Undiscovered Gems With Impressive Potential For January 2025

Reviewed by Simply Wall St

As global markets experience a surge, buoyed by easing core inflation and robust earnings from financial giants, the S&P MidCap 400 and Russell 2000 indices have posted notable gains, reflecting renewed investor confidence in small-cap stocks. With this backdrop of optimism, identifying promising small-cap opportunities becomes crucial for investors seeking to capitalize on potential growth; these undiscovered gems often possess strong fundamentals and innovative business models that align well with current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

We'll examine a selection from our screener results.

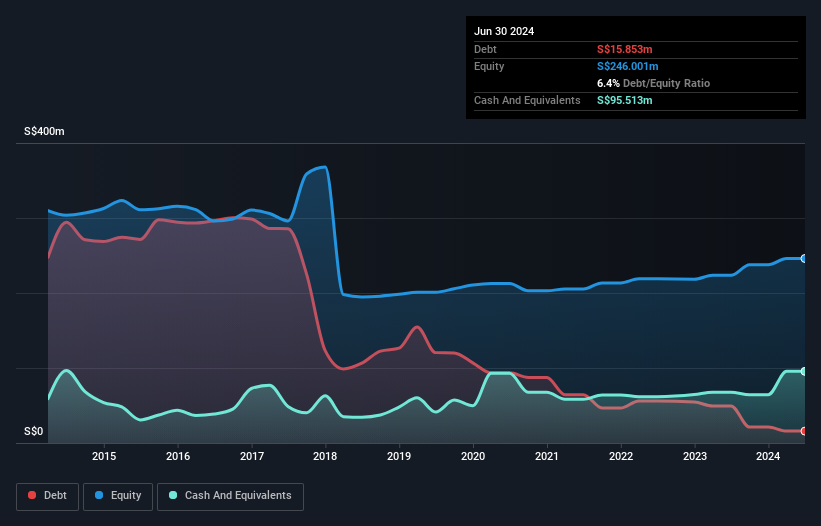

Pan-United (SGX:P52)

Simply Wall St Value Rating: ★★★★★★

Overview: Pan-United Corporation Ltd is an investment holding company that operates in the concrete and logistics sectors both in Singapore and internationally, with a market cap of SGD429.49 million.

Operations: Pan-United generates revenue primarily from its Concrete & Cement segment, which contributes SGD784.60 million, and a smaller portion from Trading and Shipping at SGD16.76 million.

Pan-United, a smaller player in its industry, has shown promising financial health and growth potential. Over the past year, earnings grew by 41%, outpacing the Trade Distributors sector's -8% performance. The company's debt to equity ratio impressively decreased from 59.9% to 6.4% over five years, indicating strong financial management. Trading at a notable 40% below estimated fair value suggests potential undervaluation in the market. With interest payments well covered by EBIT at 20.6 times and high-quality past earnings, Pan-United seems poised for continued growth with forecasted annual earnings increase of approximately 13%.

- Take a closer look at Pan-United's potential here in our health report.

Review our historical performance report to gain insights into Pan-United's's past performance.

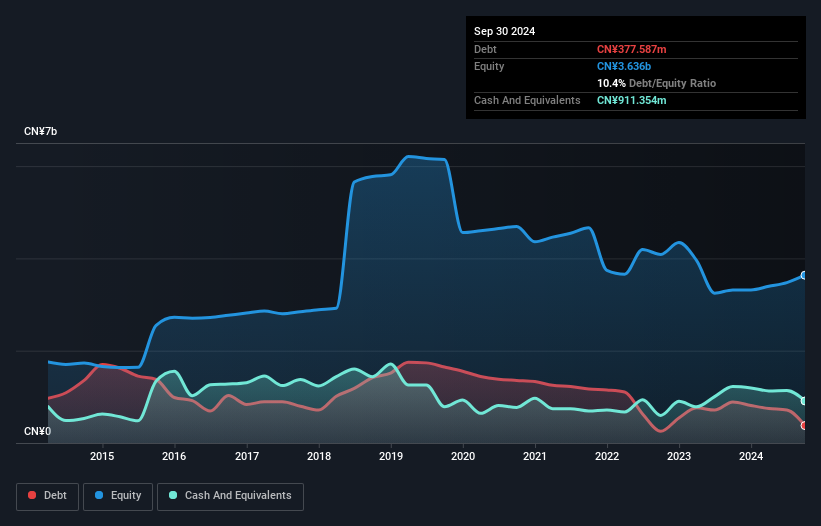

Yiwu Huading NylonLtd (SHSE:601113)

Simply Wall St Value Rating: ★★★★★★

Overview: Yiwu Huading Nylon Co., Ltd. specializes in the research, development, manufacture, and sale of nylon filaments primarily in China and has a market cap of CN¥4.45 billion.

Operations: Yiwu Huading Nylon Co., Ltd. generates revenue through the sale of nylon filaments, focusing on the Chinese market. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Yiwu Huading Nylon, a dynamic player in the chemicals sector, has showcased robust financial health with a 40% earnings growth over the past year, outpacing the industry average of -5%. The company reported net income of CNY 324.27 million for the first nine months of 2024, up from CNY 165.23 million in the previous year. Trading at approximately 60% below estimated fair value further enhances its appeal. Additionally, Yiwu Huading's debt-to-equity ratio has improved significantly from 26.8% to 10.4% over five years, highlighting prudent financial management and potential for future growth despite recent revenue challenges.

- Click here and access our complete health analysis report to understand the dynamics of Yiwu Huading NylonLtd.

Explore historical data to track Yiwu Huading NylonLtd's performance over time in our Past section.

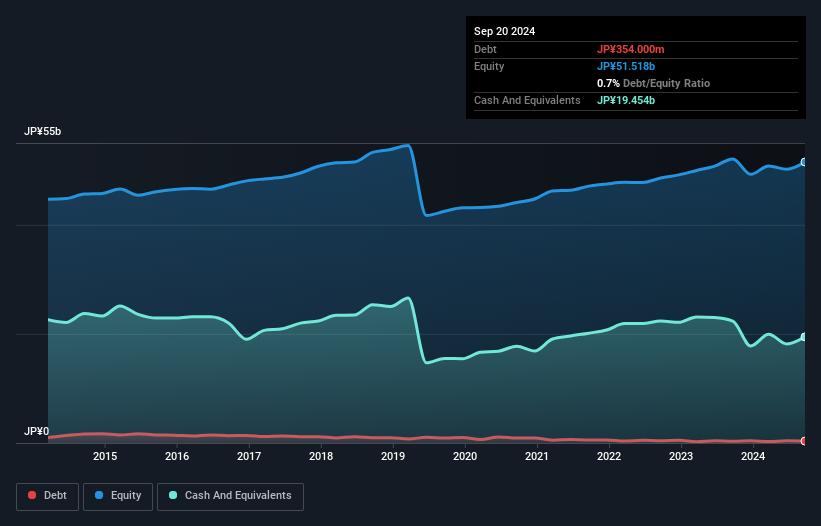

Mirai IndustryLtd (TSE:7931)

Simply Wall St Value Rating: ★★★★★★

Overview: Mirai Industry Co., Ltd. is a Japanese company that, along with its subsidiaries, focuses on the manufacturing and sale of electrical and pipe materials as well as wiring devices, with a market capitalization of approximately ¥62.59 billion.

Operations: Mirai Industry Co., Ltd. generates its revenue primarily from the sale of electrical materials and pipe materials, which account for ¥34.80 billion, followed by wiring accessories at ¥7.08 billion. The company's financial performance is influenced by its net profit margin trends over time, reflecting its ability to manage costs and optimize profitability within these segments.

Mirai Industry Ltd. showcases a promising profile with its debt to equity ratio decreasing from 2.1% to 0.7% over five years, indicating financial prudence. This company has outpaced the electrical industry with a notable earnings growth of 40% last year, reflecting robust performance despite an expected average earnings decline of 2.4% annually for the next three years. Trading at roughly two-thirds below estimated fair value suggests potential undervaluation in the market's eyes, while its high-quality past earnings and positive free cash flow further bolster confidence in its operational efficiency and fiscal health moving forward.

- Click here to discover the nuances of Mirai IndustryLtd with our detailed analytical health report.

Assess Mirai IndustryLtd's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Delve into our full catalog of 4657 Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601113

Yiwu Huading NylonLtd

Engages in the research, development, manufacture, and sale of nylon filaments primarily in China.

Flawless balance sheet and good value.