- Japan

- /

- Trade Distributors

- /

- TSE:8061

Discover 3 Top Dividend Stocks Yielding Up To 3.7%

Reviewed by Simply Wall St

As global markets navigate a period marked by interest rate cuts from the ECB and SNB, alongside expectations for further action from the Federal Reserve, investors are witnessing mixed performances across major indices. While technology stocks have buoyed the Nasdaq to new heights, other sectors face challenges amid inflationary pressures and a cooling labor market. In these uncertain times, dividend stocks can offer stability and income potential; they are often valued for their ability to provide consistent returns even when broader market conditions fluctuate.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.99% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.60% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.85% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.31% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

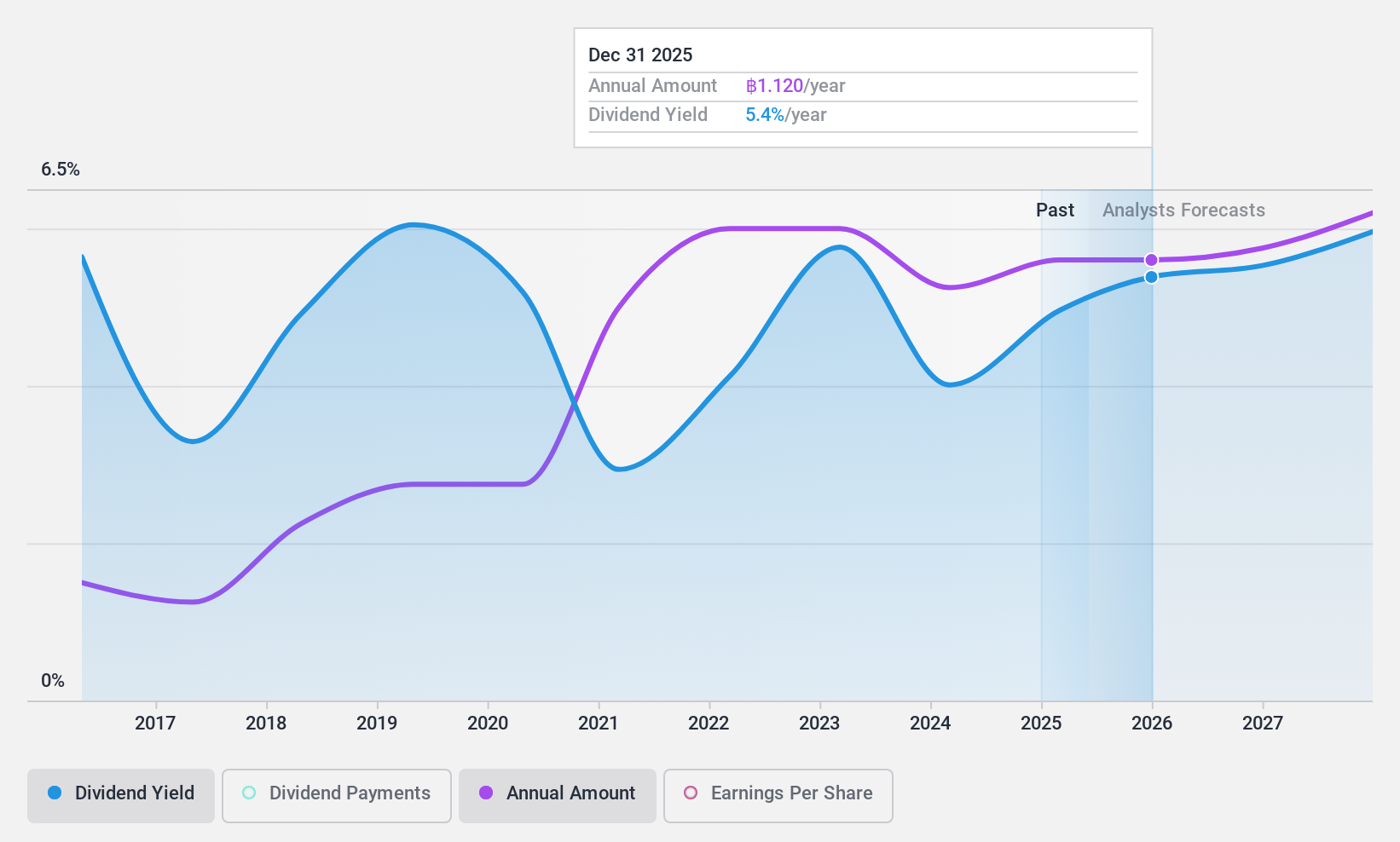

SiS Distribution (Thailand) (SET:SIS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SiS Distribution (Thailand) Public Company Limited, with a market cap of THB10.24 billion, operates in Thailand distributing computer components, smartphones, and office automation equipment.

Operations: SiS Distribution (Thailand) generates its revenue from several segments, including Phones (THB5.25 billion), Consumer Products (THB8.37 billion), Value Add Products (THB5.29 billion), and Commercial Products (THB6.36 billion).

Dividend Yield: 3.4%

SiS Distribution (Thailand) offers a stable and reliable dividend yield of 3.44%, though it is below the top tier in the Thai market. Over the past decade, dividends have grown steadily with minimal volatility, supported by a reasonable payout ratio of 57.3% and a low cash payout ratio of 26.3%. Despite high debt levels and recent earnings decline, the stock trades significantly below its estimated fair value, potentially offering value to investors focused on dividends.

- Delve into the full analysis dividend report here for a deeper understanding of SiS Distribution (Thailand).

- The valuation report we've compiled suggests that SiS Distribution (Thailand)'s current price could be quite moderate.

ENN Natural GasLtd (SHSE:600803)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ENN Natural Gas Co., Ltd. operates in China, focusing on the distribution, trading, storage, transportation, production, and engineering of natural gas with a market cap of CN¥57.09 billion.

Operations: ENN Natural Gas Co., Ltd. generates revenue through its activities in natural gas distribution, trading, storage, transportation, production, and engineering within China.

Dividend Yield: 3.4%

ENN Natural Gas Ltd.'s dividend yield of 3.38% ranks in the top 25% of the Chinese market, supported by a low payout ratio of 27.3% and a cash payout ratio of 38.5%, indicating strong coverage by earnings and cash flows. However, its dividend history is less stable, with volatility over nine years. Recent earnings growth to CNY 3.49 billion suggests improved financial health, but past dividend reliability remains a concern for investors seeking consistent income streams.

- Navigate through the intricacies of ENN Natural GasLtd with our comprehensive dividend report here.

- Our valuation report here indicates ENN Natural GasLtd may be undervalued.

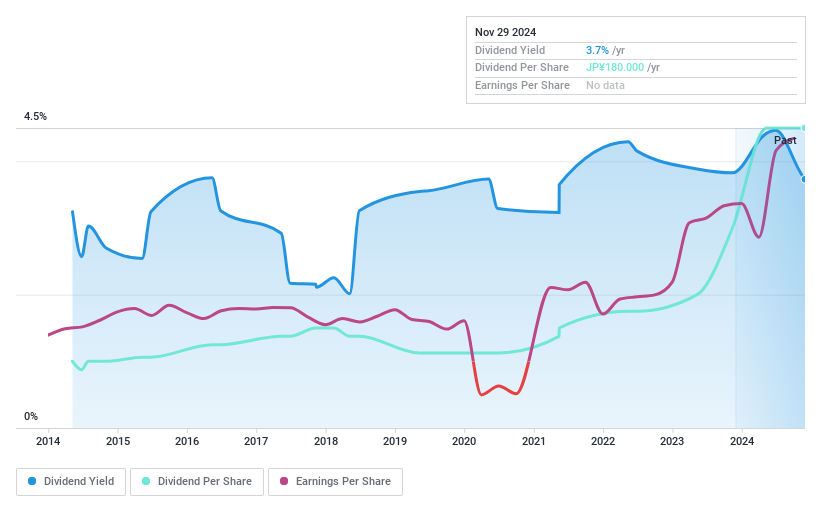

Seika (TSE:8061)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Seika Corporation is involved in the import, sale, and export of plants, machinery, and environmental protection and electronic information system equipment across Asia, Europe, the United States, and globally; it has a market cap of ¥53.07 billion.

Operations: Seika Corporation's revenue is primarily derived from its Product Business segment at ¥33.53 billion, followed by the Electric Power Business at ¥33.32 billion, and the Industrial Machinery Business at ¥25.98 billion.

Dividend Yield: 3.8%

Seika's dividend payments are well-covered by a low payout ratio of 26.9% and a cash payout ratio of 41.1%, though its dividend history has been volatile over the past decade. Recent earnings growth of 43.2% and an increase in dividends, including a second quarter end dividend rise from ¥60 to ¥90 per share, indicate financial strength. However, the follow-on equity offering may impact future dividend stability and investor confidence in consistent payouts.

- Click to explore a detailed breakdown of our findings in Seika's dividend report.

- Upon reviewing our latest valuation report, Seika's share price might be too pessimistic.

Next Steps

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1934 more companies for you to explore.Click here to unveil our expertly curated list of 1937 Top Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8061

Seika

Imports, sells, and exports plants, machinery, and environmental protection and electronic information system equipment in Asia, Europe, the United States, and internationally.

Flawless balance sheet established dividend payer.