Mitsubishi Heavy Industries (TSE:7011): Is the Market Missing Something in the Valuation?

Reviewed by Simply Wall St

If you have been watching Mitsubishi Heavy Industries (TSE:7011), you are likely wondering what comes next. There has not been a headline-making event, but the stock’s recent movement may have investors asking if the market is sensing something below the surface or simply reacting to broader sector trends. Sometimes, a sideways stretch can spark as much curiosity as a surge, especially for a company with a diverse footprint in global industry.

After a remarkable year, Mitsubishi Heavy Industries has seen its share price cool off in recent weeks. The stock is down about 6% over the past month, despite posting an impressive 109% return over the past year and a sixfold gain over three years. Those kinds of moves do not happen in a vacuum. The company’s latest results showed annual revenue growth of 7% and net income up 16%, which may have helped underpin its longer-term momentum, even as the market seems to be taking a breather.

So with momentum slowing, is Mitsubishi Heavy Industries trading at a compelling valuation, or is the market already looking ahead to the company’s next chapter?

Most Popular Narrative: 1.9% Undervalued

The prevailing narrative sees Mitsubishi Heavy Industries as modestly undervalued compared to projections of future growth in its critical sectors.

Order backlog growth to a record-high ¥10.77 trillion, with continued strong order intake in Energy Systems and infrastructure replacement projects, points to sustained multi-year revenue visibility as governments and corporations accelerate clean energy and infrastructure spending worldwide. Robust order momentum and profit expansion in next-generation energy (GTCC, nuclear, steam, carbon capture), paired with strategic realignment toward energy transition products, strengthens the long-term earnings profile and supports potential margin expansion as demand shifts to higher-value, lower-carbon solutions.

Want to uncover the key forces powering this valuation? The narrative hints at a rare combination: a growing backlog, bold sector pivots, and ambitious financial targets. Curious about the quantitative forecasts and assumptions shaping such optimism? The drivers behind this fair value may surprise you. See what lies beneath the headline numbers.

Result: Fair Value of ¥3,776.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent currency volatility or delays in major defense projects could quickly change the outlook. This serves as a reminder to investors that risks often surface unexpectedly.

Find out about the key risks to this Mitsubishi Heavy Industries narrative.Another View: What About Earnings Ratios?

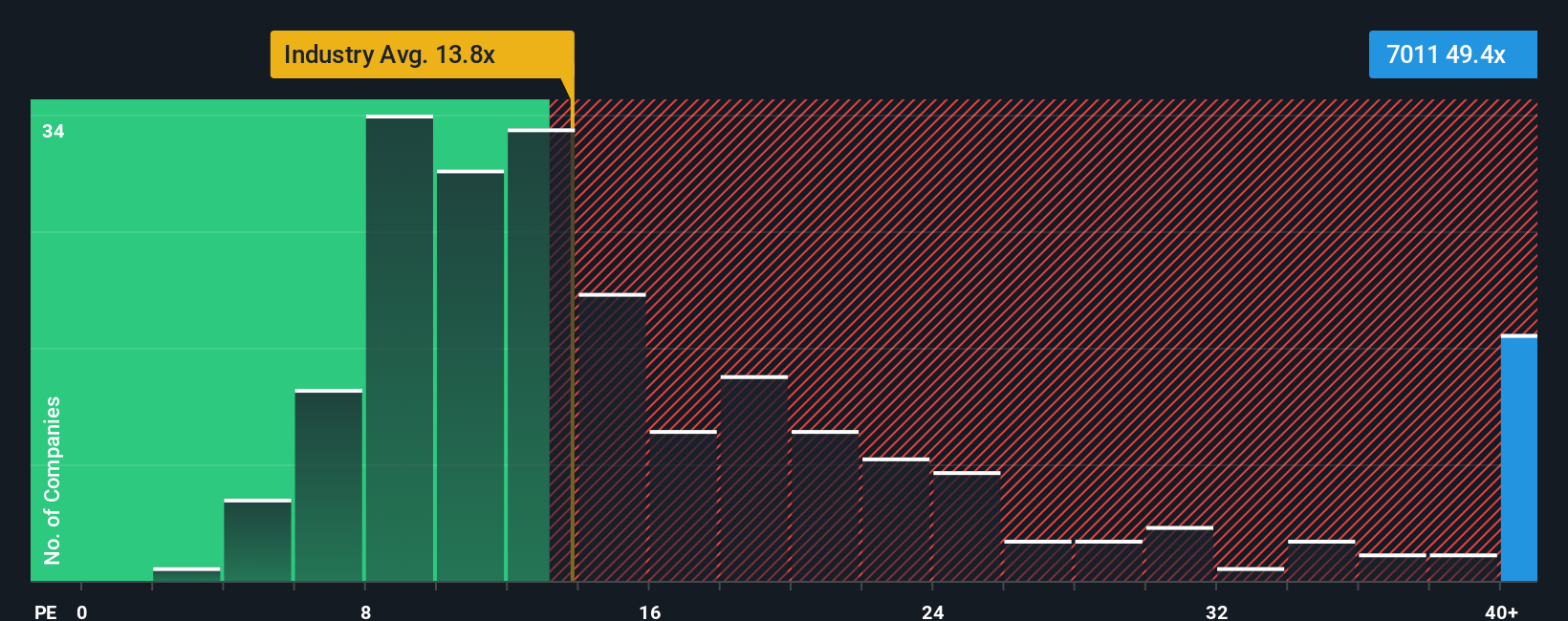

A different angle suggests Mitsubishi Heavy Industries looks expensive by traditional earnings comparisons. Its current price-to-earnings ratio is much higher than the industry average, which raises the question of whether recent optimism already prices in much of the company's growth story.

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Mitsubishi Heavy Industries to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Mitsubishi Heavy Industries Narrative

If you have a different perspective or want to dive into the numbers yourself, you can quickly create your own view and analysis in just a few minutes. Do it your way

A great starting point for your Mitsubishi Heavy Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Opportunities?

Don't settle for just one idea when you could be building a smarter, more dynamic portfolio. Check out these handpicked ways to broaden your investment strategy now:

- Boost your passive income with companies offering attractive returns linked to dividend stocks with yields > 3%. See how reliable payouts can support your goals.

- Tap into the power of innovation with AI penny stocks. Catch early movers capitalizing on artificial intelligence breakthroughs before the crowd.

- Seize value where others might not look by hunting for stocks priced below their cash flow potential using our undervalued stocks based on cash flows approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7011

Mitsubishi Heavy Industries

Manufactures and sells heavy machinery worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives