Risks To Shareholder Returns Are Elevated At These Prices For Nitchitsu Co., Ltd. (TSE:7021)

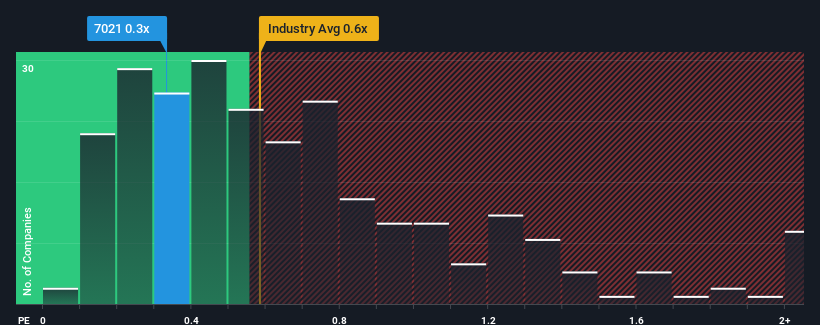

There wouldn't be many who think Nitchitsu Co., Ltd.'s (TSE:7021) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Machinery industry in Japan is similar at about 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Nitchitsu

What Does Nitchitsu's Recent Performance Look Like?

Nitchitsu has been doing a decent job lately as it's been growing revenue at a reasonable pace. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Nitchitsu, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Nitchitsu's Revenue Growth Trending?

In order to justify its P/S ratio, Nitchitsu would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.3%. Still, lamentably revenue has fallen 2.2% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 5.5% shows it's an unpleasant look.

With this in mind, we find it worrying that Nitchitsu's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Nitchitsu's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at Nitchitsu revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

You need to take note of risks, for example - Nitchitsu has 3 warning signs (and 1 which is significant) we think you should know about.

If these risks are making you reconsider your opinion on Nitchitsu, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nitchitsu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7021

Flawless balance sheet and fair value.

Market Insights

Community Narratives