Lacklustre Performance Is Driving Takeuchi Mfg. Co., Ltd.'s (TSE:6432) 27% Price Drop

The Takeuchi Mfg. Co., Ltd. (TSE:6432) share price has fared very poorly over the last month, falling by a substantial 27%. The recent drop has obliterated the annual return, with the share price now down 5.6% over that longer period.

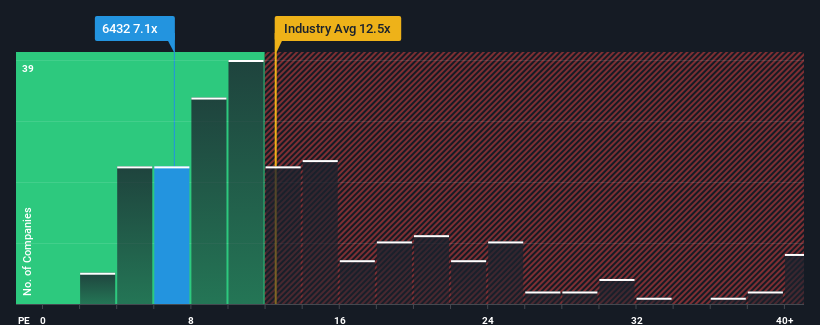

In spite of the heavy fall in price, Takeuchi Mfg's price-to-earnings (or "P/E") ratio of 7.1x might still make it look like a buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 15x and even P/E's above 22x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been advantageous for Takeuchi Mfg as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Takeuchi Mfg

How Is Takeuchi Mfg's Growth Trending?

Takeuchi Mfg's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered an exceptional 60% gain to the company's bottom line. The latest three year period has also seen an excellent 164% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings growth is heading into negative territory, declining 0.7% each year over the next three years. With the market predicted to deliver 9.6% growth per annum, that's a disappointing outcome.

With this information, we are not surprised that Takeuchi Mfg is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Takeuchi Mfg's P/E

Takeuchi Mfg's recently weak share price has pulled its P/E below most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Takeuchi Mfg maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Takeuchi Mfg with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Takeuchi Mfg, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Takeuchi Mfg might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6432

Takeuchi Mfg

Manufactures and sells construction machinery in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026