- Japan

- /

- Consumer Durables

- /

- TSE:7965

Discover 3 Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

In the current global market landscape, while major indices like the Nasdaq Composite have reached new heights, smaller-cap stocks have faced challenges, as evidenced by the Russell 2000's recent underperformance compared to its larger-cap counterparts. Amidst this backdrop of economic adjustments and anticipated rate cuts, investors are increasingly seeking opportunities in lesser-known stocks that exhibit resilience and potential for growth. Identifying a promising stock often involves looking for companies with strong fundamentals and innovative strategies that can thrive even when broader market conditions are less favorable.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Elite Color Environmental Resources Science & Technology | 30.80% | 12.99% | 1.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

MITSUI E&S (TSE:7003)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MITSUI E&S Co., Ltd., along with its subsidiaries, specializes in providing marine propulsion systems across Japan, the rest of Asia, Europe, North America, and globally, with a market cap of ¥169.09 billion.

Operations: The company's revenue model is centered on its marine propulsion systems business, catering to markets in Japan, Asia, Europe, and North America. It operates with a market capitalization of ¥169.09 billion.

Mitsui E&S, a smaller player in the machinery sector, has demonstrated impressive earnings growth over the past year at 192.6%, outpacing the industry's modest 0.8%. Despite trading at approximately 14.1% below its estimated fair value, it faces challenges with a high net debt to equity ratio of 40.9%, though this is an improvement from 101.7% five years ago. Its interest payments are comfortably covered by EBIT at a multiple of 7.9x, indicating strong financial management despite recent shareholder dilution and volatile share prices in recent months.

- Take a closer look at MITSUI E&S' potential here in our health report.

Gain insights into MITSUI E&S' past trends and performance with our Past report.

Zojirushi (TSE:7965)

Simply Wall St Value Rating: ★★★★★★

Overview: Zojirushi Corporation manufactures and markets household products in Japan and internationally, with a market cap of ¥119.13 billion.

Operations: The company generates revenue primarily from the sale of household products both in Japan and internationally. It has a market capitalization of ¥119.13 billion.

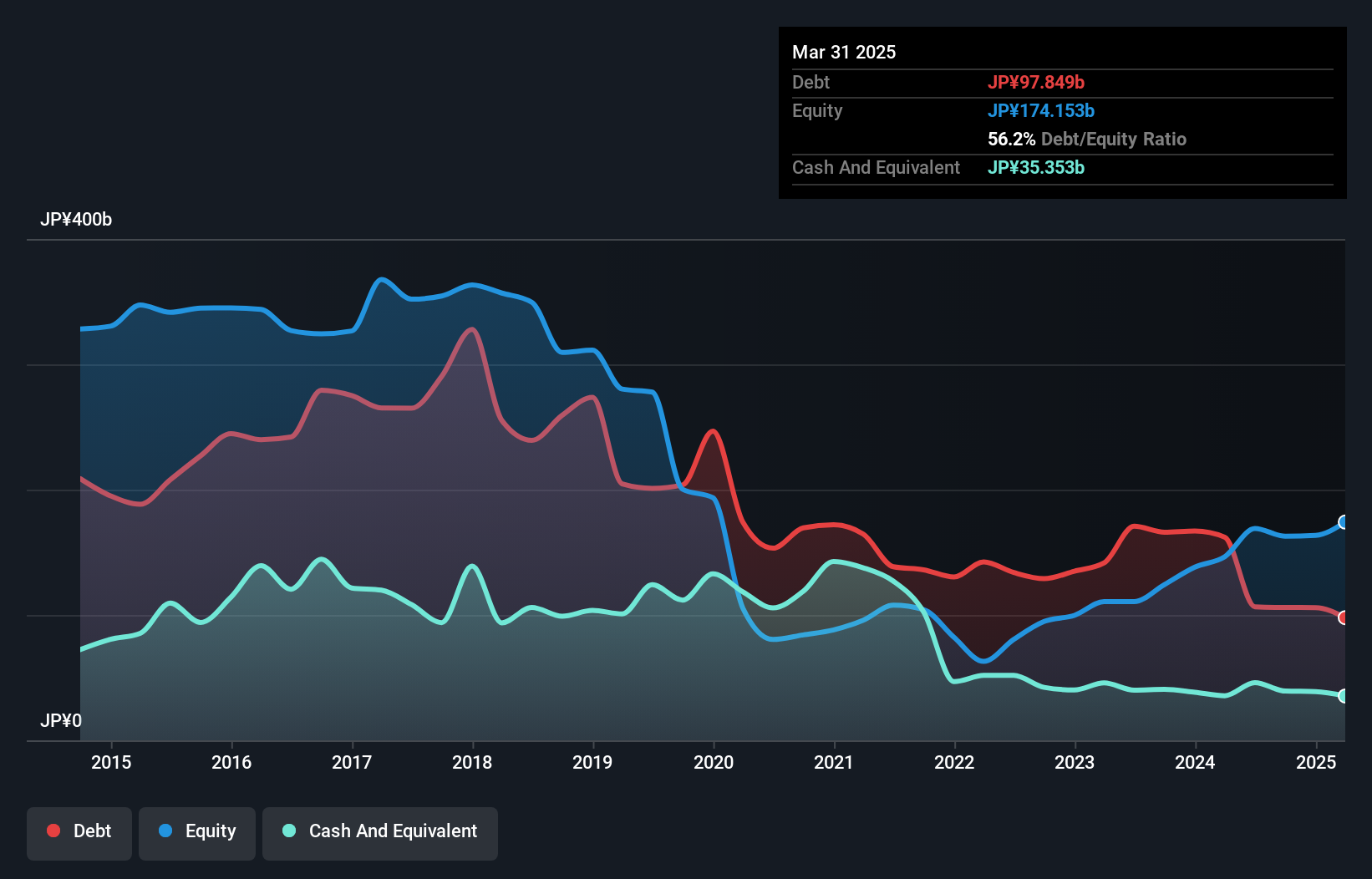

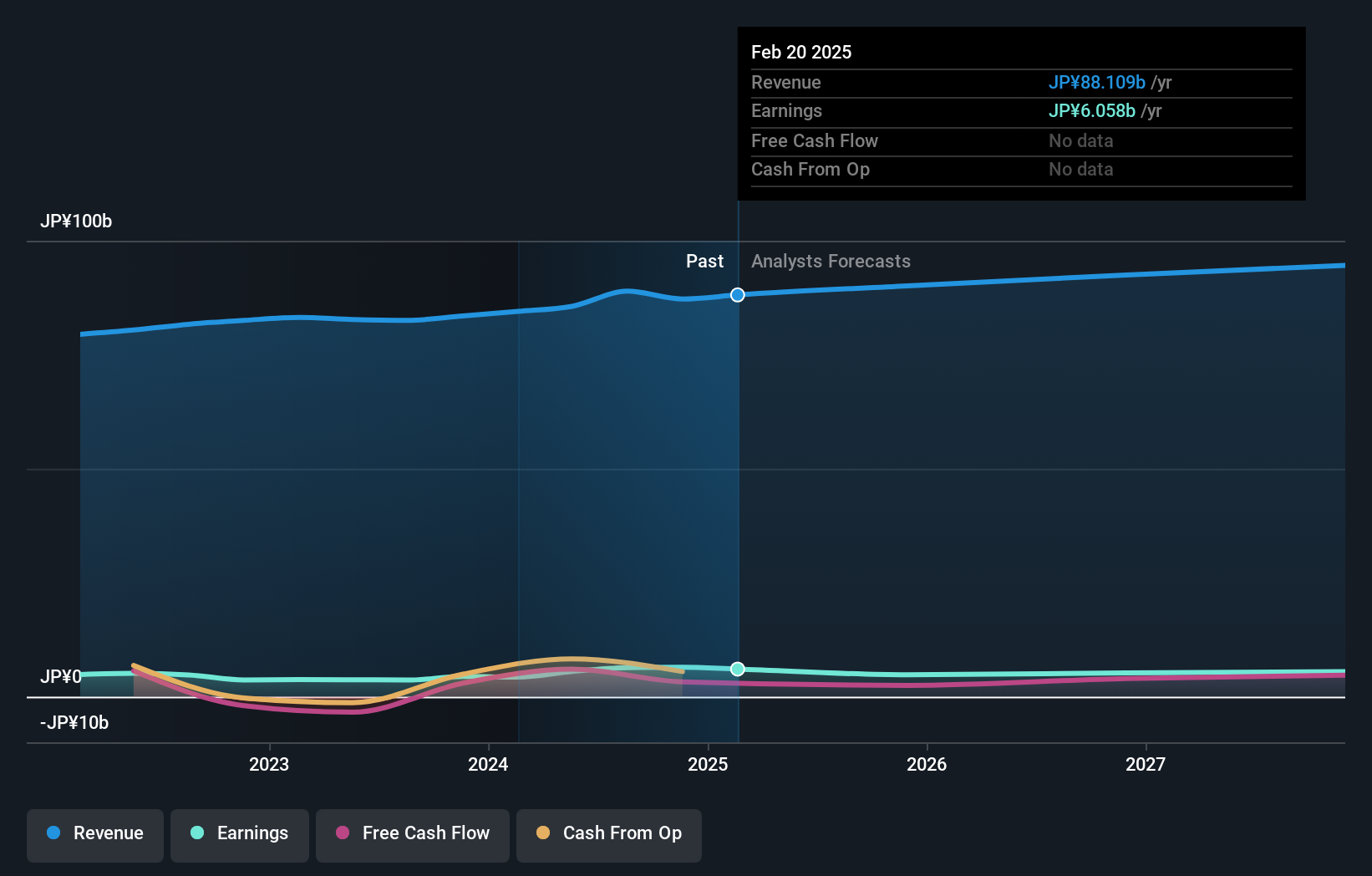

Zojirushi, a notable player in the consumer durables sector, has demonstrated strong financial health with its debt to equity ratio decreasing from 2.2% to 1.7% over five years, indicating effective debt management. The company's earnings surged by 53.7% last year, outpacing the industry average of -6.4%, showcasing its robust growth potential despite market volatility in recent months. A significant one-off gain of ¥1.9 billion influenced its recent financial performance, highlighting unique income events that may not recur regularly but reflect positively on their current position and future outlook as they continue to be free cash flow positive and profitable.

- Navigate through the intricacies of Zojirushi with our comprehensive health report here.

Review our historical performance report to gain insights into Zojirushi's's past performance.

Nishio Holdings (TSE:9699)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nishio Holdings Co., Ltd. operates in the construction machinery rental industry both in Japan and internationally, with a market capitalization of ¥118.54 billion.

Operations: Nishio Holdings generates revenue primarily from its rental segment, which contributed ¥191.50 billion. The company's gross profit margin is a key financial indicator to consider when analyzing its performance.

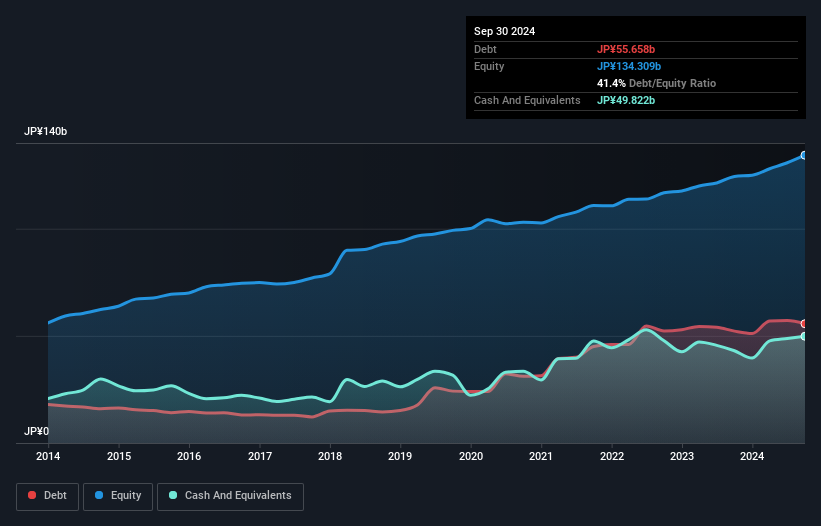

Nishio Holdings, an intriguing player in its field, has demonstrated impressive earnings growth of 12.8% over the past year, outpacing the Trade Distributors industry average of 0.4%. The company’s net debt to equity ratio stands at a satisfactory 4.3%, indicating prudent financial management over time despite rising from 24.4% to 41.4% in the last five years. With interest payments well covered by EBIT at a robust 13x, Nishio appears financially sound and is trading at nearly 20% below estimated fair value—suggesting potential undervaluation for those eyeing growth opportunities in niche markets like this one.

- Unlock comprehensive insights into our analysis of Nishio Holdings stock in this health report.

Examine Nishio Holdings' past performance report to understand how it has performed in the past.

Summing It All Up

- Delve into our full catalog of 4502 Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zojirushi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7965

Zojirushi

Manufactures and markets household products in Japan and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives