As global markets react to recent political developments and economic shifts, U.S. stocks are reaching new highs, fueled by optimism around trade policies and advancements in artificial intelligence. In this dynamic environment, dividend stocks continue to attract attention for their potential to provide steady income streams amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.00% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

OSG (TSE:6136)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OSG Corporation, along with its subsidiaries, manufactures and sells cutting tools across Japan, the Americas, Europe, Africa, and Asia with a market capitalization of ¥144.32 billion.

Operations: OSG Corporation generates revenue from various regions, with ¥37.78 billion from Asia, ¥74.31 billion from Japan, ¥35.86 billion from the Americas, and ¥37.02 billion from Europe/Africa.

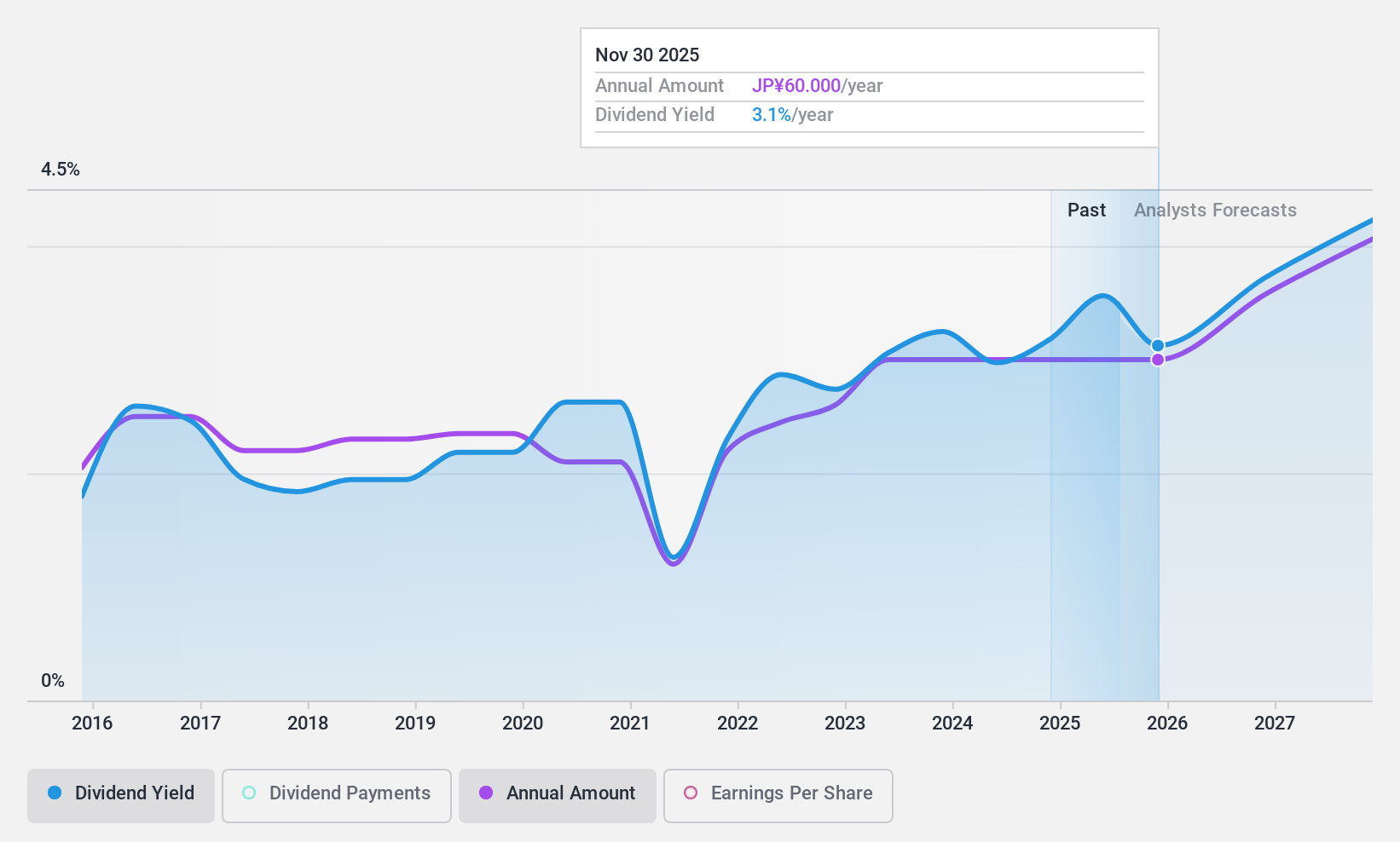

Dividend Yield: 3.5%

OSG Corporation's dividend payments are well covered by both earnings and cash flows, with payout ratios of 40.3% and 41.2%, respectively, suggesting sustainability despite a historically unstable track record. The company trades at a significant discount to its estimated fair value and offers a dividend yield slightly below the top quartile in Japan. Recent guidance indicates expected dividends of JPY 32 per share for the year-end of 2025, reflecting confidence in future earnings growth amidst volatile past payouts.

- Click to explore a detailed breakdown of our findings in OSG's dividend report.

- The analysis detailed in our OSG valuation report hints at an deflated share price compared to its estimated value.

Sakai Heavy Industries (TSE:6358)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sakai Heavy Industries, Ltd. manufactures and sells construction equipment and industrial machinery both in Japan and internationally, with a market cap of ¥19.89 billion.

Operations: Sakai Heavy Industries, Ltd. generates revenue from various regions, including ¥21.92 billion from Japan, ¥8.99 billion from the United States, ¥5.74 billion from Indonesia, and ¥1.84 billion from China.

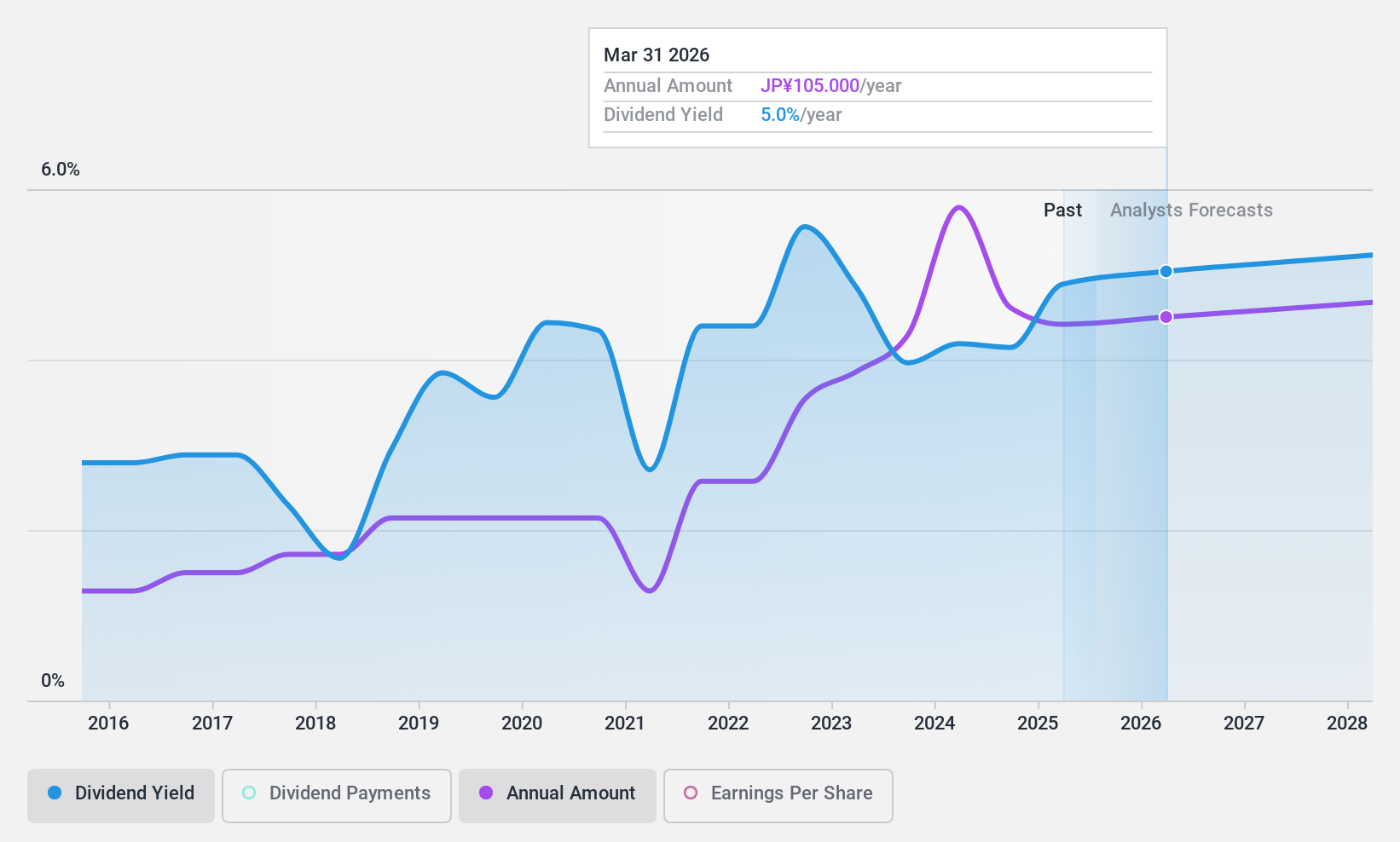

Dividend Yield: 6.2%

Sakai Heavy Industries' dividend yield of 6.24% ranks in the top 25% of Japanese payers, yet its dividends are not covered by free cash flows, raising sustainability concerns despite a reasonable payout ratio of 53.9%. Recent guidance indicates a significant reduction in annual dividends to JPY 60.50 per share from JPY 195.00 previously, highlighting volatility and unreliability over the past decade amidst declining earnings forecasts and limited cash flow support for future payouts.

- Take a closer look at Sakai Heavy Industries' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Sakai Heavy Industries is trading beyond its estimated value.

ProCredit Holding (XTRA:PCZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ProCredit Holding AG, with a market cap of €482.97 million, offers commercial banking services to small and medium enterprises and private customers across Europe, South America, and Germany.

Operations: ProCredit Holding AG generates revenue of €433.86 million from its banking services segment.

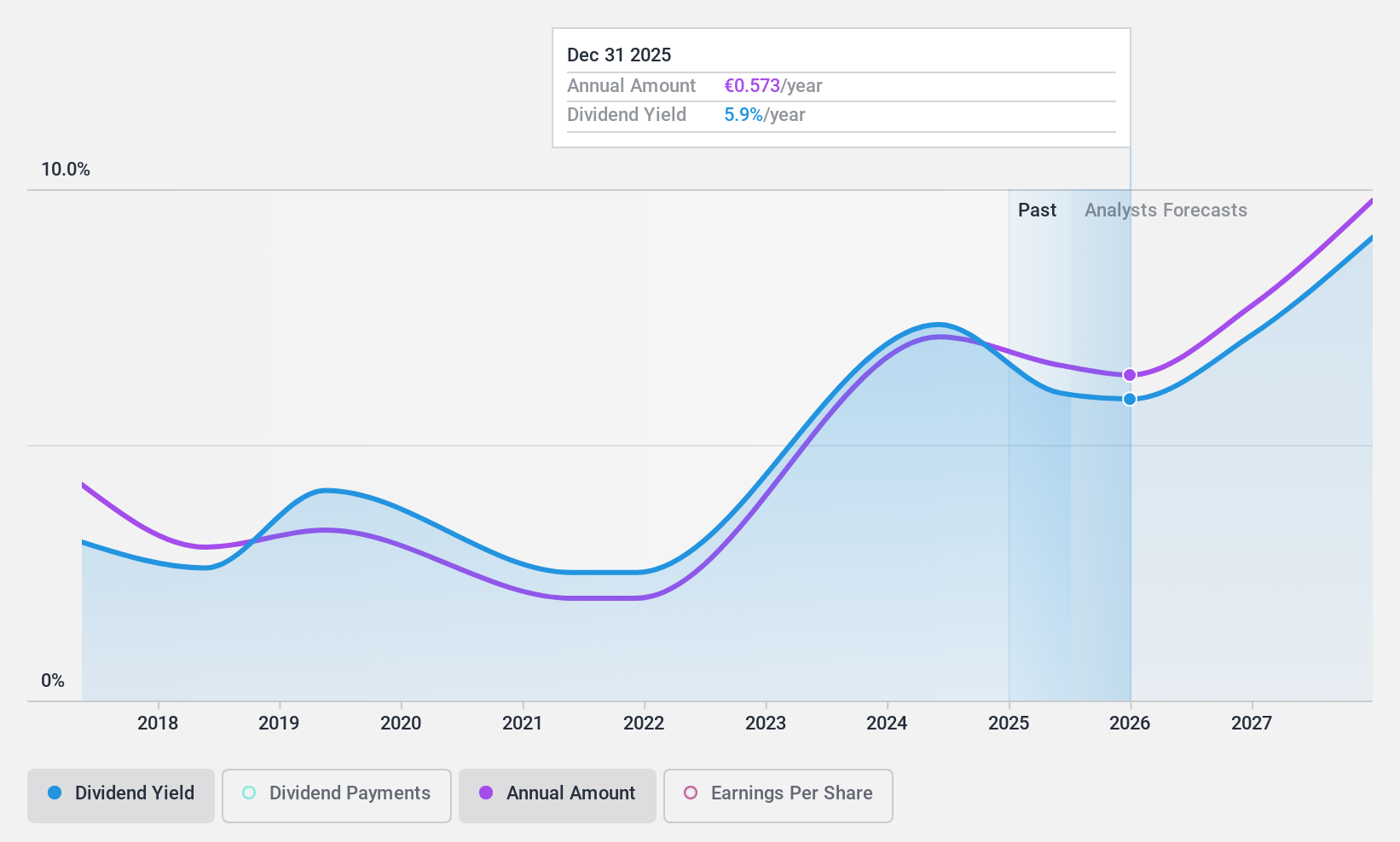

Dividend Yield: 7.4%

ProCredit Holding's dividend yield of 7.44% places it in the top 25% of German payers, with a sustainable payout ratio of 36.2%. However, its dividends have been volatile and unreliable over the past eight years, despite recent increases. The company's earnings are forecast to grow annually by 12.23%, supporting future dividend coverage at a projected payout ratio of 34%. Despite trading at good value, high bad loans at 2.1% present potential risks.

- Unlock comprehensive insights into our analysis of ProCredit Holding stock in this dividend report.

- Our valuation report here indicates ProCredit Holding may be undervalued.

Key Takeaways

- Click here to access our complete index of 1959 Top Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6136

OSG

Manufactures and sells cutting tools in Japan, the Americas, Europe, Africa, and Asia.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives