- Japan

- /

- Trade Distributors

- /

- TSE:8015

Toyota Tsusho (TSE:8015): Evaluating Valuation After a 72% One-Year Share Price Rally

Reviewed by Kshitija Bhandaru

Toyota Tsusho (TSE:8015) continues to attract investor attention as it builds on a steady track record over the past year. With shares climbing more than 70% during this period, the conversation is shifting toward what is driving this momentum.

See our latest analysis for Toyota Tsusho.

Toyota Tsusho’s momentum has been hard to ignore, with its share price notching consistent gains and pushing past ¥4,443 recently. The company’s 1-year total shareholder return of 72% speaks to the market’s growing confidence, especially as investors continue to back businesses with robust and reliable earnings growth. The combination of this strong result and a pattern of resilient price performance suggests that positive sentiment around Toyota Tsusho is firmly building over time.

If you’re watching for companies showing similar upward trends, it could be the perfect moment to discover fast growing stocks with high insider ownership.

After such an impressive rally, the key question for investors is whether Toyota Tsusho’s promising future is still undervalued by the market or if the current price already fully reflects its growth prospects.

Most Popular Narrative: 14.1% Overvalued

The most widely watched narrative puts Toyota Tsusho’s fair value at ¥3,894, which is meaningfully below the recent close of ¥4,443. This gap has sparked debate about whether optimism in the company’s long-term prospects is running ahead of fundamentals.

Toyota Tsusho is aggressively expanding its recycling, renewable energy, and decarbonization businesses, including large-scale battery recycling and green steel. The company is positioning itself to capture upside from the accelerating global shift toward electrification and ESG-driven supply chain transformation, which could drive higher revenue growth and margin improvement in coming years.

Want the inside story on why this well-known Japanese group gets such a high price target from analysts? The key lies in ambitions for renewables, game-changing supply chain shifts, and bold expansion bets set against tightening margins. If you’re curious which high-stakes assumptions support this valuation, dig deeper to discover what might really be fueling the fair value and learn what big forecasts could mean for the stock’s direction.

Result: Fair Value of ¥3,894 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, currency volatility and sector overreliance could quickly alter Toyota Tsusho’s outlook. As a result, the bullish narrative faces some significant external tests ahead.

Find out about the key risks to this Toyota Tsusho narrative.

Another View: What Do Valuation Ratios Suggest?

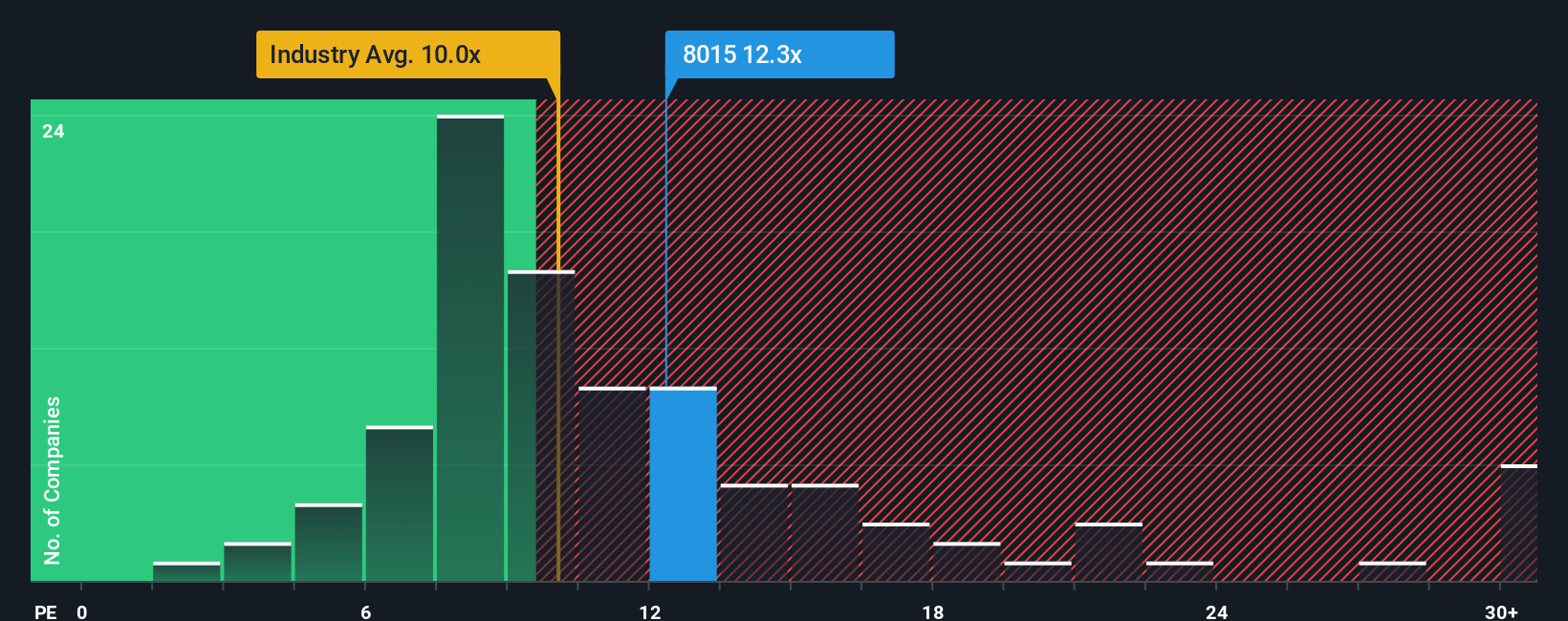

Looking at Toyota Tsusho’s valuation through its price-to-earnings ratio gives us a different perspective. The company trades at 12.8x earnings, below the Japanese market average of 14.7x, but well above both its industry average of 9.9x and a peer average of 11.6x. The fair ratio, based on market regression, is 21x. This makes Toyota Tsusho seem inexpensive if you believe the market could one day price it higher. However, being more expensive than its peers may mean less room for upside, or it could point to higher quality. Which side of the numbers will ultimately win out for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Toyota Tsusho Narrative

If you see the story differently or want to examine the numbers with your own lens, you can shape a unique narrative of your own in just a few minutes, so why not Do it your way.

A great starting point for your Toyota Tsusho research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that great opportunities rarely wait. Don’t let today’s momentum be your only win. Expand your sights and seek your next big success with these powerful stock ideas from Simply Wall Street’s Screener:

- Tap into hidden value and seek strong returns by using these 894 undervalued stocks based on cash flows, which is perfect for those aiming to catch stocks before they become the market’s next favorites.

- Target reliable yields and enhance your passive income with these 19 dividend stocks with yields > 3%, filled with companies offering attractive dividends and robust financial track records.

- Ride the wave of artificial intelligence innovation by checking out these 25 AI penny stocks, where you’ll find trailblazers shaping tomorrow’s tech landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Tsusho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8015

Toyota Tsusho

Engages in the metals, circular economy, supply chain, mobility, green infrastructure, digital solutions, and lifestyle businesses.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives