- Hong Kong

- /

- Infrastructure

- /

- SEHK:995

Enka Insaat ve Sanayi And 2 More Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

In a week marked by busy earnings reports and fluctuating economic data, global markets have experienced notable volatility, with major indices like the Nasdaq Composite and S&P 500 seeing sharp intraday highs followed by declines. Amid this backdrop, investors are increasingly turning their attention to dividend stocks as a potential source of stability and income in uncertain times. A good dividend stock often combines consistent payout history with strong fundamentals, offering investors an opportunity to enhance their portfolios even when market conditions are unpredictable.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.85% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.16% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.87% | ★★★★★★ |

| Innotech (TSE:9880) | 4.77% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.19% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.97% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.94% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.87% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.00% | ★★★★★★ |

Click here to see the full list of 2002 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

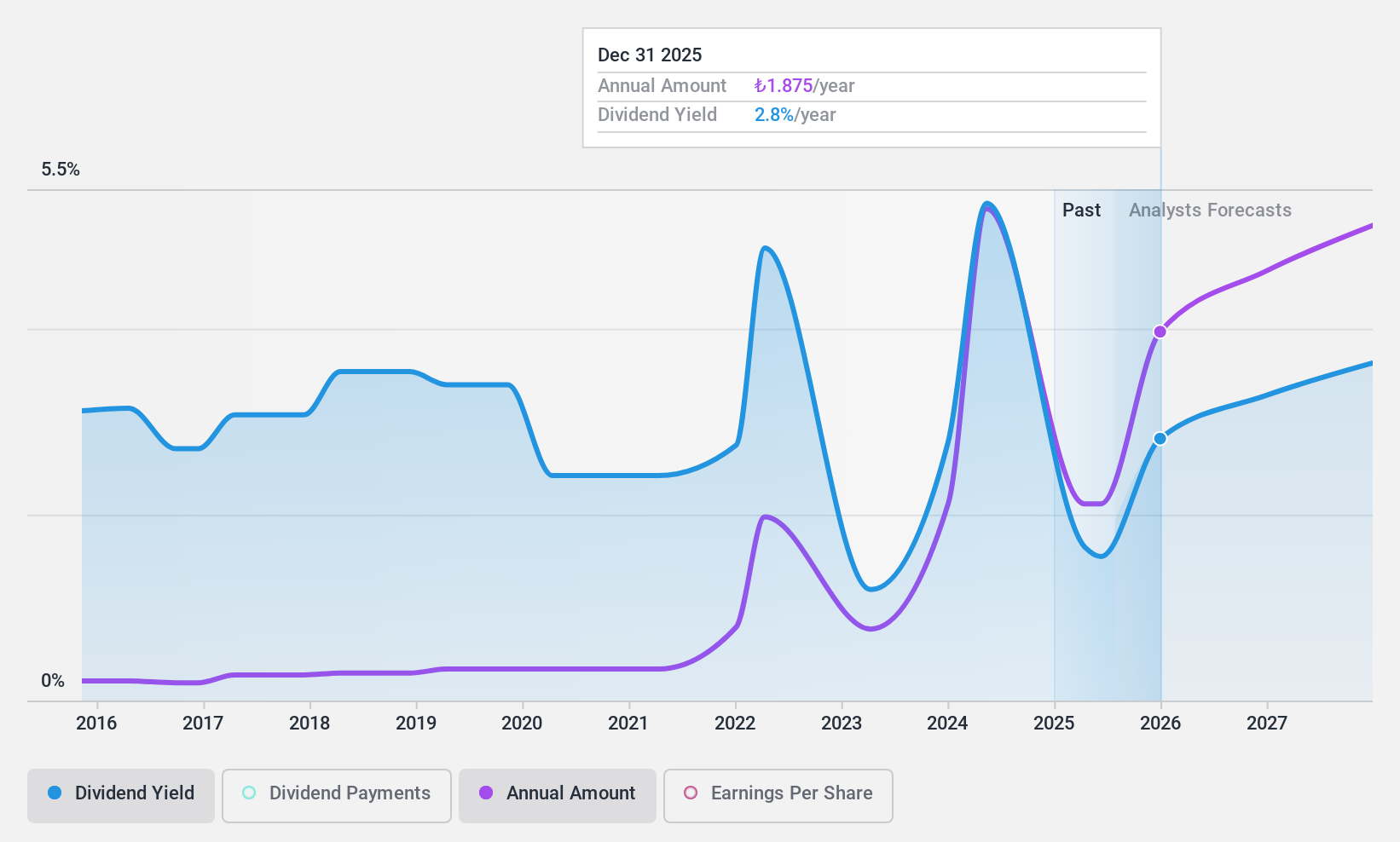

Enka Insaat ve Sanayi (IBSE:ENKAI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Enka Insaat ve Sanayi A.S. is a construction company operating in Turkey, Russia, Kazakhstan, Georgia, Europe, and internationally with a market cap of TRY2800.05 billion.

Operations: Enka Insaat ve Sanayi A.S. generates its revenue from several segments, including Construction Contracts (TRY61.77 billion), Energy (TRY10.65 billion), Real Estate Lease (TRY9.66 billion), and Trade (TRY8.27 billion).

Dividend Yield: 4.8%

Enka Insaat ve Sanayi's dividend yield of 4.81% ranks in the top 25% of the Turkish market, yet its reliability is questionable due to volatility over the past decade. Despite a low payout ratio of 47.2%, dividends are not well covered by free cash flows, with a high cash payout ratio of 229.7%. Recent earnings growth is notable, with net income for Q2 reaching TRY 6.36 billion, indicating potential for future financial stability despite current dividend concerns.

- Dive into the specifics of Enka Insaat ve Sanayi here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Enka Insaat ve Sanayi is priced higher than what may be justified by its financials.

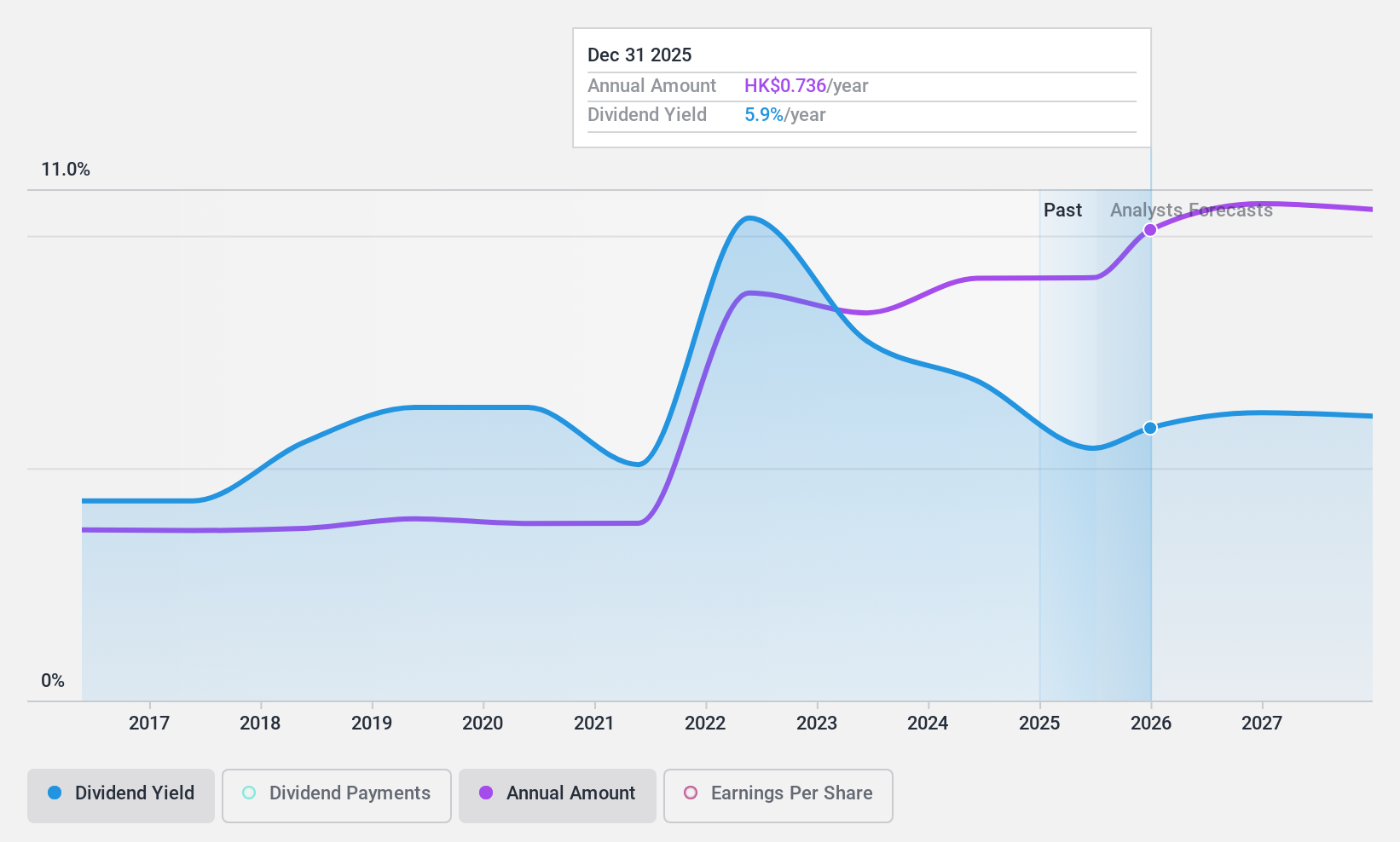

Anhui Expressway (SEHK:995)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anhui Expressway Company Limited constructs, operates, manages, and develops toll roads and associated service sections in Anhui province, China with a market cap of HK$22.40 billion.

Operations: Anhui Expressway Company Limited generates revenue primarily through the construction, operation, management, and development of toll roads and related service sections in Anhui province, China.

Dividend Yield: 7.1%

Anhui Expressway offers a dividend yield of 7.11%, which, although stable and growing over the past decade, is not well covered by free cash flows due to a high cash payout ratio of 321.5%. While the payout ratio of 65.1% suggests coverage by earnings, sustainability concerns persist as dividends exceed both earnings and cash flows. The company's price-to-earnings ratio of 9.1x is slightly below the Hong Kong market average, indicating potential value for investors seeking stability amidst moderate growth forecasts.

- Click here and access our complete dividend analysis report to understand the dynamics of Anhui Expressway.

- In light of our recent valuation report, it seems possible that Anhui Expressway is trading beyond its estimated value.

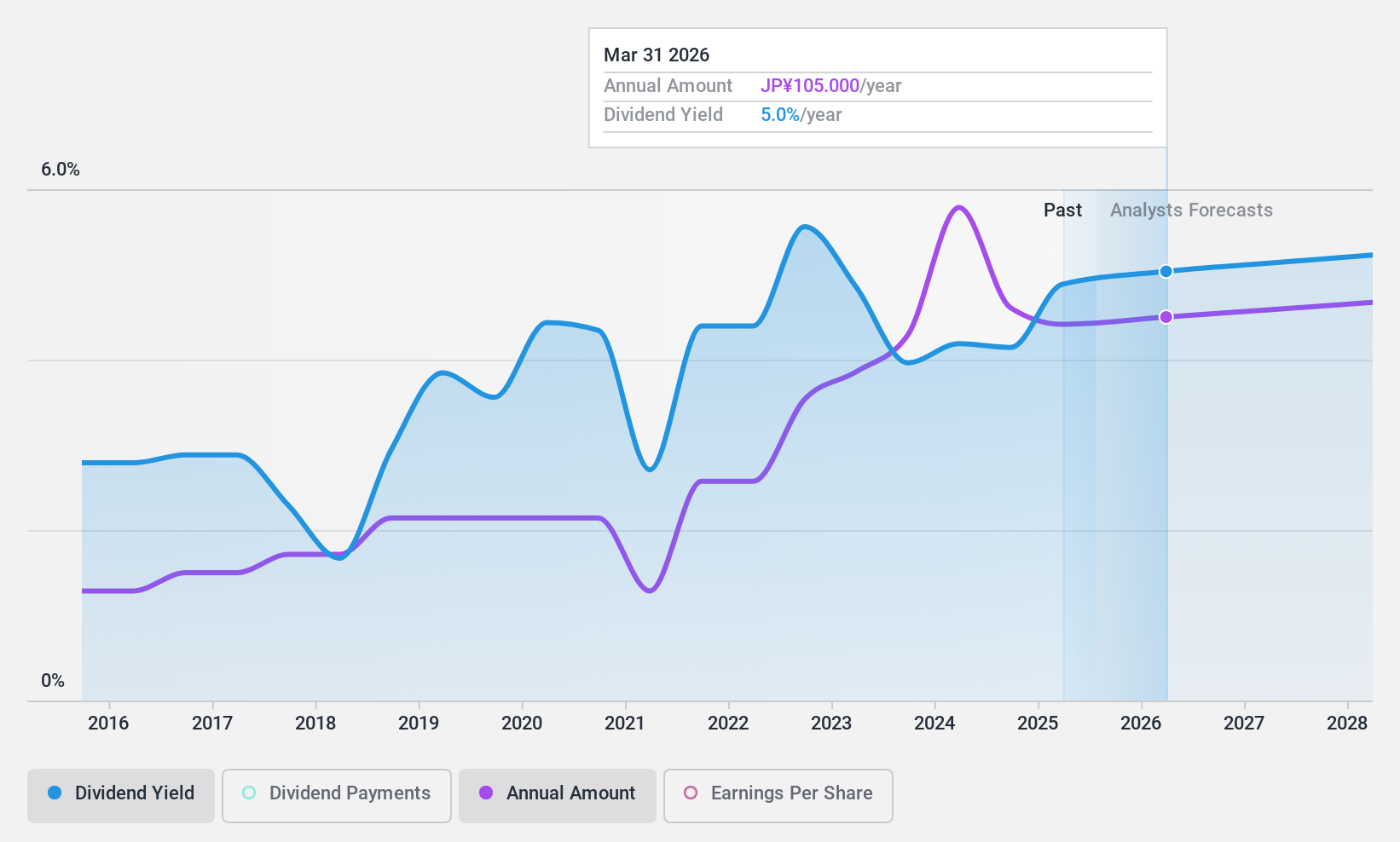

Sakai Heavy Industries (TSE:6358)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sakai Heavy Industries, Ltd. manufactures and sells construction equipment and industrial machinery both in Japan and internationally, with a market cap of ¥21.05 billion.

Operations: Sakai Heavy Industries, Ltd. generates revenue from several key regions, including ¥23.01 billion in Japan, ¥9.62 billion in the United States, ¥6.33 billion in Indonesia, and ¥1.96 billion in China.

Dividend Yield: 4.4%

Sakai Heavy Industries trades at 50.6% below its estimated fair value, offering good relative value compared to peers. Its dividend yield of 4.38% ranks in the top 25% in Japan, supported by a low payout ratio of 45.6%. Dividends are well covered by earnings and cash flows, with cash payout at 43.1%. However, the dividend history is unreliable due to volatility despite growth over the past decade and recent earnings increase of ¥50 billion (US$0.33 billion).

- Navigate through the intricacies of Sakai Heavy Industries with our comprehensive dividend report here.

- Our valuation report here indicates Sakai Heavy Industries may be undervalued.

Taking Advantage

- Delve into our full catalog of 2002 Top Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:995

Anhui Expressway

Engages in the construction, operation, management, and development of the toll roads and associated service sections in the People's Republic of China.

Average dividend payer with mediocre balance sheet.

Market Insights

Community Narratives