Japan's stock markets have experienced significant volatility recently, driven by a rebounding yen and concerns about global growth. However, reassuring comments from the Bank of Japan have helped stabilize the market, creating an environment where discerning investors might find overlooked opportunities. In such a fluctuating market, identifying stocks with strong fundamentals and growth potential becomes crucial. Here are three undiscovered gems in Japan that warrant attention for August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| QuickLtd | 0.73% | 9.61% | 14.56% | ★★★★★★ |

| Soliton Systems K.K | 0.61% | 5.36% | 20.91% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.08% | 12.04% | ★★★★★★ |

| NJS | NA | 4.22% | 1.83% | ★★★★★★ |

| NPR-Riken | 13.26% | 6.00% | 32.17% | ★★★★★☆ |

| Denyo | 4.86% | 3.76% | 1.84% | ★★★★★☆ |

| GakkyushaLtd | 22.47% | 5.11% | 19.19% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| Dear LifeLtd | 93.05% | 20.12% | 18.05% | ★★★★★☆ |

| Nippon Sharyo | 61.34% | -1.68% | -17.07% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Amano (TSE:6436)

Simply Wall St Value Rating: ★★★★★☆

Overview: Amano Corporation offers time information, parking, environmental, and cleaning systems in Japan and internationally with a market cap of ¥268.70 billion.

Operations: Amano Corporation generates revenue from time information, parking, environmental, and cleaning systems. The company's net profit margin is 8.45%.

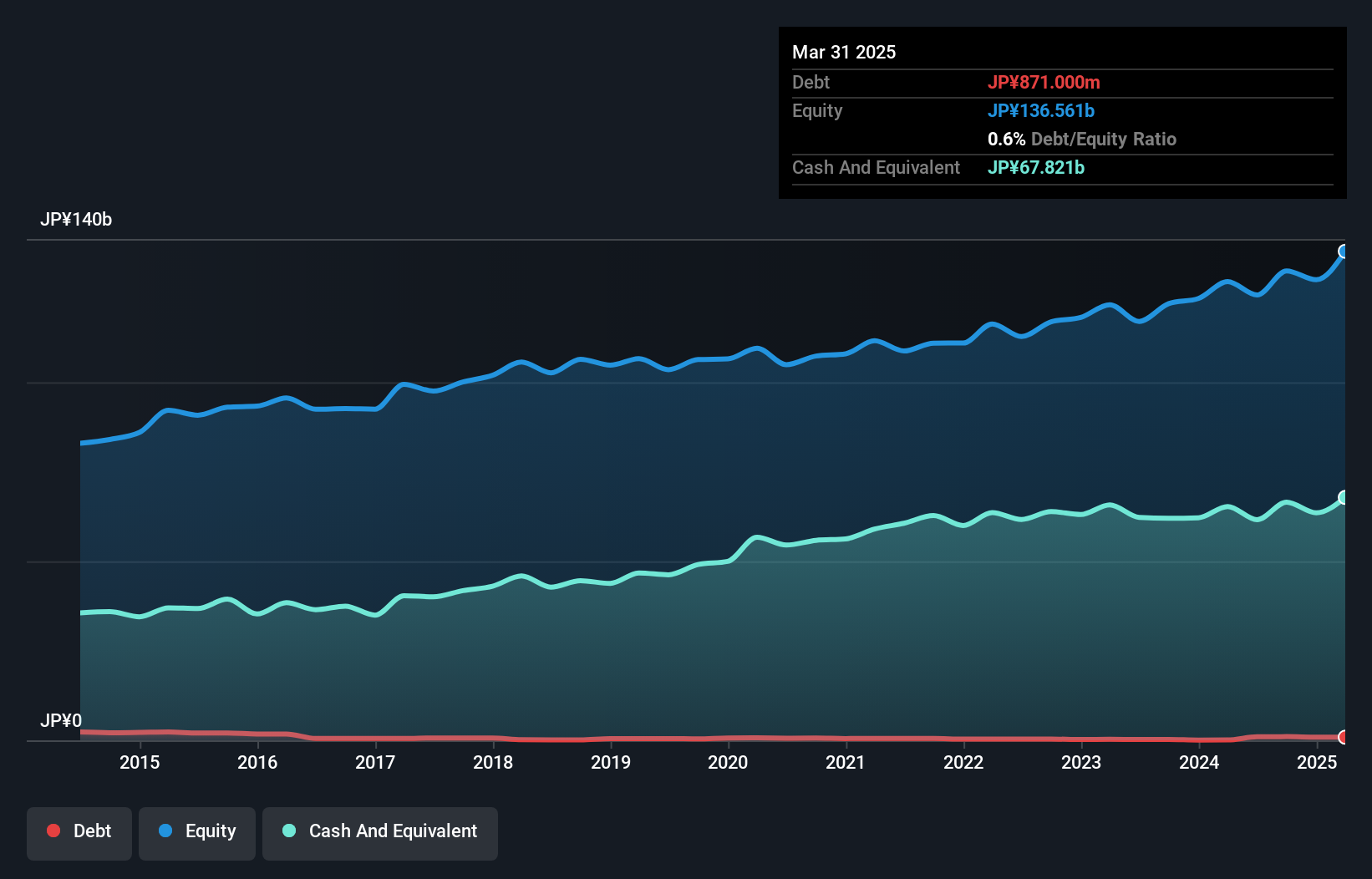

Amano's recent performance showcases its potential in the Japanese market. The company repurchased 495,700 shares for ¥1.95 billion under a buyback plan announced in April 2024, reflecting strong confidence in its valuation. Amano's debt-to-equity ratio increased from 0.5 to 0.8 over five years, while earnings grew by 9.1% last year, outpacing the Electronic industry’s growth of 2.6%. Trading at 33% below fair value, it offers an attractive entry point for investors seeking undervalued opportunities with solid fundamentals and growth prospects projected at around 9% annually.

- Navigate through the intricacies of Amano with our comprehensive health report here.

Review our historical performance report to gain insights into Amano's's past performance.

Sinko Industries (TSE:6458)

Simply Wall St Value Rating: ★★★★★★

Overview: Sinko Industries Ltd. manufactures, sells, and installs air conditioning equipment in Japan and internationally with a market cap of ¥96.12 billion.

Operations: Revenue for Sinko Industries Ltd. primarily comes from Japan (¥44.43 billion) and Asia (¥7.54 billion).

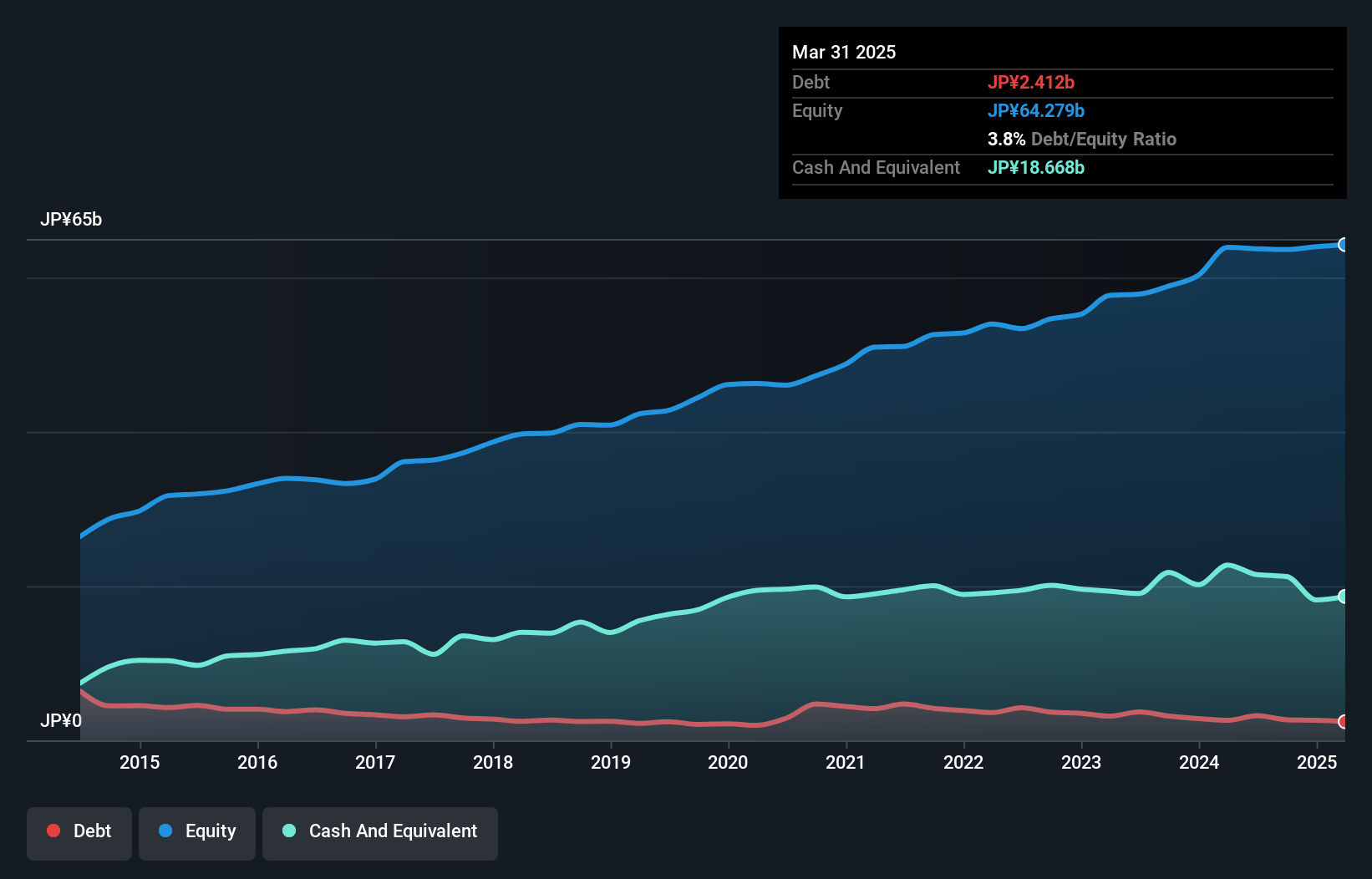

Sinko Industries, a promising player in Japan's industrial sector, has seen earnings grow by 45.8% over the past year, significantly outpacing the building industry’s 18.8%. The company repurchased 288,500 shares for ¥1.14 billion between May and June 2024. Additionally, dividends have increased to JPY 70 per share from JPY 37 a year ago. Looking forward, Sinko expects net sales of JPY 54 billion and operating profit of JPY 9.1 billion for the fiscal year ending March 2025.

- Unlock comprehensive insights into our analysis of Sinko Industries stock in this health report.

Evaluate Sinko Industries' historical performance by accessing our past performance report.

Mitsuuroko Group HoldingsLtd (TSE:8131)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mitsuuroko Group Holdings Co., Ltd. operates in diverse sectors including energy, power and electricity, food, living and wellness, with a market cap of ¥92.04 billion.

Operations: The company's primary revenue streams are from the Energy Solutions Business (¥146.89 billion) and Electric Power Business (¥134.08 billion), followed by the Foods Business (¥21.30 billion).

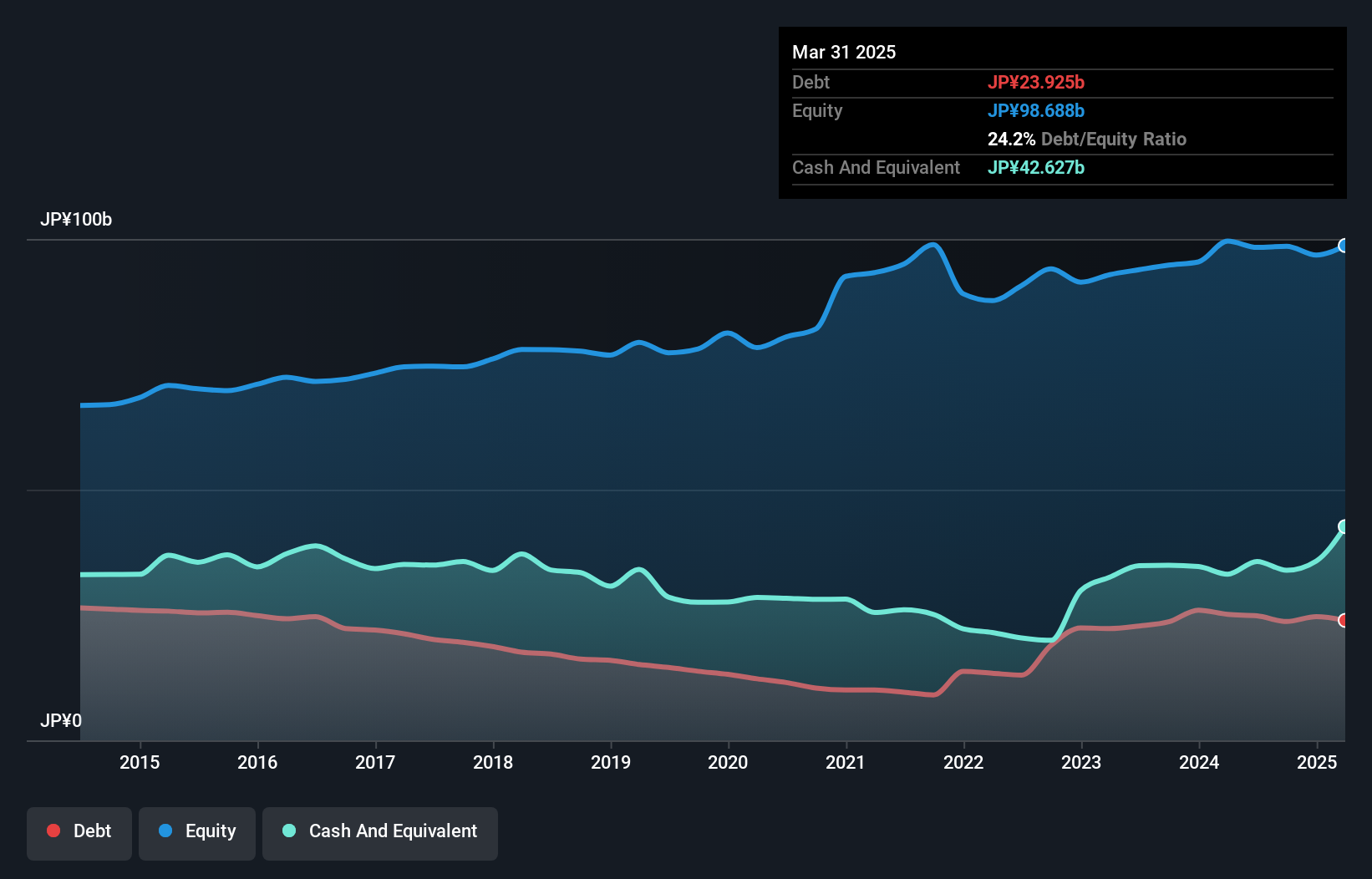

Mitsuuroko Group Holdings, a lesser-known entity in Japan's energy sector, has demonstrated robust financial health with a price-to-earnings ratio of 10.1x, below the JP market average of 12.6x. Over the past year, their earnings growth reached 16.9%, outpacing the Oil and Gas industry’s average growth rate. The company repurchased shares recently and maintains high-quality earnings while keeping its debt to equity ratio at a manageable 25.2%.

Seize The Opportunity

- Access the full spectrum of 717 Japanese Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6458

Sinko Industries

Manufactures, sells, and installs air conditioning equipment in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.