- Japan

- /

- Electrical

- /

- TSE:6592

Unpleasant Surprises Could Be In Store For Mabuchi Motor Co., Ltd.'s (TSE:6592) Shares

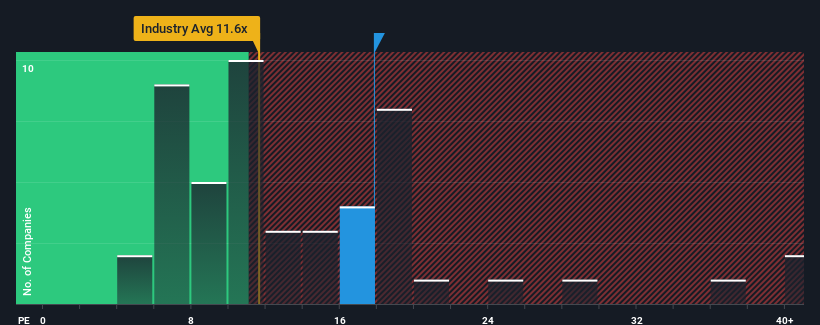

Mabuchi Motor Co., Ltd.'s (TSE:6592) price-to-earnings (or "P/E") ratio of 17.8x might make it look like a sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 14x and even P/E's below 9x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Mabuchi Motor has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Mabuchi Motor

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Mabuchi Motor would need to produce impressive growth in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 173%. The strong recent performance means it was also able to grow EPS by 124% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 21% each year as estimated by the nine analysts watching the company. That's not great when the rest of the market is expected to grow by 10% per year.

With this information, we find it concerning that Mabuchi Motor is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Mabuchi Motor currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Mabuchi Motor (at least 1 which is a bit unpleasant), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6592

Mabuchi Motor

Manufactures and sells of small electric motors Japan, Europe, and North America.

Flawless balance sheet average dividend payer.