A Look at Sumitomo Heavy Industries (TSE:6302) Valuation as Leadership and Organizational Changes Are Considered

Reviewed by Simply Wall St

Sumitomo Heavy Industries (TSE:6302) has called a November 27 board meeting to review transfers of representative directors, executive officers, and organizational changes, a leadership shake up that could subtly influence how investors view the stock.

See our latest analysis for Sumitomo Heavy Industries.

The planned leadership reshuffle lands after a strong run, with the latest ¥4,367 share price sitting on the back of a near 28% 3 month share price return and robust 5 year total shareholder return, suggesting positive momentum rather than a late cycle spike.

If this kind of strategic shift has your attention, it might be a good moment to compare what else is out there and explore aerospace and defense stocks as another pocket of industrial opportunities.

With earnings growing faster than revenue, a long record of shareholder returns, and the share price now above analyst targets, the key question is whether Sumitomo Heavy Industries is still undervalued or if markets are already pricing in future growth.

Most Popular Narrative: 21.3% Overvalued

With Sumitomo Heavy Industries last closing at ¥4,367 against a narrative fair value of ¥3,600, the most followed view prices in a rich future.

New investments and product development targeting the power semiconductor market, service robots, and advanced medical devices (like proton beam and BNCT cancer treatment equipment) are expected to position Sumitomo Heavy Industries to capitalize on accelerating automation, healthcare innovation, and digitalization, which is likely to support revenue growth and improved earnings.

Want to see what kind of steady growth, margin rebuild, and future earnings multiple are assumed to justify this trajectory? The narrative lays out the full blueprint.

Result: Fair Value of ¥3,600 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this view could be challenged if European restructuring drags on longer than expected or if weak demand in construction and semiconductor end markets continues.

Find out about the key risks to this Sumitomo Heavy Industries narrative.

Another Lens on Value

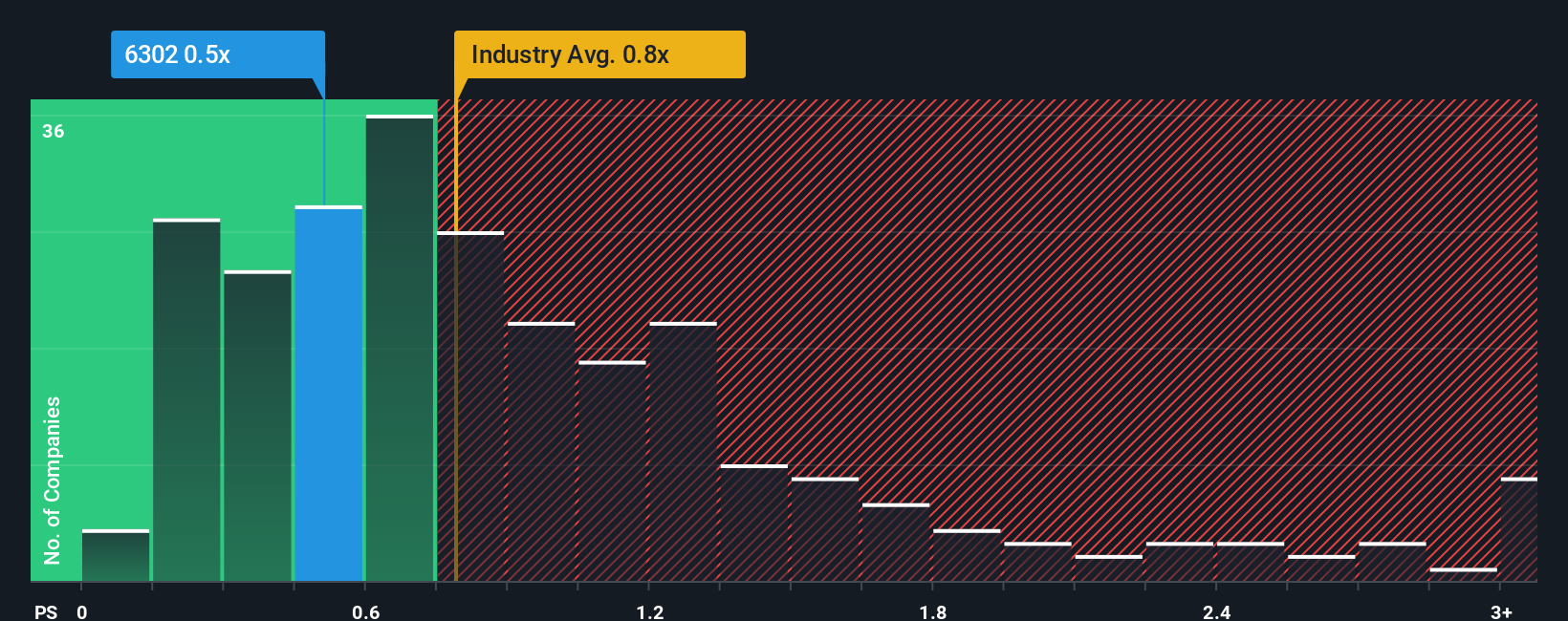

While the leading narrative suggests Sumitomo Heavy Industries is 21.3 percent overvalued versus a ¥3,600 fair value, the company actually trades at a much lower 0.5x sales versus an estimated fair ratio of 1.1x and higher peer and industry averages, hinting at upside rather than excess. Which story do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sumitomo Heavy Industries Narrative

If you see the story differently, or simply want to dig into the numbers yourself, you can build a fresh view in minutes with Do it your way.

A great starting point for your Sumitomo Heavy Industries research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one opportunity. Use the Simply Wall St Screener to quickly surface fresh, data driven stock ideas tailored to the way you like to invest.

- Capture potential mispricings by reviewing these 907 undervalued stocks based on cash flows that may be trading below what their cash flows suggest they are worth.

- Target future growth stories by assessing these 26 AI penny stocks positioned at the forefront of artificial intelligence adoption and innovation.

- Strengthen your income strategy by focusing on these 14 dividend stocks with yields > 3% that can help support reliable, long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6302

Sumitomo Heavy Industries

Manufactures and sells general machinery worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026