- Japan

- /

- Electrical

- /

- TSE:7931

Undiscovered Gems Promising Stocks To Explore This November 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of shifting economic policies and interest rate expectations, small-cap stocks have seen varied performances, particularly as sectors like financials and energy react to potential deregulation benefits. Amidst this backdrop, investors may find opportunities in lesser-known stocks that demonstrate strong fundamentals and resilience to current market volatility. Identifying such "undiscovered gems" requires a keen eye for companies with robust growth potential and adaptability in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| Thai Energy Storage Technology | 9.49% | -1.42% | 1.73% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Tethys Petroleum | NA | 29.98% | 44.48% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Argosy Research (TPEX:3217)

Simply Wall St Value Rating: ★★★★★★

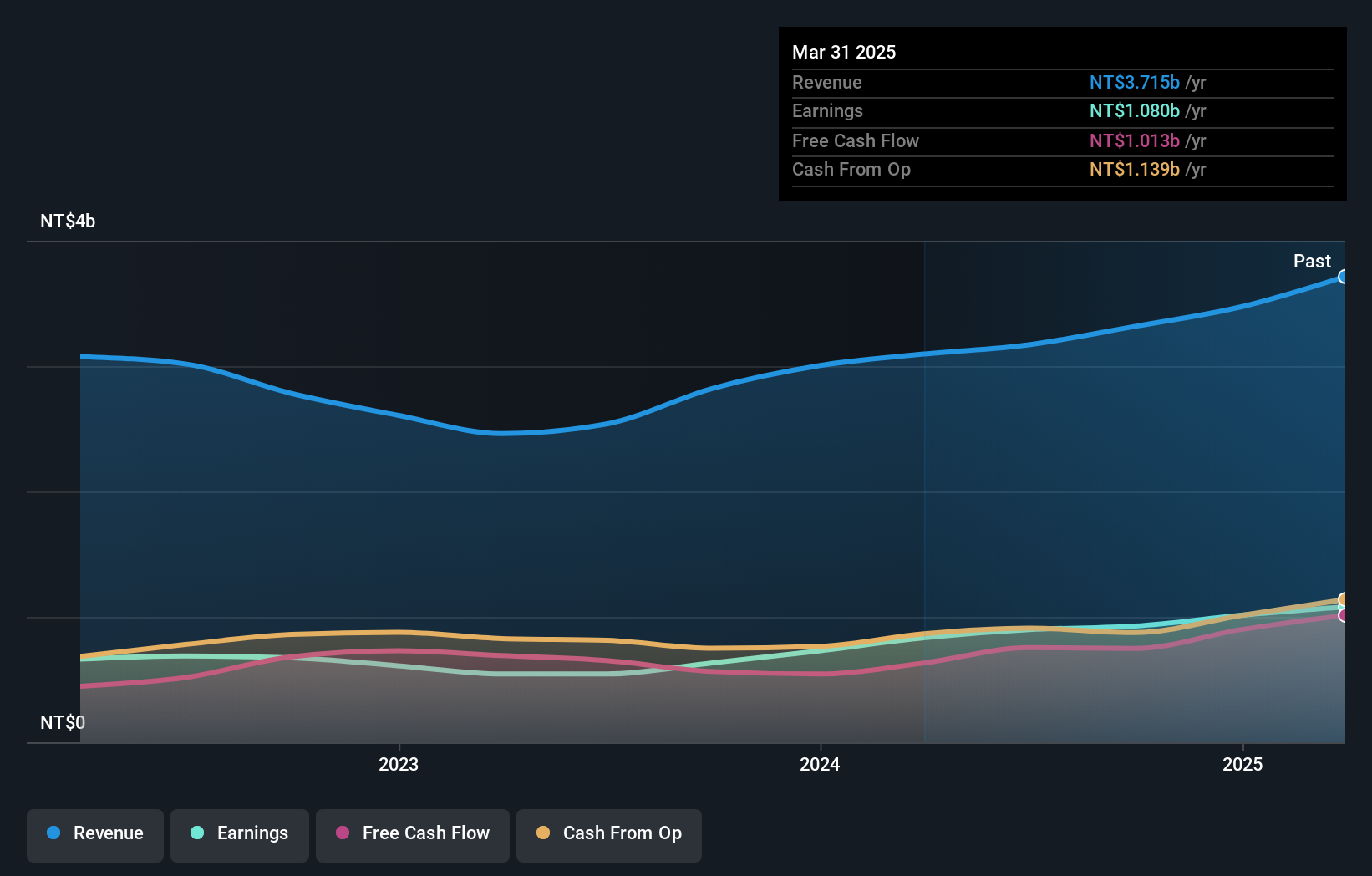

Overview: Argosy Research Inc. specializes in producing and selling electronic components, connectors, and system products across Asia, the United States, and internationally with a market cap of NT$13.65 billion.

Operations: Argosy Research generates revenue primarily from the manufacturing and sales of electronic component products, totaling NT$3.32 billion.

Argosy Research, a smaller player in the electronics industry, has demonstrated impressive growth with earnings surging 46% over the past year, outpacing the industry's 9%. The company is trading at nearly 44% below its estimated fair value and boasts high-quality earnings. Recent financial results highlight sales of TWD 1.04 billion for Q3 2024, up from TWD 893.9 million last year, with net income rising to TWD 314.74 million from TWD 286.59 million. Argosy's strategic moves include forming new committees to enhance governance and sustainability efforts as it navigates future growth prospects confidently without debt concerns.

- Get an in-depth perspective on Argosy Research's performance by reading our health report here.

Explore historical data to track Argosy Research's performance over time in our Past section.

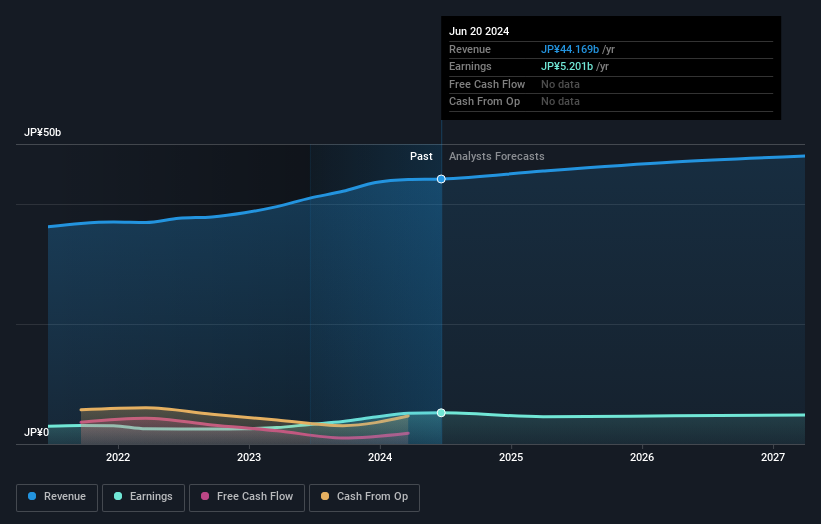

Mirai IndustryLtd (TSE:7931)

Simply Wall St Value Rating: ★★★★★★

Overview: Mirai Industry Co., Ltd., along with its subsidiaries, is involved in the production and distribution of electrical and pipe materials, as well as wiring devices in Japan, with a market capitalization of ¥60.97 billion.

Operations: Mirai Industry Co., Ltd. generates revenue primarily from electrical materials and pipe materials, contributing ¥34.80 billion, followed by wiring accessories at ¥7.08 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability trends over time.

Mirai Industry, a nimble player in its sector, has seen its debt to equity ratio shrink from 2.1% to 0.7% over five years, showcasing financial prudence. Earnings surged by 40%, outpacing the electrical industry's growth of 15%. Despite this robust performance, future earnings are expected to dip by an average of 2.4% annually over the next three years. Trading at a significant discount—65% below estimated fair value—it remains an intriguing prospect for investors seeking undervalued opportunities. Recently, Mirai announced dividends totaling ¥130 per share for fiscal year ending March 2025 and projects net sales of ¥45 billion with operating profit hitting ¥6.6 billion.

- Click to explore a detailed breakdown of our findings in Mirai IndustryLtd's health report.

Evaluate Mirai IndustryLtd's historical performance by accessing our past performance report.

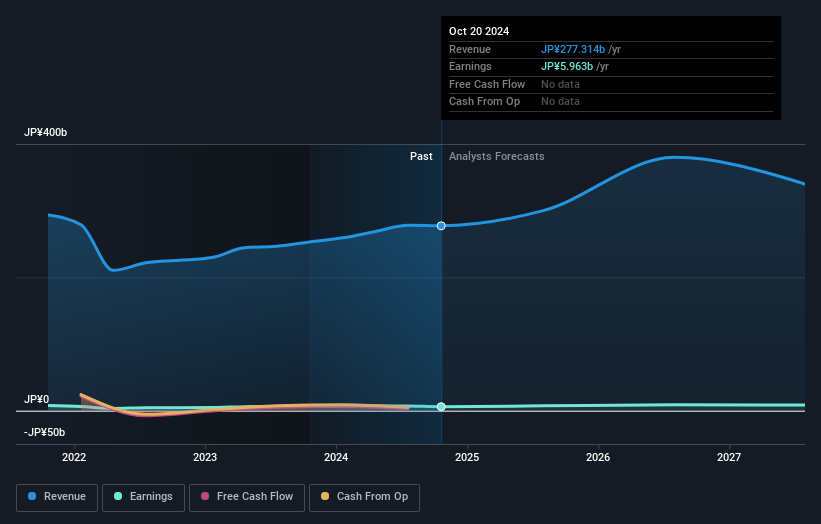

Uchida Yoko (TSE:8057)

Simply Wall St Value Rating: ★★★★★★

Overview: Uchida Yoko Co., Ltd. offers solutions for government and education, office, and information systems both in Japan and internationally, with a market cap of ¥67.53 billion.

Operations: The company's revenue streams are primarily derived from its Information-Related segment at ¥139.85 billion, followed by Public Related Business at ¥81.01 billion and Office Related Business at ¥56.63 billion.

With a solid track record, Uchida Yoko shines with its earnings growing by 9.9% over the past year, outpacing the IT industry average of 9.4%. The company's price-to-earnings ratio stands at 9.7x, which is favorable compared to Japan's market average of 13.5x, suggesting potential value. Uchida Yoko also boasts a robust financial position with more cash than total debt and a reduced debt-to-equity ratio from 5.4% to 3.3% over five years, indicating prudent financial management. These factors combined paint an encouraging picture for this under-the-radar player in the tech sector.

- Click here and access our complete health analysis report to understand the dynamics of Uchida Yoko.

Assess Uchida Yoko's past performance with our detailed historical performance reports.

Next Steps

- Click here to access our complete index of 4627 Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Mirai IndustryLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7931

Mirai IndustryLtd

Engages in the manufacture and sale of electrical and pipe materials, and wiring devices in Japan.

Flawless balance sheet average dividend payer.