- Japan

- /

- Semiconductors

- /

- TSE:6055

3 Japanese Stocks Trading At An Estimated Discount

Reviewed by Simply Wall St

Japan’s stock markets have rebounded strongly, with the Nikkei 225 Index gaining 8.7% and the broader TOPIX Index up 7.9%, boosted by better-than-expected U.S. economic data and a stronger-than-anticipated expansion in Japan's GDP for the second quarter of the year. This positive sentiment provides a fertile ground for identifying stocks that may be trading at an estimated discount. In this article, we will explore three Japanese stocks that are currently perceived as undervalued, offering potential investment opportunities amidst these favorable market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Syuppin (TSE:3179) | ¥1335.00 | ¥2664.03 | 49.9% |

| Micronics Japan (TSE:6871) | ¥4915.00 | ¥9742.82 | 49.6% |

| Hottolink (TSE:3680) | ¥333.00 | ¥662.24 | 49.7% |

| BayCurrent Consulting (TSE:6532) | ¥4433.00 | ¥8604.06 | 48.5% |

| Kadokawa (TSE:9468) | ¥3007.00 | ¥5635.91 | 46.6% |

| SHIFT (TSE:3697) | ¥11815.00 | ¥23307.54 | 49.3% |

| Ohara (TSE:5218) | ¥1324.00 | ¥2576.62 | 48.6% |

| Fudo Tetra (TSE:1813) | ¥2362.00 | ¥4418.70 | 46.5% |

| TORIDOLL Holdings (TSE:3397) | ¥3531.00 | ¥7015.86 | 49.7% |

| SBI ARUHI (TSE:7198) | ¥858.00 | ¥1706.18 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

JAPAN MATERIAL (TSE:6055)

Overview: JAPAN MATERIAL Co., Ltd. operates in the electronics and graphics businesses in Japan and has a market cap of ¥184 billion.

Operations: The company's revenue segments are comprised of ¥47.65 billion from Electronics, ¥1.56 billion from Graphics Solution Business, and ¥206 million from Solar Power Generation Business.

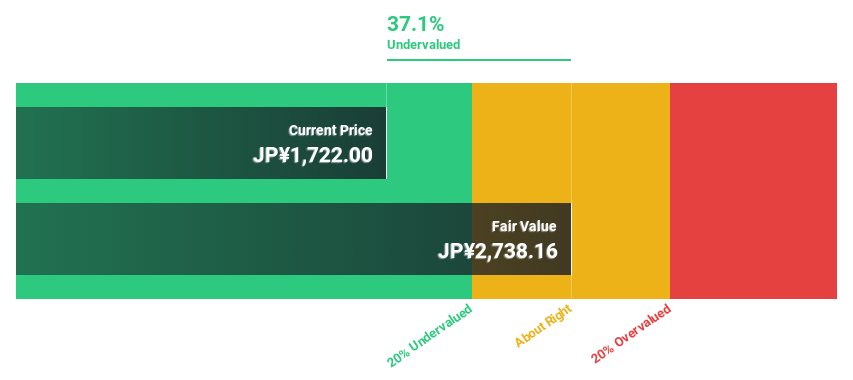

Estimated Discount To Fair Value: 34.2%

JAPAN MATERIAL is trading at ¥1791, significantly below its estimated fair value of ¥2720.65, indicating it is highly undervalued based on discounted cash flow analysis. The company forecasts robust earnings growth of 24.43% annually over the next three years, outpacing the market average. However, despite this potential, its share price has been highly volatile recently. JAPAN MATERIAL projects net sales of ¥50 billion and operating profit of ¥10 billion for FY2025.

- Insights from our recent growth report point to a promising forecast for JAPAN MATERIAL's business outlook.

- Click here to discover the nuances of JAPAN MATERIAL with our detailed financial health report.

Insource (TSE:6200)

Overview: Insource Co., Ltd. offers a range of lecturer dispatch type training, open lectures, and other educational services in Japan, with a market cap of ¥78.78 billion.

Operations: The Education Service Business segment generated ¥12.06 billion in revenue.

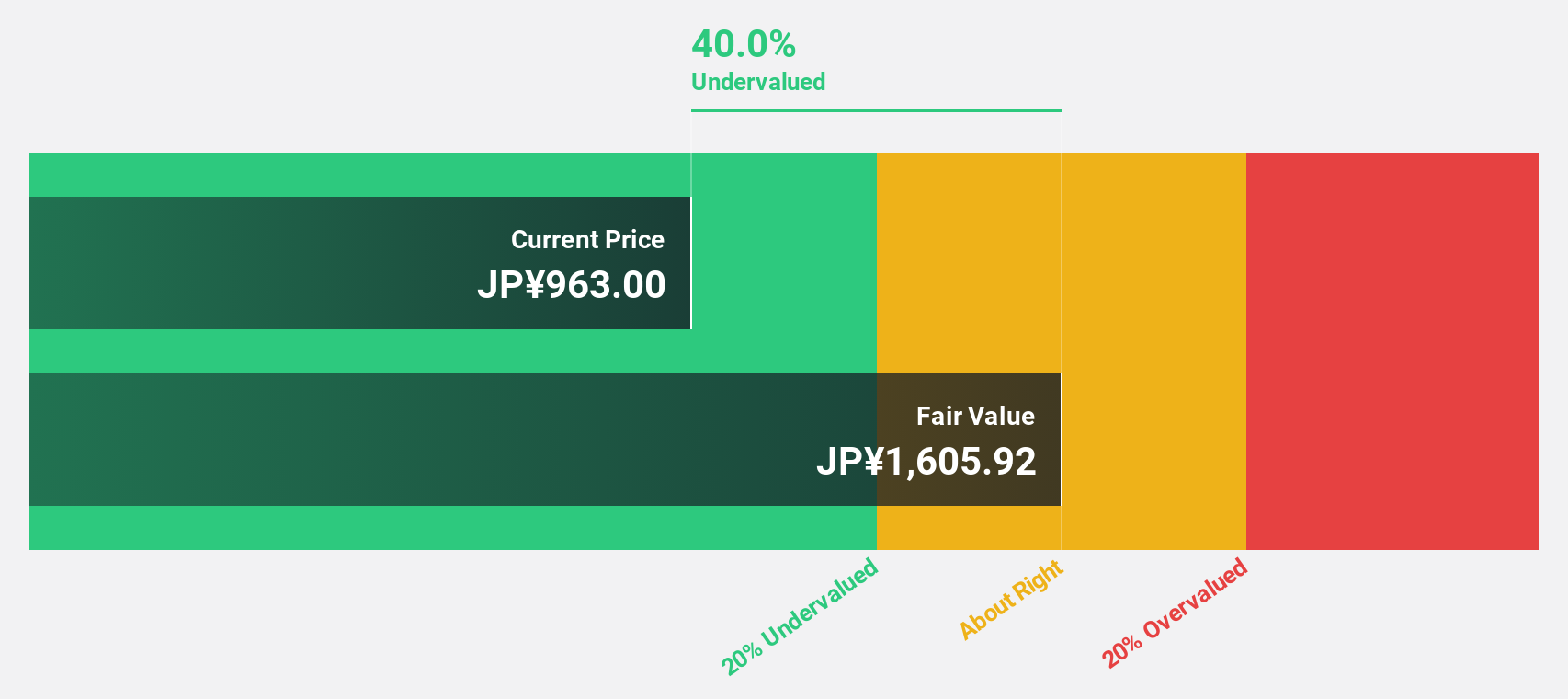

Estimated Discount To Fair Value: 41.8%

Insource is trading at ¥939, well below its estimated fair value of ¥1612.08, making it highly undervalued based on discounted cash flow analysis. The company forecasts earnings growth of 18.65% annually and revenue growth of 14.9% per year, both surpassing the JP market averages. Recent updates include revised earnings guidance for FY2024 with net sales expected at ¥12.47 billion and a dividend increase to ¥19.5 per share from ¥13 last year.

- Our expertly prepared growth report on Insource implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Insource's balance sheet health report.

Micronics Japan (TSE:6871)

Overview: Micronics Japan Co., Ltd. develops, manufactures, and sells testing and measurement equipment for semiconductors and LCD testing systems worldwide, with a market cap of ¥189.67 billion.

Operations: The company's revenue segments include testing and measurement equipment for semiconductors and LCD testing systems.

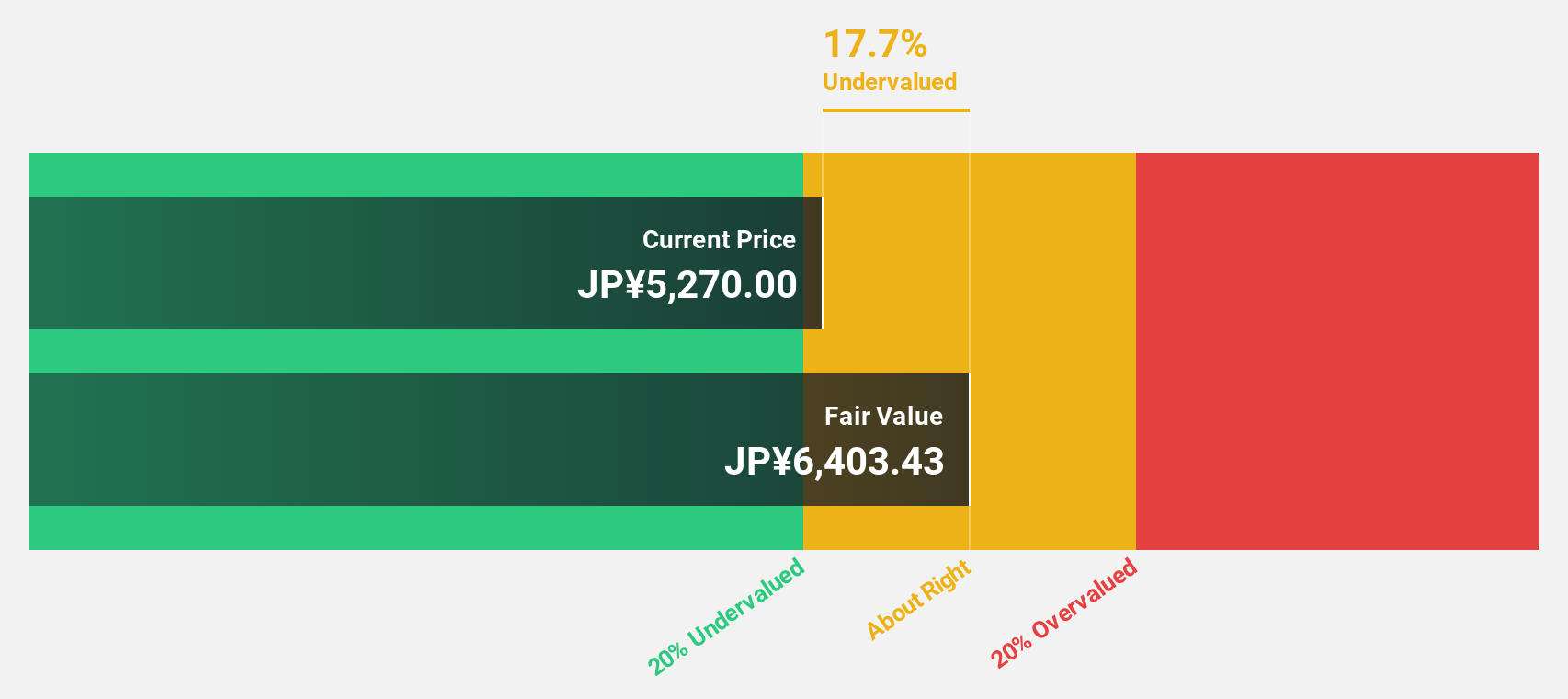

Estimated Discount To Fair Value: 49.6%

Micronics Japan, trading at ¥4915, is significantly undervalued with an estimated fair value of ¥9742.82 based on discounted cash flow analysis. Despite high share price volatility over the past three months, its earnings are forecast to grow 32.88% annually over the next three years, outpacing the JP market's 8.6%. Revenue is also expected to increase by 20.4% per year, well above the market average of 4.3%.

- Our growth report here indicates Micronics Japan may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Micronics Japan.

Next Steps

- Access the full spectrum of 84 Undervalued Japanese Stocks Based On Cash Flows by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6055

JAPAN MATERIAL

Operates in the electronics and graphics businesses in Japan.

Flawless balance sheet with reasonable growth potential.