- Japan

- /

- Trade Distributors

- /

- TSE:8053

Should Sumitomo's Rare Earths Offtake with Victory Metals Matter to Investors in (TSE:8053)?

Reviewed by Sasha Jovanovic

- Victory Metals recently announced a non-binding letter of intent with Sumitomo Corporation to advance offtake discussions for the North Stanmore Heavy Rare Earths Project in Western Australia, enabling supply of up to 30% of annual production over an initial five-year period.

- This collaboration strengthens Sumitomo’s access to critical materials and expands its global supply chain reach, underscoring the company's focus on resource security.

- With the rare earths offtake agreement highlighting Sumitomo’s commitment to critical minerals, we’ll explore its impact on the broader investment story.

Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

What Is Sumitomo's Investment Narrative?

To be a shareholder in Sumitomo right now, you have to believe in the company's ability to build value through disciplined capital allocation, stable earnings, and strategic global partnerships. The recent buyback completion adds support to the stock and signals management’s confidence, but market reactions have been relatively subdued, suggesting limited immediate impact for current catalysts. The rare earths offtake announcement with Victory Metals could be a catalyst over time, as it positions Sumitomo at the heart of global supply chains for critical minerals, but it is unlikely to drive near-term earnings or rerate risk and reward right away. The big-picture risks remain: execution pace, unclear strategic differentiation per JPMorgan’s latest coverage, and potential capital needs, such as additional spending on the Madagascar nickel project. The focus for the short term continues to be management’s ability to convert positive news into improved profitability and clear strategic direction. Yet balancing this optimism, execution risk, especially with major new projects, remains a key consideration for shareholders.

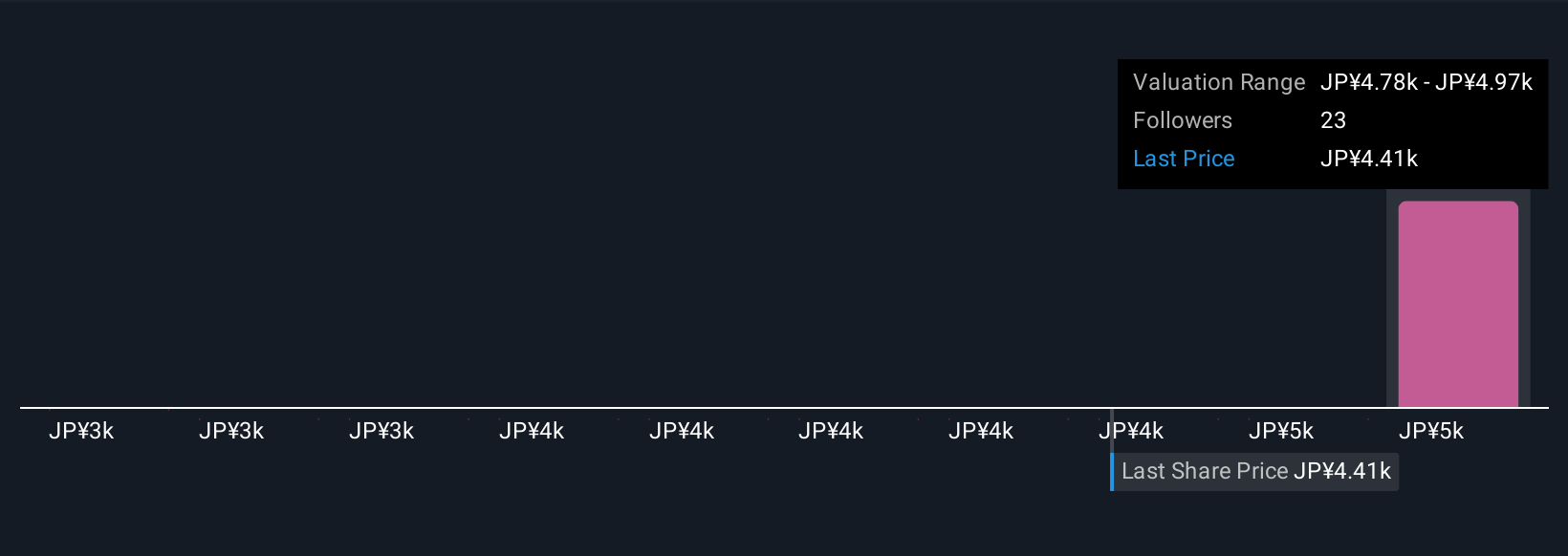

Despite retreating, Sumitomo's shares might still be trading 13% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Sumitomo - why the stock might be worth as much as 15% more than the current price!

Build Your Own Sumitomo Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sumitomo research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Sumitomo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sumitomo's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8053

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives