- Japan

- /

- Electrical

- /

- TSE:6503

Mitsubishi Electric (TSE:6503): Valuation Check After New Cooling Tech and High-Voltage IGBT Module Advances

Reviewed by Simply Wall St

Mitsubishi Electric (TSE:6503) just put its R and D engine on display, unveiling microbubble driven cooling tech and new high isolation HVIGBT modules that directly target efficiency, carbon neutrality, and heavy duty industrial demand.

See our latest analysis for Mitsubishi Electric.

Investors seem to be noticing these moves, with a 1 day share price return of 3.42 percent adding to a strong year to date share price return of 72.10 percent and an 81.38 percent 1 year total shareholder return. This suggests momentum is still building rather than fading.

If Mitsubishi Electric's push into advanced power electronics has your attention, this could be a good moment to explore other aerospace and defense stocks that are also leaning into efficiency and electrification themes.

Yet with the share price already far above analyst targets and trading at a steep premium to intrinsic value models, investors face a tougher question: is Mitsubishi Electric still a buy, or is future growth already priced in?

Most Popular Narrative Narrative: 13% Overvalued

With Mitsubishi Electric last closing at ¥4621 against a narrative fair value of ¥4090, the current share price already sits ahead of modeled fundamentals.

In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be ¥6044.2 billion, earnings will come to ¥423.4 billion, and it would be trading on a PE ratio of 20.1x, assuming you use a discount rate of 6.9%. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

Want to see what really underpins this stretch valuation case? Behind it sit tightly calibrated growth, margin, and multiple assumptions that could surprise you.

Result: Fair Value of ¥4090 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could quickly unravel if digital transformation continues to lag or AI driven automation accelerates away from Mitsubishi Electric's traditional hardware base.

Find out about the key risks to this Mitsubishi Electric narrative.

Another Lens on Valuation

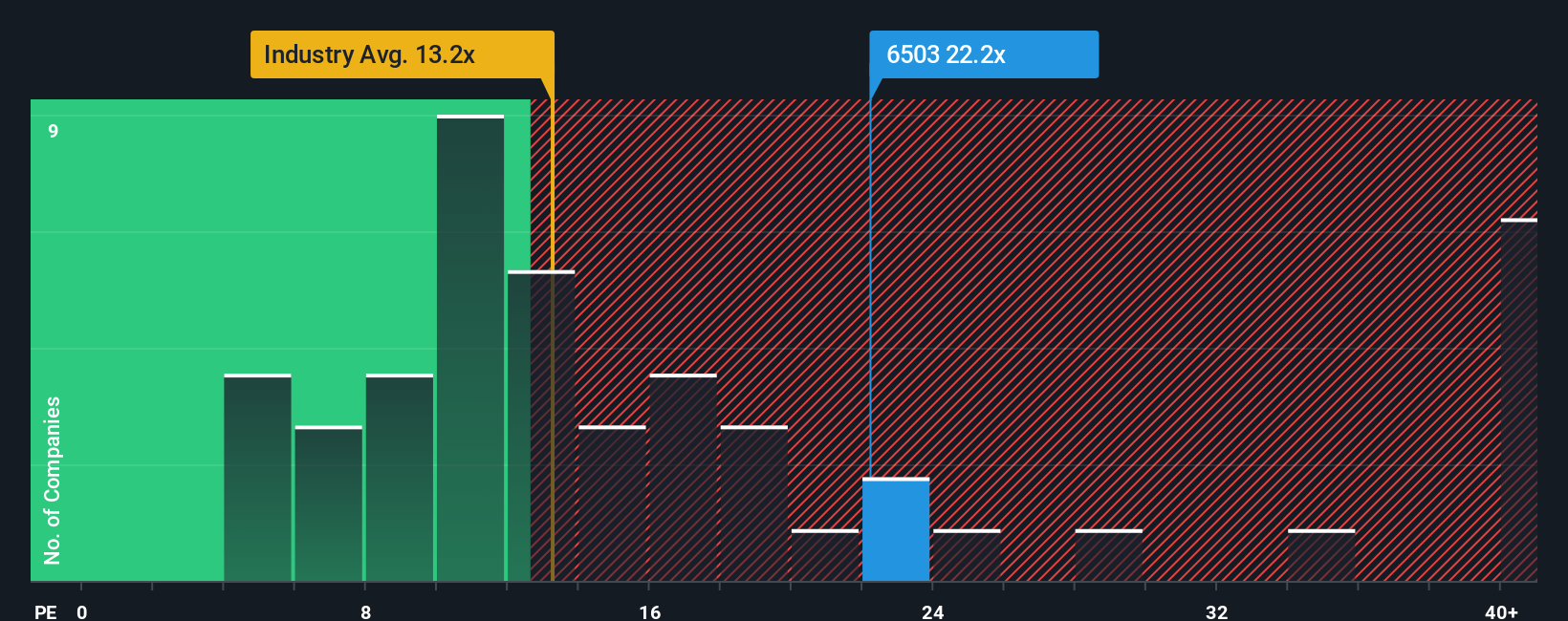

Price to earnings paints a more nuanced picture. Mitsubishi Electric trades on 23.9 times earnings, above the JP Electrical industry at 13.6 times and slightly above peers at 23.3 times, yet below a fair ratio of 26.4 times. Is this a safety margin or a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mitsubishi Electric Narrative

If you see the numbers differently or want to stress test the assumptions yourself, you can build a fresh narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mitsubishi Electric.

Ready for more high conviction ideas?

Do not stop with one compelling story. Use the Simply Wall St screener to uncover fresh, data backed opportunities tailored to the way you like to invest.

- Capture potential mispricings early by scanning these 901 undervalued stocks based on cash flows that could offer stronger upside relative to their cash flow forecasts.

- Ride structural growth themes by targeting these 30 healthcare AI stocks harnessing intelligent diagnostics, automation, and data driven patient outcomes.

- Supercharge your hunt for yield by focusing on these 15 dividend stocks with yields > 3% that can support income goals without abandoning quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6503

Mitsubishi Electric

Develops, manufactures, sells, and distributes electrical and electronic equipment in Japan, North America, rest of Asia, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026