- Japan

- /

- Electrical

- /

- TSE:6503

Mitsubishi Electric (TSE:6503) Showcases Innovation With Serendie At CEATEC 2025

Reviewed by Simply Wall St

Mitsubishi Electric (TSE:6503) is preparing to showcase innovative technologies at CEATEC 2025, focusing on the integration of AI and cloud computing. This emphasis on innovation coincides with a 26% price increase in Mitsubishi Electric's shares over the last quarter. The company's recent developments in AI and 6G-compatible technologies may have played a role in enhancing investor sentiment. Meanwhile, the broader market has been buoyant, with the S&P 500 and Nasdaq reaching record highs, possibly supporting Mitsubishi Electric's upward trajectory. The company's alignment with current technological trends appears to have contributed favorably to its financial performance.

The recent announcement of Mitsubishi Electric's participation in CEATEC 2025, focusing on AI and cloud computing technologies, aligns with themes of industrial automation and decarbonization that are expected to shape future infrastructure. This focus could bolster their standing in industrial automation and energy systems, supporting sustained revenue growth amid global demand for these technologies. Over the last three years, Mitsubishi Electric's total return, combining share price appreciation and dividends, reached 190.59%. This robust performance indicates strong investor interest, likely bolstered by shifts towards digital transformation and automated solutions.

Over the past year, Mitsubishi Electric has outperformed the broader JP Market, which saw a 20.4% return. This relative market outperformance could suggest confidence in its strategy amidst competitive pressures and digital transformation challenges. The company's recent price increase of 26% over the last quarter elevates its shares to ¥3684.00, which is above the analyst consensus price target of ¥3443.38. This indicates some market optimism beyond the projected fair value, potentially driven by expected advancements in AI and 6G technologies.

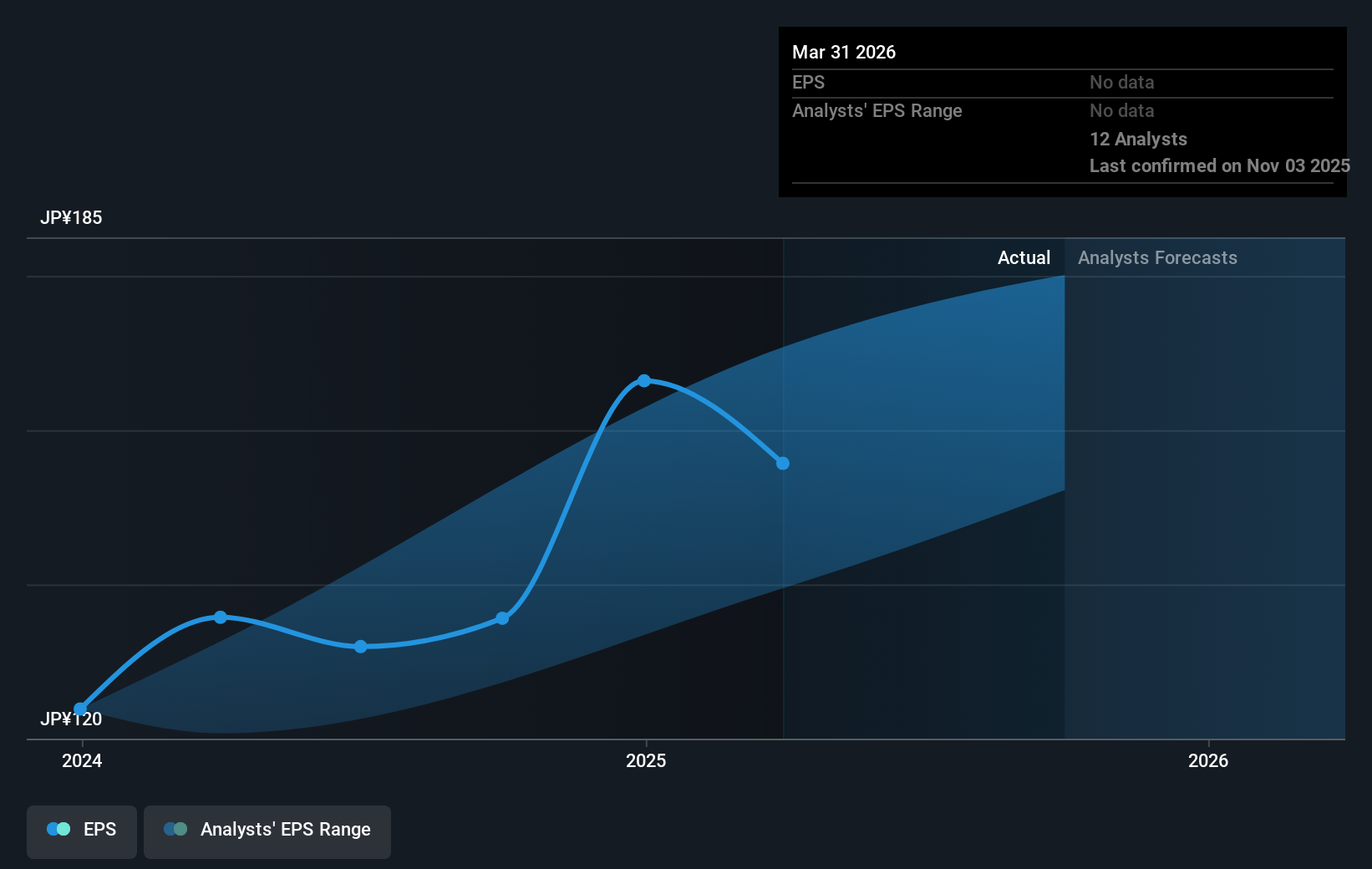

In terms of revenue and earnings forecasts, the focus on showcasing advanced technologies may enhance Mitsubishi Electric's growth trajectory. Analysts expect revenue growth of 2.9% annually and a gradual increase in profit margins over the next three years, but successful integration of these technologies could result in better-than-anticipated financial outcomes. However, it's important to remain cautious about potential risks, such as competition and pricing pressures, which could impact execution and profitability in targeted segments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6503

Mitsubishi Electric

Develops, manufactures, sells, and distributes electrical and electronic equipment in Japan, North America, rest of Asia, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives