- Japan

- /

- Electrical

- /

- TSE:6932

Top Asian Dividend Stocks For May 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing trade tensions and mixed economic signals, Asian indices have shown resilience amidst these shifting dynamics. In this environment, dividend stocks in Asia can offer investors a measure of stability and income potential, making them an attractive consideration for those seeking to balance growth with consistent returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.89% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.43% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.55% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.19% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.17% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.78% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.97% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.12% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.39% | ★★★★★★ |

Click here to see the full list of 1237 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

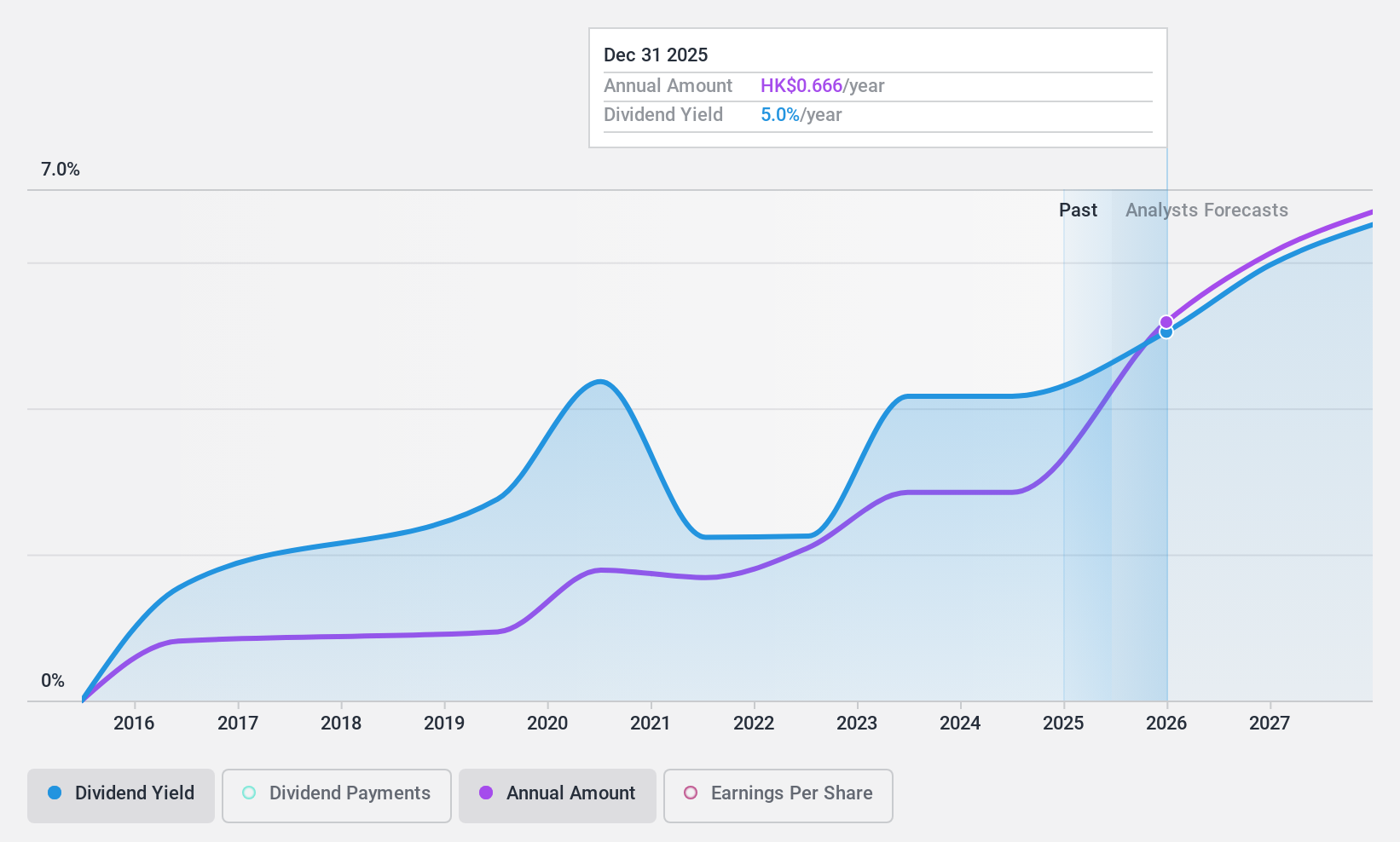

Dongfang Electric (SEHK:1072)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dongfang Electric Corporation Limited designs, develops, manufactures, and sells power generation equipment in China and internationally with a market cap of HK$56.53 billion.

Operations: Dongfang Electric Corporation Limited's revenue segments include CN¥17.45 billion from clean and efficient power generation equipment, CN¥4.22 billion from renewable energy equipment, CN¥3.56 billion from engineering and trade, and CN¥1.02 billion from modern manufacturing services.

Dividend Yield: 4%

Dongfang Electric's dividend payments, while covered by a payout ratio of 43.1% and a cash payout ratio of 59.2%, have been volatile over the past decade, with significant drops exceeding 20%. Despite recent earnings growth, reflected in Q1 2025 net income of CNY 1.15 billion up from CNY 905.75 million year-on-year, its dividend yield remains lower than top-tier Hong Kong dividend payers at only 4.01%.

- Click here to discover the nuances of Dongfang Electric with our detailed analytical dividend report.

- The analysis detailed in our Dongfang Electric valuation report hints at an inflated share price compared to its estimated value.

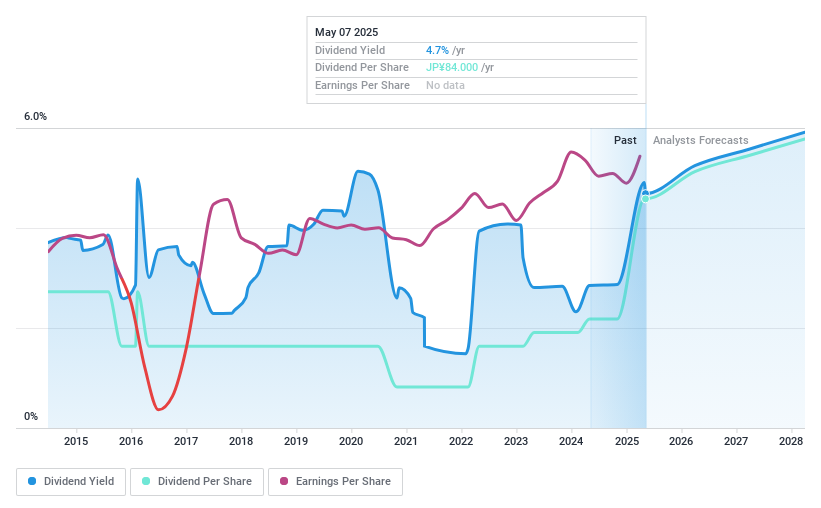

ENDO Lighting (TSE:6932)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ENDO Lighting Corporation plans, designs, manufactures, and sells light fixtures in Japan and internationally, with a market cap of ¥27.13 billion.

Operations: ENDO Lighting Corporation generates revenue from three main segments: Lighting Fixtures (¥47.98 billion), Interior Furniture (¥1.39 billion), and Environment related Business (¥10.19 billion).

Dividend Yield: 4.6%

ENDO Lighting's recent dividend increase to JPY 30.00 per share reflects a positive trend, with expectations of further rises in 2026. Despite a low payout ratio of 15.4%, dividends are not well covered by free cash flows, raising sustainability concerns. The company's price-to-earnings ratio of 5.7x suggests good value relative to the JP market average, but past dividend volatility and lack of free cash flow coverage may affect reliability for income-focused investors.

- Click here and access our complete dividend analysis report to understand the dynamics of ENDO Lighting.

- Insights from our recent valuation report point to the potential undervaluation of ENDO Lighting shares in the market.

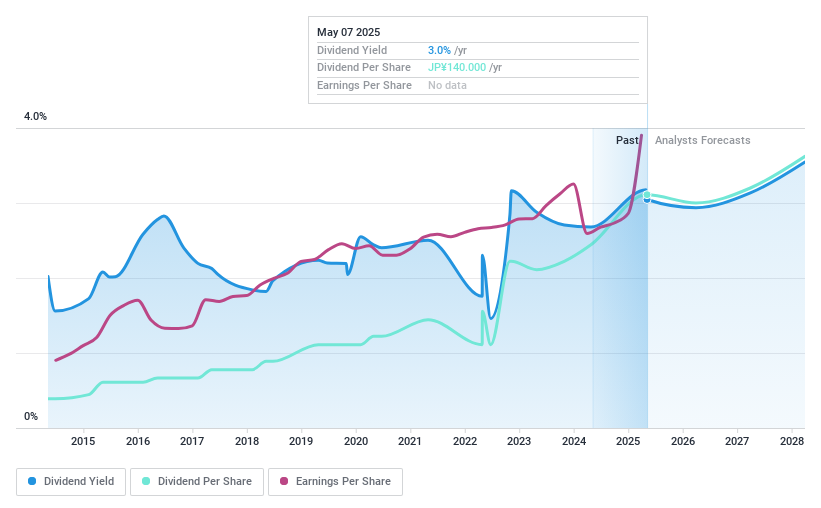

DTS (TSE:9682)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DTS Corporation offers systems integration services in Japan and has a market cap of ¥183.95 billion.

Operations: DTS Corporation's revenue segments include systems integration services in Japan.

Dividend Yield: 3.1%

DTS Corporation's dividend yield of 3.07% is modest compared to top-tier Japanese payers, and while dividends have grown over the past decade, their volatility raises reliability concerns. The company's dividends are covered by earnings (50% payout ratio) and cash flows (69.2% cash payout ratio), suggesting sustainability despite an unstable track record. Recent share buyback initiatives totaling ¥7.5 billion aim to enhance shareholder returns and capital efficiency, potentially benefiting dividend investors in the long term.

- Delve into the full analysis dividend report here for a deeper understanding of DTS.

- Our valuation report here indicates DTS may be undervalued.

Taking Advantage

- Get an in-depth perspective on all 1237 Top Asian Dividend Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ENDO Lighting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6932

ENDO Lighting

Plans, designs, manufactures, and sells light fixtures in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives