Stock Analysis

As of July 2024, the Japanese stock market has shown signs of volatility, particularly with a retreat from recent highs amid speculation about currency market interventions. This environment underscores the potential value in exploring lesser-known stocks that might be less affected by broad market movements and could offer unique growth opportunities. In such a dynamic landscape, identifying stocks with solid fundamentals and potential for growth becomes crucial. These undiscovered gems can provide diversification benefits and possibly steadier returns amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 5.16% | 12.45% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.49% | 11.48% | ★★★★★★ |

| Tsubakimoto Kogyo | NA | 1.22% | -0.23% | ★★★★★★ |

| KurimotoLtd | 17.04% | 3.22% | 19.20% | ★★★★★★ |

| NJS | NA | 4.22% | 1.83% | ★★★★★★ |

| Techno Smart | NA | 5.05% | -2.17% | ★★★★★★ |

| NPR-Riken | 13.26% | 6.00% | 32.17% | ★★★★★☆ |

| GakkyushaLtd | 22.47% | 5.11% | 19.19% | ★★★★★☆ |

| Marusan Securities | 5.16% | 0.97% | 11.87% | ★★★★★☆ |

| Toyo Kanetsu K.K | 45.07% | 2.00% | 11.94% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

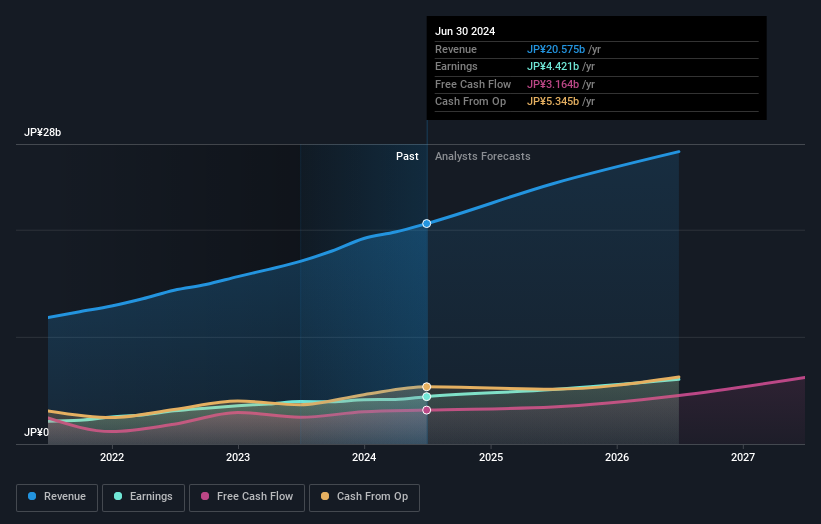

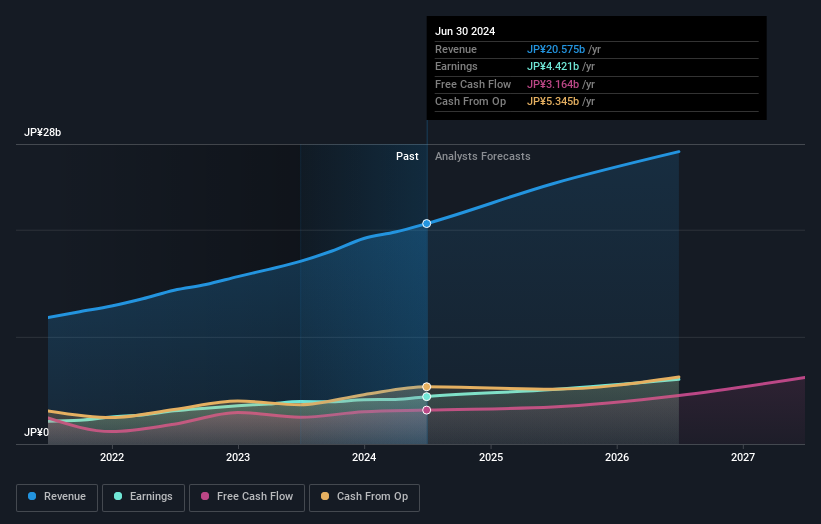

COVER (TSE:5253)

Simply Wall St Value Rating: ★★★★★★

Overview: COVER Corporation operates in the virtual platform and VTuber production sectors, with a market capitalization of ¥132.82 billion.

Operations: This entity generates revenue primarily through sales, evidenced by a significant increase from ¥5.72 billion in 2021 to ¥30.17 billion by mid-2024. The company's gross profit margin has seen fluctuations but remained notable at 46.37% as of the latest data point in 2024, reflecting its ability to manage production costs effectively relative to sales.

COVER Corporation, a lesser-known gem in Japan's entertainment sector, demonstrates robust financial health and growth potential. With earnings that surged by 65% last year, outpacing the industry's decline of 11.8%, COVER stands out. The company is trading at a compelling 39.3% below its estimated fair value and has maintained a debt-free status for five years. Looking ahead, earnings are expected to grow by approximately 18.56% annually, underscoring its promising outlook amidst market volatility.

- Unlock comprehensive insights into our analysis of COVER stock in this health report.

Gain insights into COVER's historical performance by reviewing our past performance report.

COVER (TSE:5253)

Simply Wall St Value Rating: ★★★★★★

Overview: COVER Corporation operates in the virtual platform and VTuber production sectors, with a market capitalization of ¥132.82 billion.

Operations: This entity generates revenue primarily through sales, evidenced by a significant increase from ¥5.72 billion in 2021 to ¥30.17 billion by mid-2024. The company's gross profit margin has seen fluctuations but remained notable at 46.37% as of the latest data point in 2024, reflecting its ability to manage production costs effectively relative to sales.

COVER Corporation, a lesser-known gem in Japan's entertainment sector, demonstrates robust financial health and growth potential. With earnings that surged by 65% last year, outpacing the industry's decline of 11.8%, COVER stands out. The company is trading at a compelling 39.3% below its estimated fair value and has maintained a debt-free status for five years. Looking ahead, earnings are expected to grow by approximately 18.56% annually, underscoring its promising outlook amidst market volatility.

- Unlock comprehensive insights into our analysis of COVER stock in this health report.

Gain insights into COVER's historical performance by reviewing our past performance report.

KeePer Technical Laboratory (TSE:6036)

Simply Wall St Value Rating: ★★★★★★

Overview: KeePer Technical Laboratory Co., Ltd. specializes in the development, manufacturing, and sale of car coatings, car washing chemicals and equipment within Japan, with a market capitalization of ¥111.49 billion.

Operations: This entity generates revenue primarily through the sale of its products, consistently achieving a gross profit margin above 68% over multiple reporting periods. It incurs significant operating expenses, with general and administrative costs forming a substantial part of these expenses.

KeePer Technical Laboratory, a lesser-known entity in Japan's bustling market, has demonstrated notable growth with a 14.3% increase in monthly sales from the previous year and a robust expansion strategy, including the recent opening of new stores in Chiba and Saitama. This growth is complemented by an earnings forecast promising an annual increase of 17.43%, outpacing industry norms. The company's strategic store placements and innovative service models underscore its potential as an undiscovered gem in the region.

- Get an in-depth perspective on KeePer Technical Laboratory's performance by reading our health report here.

Understand KeePer Technical Laboratory's track record by examining our Past report.

KeePer Technical Laboratory (TSE:6036)

Simply Wall St Value Rating: ★★★★★★

Overview: KeePer Technical Laboratory Co., Ltd. specializes in the development, manufacturing, and sale of car coatings, car washing chemicals and equipment within Japan, with a market capitalization of ¥111.49 billion.

Operations: This entity generates revenue primarily through the sale of its products, consistently achieving a gross profit margin above 68% over multiple reporting periods. It incurs significant operating expenses, with general and administrative costs forming a substantial part of these expenses.

KeePer Technical Laboratory, a lesser-known entity in Japan's bustling market, has demonstrated notable growth with a 14.3% increase in monthly sales from the previous year and a robust expansion strategy, including the recent opening of new stores in Chiba and Saitama. This growth is complemented by an earnings forecast promising an annual increase of 17.43%, outpacing industry norms. The company's strategic store placements and innovative service models underscore its potential as an undiscovered gem in the region.

- Get an in-depth perspective on KeePer Technical Laboratory's performance by reading our health report here.

Understand KeePer Technical Laboratory's track record by examining our Past report.

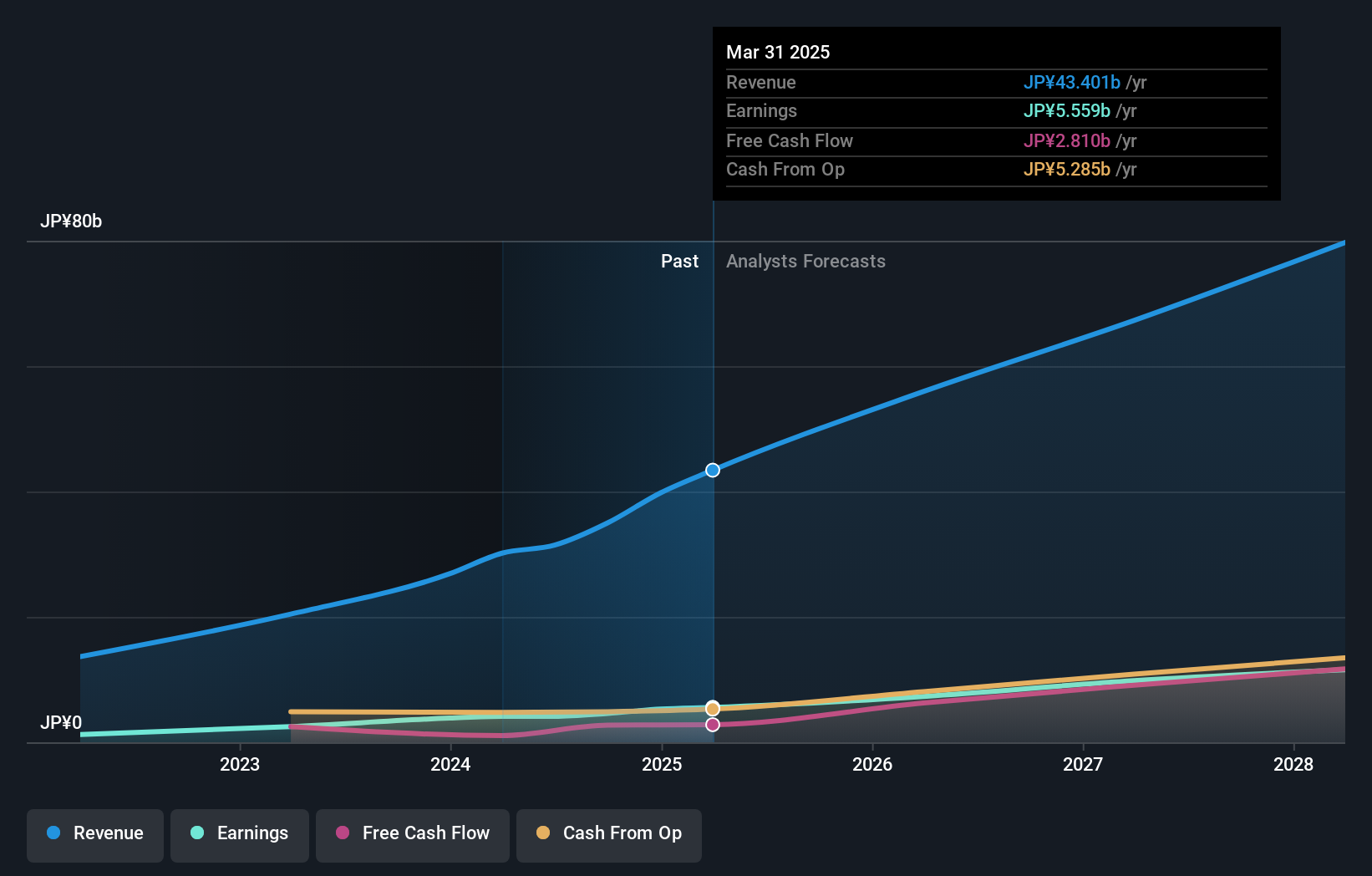

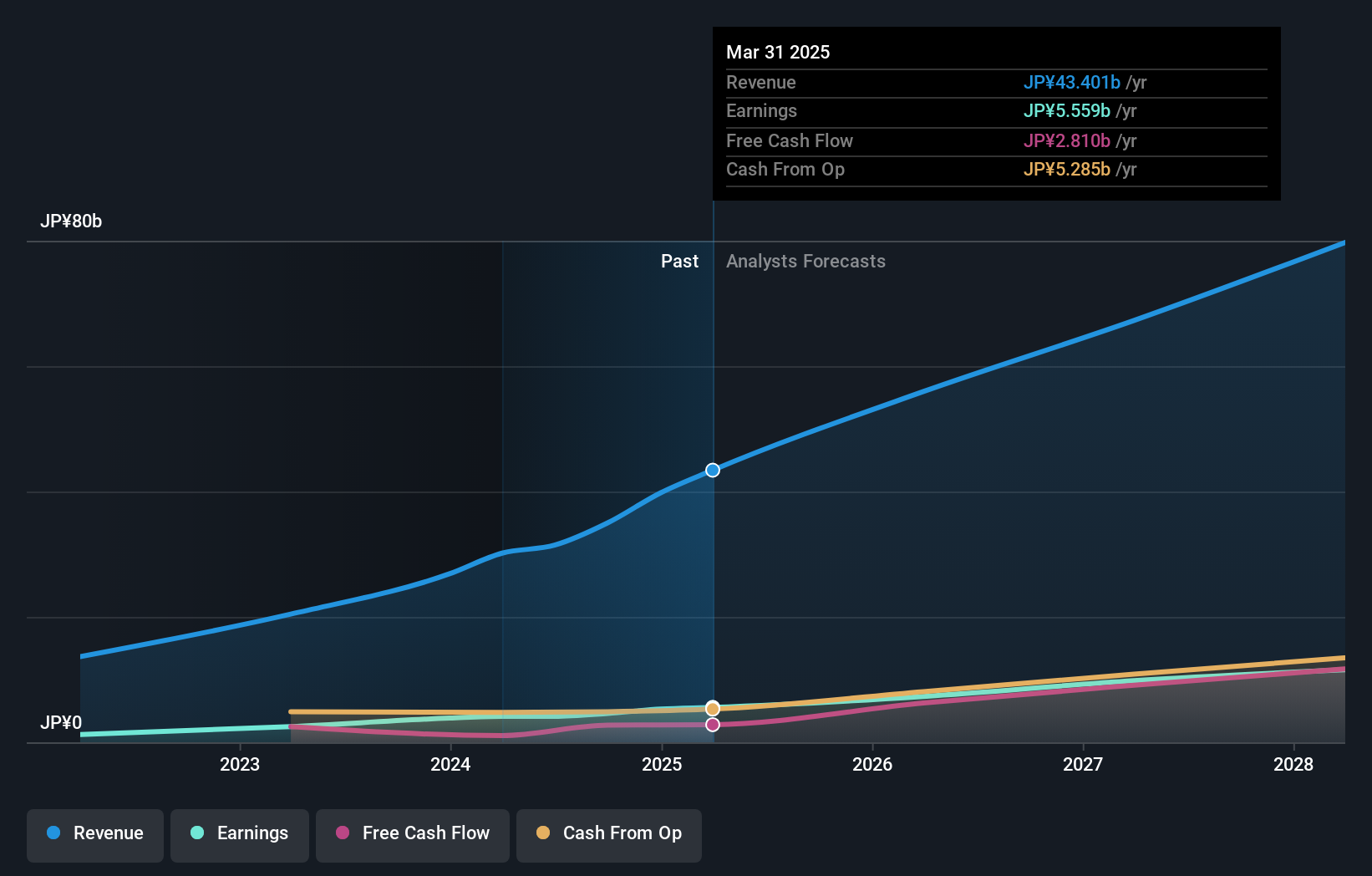

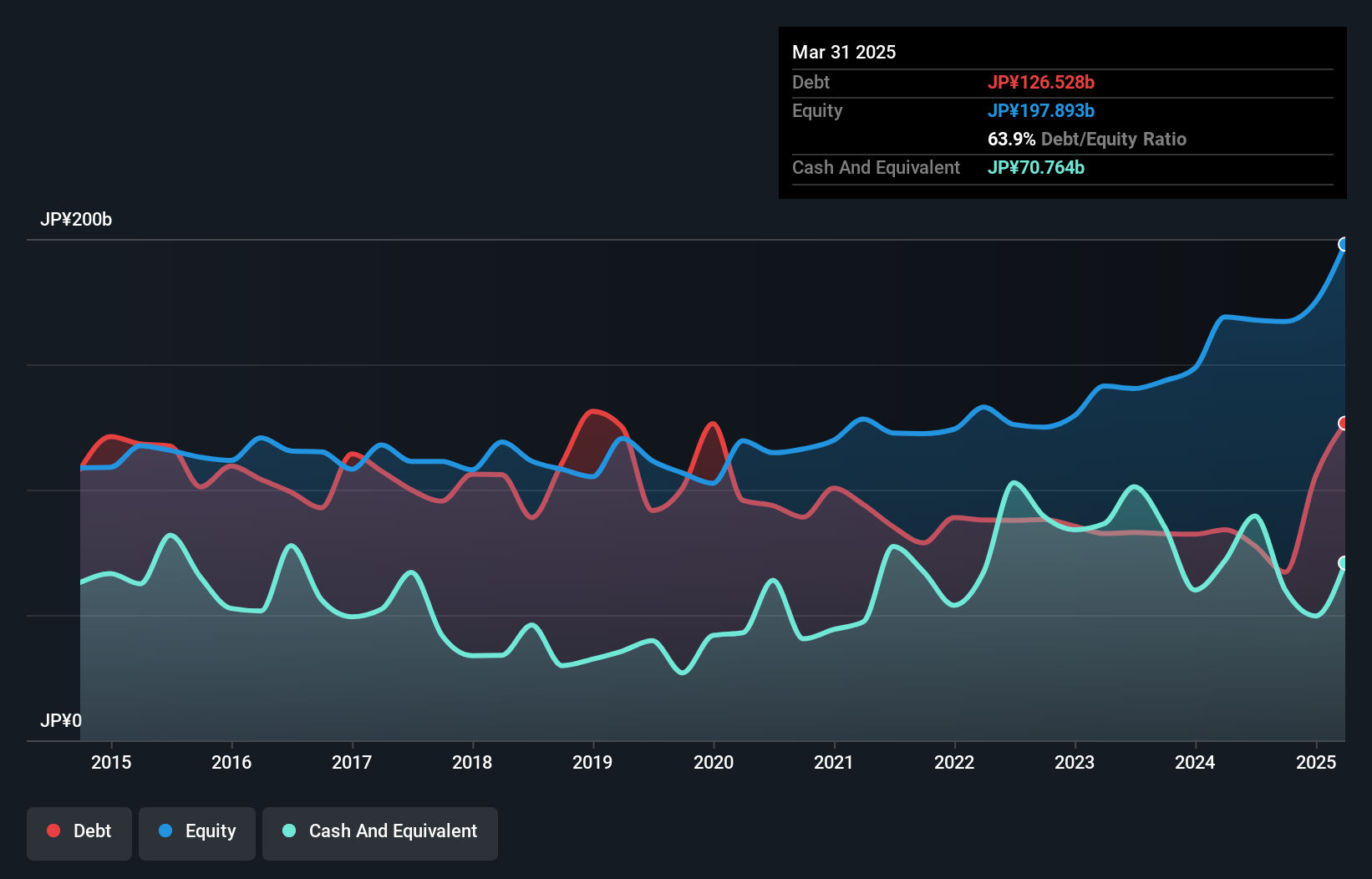

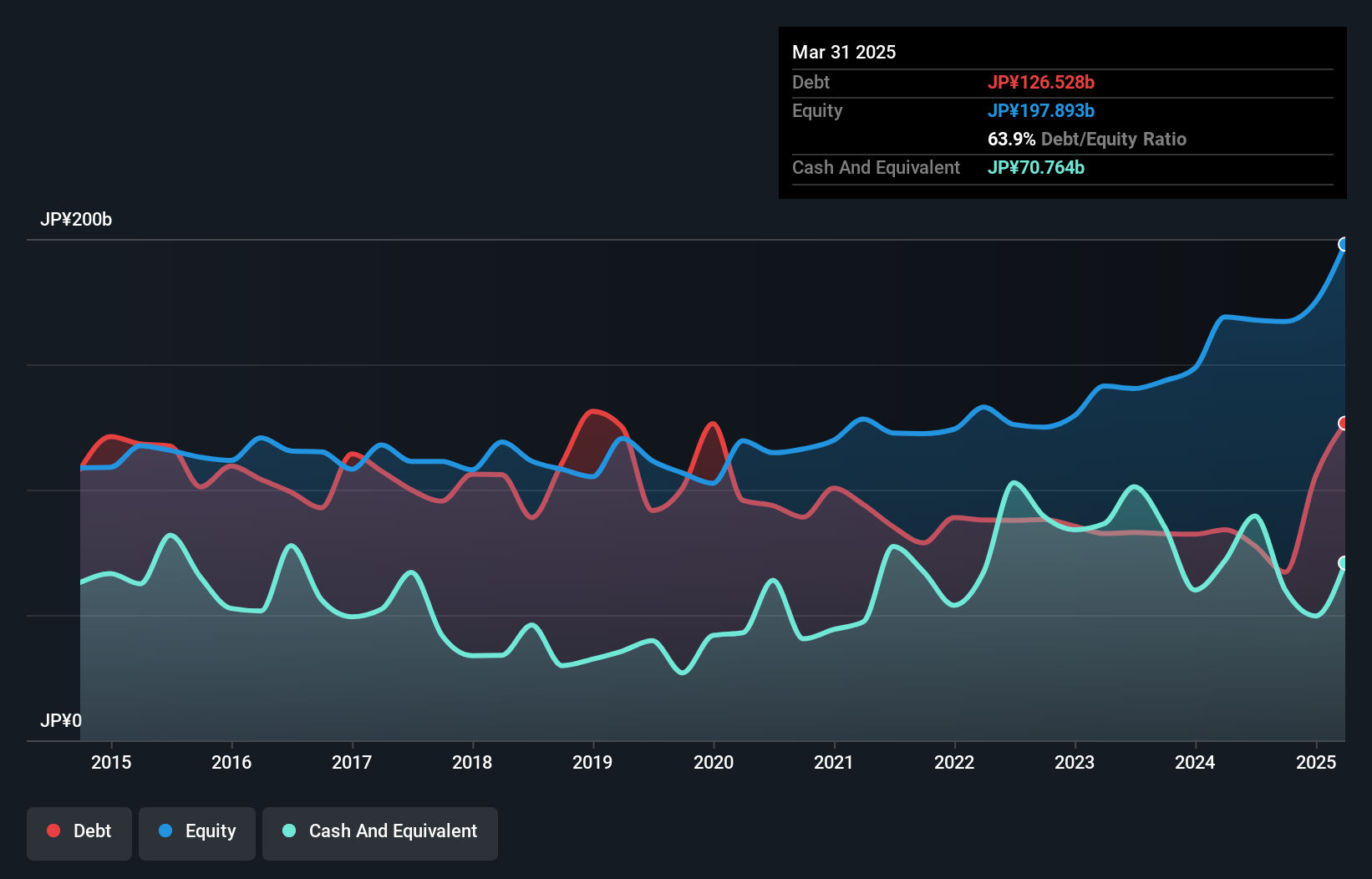

Hitachi Zosen (TSE:7004)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hitachi Zosen Corporation specializes in designing, constructing, and manufacturing energy-from-waste plants, desalination plants, and water and sewage treatment plants across Japan and globally, with a market capitalization of ¥199.19 billion.

Operations: This entity generates revenue primarily through the sale of goods and services, evidenced by a gross profit margin of 17.15% in the latest reported period. Key costs include cost of goods sold (COGS) and operating expenses, with COGS amounting to ¥460.54 billion and operating expenses at ¥70.98 billion as of the most recent data point.

Hitachi Zosen, soon to be Kanadevia Corporation, showcases robust financial health and promising growth prospects. With a P/E ratio of 10.5, significantly below the Japanese market average of 14.6, it offers relative value in its sector. The company's earnings have surged by 22% over the past year, outpacing the machinery industry’s growth rate of 15.7%. Additionally, its net debt-to-equity ratio has improved from 103.7% to a more manageable 49.7%, reflecting prudent fiscal management and operational efficiency.

- Take a closer look at Hitachi Zosen's potential here in our health report.

Gain insights into Hitachi Zosen's past trends and performance with our Past report.

Hitachi Zosen (TSE:7004)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hitachi Zosen Corporation specializes in designing, constructing, and manufacturing energy-from-waste plants, desalination plants, and water and sewage treatment plants across Japan and globally, with a market capitalization of ¥199.19 billion.

Operations: This entity generates revenue primarily through the sale of goods and services, evidenced by a gross profit margin of 17.15% in the latest reported period. Key costs include cost of goods sold (COGS) and operating expenses, with COGS amounting to ¥460.54 billion and operating expenses at ¥70.98 billion as of the most recent data point.

Hitachi Zosen, soon to be Kanadevia Corporation, showcases robust financial health and promising growth prospects. With a P/E ratio of 10.5, significantly below the Japanese market average of 14.6, it offers relative value in its sector. The company's earnings have surged by 22% over the past year, outpacing the machinery industry’s growth rate of 15.7%. Additionally, its net debt-to-equity ratio has improved from 103.7% to a more manageable 49.7%, reflecting prudent fiscal management and operational efficiency.

- Take a closer look at Hitachi Zosen's potential here in our health report.

Gain insights into Hitachi Zosen's past trends and performance with our Past report.

Turning Ideas Into Actions

- Gain an insight into the universe of 757 Japanese Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether KeePer Technical Laboratory is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6036

KeePer Technical Laboratory

Develops, manufactures, and sells car coatings, car washing chemicals and equipment, and other products in Japan.

Flawless balance sheet with reasonable growth potential.