In the current global market landscape, uncertainties surrounding trade policies and mixed economic indicators have led to fluctuating performances across major indices. With U.S. job growth falling short of estimates and tariff concerns looming, investors are increasingly seeking stability through reliable dividend stocks that offer consistent income potential amidst market volatility. In such an environment, a good dividend stock is characterized by a strong track record of payouts and resilience in diverse economic conditions, making them appealing options for those looking to balance risk with steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.88% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.03% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.79% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.28% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.46% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.11% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Comefly Outdoor (SHSE:603908)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Comefly Outdoor Co., Ltd., operating as MOBI GARDEN, focuses on the research, design, development, and sale of outdoor products in China with a market cap of CN¥2.19 billion.

Operations: Comefly Outdoor Co., Ltd. generates its revenue primarily from the apparel segment, which accounts for CN¥1.38 billion.

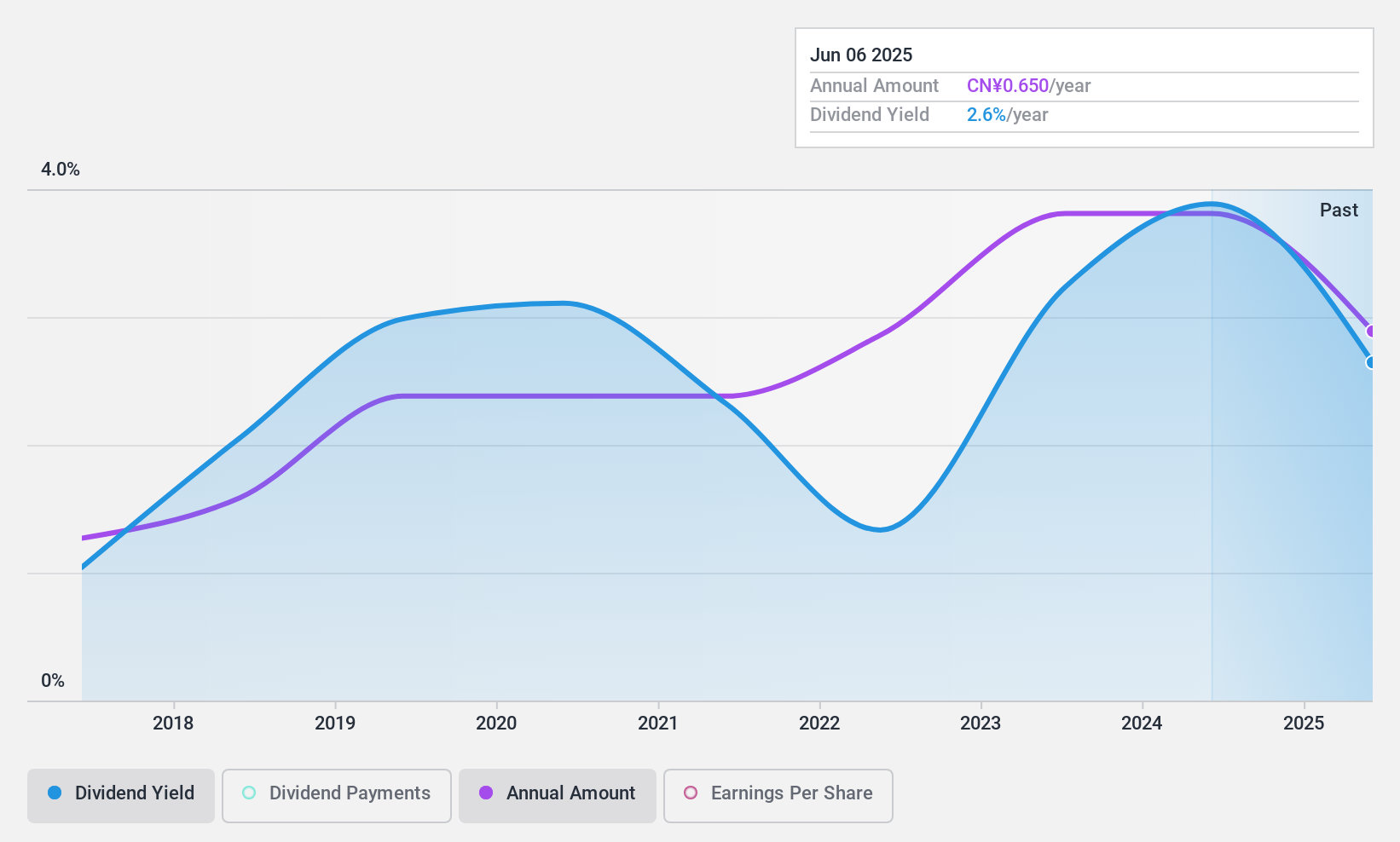

Dividend Yield: 3.6%

Comefly Outdoor's dividend payments have been reliable and stable, with eight years of consistent growth. The company's payout ratio stands at 89.7%, indicating dividends are covered by earnings, while a cash payout ratio of 51.3% suggests sustainability from cash flows. With a dividend yield of 3.63%, it ranks in the top 25% among CN market payers. Despite trading at a discount to its fair value estimate, investors should note the relatively short dividend history.

- Navigate through the intricacies of Comefly Outdoor with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Comefly Outdoor is trading behind its estimated value.

Toyo Kanetsu K.K (TSE:6369)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyo Kanetsu K.K. operates in plant and machinery, material handling systems, and other sectors across Japan, Southeast Asia, and internationally with a market cap of ¥28.91 billion.

Operations: Toyo Kanetsu K.K.'s revenue is derived from its operations in plant and machinery and material handling systems across various regions.

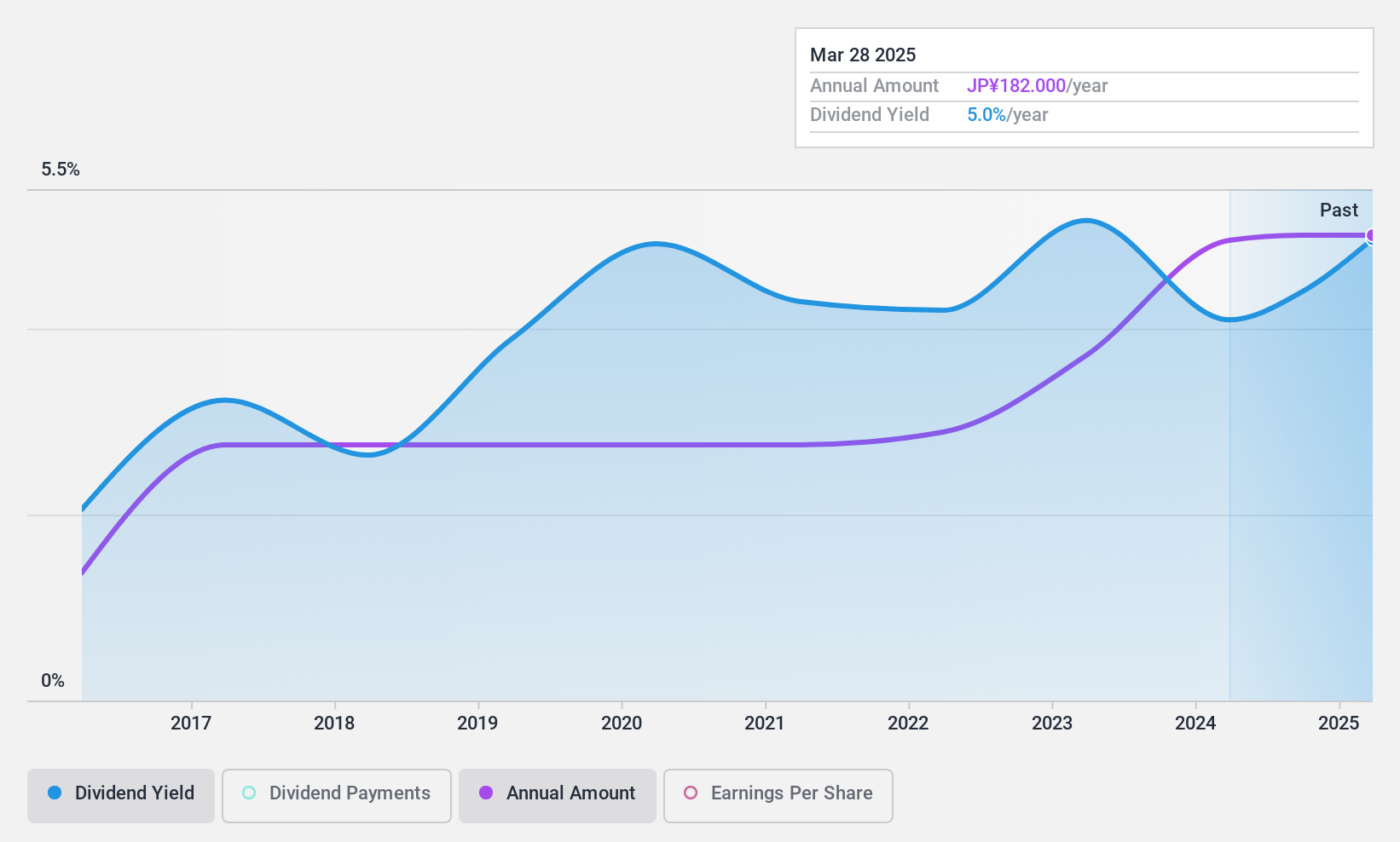

Dividend Yield: 4.6%

Toyo Kanetsu K.K.'s dividend yield of 4.58% ranks it among the top 25% in Japan, though its dividends have been volatile over the past decade. The payout ratio of 37.1% and cash payout ratio of 40.7% indicate strong coverage by earnings and cash flows, suggesting sustainability despite an unstable track record. Recent earnings growth of 133.5% could support future payouts, but investors should be cautious due to historical volatility in dividend payments.

- Delve into the full analysis dividend report here for a deeper understanding of Toyo Kanetsu K.K.

- Upon reviewing our latest valuation report, Toyo Kanetsu K.K's share price might be too pessimistic.

Mabuchi Motor (TSE:6592)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mabuchi Motor Co., Ltd. manufactures and sells small electric motors in Japan, Europe, and North America with a market cap of ¥265.24 billion.

Operations: Mabuchi Motor Co., Ltd.'s revenue segments are comprised of ¥185.58 billion from Asia, ¥121.27 billion from Japan, ¥46.05 billion from Europe, and ¥41.25 billion from the United States of America.

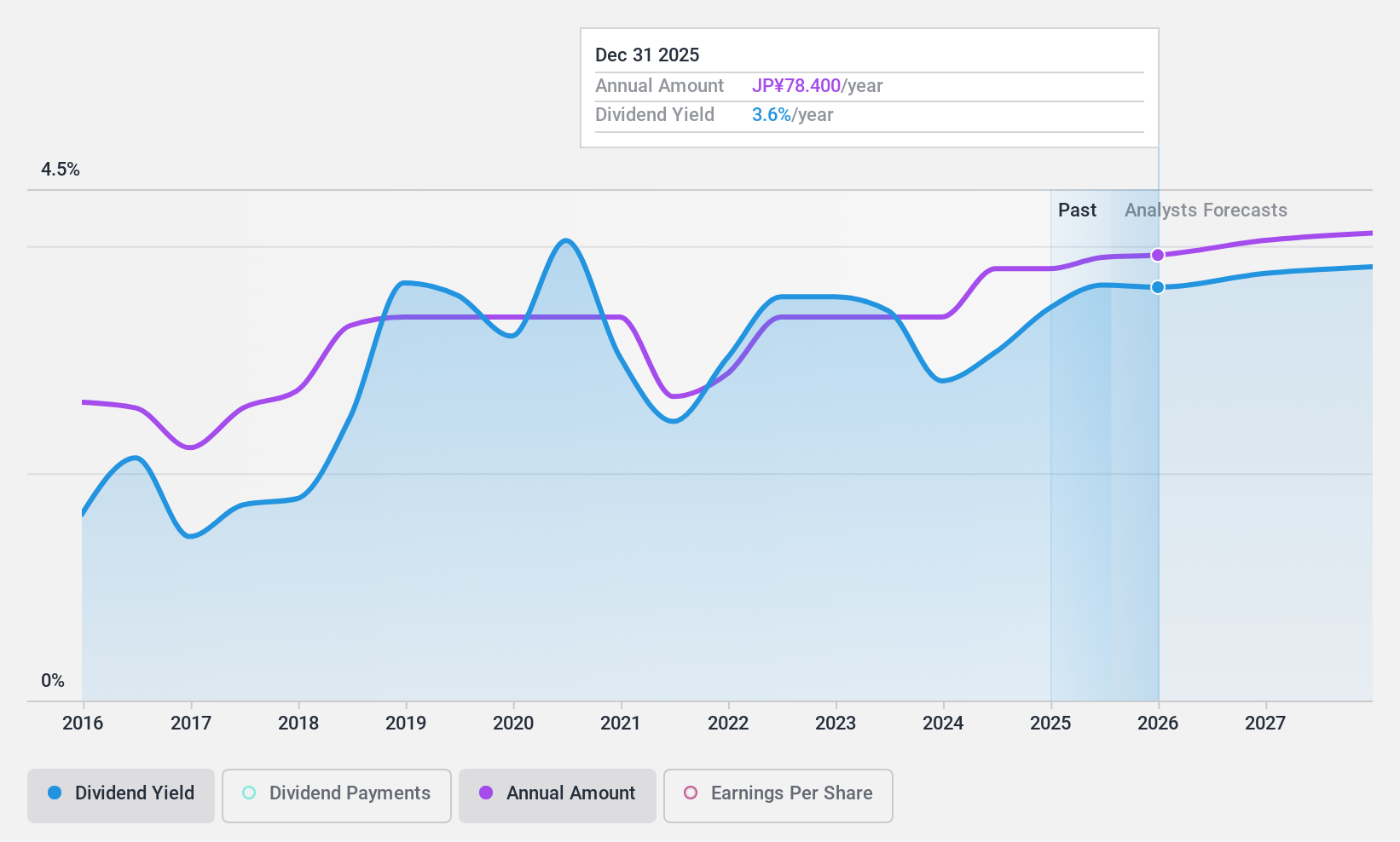

Dividend Yield: 3.5%

Mabuchi Motor's dividend yield of 3.52% is below the top 25% of Japanese dividend payers, with a history of volatility over the past decade despite overall growth. The payout ratio of 51.1% and cash payout ratio of 47.1% suggest dividends are well-covered by earnings and cash flows, indicating sustainability. However, recent guidance revisions show decreased profit expectations due to impairment losses, which may affect future dividend stability amidst ongoing strategic adjustments like share buybacks and corporate transactions.

- Get an in-depth perspective on Mabuchi Motor's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Mabuchi Motor shares in the market.

Seize The Opportunity

- Investigate our full lineup of 1964 Top Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603908

Comefly Outdoor

Comefly Outdoor Co., Ltd., doing business as MOBI GARDEN, engages in the research, design, development, and sale of outdoor products in China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives