Investors Still Aren't Entirely Convinced By Kawasaki Heavy Industries, Ltd.'s (TSE:7012) Revenues Despite 26% Price Jump

Kawasaki Heavy Industries, Ltd. (TSE:7012) shareholders have had their patience rewarded with a 26% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 35%.

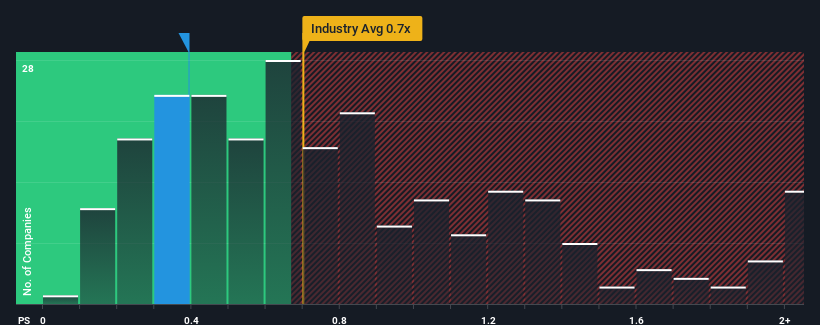

In spite of the firm bounce in price, there still wouldn't be many who think Kawasaki Heavy Industries' price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Japan's Machinery industry is similar at about 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Kawasaki Heavy Industries

How Kawasaki Heavy Industries Has Been Performing

Recent revenue growth for Kawasaki Heavy Industries has been in line with the industry. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Keen to find out how analysts think Kawasaki Heavy Industries' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Kawasaki Heavy Industries' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.0% last year. The latest three year period has also seen a 14% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 7.0% per annum during the coming three years according to the twelve analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 4.3% per annum, which is noticeably less attractive.

With this information, we find it interesting that Kawasaki Heavy Industries is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Its shares have lifted substantially and now Kawasaki Heavy Industries' P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Kawasaki Heavy Industries currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Kawasaki Heavy Industries that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Kawasaki Heavy Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7012

Kawasaki Heavy Industries

Engages in aerospace systems, energy solution and marine engineering, precision machinery and robot, rolling stock, and motorcycle and engine businesses in Japan and internationally.

Solid track record and fair value.