As global markets navigate a complex landscape marked by U.S. regulatory uncertainties and tariff tensions, Asian economies are also feeling the ripple effects, with stock indices in Japan and China experiencing notable declines. Despite these challenges, dividend stocks in Asia continue to attract attention for their potential to provide steady income streams amidst market volatility. In this context, identifying strong dividend stocks involves looking for companies with stable earnings and robust cash flow that can sustain payouts even during economic uncertainty.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.48% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.91% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.08% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.05% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| PAX Global Technology (SEHK:327) | 9.34% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.29% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.26% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.47% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.19% | ★★★★★★ |

Click here to see the full list of 1124 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

LT Group (PSE:LTG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: LT Group, Inc. operates in banking, distilled spirits, beverages, tobacco, property development, and other sectors both in the Philippines and internationally with a market cap of approximately ₱132.61 billion.

Operations: LT Group, Inc.'s revenue is primarily derived from its banking segment at ₱75.07 billion, followed by distilled spirits at ₱33.85 billion, beverages at ₱18.21 billion, and property development contributing ₱2.53 billion.

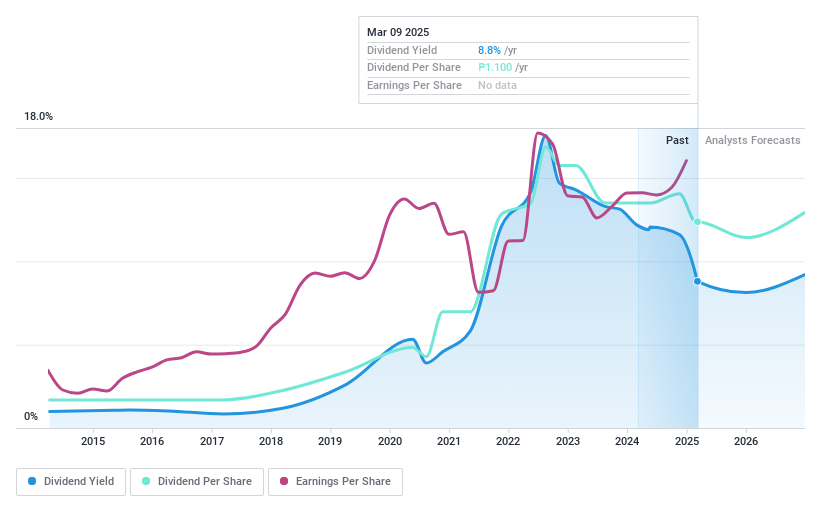

Dividend Yield: 9%

LT Group's dividend payments have grown over the past decade and remain well-covered by earnings (payout ratio: 5.6%) and cash flows (cash payout ratio: 24.8%). Despite an attractive yield of 8.97%, placing it in the top 25% of Philippine market payers, its dividend track record is unstable with volatility over the years. Recent financials show increased revenue to PHP 128.97 billion, yet future earnings are expected to decline significantly.

- Take a closer look at LT Group's potential here in our dividend report.

- Our valuation report unveils the possibility LT Group's shares may be trading at a premium.

Komori (TSE:6349)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Komori Corporation specializes in the manufacture, sale, and repair of printing presses across Japan, North America, Europe, and Greater China with a market cap of ¥70.09 billion.

Operations: Komori Corporation's revenue segments include ¥82.17 billion from Japan, ¥23.15 billion from Europe, ¥15.17 billion from Greater China, and ¥10.55 billion from North America.

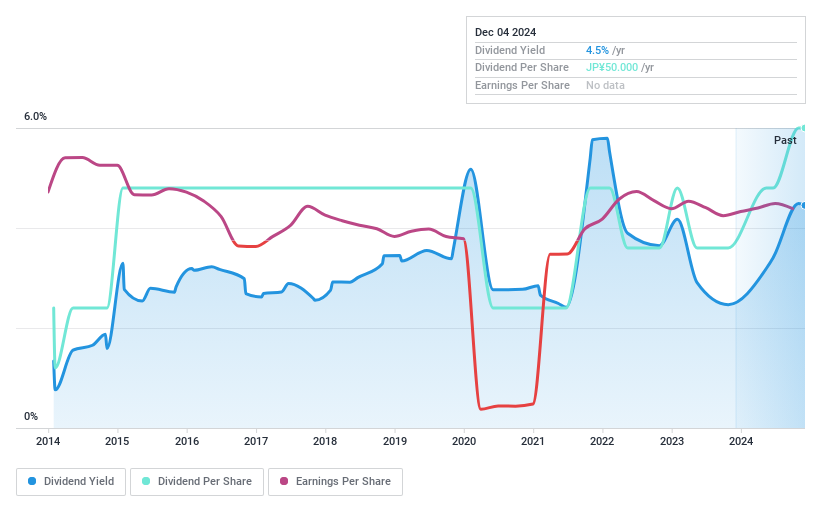

Dividend Yield: 4.2%

Komori Corporation's dividend yield of 4.16% ranks in the top 25% of Japanese market payers, with a recent forecast increase to JPY 35 per share for fiscal year ending March 2025. Despite historical volatility, dividends are covered by earnings (payout ratio: 29.6%) and cash flows (cash payout ratio: 60.8%). The board meeting on February 26, 2025, considered share cancellation under Article 178, indicating a focus on shareholder returns alongside its medium-term management plan goals.

- Unlock comprehensive insights into our analysis of Komori stock in this dividend report.

- Upon reviewing our latest valuation report, Komori's share price might be too pessimistic.

Hashimoto Sogyo HoldingsLtd (TSE:7570)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hashimoto Sogyo Holdings Co., Ltd. operates in Japan, focusing on the processing, manufacturing, and sale of plumbing and housing equipment with a market cap of ¥25.70 billion.

Operations: Hashimoto Sogyo Holdings Co., Ltd. generates revenue through its segments: Piping Materials (¥46.46 billion), Housing Equipment (¥29.16 billion), Air Conditioning & Pumps (¥38.52 billion), and Sanitary Ware and Metal Fittings (¥46.75 billion).

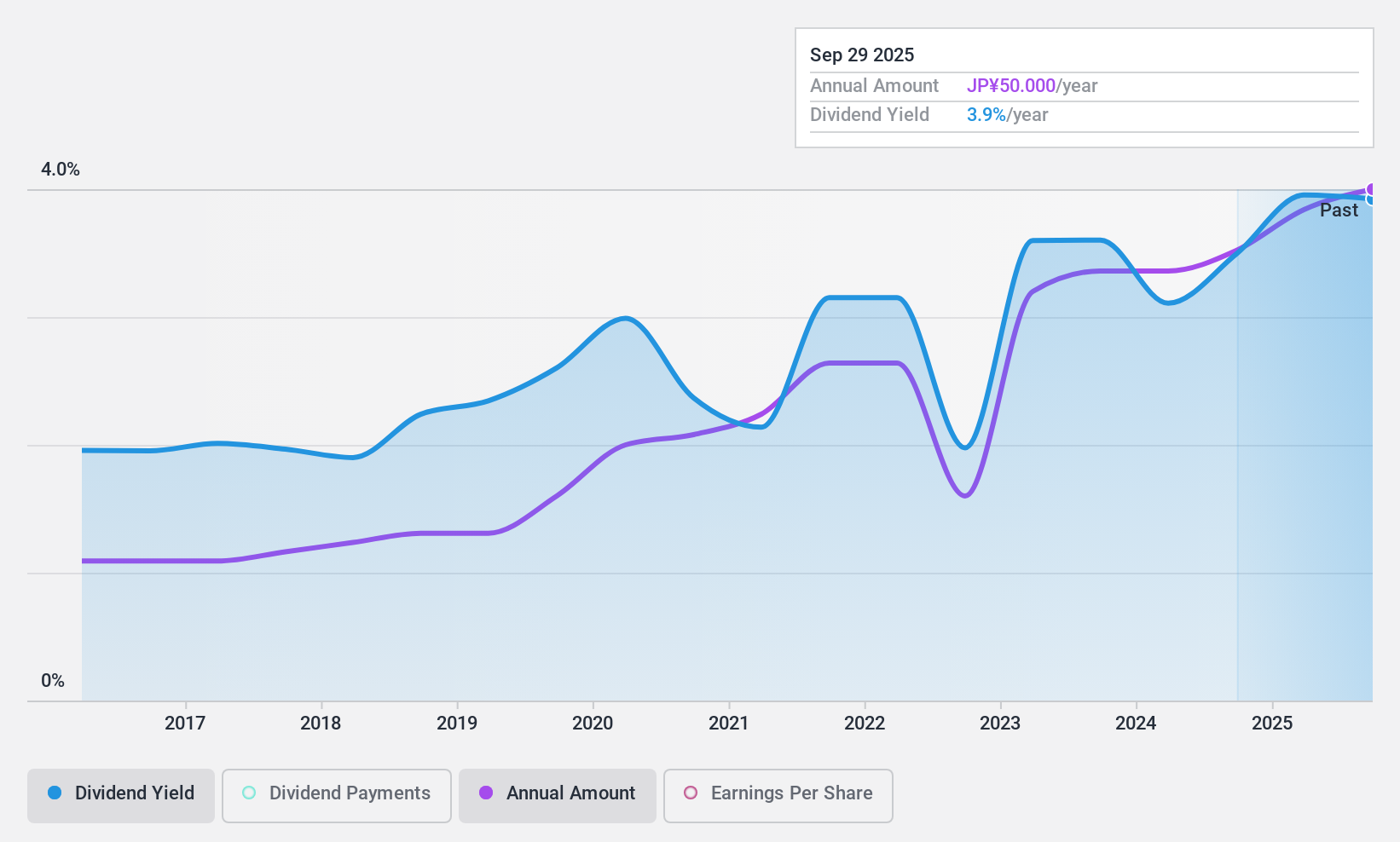

Dividend Yield: 3.7%

Hashimoto Sogyo Holdings Ltd.'s dividend yield of 3.72% is slightly below the top 25% in Japan, but dividends have been stable and growing over the past decade. Despite a low payout ratio of 33%, dividends are not covered by free cash flows or earnings, raising sustainability concerns. Recent share buyback announcements totaling ¥682.55 million suggest a flexible capital policy amidst business changes, though operating cash flow coverage for debt remains inadequate.

- Click here and access our complete dividend analysis report to understand the dynamics of Hashimoto Sogyo HoldingsLtd.

- The analysis detailed in our Hashimoto Sogyo HoldingsLtd valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Click here to access our complete index of 1124 Top Asian Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Komori might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6349

Komori

Engages in the manufacture, sale, and repair of printing presses in Japan, North America, Europe, and Greater China.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives