- Japan

- /

- Commercial Services

- /

- TSE:7994

Top Japanese Dividend Stocks Yielding Up To 5.2%

Reviewed by Simply Wall St

Japan's stock markets have rebounded strongly, with the Nikkei 225 Index gaining 8.7% and the broader TOPIX Index up 7.9%, buoyed by better-than-expected U.S. economic data and a weaker yen supporting exporters. This positive momentum is further supported by Japan’s robust GDP growth in the second quarter, which expanded more than anticipated. In this favorable economic environment, dividend stocks can be particularly attractive for investors seeking steady income and potential capital appreciation. Here are three top Japanese dividend stocks yielding up to 5.2%.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.16% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.98% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.79% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.96% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.50% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.50% | ★★★★★★ |

| Innotech (TSE:9880) | 4.64% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.07% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

Click here to see the full list of 459 stocks from our Top Japanese Dividend Stocks screener.

We'll examine a selection from our screener results.

Yagami (NSE:7488)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Yagami Inc. operates as a specialized trading company in the educational market in Japan and has a market cap of ¥14.68 billion.

Operations: Yagami Inc. generates revenue through three primary segments: Industrial Machine (¥2.82 billion), Scientific Equipment (¥5.02 billion), and Health and Medical Equipment (¥2.70 billion).

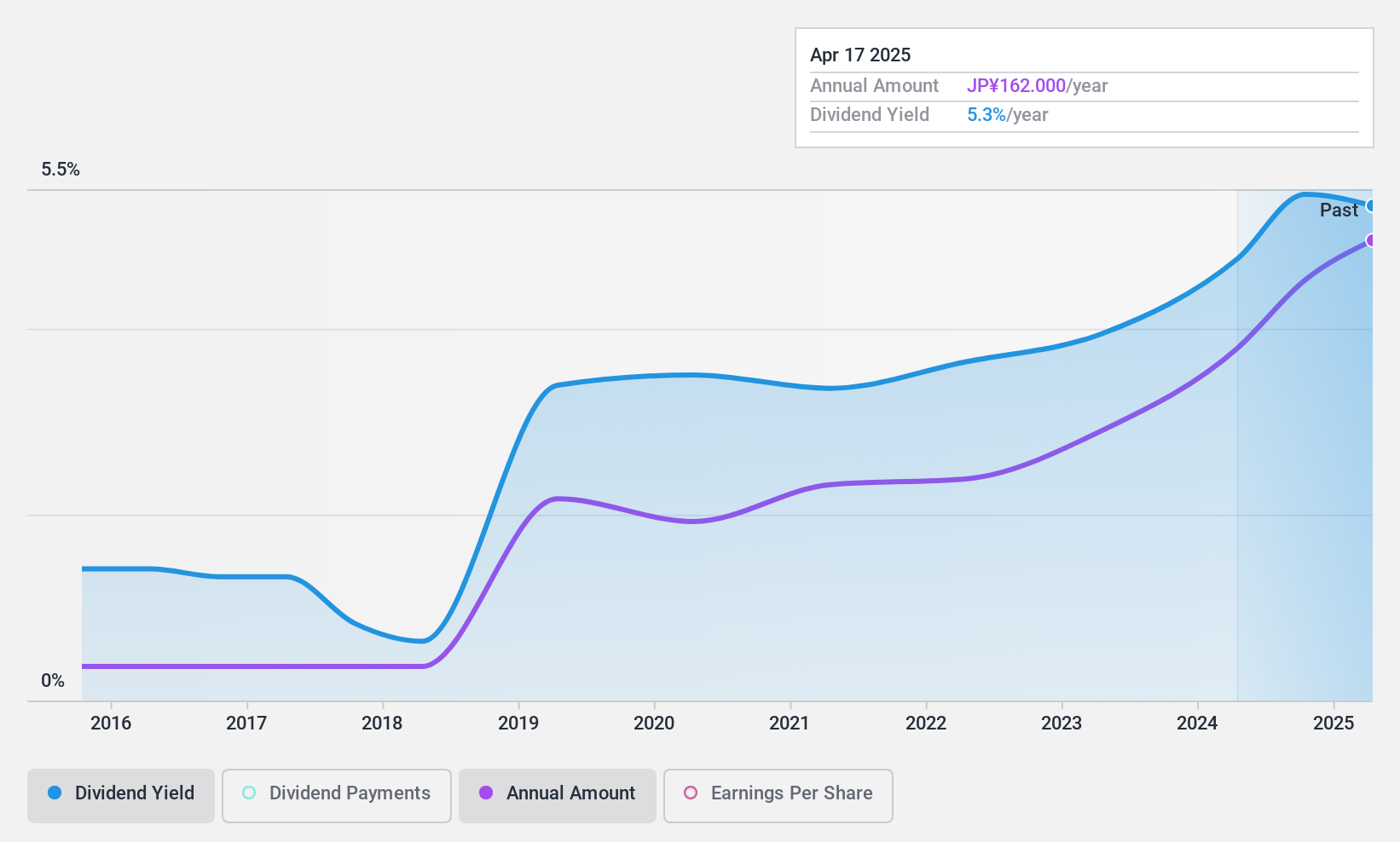

Dividend Yield: 5.3%

Yagami offers a compelling option for dividend investors with its 5.29% yield, positioning it in the top 25% of JP market dividend payers. The company's dividends have been stable and growing over the past decade, supported by a payout ratio of 70.2% and cash payout ratio of 89.4%. Additionally, Yagami's P/E ratio (12.2x) is attractive compared to the JP market average (13.4x), indicating good value potential for investors seeking reliable income streams.

- Click here and access our complete dividend analysis report to understand the dynamics of Yagami.

- The analysis detailed in our Yagami valuation report hints at an inflated share price compared to its estimated value.

Seiko Electric (TSE:6653)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Seiko Electric Co., Ltd. primarily operates in the fields of power systems, environmental energy, and control systems in Japan, with a market cap of ¥16.02 billion.

Operations: Seiko Electric Co., Ltd. generates revenue from its core segments in power systems, environmental energy, and control systems within Japan.

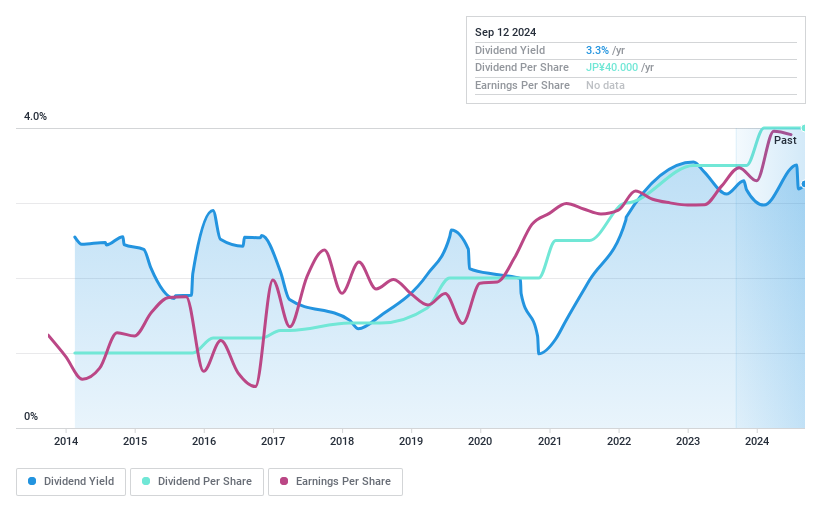

Dividend Yield: 3%

Seiko Electric's dividend payments have been reliable and growing over the past decade, supported by a low payout ratio of 32% and a cash payout ratio of 24.7%. Recent news highlights an increase in its second quarter dividend to ¥20.00 per share from ¥17.50 last year, with payments commencing on August 30, 2024. Although its current yield of 3.04% is below the top quartile in Japan, it remains well-covered by earnings and cash flows.

- Dive into the specifics of Seiko Electric here with our thorough dividend report.

- Our valuation report unveils the possibility Seiko Electric's shares may be trading at a premium.

Okamura (TSE:7994)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Okamura Corporation, with a market cap of ¥189.95 billion, operates in Japan manufacturing, selling, distributing, and installing office furniture, store displays, material handling systems, and industrial machinery.

Operations: Okamura Corporation generates revenue from office furniture, store displays, material handling systems, and industrial machinery within Japan.

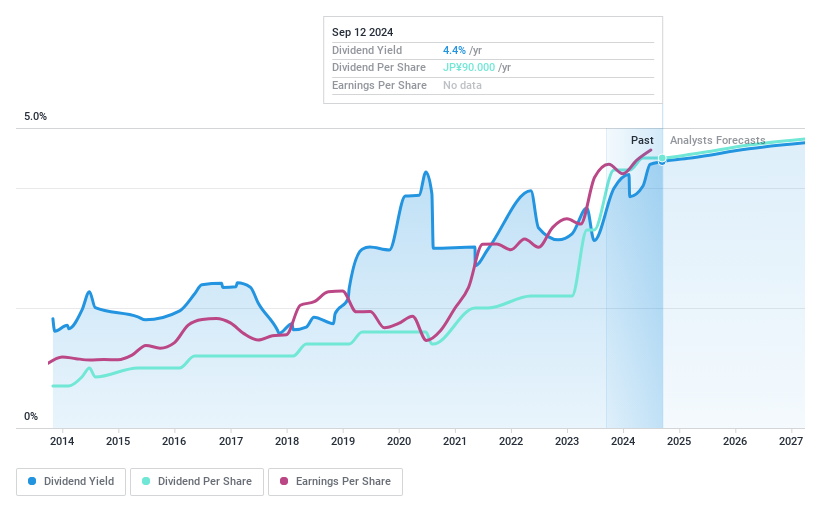

Dividend Yield: 4.5%

Okamura's dividend payments have been reliable and growing over the past decade, though not covered by free cash flows. The company is trading at good value compared to peers and analysts expect a 32.9% price increase. Despite an 8.4% earnings growth last year, large one-off items impacted results. Okamura announced a ¥5 billion sustainability bond offering with a 0.931% coupon due June 2029, indicating efforts to secure stable financing for future operations.

- Unlock comprehensive insights into our analysis of Okamura stock in this dividend report.

- Upon reviewing our latest valuation report, Okamura's share price might be too pessimistic.

Turning Ideas Into Actions

- Navigate through the entire inventory of 459 Top Japanese Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7994

Okamura

Manufactures, sells, distributes, and installs office furniture, store displays, material handling systems, and industrial machinery in Japan.

Very undervalued with flawless balance sheet and pays a dividend.