- Japan

- /

- Electrical

- /

- TSE:6503

Mitsubishi Electric (TSE:6503): Valuation in Focus After Tech Launches and Major Share Buyback Completion

Reviewed by Kshitija Bhandaru

Mitsubishi Electric (TSE:6503) is making headlines with a dual stream of news. The company introduced cutting-edge innovations in display and health technology, while also wrapping up a significant share buyback in early October.

See our latest analysis for Mitsubishi Electric.

Mitsubishi Electric’s steady stream of product breakthroughs and a recently completed share buyback appear to have fueled renewed optimism among investors. The stock’s share price has climbed 46.3% so far this year, while its total shareholder return over the past twelve months sits at an impressive 66.8%. These factors suggest a meaningful shift in market sentiment and longer-term confidence.

Curious where the next breakout could be? Consider expanding your search and discover See the full list for free.

With Mitsubishi Electric’s shares soaring and fresh innovations hitting the market, the big question now is whether the current valuation leaves room for upside or if the market has already priced in all future growth.

Most Popular Narrative: 7% Overvalued

Mitsubishi Electric’s latest fair value estimate, at ¥3,668, sits slightly below the last close of ¥3,927. While the surge in share price has grabbed attention, the most watched narrative now suggests the market is pricing in extra optimism ahead of fundamentals. Investors are left asking whether this momentum can keep outpacing the story that’s unfolding underneath.

Expansion in the Energy Systems and Public Utility segments is driven by ongoing investments in power distribution and the transition toward electrification and energy efficiency, supported by worldwide decarbonization initiatives. This should result in higher recurring revenues and improved net margins as Mitsubishi Electric benefits from secular shifts to sustainable infrastructure.

Interested in why the narrative points to such a punchy valuation? The secret weapon: ambitious earnings goals, steady profit expansion, and the bold expectation of richer future margins. Lean in, question the drivers, and see what’s fueling this price target.

Result: Fair Value of ¥3,668 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from lower-cost Asian manufacturers or rapid shifts to digital-first automation could quickly challenge Mitsubishi Electric's growth narrative.

Find out about the key risks to this Mitsubishi Electric narrative.

Another View: Market Ratios Provide a Different Angle

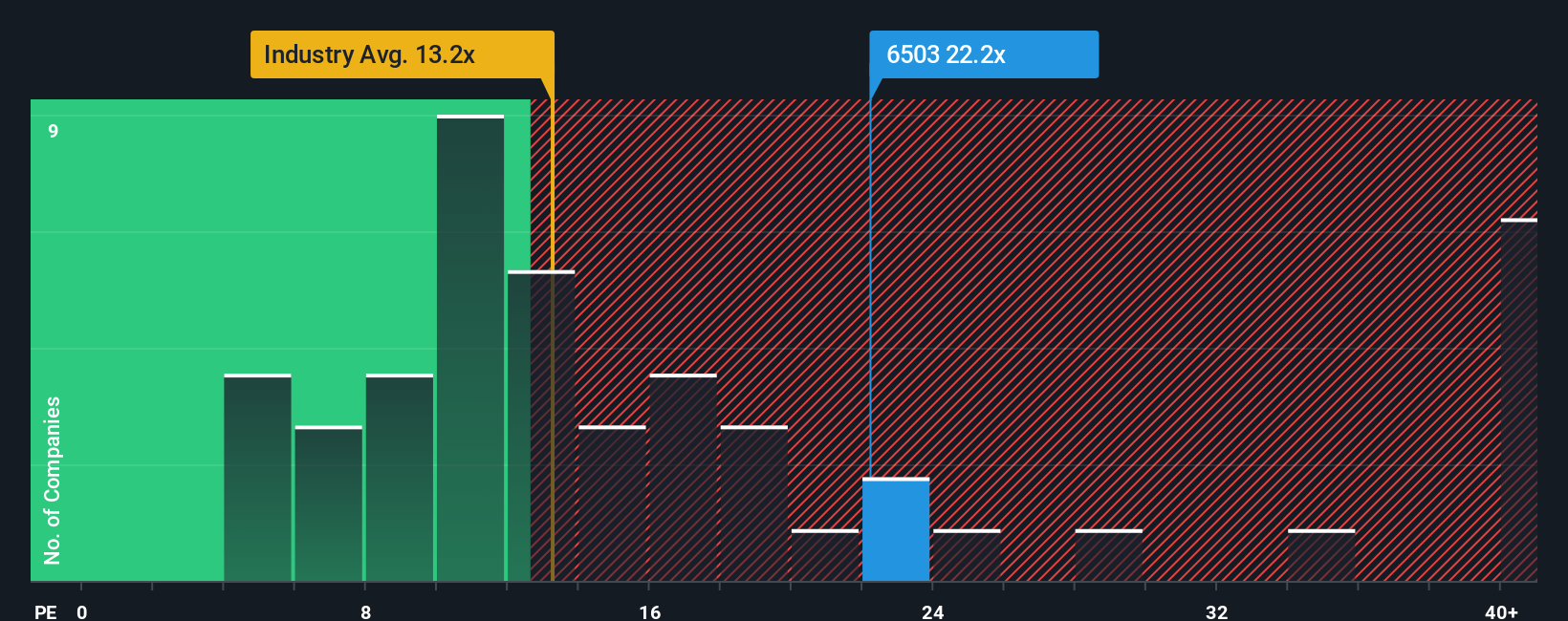

While the most popular narrative points to Mitsubishi Electric being overvalued based on its fair value estimate, a look at the company's price-to-earnings ratio tells a slightly different story. Mitsubishi Electric trades at 22x earnings, which is notably cheaper than the peer group average of 26.2x and even below its own fair ratio of 26.3x. This discount to both peers and the fair ratio could signal that the market is overlooking potential value, or it may reflect skepticism about sustainability of recent growth. Are investors being too cautious, or does the market see risks that aren’t obvious in the numbers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mitsubishi Electric Narrative

If you see things differently or want to draw your own conclusions, you can dive into the data and craft a fresh perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mitsubishi Electric.

Looking for more investment ideas?

Smart investors always keep an eye on the next big opportunity. Don’t miss out. Use the Simply Wall St Screener to find stocks shaping tomorrow’s winners.

- Capture the potential of fast-growing companies riding the artificial intelligence wave when you check out these 24 AI penny stocks set to benefit from the latest machine learning breakthroughs.

- Maximize your portfolio’s value by targeting these 899 undervalued stocks based on cash flows identified by strong fundamentals and attractive cash flow profiles.

- Boost your income and stability with these 19 dividend stocks with yields > 3%, featuring attractive yields and resilient financials that can strengthen your long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6503

Mitsubishi Electric

Develops, manufactures, sells, and distributes electrical and electronic equipment in Japan, North America, rest of Asia, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives