- Japan

- /

- Electrical

- /

- TSE:6503

Can Mitsubishi Electric (TSE:6503) Leverage Smart Rail Projects to Reinvent Its Technology Narrative?

Reviewed by Sasha Jovanovic

- Mitsubishi Electric Corporation recently announced its collaboration with the Japan International Cooperation Agency and Hankyu Corporation to advance energy conservation measures for Manila’s Light Rail Transit Authority Line 1, using proprietary data-analysis services to assess and optimize the system’s energy usage.

- This partnership underscores the company’s international role in sustainable infrastructure, while its unveiling of the CielVision aerial display system further highlights continued innovation in next-generation technologies for immersive digital experiences.

- We'll explore how Mitsubishi Electric's push into sustainable rail solutions could alter views on its future infrastructure and technology narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Mitsubishi Electric Investment Narrative Recap

To be a shareholder in Mitsubishi Electric, you need to believe in its ability to capture secular growth in sustainable infrastructure and advanced automation despite the risk of digital disruption and ongoing margin pressure. News of the Manila LRT energy-efficiency collaboration positions the company at the heart of global decarbonization trends, reinforcing a major catalyst, but does not materially change the near-term risk that faster adoption of AI software could shift market demand away from hardware-focused offerings.

Among recent initiatives, the completion of a significant share buyback stands out, signaling confidence in capital management and shareholder returns. This move adds momentum to capital allocation efforts, potentially supporting the narrative that recurring revenues and cost optimization are near-term catalysts for stability.

Yet for investors, it is just as important to understand, by contrast, the persistent risk of margin pressure from intensifying competition and...

Read the full narrative on Mitsubishi Electric (it's free!)

Mitsubishi Electric's outlook anticipates ¥6,044.2 billion in revenue and ¥423.4 billion in earnings by 2028. This scenario is based on annual revenue growth of 2.9% and an earnings increase of ¥57.5 billion from the current ¥365.9 billion.

Uncover how Mitsubishi Electric's forecasts yield a ¥3568 fair value, a 10% downside to its current price.

Exploring Other Perspectives

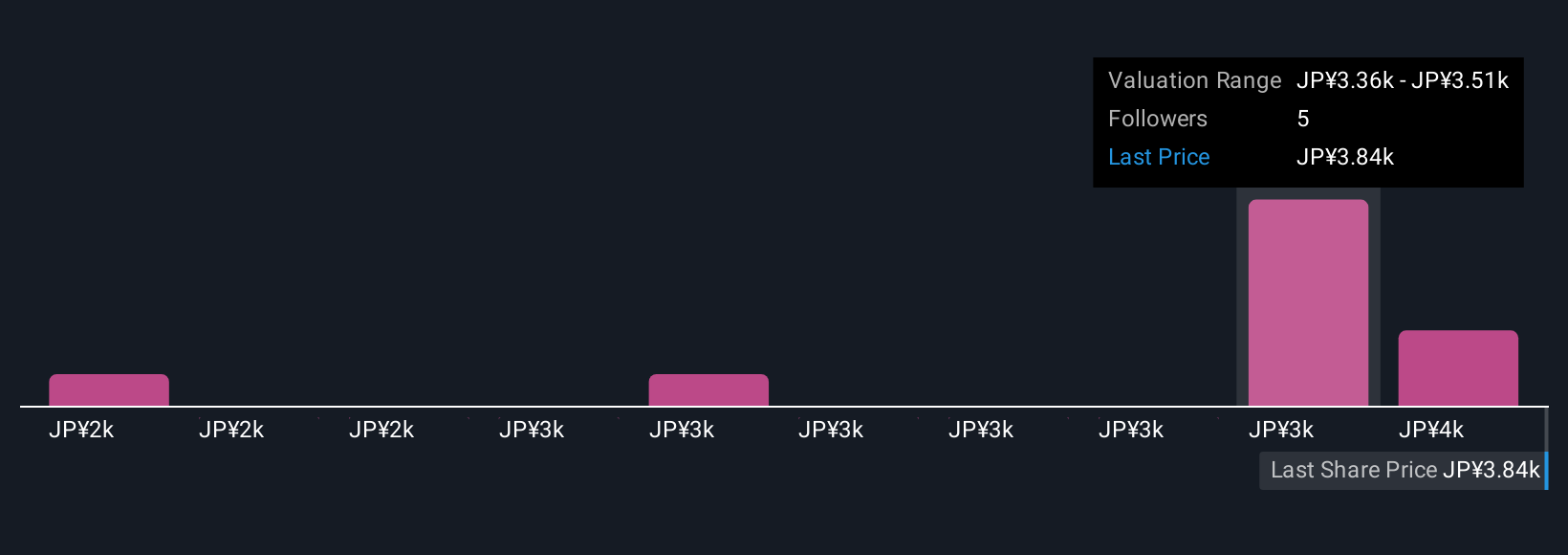

Four members of the Simply Wall St Community set Mitsubishi Electric’s fair value between ¥2,114 and ¥3,568 per share. With industry shifts toward digital solutions, your view on future competitiveness could set expectations, explore more opinions to see where you stand.

Explore 4 other fair value estimates on Mitsubishi Electric - why the stock might be worth as much as ¥3568!

Build Your Own Mitsubishi Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsubishi Electric research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Mitsubishi Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsubishi Electric's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6503

Mitsubishi Electric

Develops, manufactures, sells, and distributes electrical and electronic equipment in Japan, North America, rest of Asia, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives