As global markets navigate a fluctuating landscape marked by shifts in consumer confidence and economic indicators, major stock indexes have shown moderate gains despite some mid-week declines. In this environment, dividend stocks can offer a measure of stability and potential income, making them an attractive option for investors seeking to balance growth with income generation amidst current market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1948 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

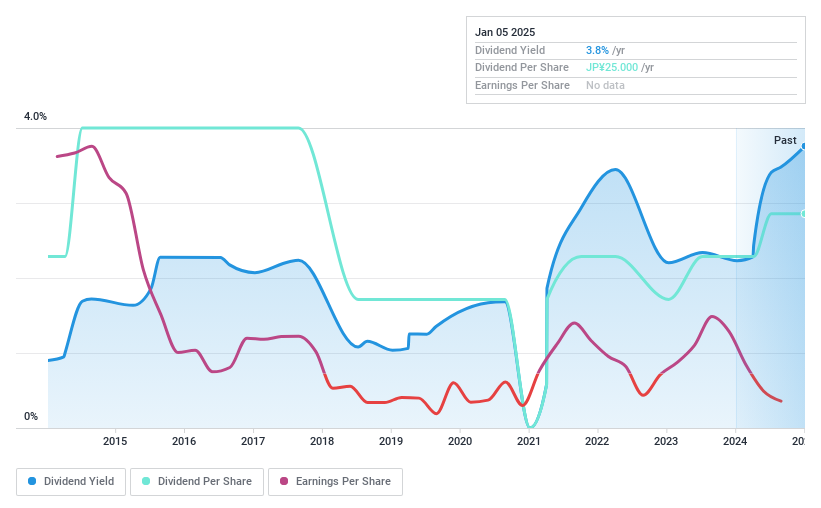

Sankyo TateyamaInc (TSE:5932)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sankyo Tateyama, Inc. is involved in the development, manufacture, and sale of building, housing, and exterior construction materials in Japan with a market cap of ¥20.84 billion.

Operations: Sankyo Tateyama, Inc. generates revenue through its segments focused on building, housing, and exterior construction materials in Japan.

Dividend Yield: 3.8%

Sankyo Tateyama Inc.'s dividend payments have been volatile over the past decade, lacking consistent growth. Despite a low cash payout ratio of 9.3%, indicating strong coverage by cash flows, the dividends are not well covered by earnings due to unprofitability. The company's high debt level further complicates its financial position. However, it trades significantly below its estimated fair value and offers a dividend yield in the top 25% of Japan's market at 3.76%.

- Dive into the specifics of Sankyo TateyamaInc here with our thorough dividend report.

- Our expertly prepared valuation report Sankyo TateyamaInc implies its share price may be lower than expected.

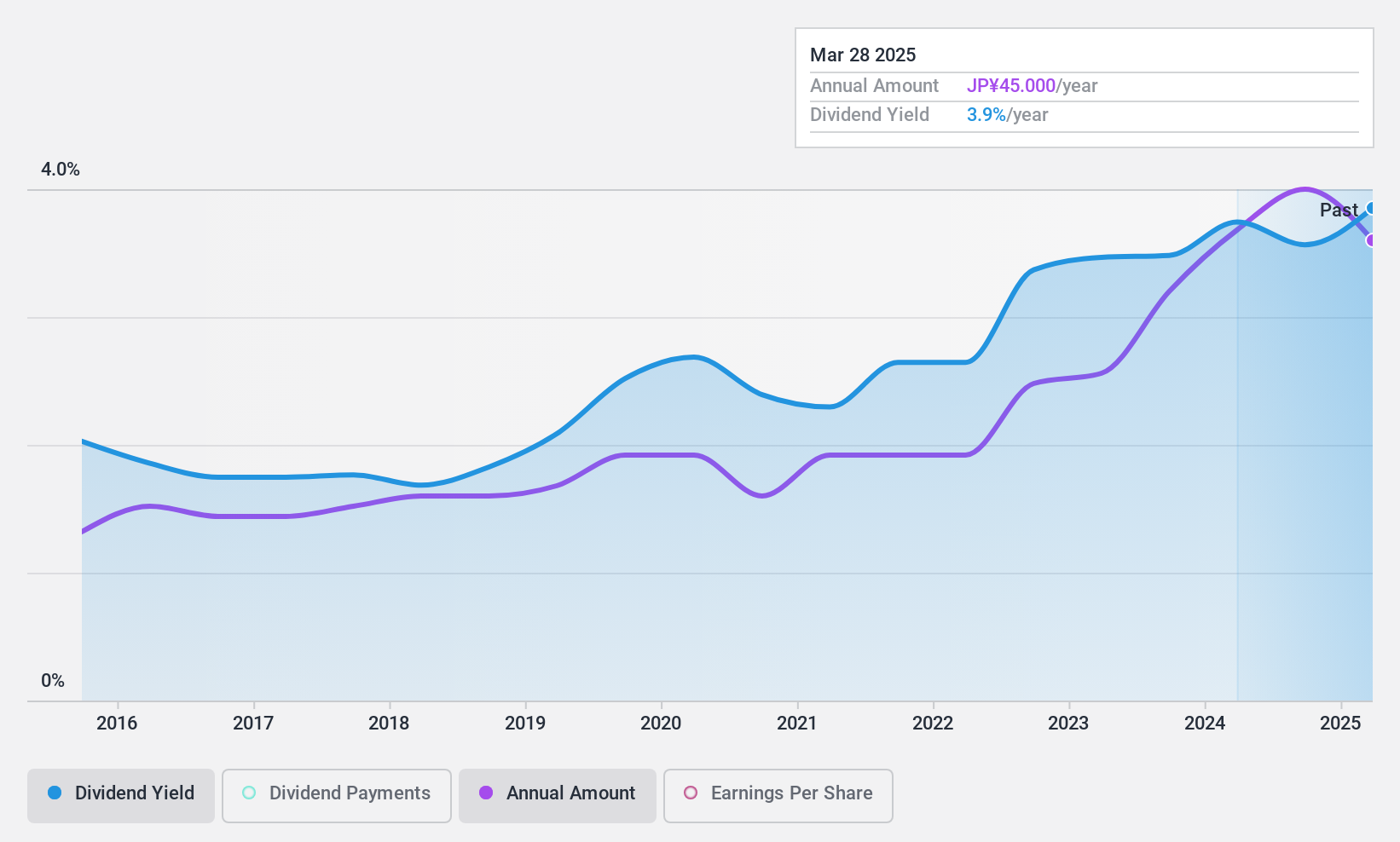

ANEST IWATA (TSE:6381)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ANEST IWATA Corporation engages in the air energy and coating business across Japan, Europe, the Americas, China, and other international markets with a market cap of ¥56.87 billion.

Operations: ANEST IWATA Corporation's revenue segments include ¥13.03 billion from China, ¥25.21 billion from Japan, ¥10.08 billion from Europe, and ¥7.65 billion from the Americas.

Dividend Yield: 3.5%

ANEST IWATA's dividend payments have been inconsistent over the past decade, with periods of volatility. Despite this, dividends are well supported by earnings and cash flows, with a payout ratio of 43.5% and a cash payout ratio of 36.6%. The company recently affirmed an interim dividend of ¥22 per share. It completed a share buyback program totaling ¥399.88 million, indicating potential confidence in its financial stability despite offering a lower yield than top-tier payers in Japan's market.

- Unlock comprehensive insights into our analysis of ANEST IWATA stock in this dividend report.

- Our valuation report here indicates ANEST IWATA may be undervalued.

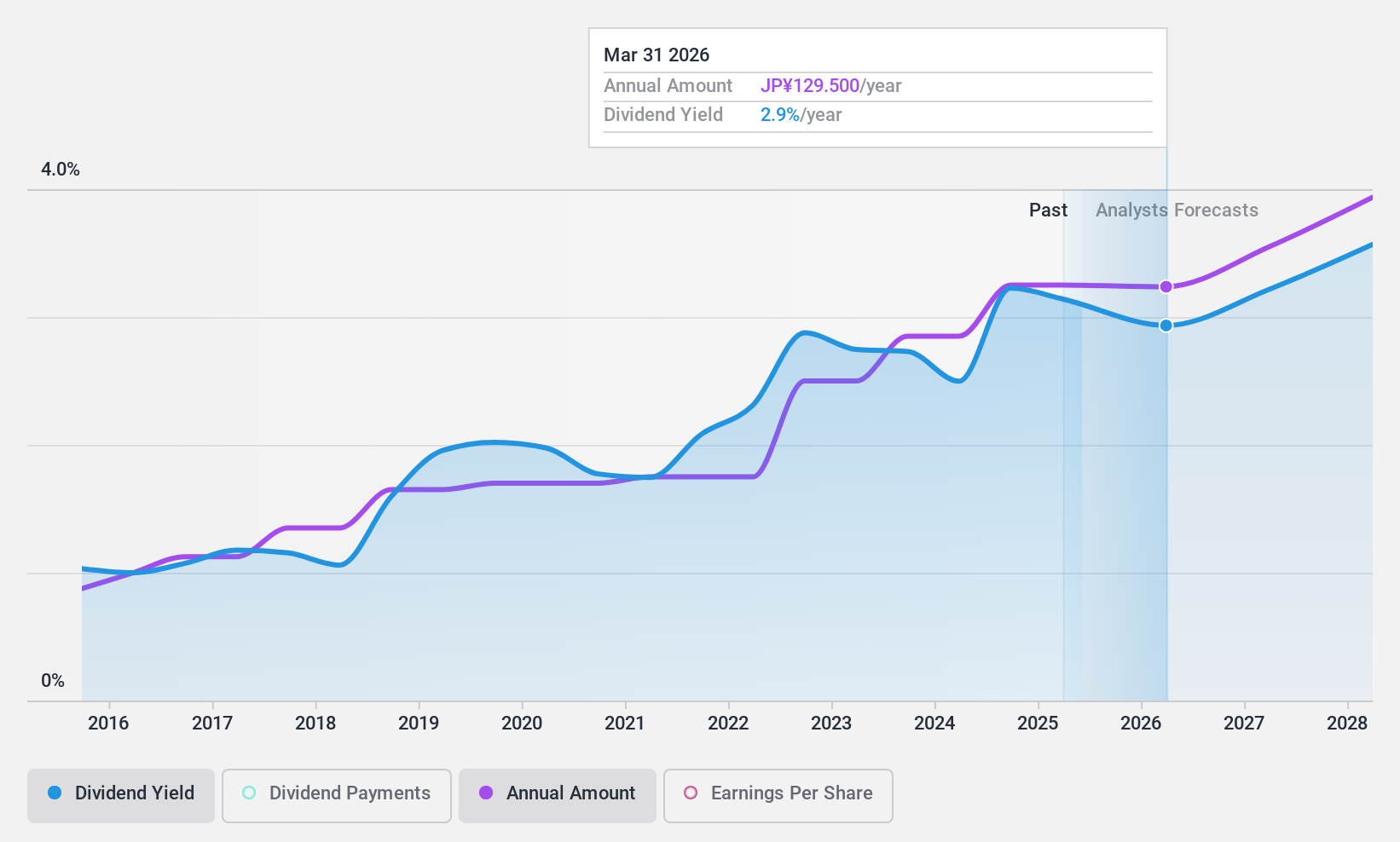

SundrugLtd (TSE:9989)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sundrug Co., Ltd. operates and manages drug stores and dispensing pharmacies in Japan, with a market cap of ¥470.68 billion.

Operations: Sundrug Co., Ltd. generates revenue through its Drugstore Business, accounting for ¥504.24 billion, and its Discount Store Business, contributing ¥327.23 billion.

Dividend Yield: 3.2%

Sundrug Ltd.'s dividends are reliably stable and have grown over the past decade, supported by a manageable payout ratio of 48.6%. However, with a high cash payout ratio of 746.5%, dividends are not covered by free cash flow, raising concerns about sustainability. The current dividend yield of 3.23% is below Japan's top-tier payers' average. Earnings have increased modestly at 3.6% annually over five years, indicating some growth potential despite coverage issues.

- Click to explore a detailed breakdown of our findings in SundrugLtd's dividend report.

- Insights from our recent valuation report point to the potential overvaluation of SundrugLtd shares in the market.

Turning Ideas Into Actions

- Explore the 1948 names from our Top Dividend Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5932

Sankyo TateyamaInc

Engages in the development, manufacture, and sale of building, housing, and exterior construction materials in Japan.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives