- Japan

- /

- Food and Staples Retail

- /

- TSE:7481

Three Solid Japanese Dividend Stocks Offering Up To 4.4% Yield

Reviewed by Simply Wall St

Amidst a backdrop of mixed performance in global markets, Japan's stock market has shown resilience, with the Nikkei 225 Index experiencing modest gains. This environment underscores the appeal of dividend stocks, particularly for investors looking for steady income streams in a landscape marked by economic uncertainties and fluctuating market conditions. In this context, selecting stocks with solid dividends can be a prudent strategy to navigate through volatility while aiming for consistent returns.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.94% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.63% | ★★★★★★ |

| Globeride (TSE:7990) | 3.75% | ★★★★★★ |

| Yahagi ConstructionLtd (TSE:1870) | 3.88% | ★★★★★★ |

| Ryoyu Systems (TSE:4685) | 3.48% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.75% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.16% | ★★★★★★ |

| Japan Pulp and Paper (TSE:8032) | 4.23% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.19% | ★★★★★★ |

| Innotech (TSE:9880) | 4.09% | ★★★★★★ |

Click here to see the full list of 399 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

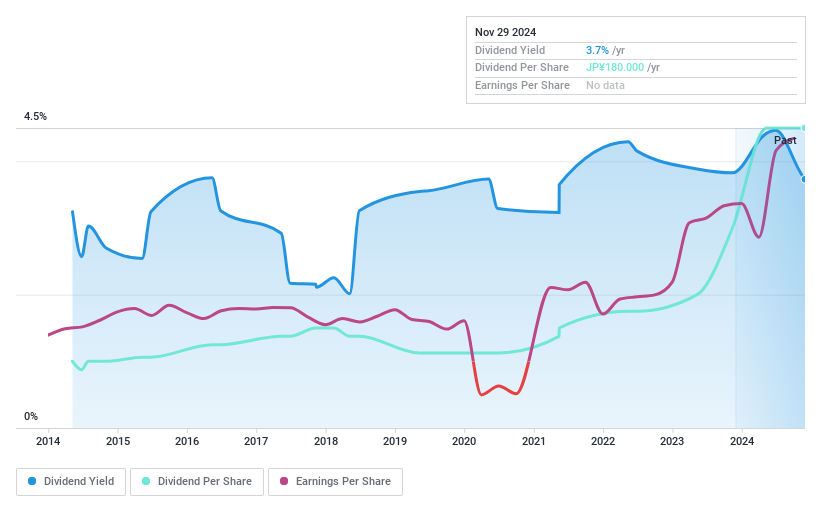

Chugai Ro (TSE:1964)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chugai Ro Co., Ltd. operates in the development of thermal technology solutions both in Japan and globally, with a market capitalization of approximately ¥23.60 billion.

Operations: Chugai Ro Co., Ltd. generates revenue primarily from its Heat Treatment Furnace segment at ¥13.91 billion, followed by its Plant segment with ¥11.21 billion, and Development activities contributing ¥1.90 billion.

Dividend Yield: 3.1%

Chugai Ro has demonstrated a reliable dividend history over the past decade with stable and growing payments. Despite a price-to-earnings ratio of 10.7x, below the Japanese market average, its dividends are not fully supported by free cash flow, indicating potential sustainability issues. Recent share buybacks totaling ¥309.86 million reflect proactive capital management but also highlight challenges in maintaining dividend payouts without adequate cash flow coverage.

- Click to explore a detailed breakdown of our findings in Chugai Ro's dividend report.

- Our valuation report here indicates Chugai Ro may be overvalued.

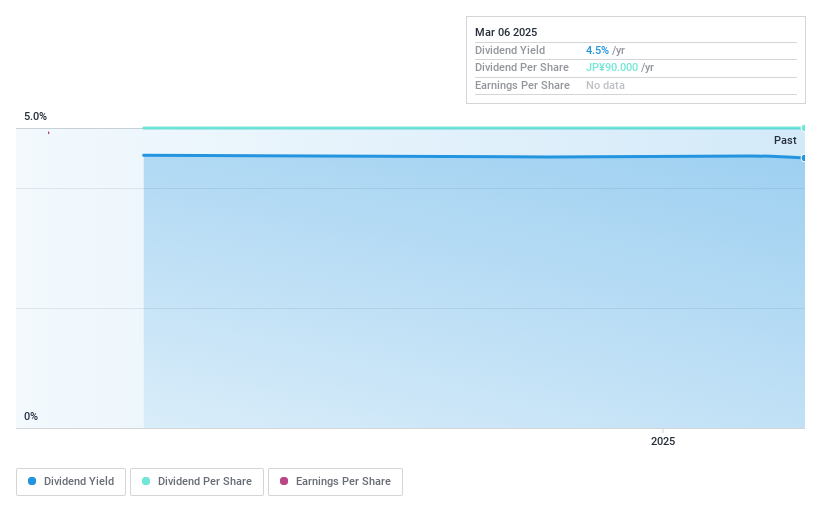

Oie Sangyo (TSE:7481)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oie Sangyo Co., Ltd. is a food trading company based in Japan, with a market capitalization of approximately ¥16.83 billion.

Operations: Oie Sangyo Co., Ltd. generates revenue primarily through its food wholesale business, which accounted for ¥111.22 billion, and its warehousing business, contributing ¥0.16 billion.

Dividend Yield: 4.4%

Oie Sangyo offers a promising dividend yield at 4.42%, ranking in the top 25% of Japanese dividend payers. The company's dividends are well-supported by both earnings and cash flows, with payout ratios of 17.4% and 27.9% respectively, indicating sustainability. However, it's worth noting that Oie Sangyo has only recently initiated dividend payments, making long-term stability and growth assessments premature at this stage. Additionally, the company's share price has shown significant volatility recently.

- Navigate through the intricacies of Oie Sangyo with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Oie Sangyo is trading behind its estimated value.

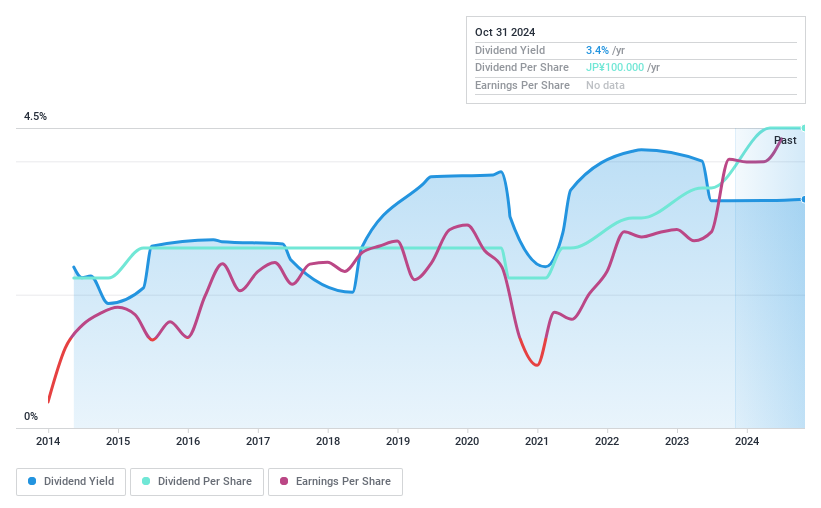

Seika (TSE:8061)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Seika Corporation, with a market cap of ¥53.44 billion, engages in the import, sale, and export of plants, machinery, and environmental protection and electronic information system equipment across Asia, Europe, the United States, and other global markets.

Operations: Seika Corporation generates its revenue from the import, sale, and export of plants and machinery as well as environmental protection and electronic information system equipment across various global regions.

Dividend Yield: 4.1%

Seika boasts a dividend yield of 4.06%, placing it among the top 25% of Japanese dividend payers. However, its dividends are not fully supported by earnings or cash flows, with a high cash payout ratio of 114.5%. Despite a favorable price-to-earnings ratio of ¥11.9x compared to the market average of ¥14.2x, Seika's share price has been highly volatile over the past three months. Additionally, while dividends have grown over the past decade, their reliability and stability have been compromised by significant fluctuations.

- Click here and access our complete dividend analysis report to understand the dynamics of Seika.

- Our valuation report unveils the possibility Seika's shares may be trading at a premium.

Where To Now?

- Access the full spectrum of 399 Top Dividend Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7481

Excellent balance sheet and good value.

Market Insights

Community Narratives