- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7739

Discovering Japan's Undiscovered Gems in August 2024

Reviewed by Simply Wall St

Japan’s stock markets have shown a robust rebound recently, with the Nikkei 225 Index gaining 8.7% and the broader TOPIX Index up 7.9%, buoyed by better-than-expected U.S. economic data and a weaker yen benefiting exporters. This positive sentiment, coupled with Japan’s stronger-than-anticipated GDP growth in the second quarter, has created an opportune environment for discovering undervalued small-cap stocks. In this context, identifying promising small-cap stocks involves looking for companies that demonstrate strong fundamentals, innovative business models, and resilience in fluctuating economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ryoyu Systems | NA | 1.08% | 8.08% | ★★★★★★ |

| Tokyo Tekko | 10.81% | 7.30% | 7.30% | ★★★★★★ |

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| Kanda HoldingsLtd | 30.47% | 4.35% | 18.02% | ★★★★★★ |

| KurimotoLtd | 20.73% | 3.34% | 18.64% | ★★★★★★ |

| Icom | NA | 4.68% | 14.92% | ★★★★★★ |

| Nikko | 31.99% | 4.24% | -8.75% | ★★★★★☆ |

| Kappa Create | 74.42% | -0.45% | 3.62% | ★★★★★☆ |

| Nippon Sharyo | 61.34% | -1.68% | -17.07% | ★★★★☆☆ |

| Toho Bank | 98.27% | 0.43% | 22.80% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Fixstars (TSE:3687)

Simply Wall St Value Rating: ★★★★★☆

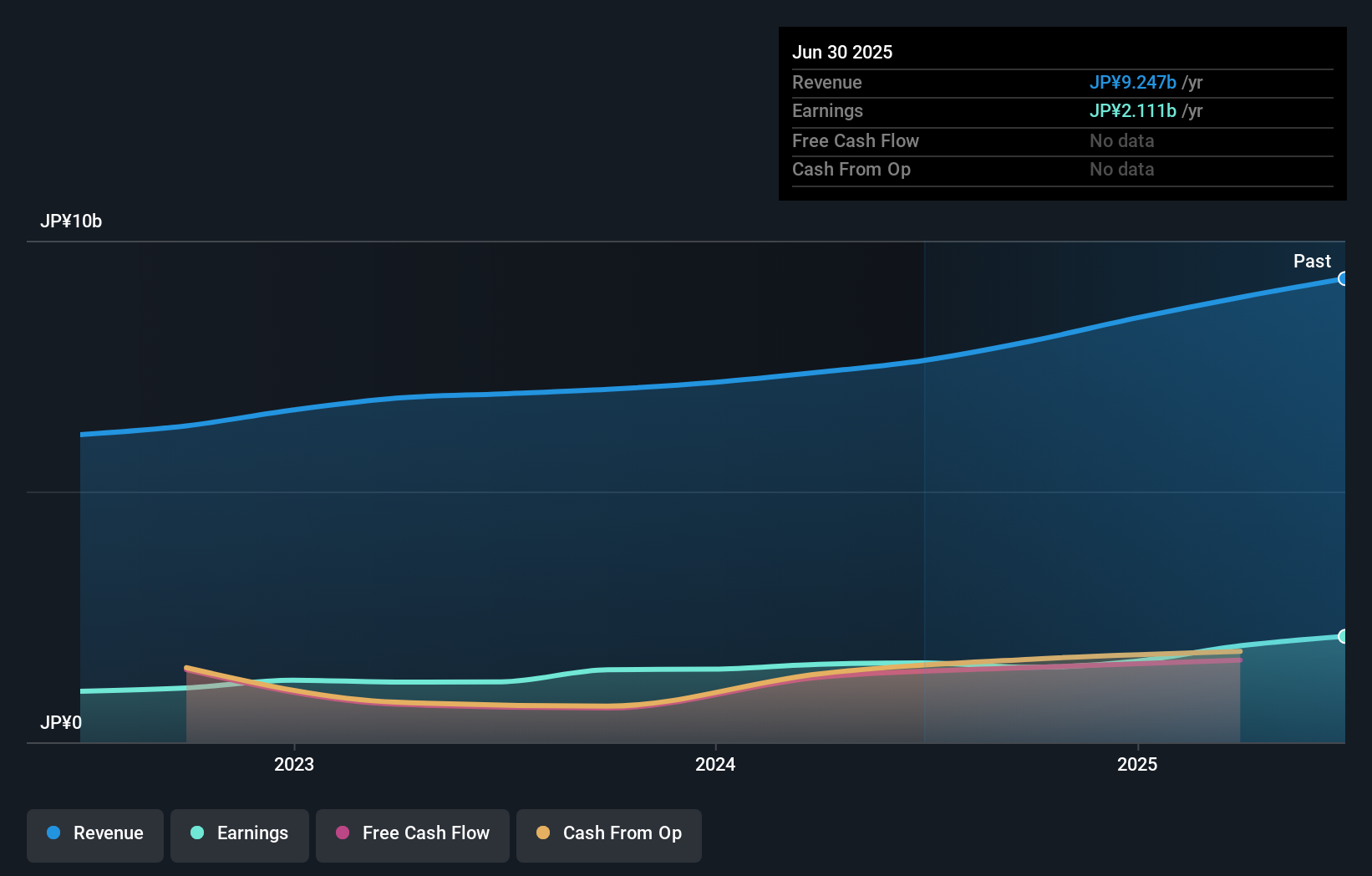

Overview: Fixstars Corporation is a software company operating in Japan and internationally with a market cap of ¥50.13 billion.

Operations: The company generates revenue through its software solutions and services. With a market cap of ¥50.13 billion, it focuses on various segments contributing to its overall financial performance.

With a debt to equity ratio rising from 0% to 14.4% over five years, Fixstars Corporation's financials show robust management of liabilities. The company has more cash than its total debt, and its interest payments are covered 1134 times by EBIT. Earnings growth of 29.7% last year outpaced the software industry average of 15.4%. Despite high volatility in share price recently, Fixstars is forecasted to grow earnings by 15.76% annually.

- Get an in-depth perspective on Fixstars' performance by reading our health report here.

Review our historical performance report to gain insights into Fixstars''s past performance.

Canon Electronics (TSE:7739)

Simply Wall St Value Rating: ★★★★★★

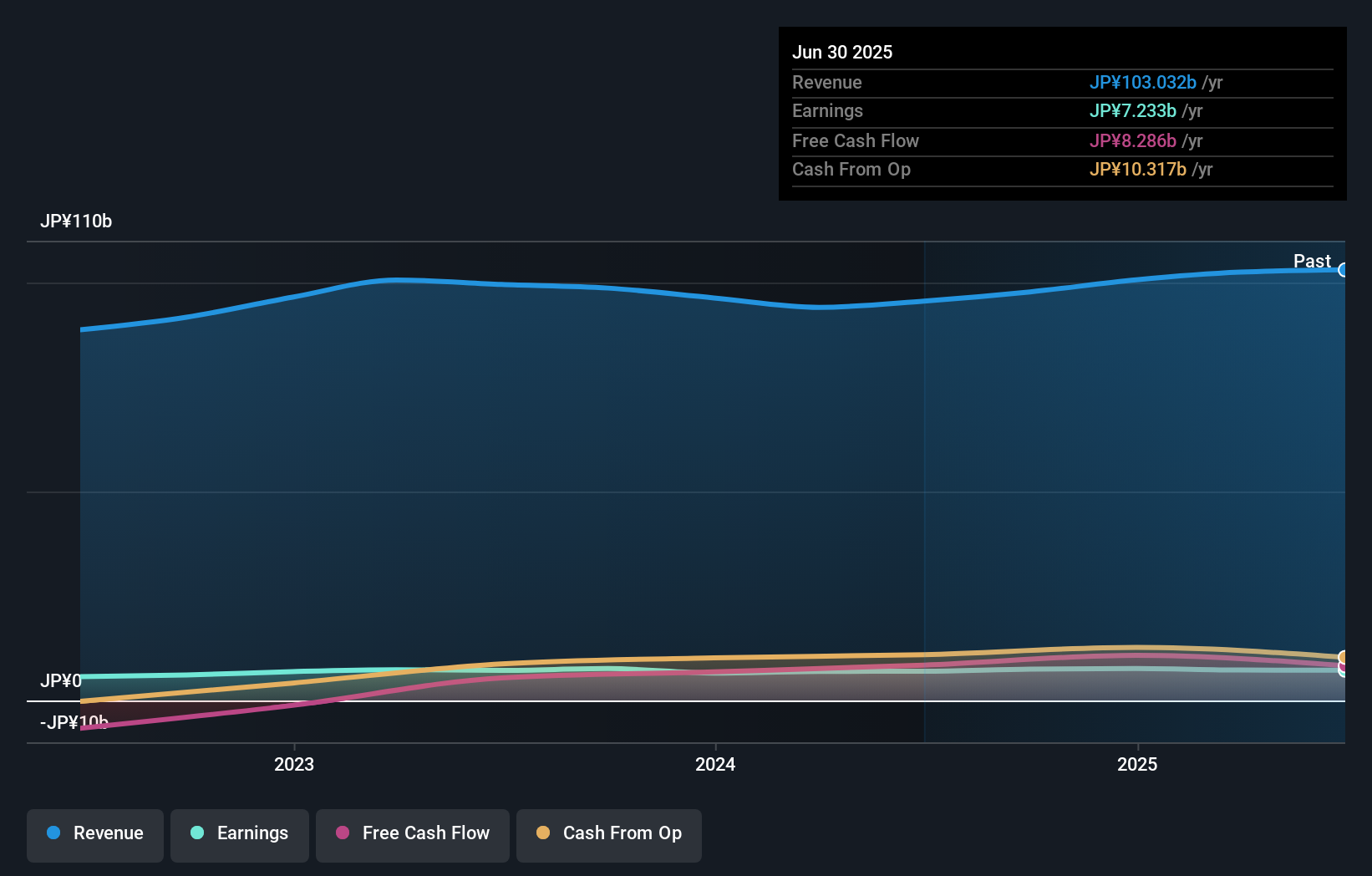

Overview: Canon Electronics Inc. develops, produces, and sells precision machines and instruments, as well as electric and electronic machines and instruments in Japan and internationally, with a market cap of ¥89.89 billion.

Operations: Canon Electronics generates revenue primarily from Components (¥55.44 billion) and Electronic Information Equipment (¥29.22 billion).

Canon Electronics, trading at 66.7% below its estimated fair value, offers a compelling opportunity despite recent challenges. The company is debt-free and boasts high-quality earnings, which enhances its financial stability. However, it experienced negative earnings growth of -2.7% over the past year compared to the electronic industry's average of 7.3%. With no debt for over five years and positive free cash flow, Canon Electronics remains a resilient player in its sector.

- Click to explore a detailed breakdown of our findings in Canon Electronics' health report.

Explore historical data to track Canon Electronics' performance over time in our Past section.

Maruzen Showa Unyu (TSE:9068)

Simply Wall St Value Rating: ★★★★★★

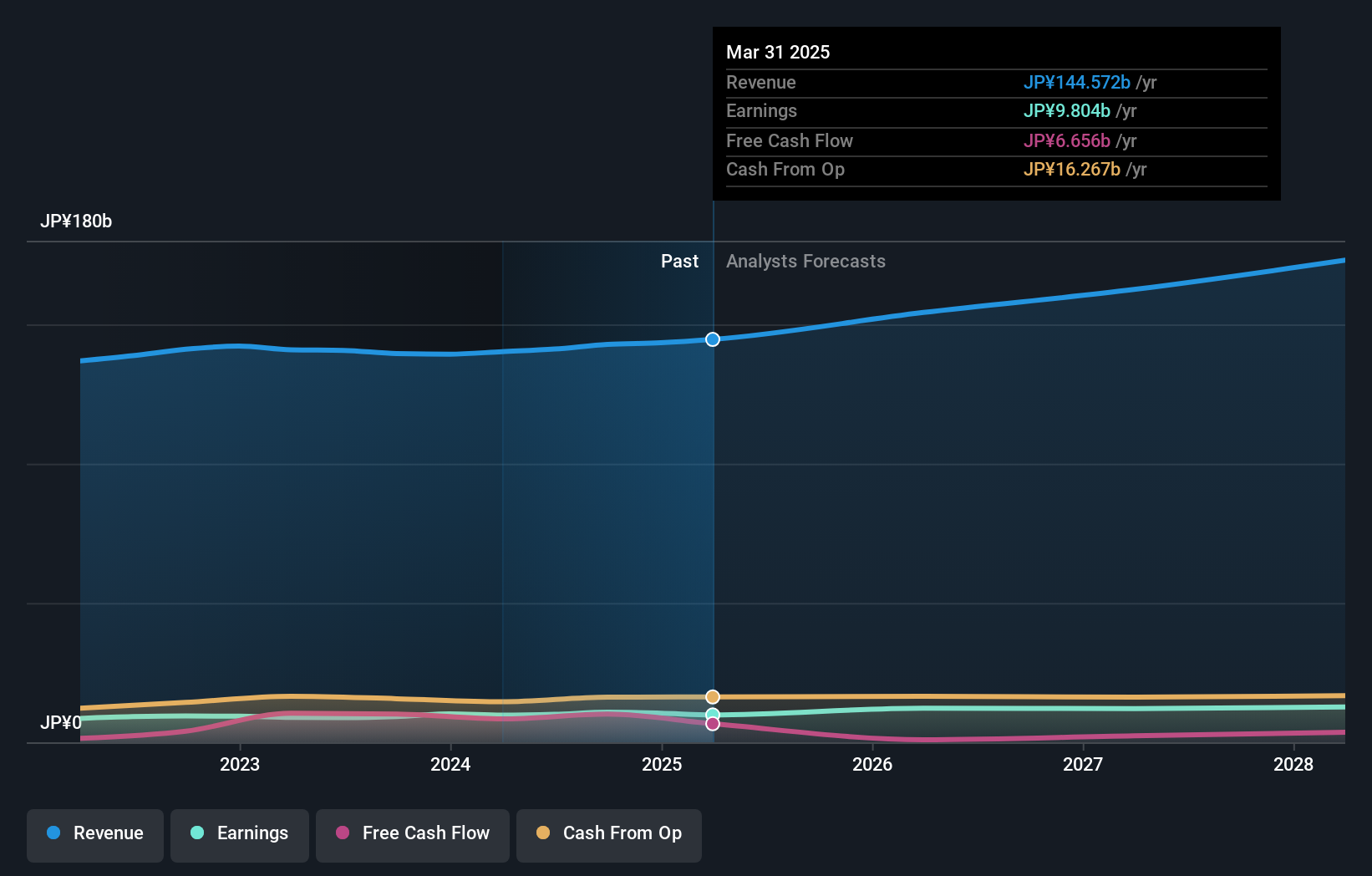

Overview: Maruzen Showa Unyu Co., Ltd. provides logistics solutions both in Japan and internationally, with a market cap of approximately ¥97.40 billion.

Operations: Maruzen Showa Unyu generates revenue primarily from its Logistics Business, which contributed ¥121.86 billion, and its On-Site Work and Machinery Handling Business, which added ¥15.94 billion.

Maruzen Showa Unyu, a lesser-known transportation company in Japan, boasts a price-to-earnings ratio of 10x, which is attractive compared to the JP market's 13.4x. Over the past five years, its debt-to-equity ratio has decreased from 23.2% to 22.4%, indicating prudent financial management. Although recent earnings growth of 9.1% lagged behind the industry average of 20.5%, it remains profitable with an anticipated annual growth rate of 8.18%.

- Click here to discover the nuances of Maruzen Showa Unyu with our detailed analytical health report.

Understand Maruzen Showa Unyu's track record by examining our Past report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 754 Japanese Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7739

Canon Electronics

Develops, produces, and sells precision machines and instruments, and electric and electronic machines and instruments in Japan and internationally.

Flawless balance sheet average dividend payer.