- Japan

- /

- Trade Distributors

- /

- TSE:8001

ITOCHU (TSE:8001): Assessing Valuation After Completing Its Latest Share Buyback Program

Reviewed by Simply Wall St

ITOCHU (TSE:8001) just wrapped up its latest share buyback, closing the plan on December 16 after repurchasing about 1.3% of shares. That capital return move is drawing fresh investor attention.

See our latest analysis for ITOCHU.

The buyback wraps up a year where ITOCHU has seen solid momentum, with a roughly 21 percent year to date share price return and a powerful multi year total shareholder return profile that suggests investors still see room for compounding.

If this kind of capital allocation has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership as a way to uncover the next round of potential compounders.

But with shares near record highs, a long run of outperformance, and analysts only seeing modest upside from here, the key question now is whether ITOCHU is still undervalued or whether markets are already pricing in future growth.

Most Popular Narrative: 7% Undervalued

With ITOCHU last closing at ¥9,460 against a narrative fair value near ¥10,175, the most followed view argues there is still some upside left.

Progress on asset replacement and active portfolio management, along with robust share buyback activity, is likely to drive EPS growth and support shareholder returns, which may not be fully reflected in the current valuation.

Curious how modest revenue growth, slightly tightening margins, and a richer future earnings multiple can still add up to upside from here? The full narrative breaks down the exact growth path, the discount rate assumptions, and the earnings power ITOCHU must deliver to justify that higher fair value. Want to see the numbers behind that conviction?

Result: Fair Value of ¥10,175.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on resource-linked earnings and softer demand in key markets like China could quickly challenge the current undervaluation narrative.

Find out about the key risks to this ITOCHU narrative.

Another Angle On Valuation

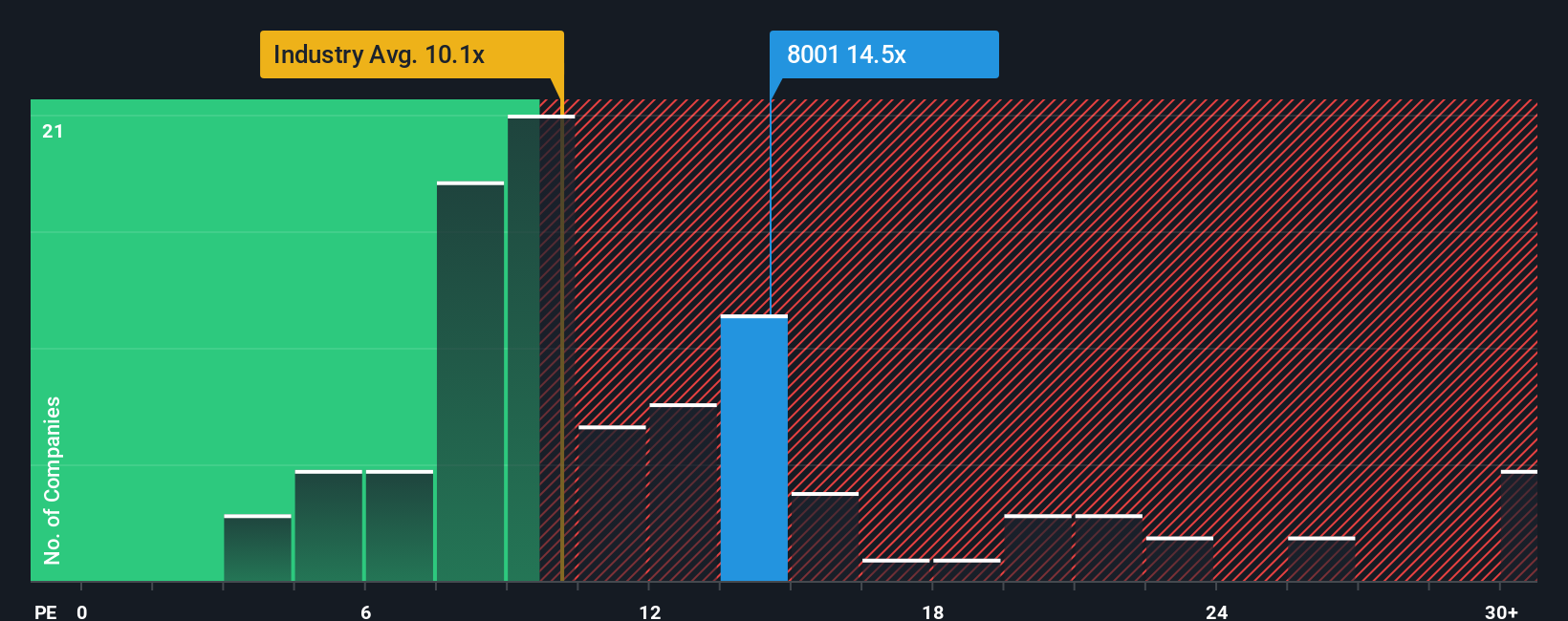

While the narrative fair value suggests ITOCHU is about 7 percent undervalued, a simple earnings lens is less generous. At 14.1 times earnings, the stock looks expensive versus the Trade Distributors industry on 10.2 times, yet cheaper than peers on 15 times and well below its 23.2 times fair ratio. Is the market underestimating or overestimating how long ITOCHU can keep compounding?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ITOCHU Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a fresh view in minutes: Do it your way.

A great starting point for your ITOCHU research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at ITOCHU, you could miss exceptional opportunities. Put the Simply Wall Street Screener to work and plan your next investing move.

- Capture mispriced potential by scanning these 907 undervalued stocks based on cash flows that may be trading below their long term cash flow power.

- Explore innovation by targeting these 24 AI penny stocks that are positioned to benefit from breakthroughs in artificial intelligence.

- Strengthen your income stream by focusing on these 10 dividend stocks with yields > 3% that aim to combine yield with solid underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8001

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion