As global markets continue to navigate a landscape of geopolitical tensions and economic uncertainties, smaller-cap indexes have shown resilience, outperforming their larger counterparts amid broad-based gains. With the U.S. indexes nearing record highs and positive sentiment bolstered by strong labor market data, investors may find opportunities in lesser-known stocks that exhibit potential for growth within this dynamic environment. Identifying a promising stock often involves looking at companies with solid fundamentals and the ability to thrive despite broader market challenges, making them compelling options for those seeking undiscovered gems in today's market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Union Coop (DFM:UNIONCOOP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Union Coop operates hypermarkets and consumer cooperatives in the United Arab Emirates with a market capitalization of AED3.94 billion.

Operations: Union Coop generates revenue primarily through its retail segment, contributing AED1.72 billion, and e-commerce activities, adding AED125.72 million.

Union Coop, a nimble player in the consumer retailing sector, has demonstrated robust financial health with no debt over the past five years. Its earnings surged by 32% last year, outpacing industry growth and reflecting high-quality earnings. Trading at 8.1% below estimated fair value suggests potential for investors seeking undervalued opportunities. Recent reports highlight a net income of AED 49.56 million for Q3 2024, up from AED 42.38 million the previous year, with basic earnings per share rising to AED 0.03 from AED 0.02 a year ago, indicating steady profitability amidst ongoing strategic evaluations like transforming into a PJSC.

- Click here to discover the nuances of Union Coop with our detailed analytical health report.

Evaluate Union Coop's historical performance by accessing our past performance report.

Toagosei (TSE:4045)

Simply Wall St Value Rating: ★★★★★★

Overview: Toagosei Co., Ltd. is a company that, along with its subsidiaries, engages in the manufacturing, distribution, and sale of chemical products both in Japan and globally, with a market cap of ¥170.57 billion.

Operations: Toagosei generates revenue primarily from its Fundamental Chemistry Product Business, which contributes ¥81.68 billion, followed by the Polymers and Oligomer Business at ¥36.44 billion. The Resin Processing Product Business adds ¥28.69 billion to the revenue stream, while Adhesive Material and Highly Functional Inorganic Materials Businesses contribute smaller amounts of ¥13.62 billion and ¥10.34 billion respectively.

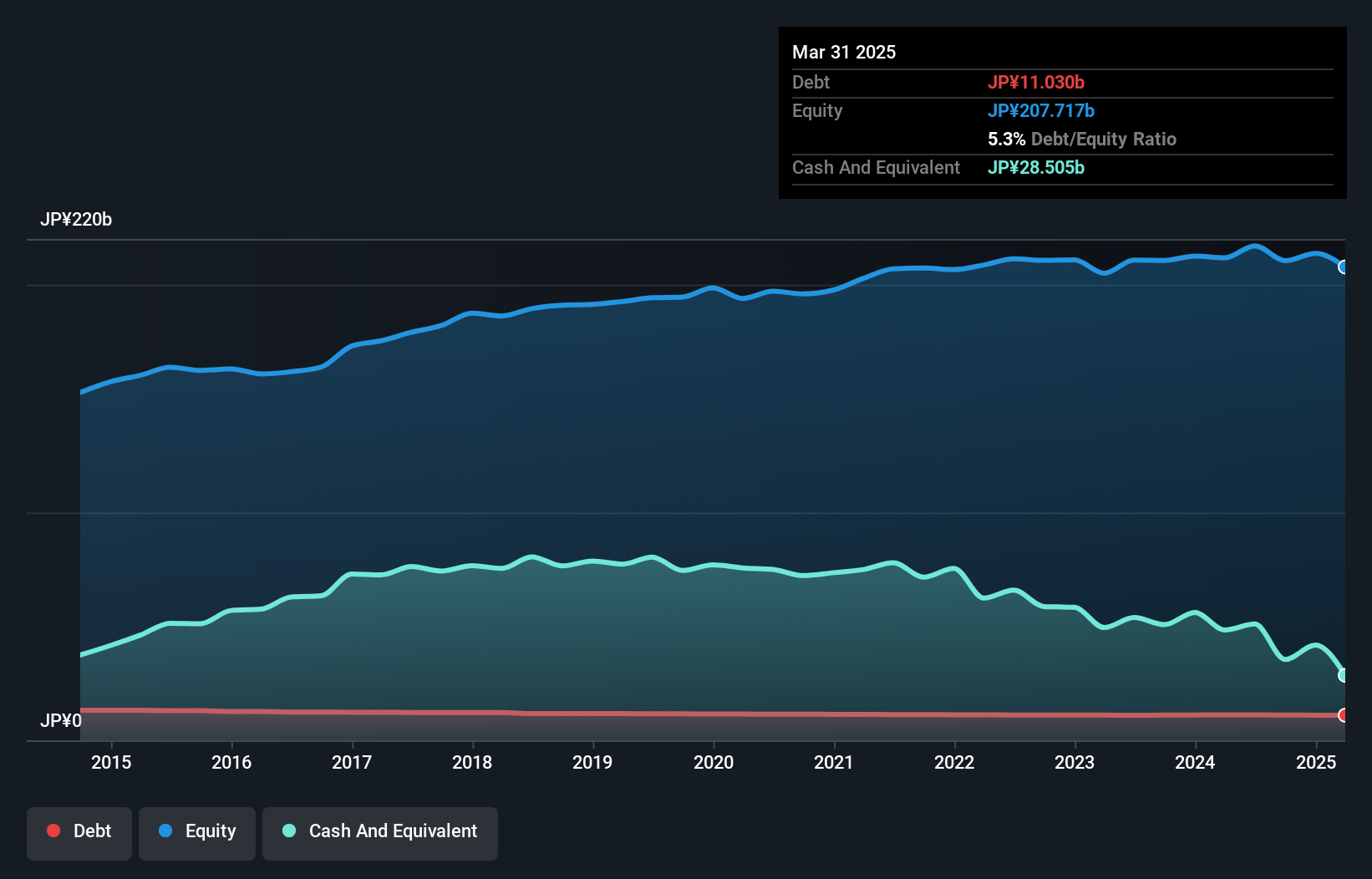

Toagosei, a promising name in the chemical industry, has demonstrated robust earnings growth of 39.9% over the past year, outpacing its industry peers significantly. The company is trading at 38.5% below its estimated fair value, suggesting potential undervaluation in the market. Recent strategic moves include a foray into land-based salmon farming through investment and supply of essential liquid chemicals to Soul of Japan K.K., showcasing its commitment to sustainability and innovation. Additionally, Toagosei's debt-to-equity ratio has improved from 6% to 5.3% over five years, reflecting prudent financial management amidst ongoing share repurchases totaling ¥5.92 billion this year.

- Click to explore a detailed breakdown of our findings in Toagosei's health report.

Gain insights into Toagosei's past trends and performance with our Past report.

Takara StandardLtd (TSE:7981)

Simply Wall St Value Rating: ★★★★★★

Overview: Takara Standard Co., Ltd. is a company that specializes in the manufacturing and sale of enameled products, with a market capitalization of ¥111.47 billion.

Operations: Takara Standard Co., Ltd. generates revenue primarily through the manufacturing and sale of enameled products. The company's financial performance is reflected in its market capitalization of ¥111.47 billion, indicating its scale within the industry.

Takara Standard, a player in the building industry, shows a mixed performance with earnings growing 2% annually over five years. Despite this steady growth, its recent annual earnings increase of 2.9% lagged behind the industry's 7.6%. The company trades at a significant discount of 57.8% below its estimated fair value, suggesting potential undervaluation. Financially sound, Takara's debt to equity ratio has improved from 5.8% to 4%, and it holds more cash than total debt. Recent events include a slight dividend hike to ¥28 per share but no shares were repurchased in the latest tranche update.

- Click here and access our complete health analysis report to understand the dynamics of Takara StandardLtd.

Understand Takara StandardLtd's track record by examining our Past report.

Key Takeaways

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4634 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toagosei might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4045

Toagosei

Manufactures, distributes, and sells chemical products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.