- Japan

- /

- Electronic Equipment and Components

- /

- TSE:3076

Top 3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are increasingly seeking stability amidst the volatility. In such an environment, dividend stocks can offer a reliable income stream and potential for portfolio enhancement, making them an attractive option for those looking to balance risk with steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.24% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.72% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Ai Holdings (TSE:3076)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Ai Holdings Corporation offers security and peripheral computer equipment, measuring devices, and card and office equipment, with a market cap of ¥100.31 billion.

Operations: Ai Holdings Corporation's revenue segments include security and peripheral computer equipment, measuring devices, and card and office equipment.

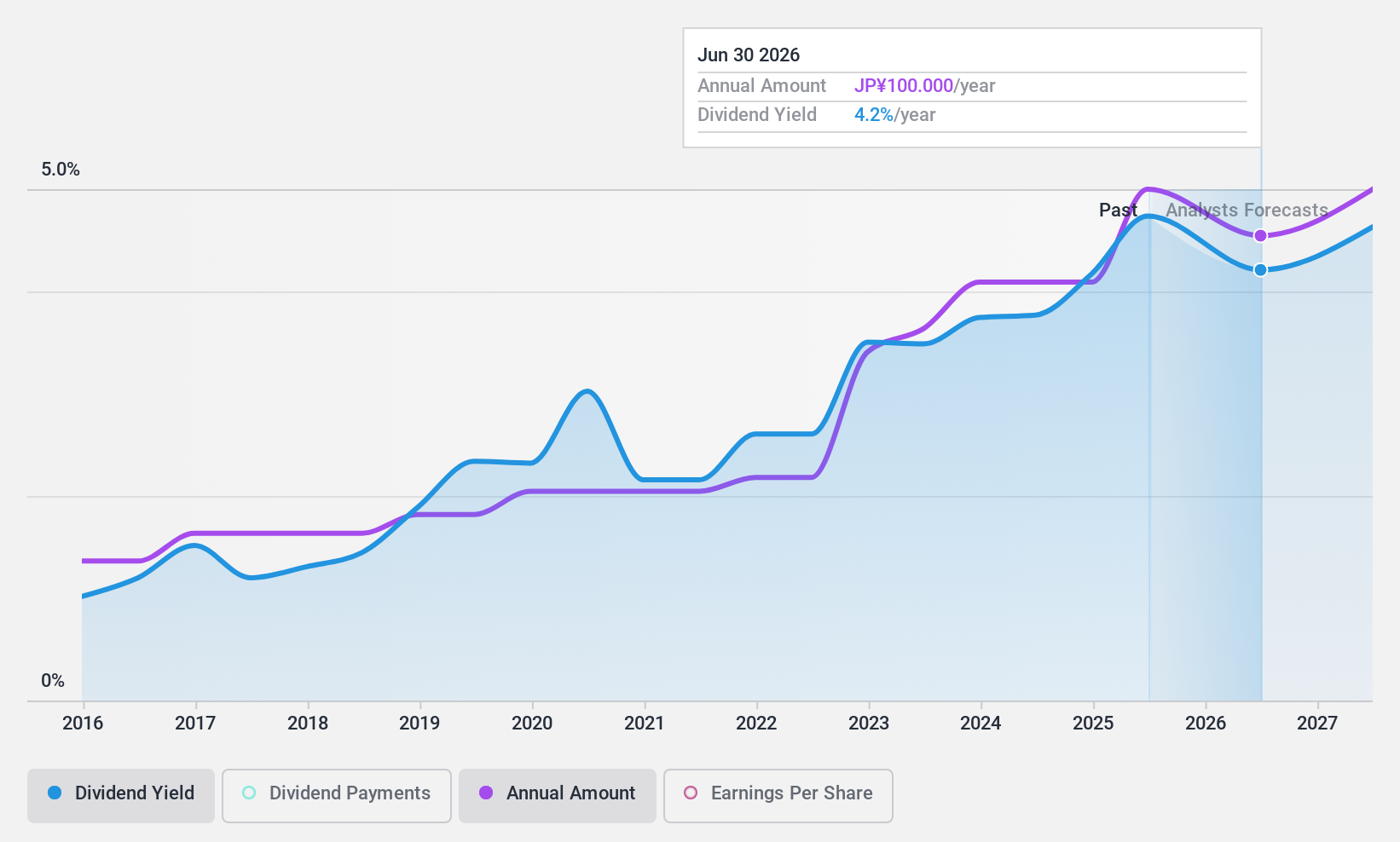

Dividend Yield: 4.2%

Ai Holdings offers a compelling option for dividend investors with stable and growing dividends over the past decade. The company maintains a high dividend yield of 4.25%, placing it in the top 25% of JP market payers, supported by a low payout ratio of 17.8%. Despite earnings forecasted to decline significantly, revenue is expected to grow annually by 14.05%. Its Price-To-Earnings ratio is attractively low at 4.2x compared to the JP market average.

- Navigate through the intricacies of Ai Holdings with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Ai Holdings is trading behind its estimated value.

Kumiai Chemical Industry (TSE:4996)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kumiai Chemical Industry Co., Ltd. manufactures and sells agrochemicals both in Japan and internationally, with a market cap of approximately ¥89.56 billion.

Operations: Kumiai Chemical Industry Co., Ltd. generates revenue primarily through its Pesticides and Agriculture segment, which accounts for ¥128.14 billion, alongside its Fine Chemicals segment contributing ¥25.02 billion.

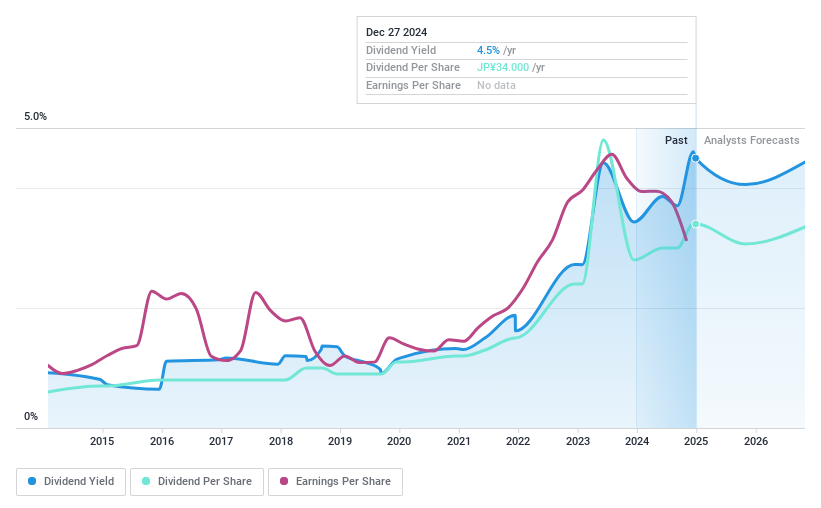

Dividend Yield: 4.6%

Kumiai Chemical Industry's dividend yield of 4.57% ranks in the top 25% of JP market payers, yet its dividends are not well covered by free cash flows, indicating potential sustainability issues. Although trading at a significant discount to its estimated fair value and showing improved earnings forecasts, the company's dividend history has been volatile over the past decade. Recent guidance maintains steady dividends per share for upcoming quarters and fiscal year despite these challenges.

- Click here and access our complete dividend analysis report to understand the dynamics of Kumiai Chemical Industry.

- The valuation report we've compiled suggests that Kumiai Chemical Industry's current price could be quite moderate.

Takashima (TSE:8007)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Takashima & Co., Ltd. operates in Japan through its subsidiaries, focusing on the design, proposal, processing, material sale, and distribution of construction and building products, with a market cap of ¥21.61 billion.

Operations: Takashima & Co., Ltd. generates revenue through its activities in the construction and building products sector, encompassing design, proposal, processing, material sales, and distribution within Japan.

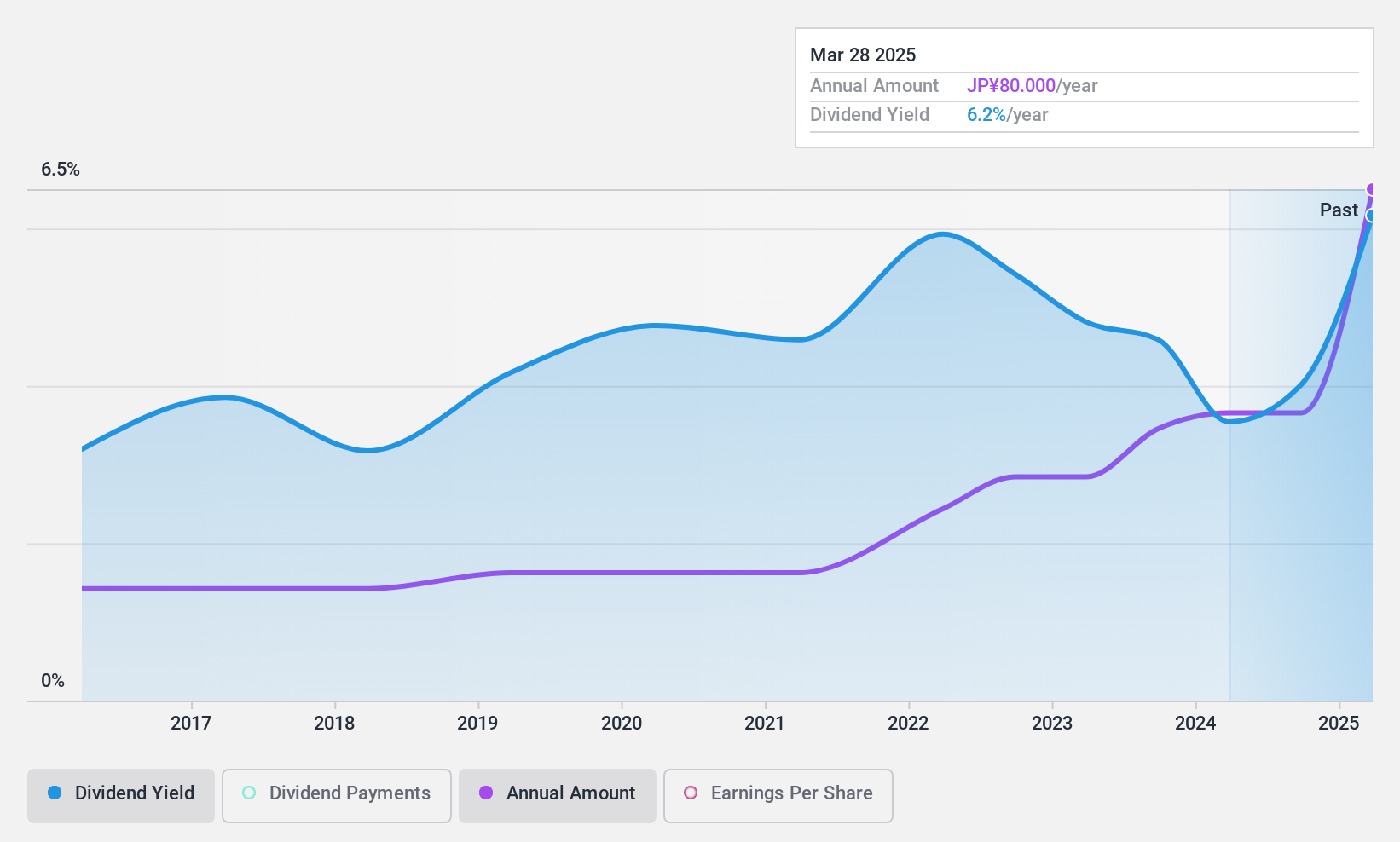

Dividend Yield: 6.3%

Takashima's dividend yield of 6.34% places it among the top 25% in Japan, supported by a low payout ratio of 24.6%, indicating strong earnings coverage. However, its dividend history is marked by volatility and recent reductions, with a JPY 40 per share payment for Q2 ending September 2024. Despite robust earnings growth of 155.8% last year and trading significantly below fair value estimates, the sustainability and reliability of future dividends remain uncertain amidst executive changes.

- Take a closer look at Takashima's potential here in our dividend report.

- Our expertly prepared valuation report Takashima implies its share price may be lower than expected.

Next Steps

- Navigate through the entire inventory of 1951 Top Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3076

Ai Holdings

Provides security and peripheral computer equipment, measuring devices, and card and other office equipment.

6 star dividend payer with solid track record.