Why We're Not Concerned Yet About Hoden Seimitsu Kako Kenkyusho Co., Ltd.'s (TSE:6469) 26% Share Price Plunge

Hoden Seimitsu Kako Kenkyusho Co., Ltd. (TSE:6469) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 109%.

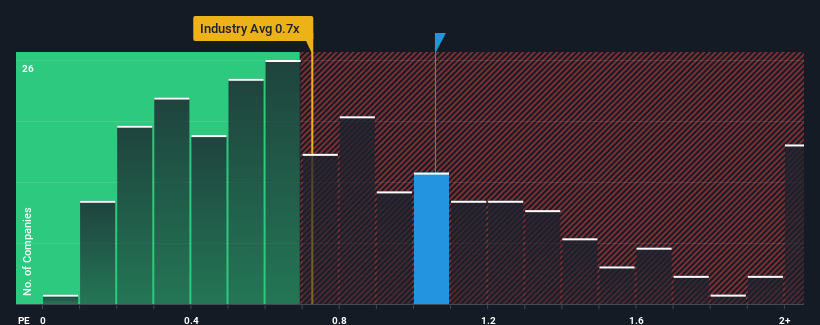

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Hoden Seimitsu Kako Kenkyusho's P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in Japan is also close to 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Hoden Seimitsu Kako Kenkyusho

What Does Hoden Seimitsu Kako Kenkyusho's Recent Performance Look Like?

The recent revenue growth at Hoden Seimitsu Kako Kenkyusho would have to be considered satisfactory if not spectacular. It might be that many expect the respectable revenue performance to only match most other companies over the coming period, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hoden Seimitsu Kako Kenkyusho will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

Hoden Seimitsu Kako Kenkyusho's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.1%. The latest three year period has also seen a 11% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 4.0% shows it's about the same on an annualised basis.

In light of this, it's understandable that Hoden Seimitsu Kako Kenkyusho's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Bottom Line On Hoden Seimitsu Kako Kenkyusho's P/S

With its share price dropping off a cliff, the P/S for Hoden Seimitsu Kako Kenkyusho looks to be in line with the rest of the Machinery industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we've seen, Hoden Seimitsu Kako Kenkyusho's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

It is also worth noting that we have found 4 warning signs for Hoden Seimitsu Kako Kenkyusho (2 shouldn't be ignored!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Hoden Seimitsu Kako Kenkyusho, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hoden Seimitsu Kako Kenkyusho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6469

Hoden Seimitsu Kako Kenkyusho

Manufactures and sells electric discharge machining, industrial gas turbine parts, and other metal products.

Flawless balance sheet with reasonable growth potential.