- Japan

- /

- Entertainment

- /

- TSE:5032

High Growth Tech Stocks to Watch in Japan This August 2024

Reviewed by Simply Wall St

Japan’s stock markets have rebounded strongly, with the Nikkei 225 Index gaining 8.7% and the broader TOPIX Index up 7.9%, driven by better-than-expected U.S. economic data and a robust second-quarter GDP expansion in Japan. This positive market sentiment offers a favorable backdrop for high-growth tech stocks, which often excel during periods of economic optimism and technological advancement.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 51.80% | 61.94% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 25.55% | 25.92% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| SHIFT | 21.58% | 32.81% | ★★★★★★ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 22.69% | 62.99% | ★★★★★★ |

| Money Forward | 20.51% | 66.90% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

JMDC (TSE:4483)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JMDC Inc. operates in Japan, offering medical statistics data services with a market capitalization of ¥243.45 billion.

Operations: The company generates revenue primarily from Healthcare-Big Data (¥27.17 billion), Tele-Medicine (¥5.77 billion), and Dispensing Pharmacy Support (¥1.22 billion). The Healthcare-Big Data segment is the largest contributor to its revenue stream.

JMDC's revenue is projected to grow at 17.4% annually, surpassing the broader JP market's 4.3% growth rate. Despite a challenging past year with a -40.6% earnings drop, future earnings are expected to rise significantly by 25.5% per year over the next three years, outpacing the JP market's 8.6%. The company's R&D expenses reflect its commitment to innovation, with ¥2 billion allocated last year, ensuring it stays competitive in healthcare analytics and AI solutions for clients like hospitals and insurers.

- Click to explore a detailed breakdown of our findings in JMDC's health report.

Assess JMDC's past performance with our detailed historical performance reports.

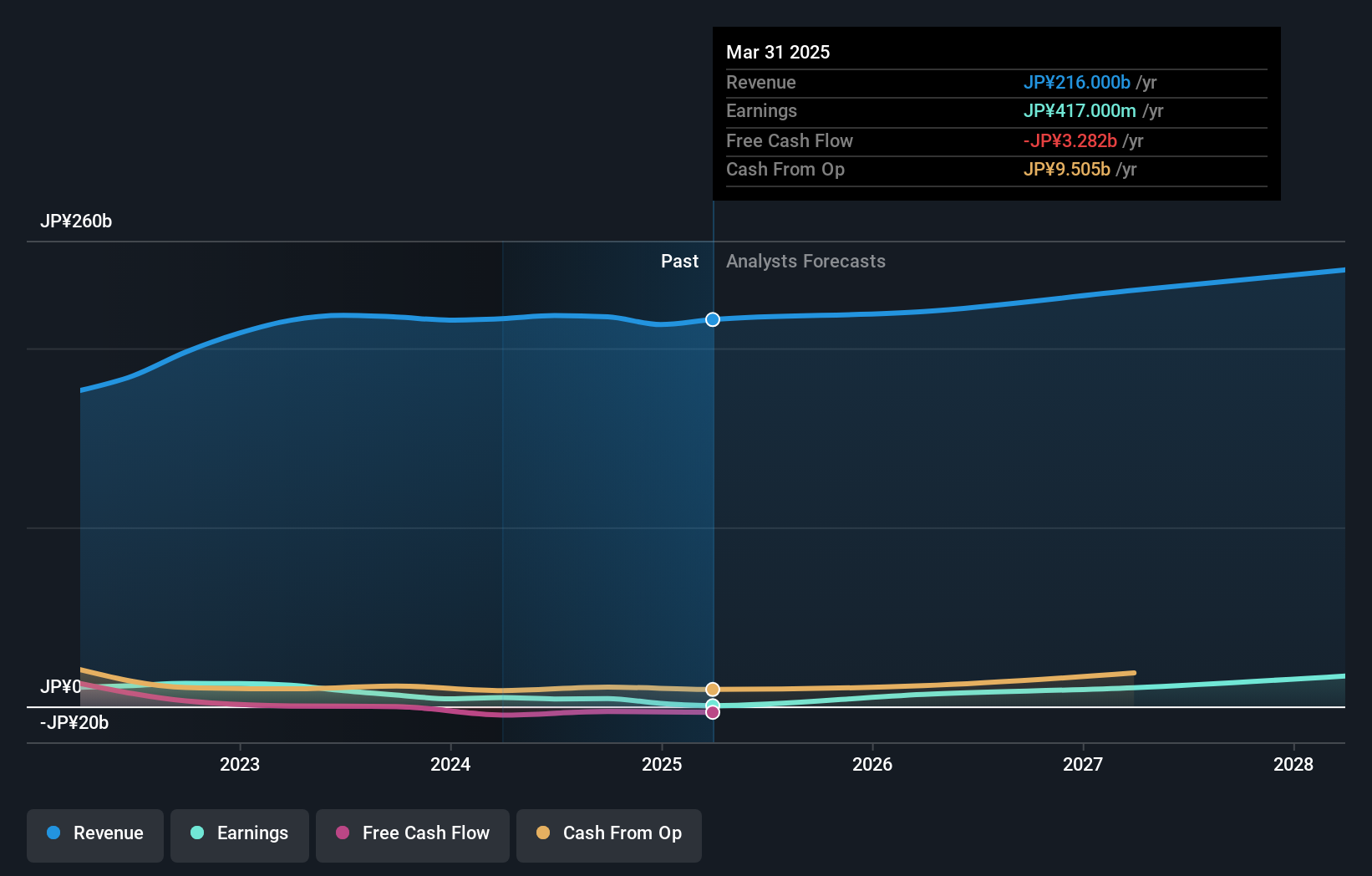

ANYCOLOR (TSE:5032)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ANYCOLOR Inc. is an entertainment company with operations in Japan and internationally, boasting a market cap of ¥145.41 billion.

Operations: ANYCOLOR Inc. generates revenue primarily through entertainment services, including virtual YouTubers and digital content creation. The company leverages its talent pool to produce engaging multimedia experiences, driving both domestic and international sales.

ANYCOLOR is making significant strides in the tech industry, with earnings growth of 30.3% over the past year, far outpacing the Entertainment industry's -17.1%. The company's R&D expenses highlight its commitment to innovation, with ¥2 billion allocated last year. Revenue is forecasted to grow at 13.3% annually, surpassing the broader JP market's 4.3%. Recently, ANYCOLOR completed a share repurchase program worth ¥7,499.97 million for 2,712,000 shares (4.34%), aimed at improving capital efficiency and shareholder returns.

- Delve into the full analysis health report here for a deeper understanding of ANYCOLOR.

Gain insights into ANYCOLOR's historical performance by reviewing our past performance report.

Topcon (TSE:7732)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Topcon Corporation, with a market cap of ¥163.39 billion, develops, manufactures, and sells positioning, eye care, and smart infrastructure products in Japan and internationally.

Operations: Topcon generates revenue primarily from its Positioning Business and Eye Care Business, with the former contributing ¥148.60 billion and the latter ¥67.89 billion. The company operates both domestically in Japan and internationally, focusing on developing advanced technological products for various industries.

Topcon Corporation anticipates a 5.6% annual revenue growth, outpacing the broader JP market's 4.3%. Despite a significant one-off loss of ¥2.8B impacting recent financials, earnings are projected to surge by 24.1% annually over the next three years, considerably higher than the market's 8.6%. The company's R&D expenditure underscores its innovation drive, with ¥10 billion allocated last year to advance its tech and AI capabilities, potentially enhancing future profitability and industry standing.

- Dive into the specifics of Topcon here with our thorough health report.

Review our historical performance report to gain insights into Topcon's's past performance.

Taking Advantage

- Access the full spectrum of 131 Japanese High Growth Tech and AI Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5032

ANYCOLOR

Operates as an entertainment company in Japan and internationally.

Excellent balance sheet with reasonable growth potential.