.75% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.06% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.45% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.80% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.43% | ★★★★★★ |

Click here to see the full list of 1046 stocks from our Top Asian Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

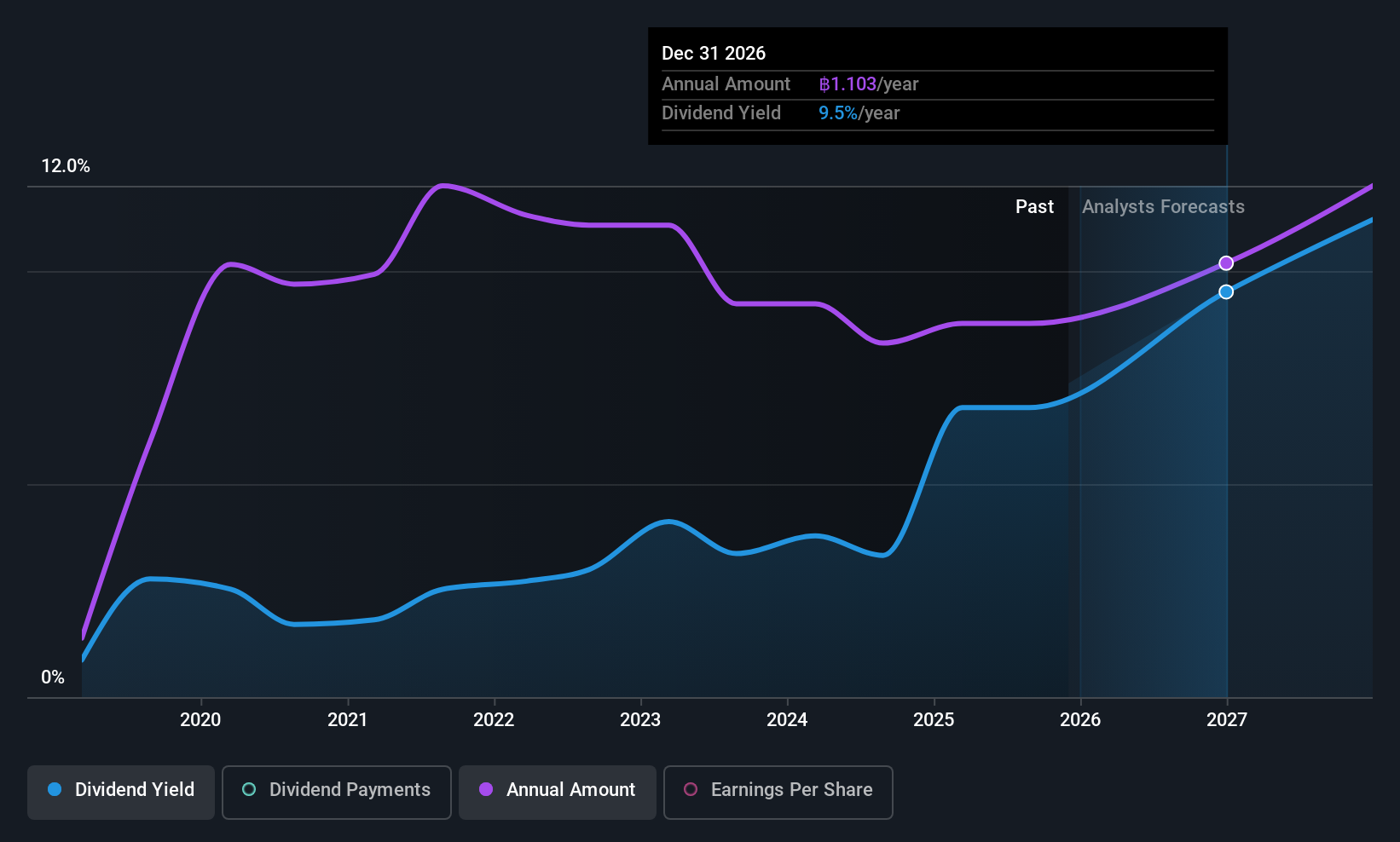

TQM Alpha (SET:TQM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TQM Alpha Public Company Limited operates as an insurance brokerage firm in Thailand with a market capitalization of THB6.89 billion.

Operations: TQM Alpha Public Company Limited generates revenue through several segments, including Non-Life Insurance Brokerage (THB3.36 billion), Life Insurance Brokerage (THB186.90 million), Reinsurance Premium Brokerage (THB270.47 million), Personal Loans for Other Loans (THB135.88 million), and Consulting Services for Computer Business (THB101.83 million).

Dividend Yield: 8.2%

TQM Alpha's dividend yield is in the top 25% of Thai market payers, with a payout ratio indicating earnings and cash flow coverage. However, its dividend track record is unstable, with volatility over seven years. Recent earnings show a decline in revenue and net income compared to last year, suggesting potential pressure on future dividends. Despite trading below estimated fair value, investors should consider the reliability of TQM’s dividends given its historical payment instability.

- Click here and access our complete dividend analysis report to understand the dynamics of TQM Alpha.

- Our expertly prepared valuation report TQM Alpha implies its share price may be lower than expected.

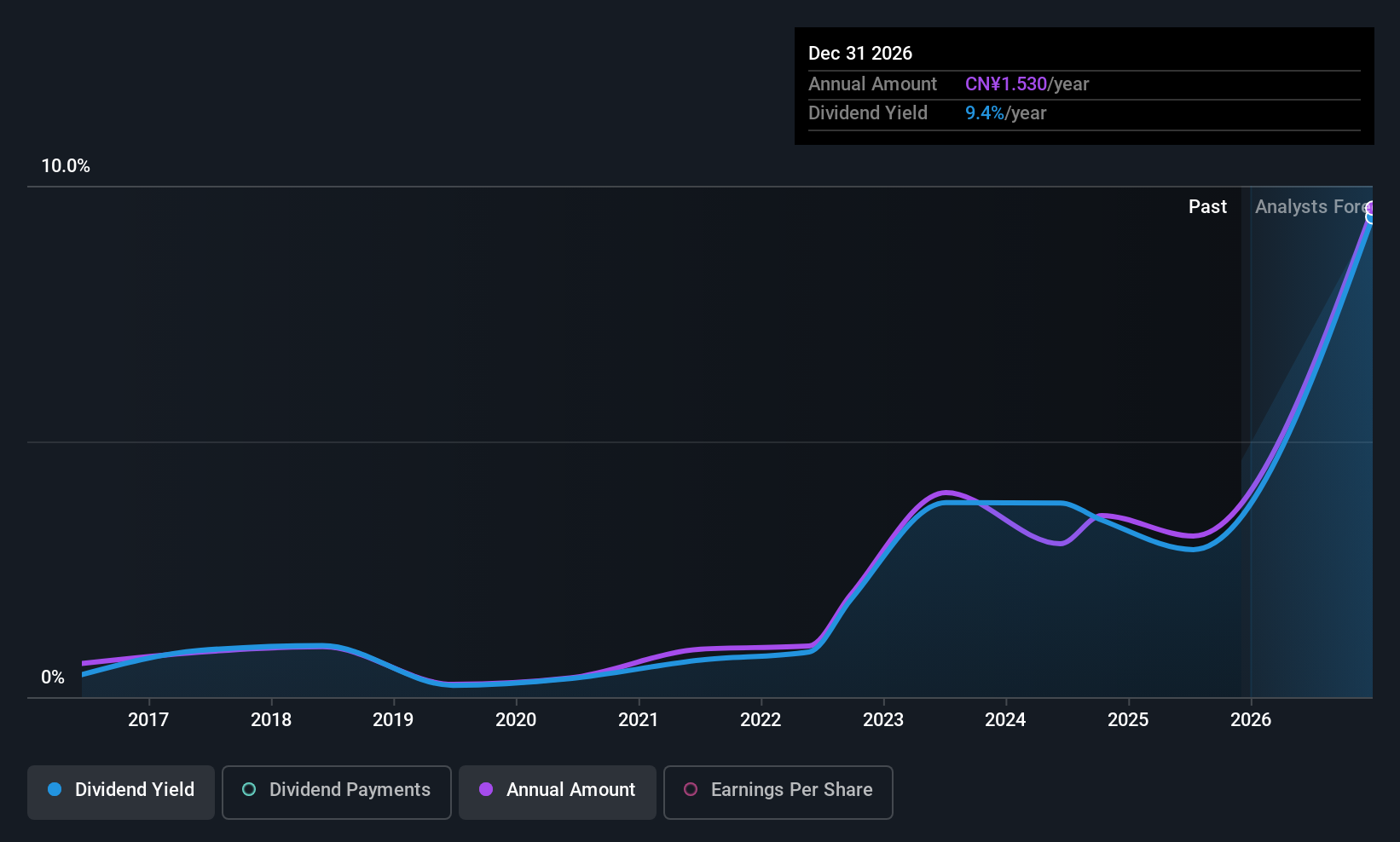

Beijing Sanlian Hope Shin-Gosen Technical Service (SZSE:300384)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing Sanlian Hope Shin-Gosen Technical Service Co., Ltd. operates in the technical services sector and has a market cap of CN¥5.30 billion.

Operations: Beijing Sanlian Hope Shin-Gosen Technical Service Co., Ltd. operates in the technical services sector, but specific revenue segments are not provided in the available data.

Dividend Yield: 3%

Beijing Sanlian Hope Shin-Gosen Technical Service features a dividend yield in the top 25% of the CN market, yet its dividends have been volatile over the past decade. The company's payout ratio of 27% suggests earnings coverage, but a high cash payout ratio indicates insufficient free cash flow support. Recent earnings show decreased revenue and net income, which may impact future dividends. Despite these challenges, it trades at a favorable price-to-earnings ratio compared to peers.

- Delve into the full analysis dividend report here for a deeper understanding of Beijing Sanlian Hope Shin-Gosen Technical Service.

- According our valuation report, there's an indication that Beijing Sanlian Hope Shin-Gosen Technical Service's share price might be on the cheaper side.

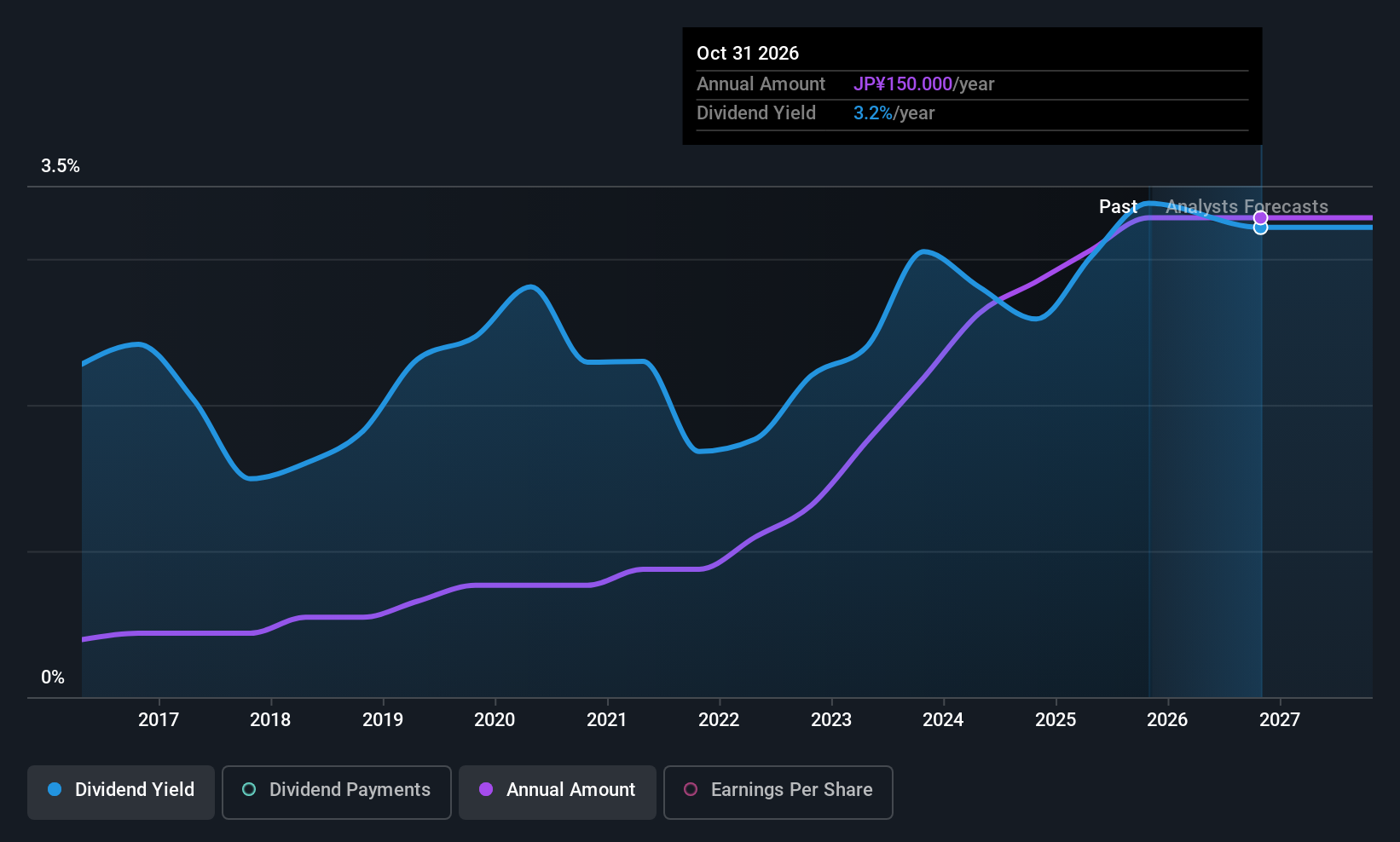

Senshu ElectricLtd (TSE:9824)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Senshu Electric Co., Ltd. operates in Japan by trading various cables, wires, and materials related to electrical construction work, with a market cap of ¥84.41 billion.

Operations: Senshu Electric Co., Ltd.'s revenue primarily comes from its Electric Wire and Cable Business, which generated ¥138.40 million.

Dividend Yield: 3%

Senshu Electric Ltd. has maintained stable and growing dividends over the past decade, supported by a low payout ratio of 34.1% and a cash payout ratio of 30.2%, ensuring dividend sustainability from both earnings and cash flows. Despite recent downward revisions in earnings guidance due to delayed demand recovery in key sectors, the company continues to enhance shareholder returns through a share repurchase program worth ¥500 million, potentially bolstering its capital efficiency amidst market challenges.

- Click here to discover the nuances of Senshu ElectricLtd with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Senshu ElectricLtd is priced lower than what may be justified by its financials.

Where To Now?

- Take a closer look at our Top Asian Dividend Stocks list of 1046 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9824

Senshu ElectricLtd

Trades in various cables, wires, and materials related to electrical construction work in Japan.

Excellent balance sheet established dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026