Undiscovered Gems with Promising Potential for February 2025

Reviewed by Simply Wall St

As global markets grapple with tariff uncertainties and mixed economic signals, small-cap stocks have shown resilience, with the S&P 600 maintaining its position amidst broader market fluctuations. In this environment, identifying promising opportunities often involves seeking out companies that demonstrate strong fundamentals and potential for growth despite external pressures.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Boursa Kuwait Securities Company K.P.S.C | NA | 14.28% | 2.26% | ★★★★★★ |

| Interactive Digital Technologies | 1.30% | 6.10% | 4.63% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.72% | 10.32% | 7.30% | ★★★★★☆ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Bosun (SZSE:002282)

Simply Wall St Value Rating: ★★★★★★

Overview: Bosun Co., Ltd. is a company that researches, manufactures, and sells diamond tools both in China and internationally, with a market capitalization of CN¥4.37 billion.

Operations: Bosun generates revenue primarily from the sale of diamond tools, with a significant portion of its costs attributed to manufacturing expenses. The company has seen fluctuations in its gross profit margin over recent periods, reflecting changes in production efficiency and cost management.

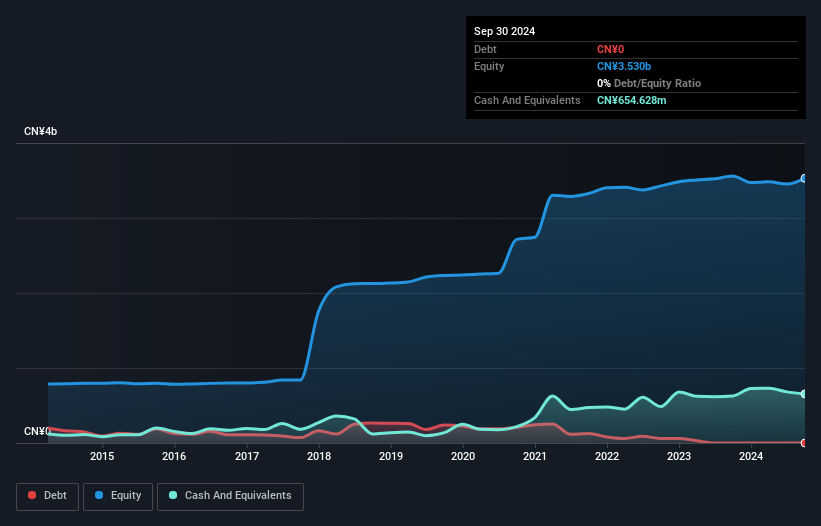

Bosun's financial health is impressive, with no debt currently compared to a 10.7% debt-to-equity ratio five years ago, highlighting its solid balance sheet. The company has outpaced the Machinery industry with a remarkable earnings growth of 49% over the past year, suggesting strong operational performance. Its price-to-earnings ratio stands at 22x, which is attractive against the CN market average of 36x, indicating potential undervaluation. Bosun's profitability and high-quality earnings further enhance its appeal as an investment candidate. Recent shareholder meetings focused on amending business scope and board elections could signal strategic shifts ahead.

- Click to explore a detailed breakdown of our findings in Bosun's health report.

Review our historical performance report to gain insights into Bosun's's past performance.

Union Tool (TSE:6278)

Simply Wall St Value Rating: ★★★★★★

Overview: Union Tool Co. designs, manufactures, and sells cutting tools, linear motion products, and metal machining equipment in Japan, China, Taiwan, and internationally with a market cap of ¥79.21 billion.

Operations: Union Tool Co. generates revenue primarily from Japan and Asia, with ¥20.95 billion and ¥15.54 billion respectively, while Europe and North America contribute smaller portions at ¥2.10 billion and ¥1.73 billion.

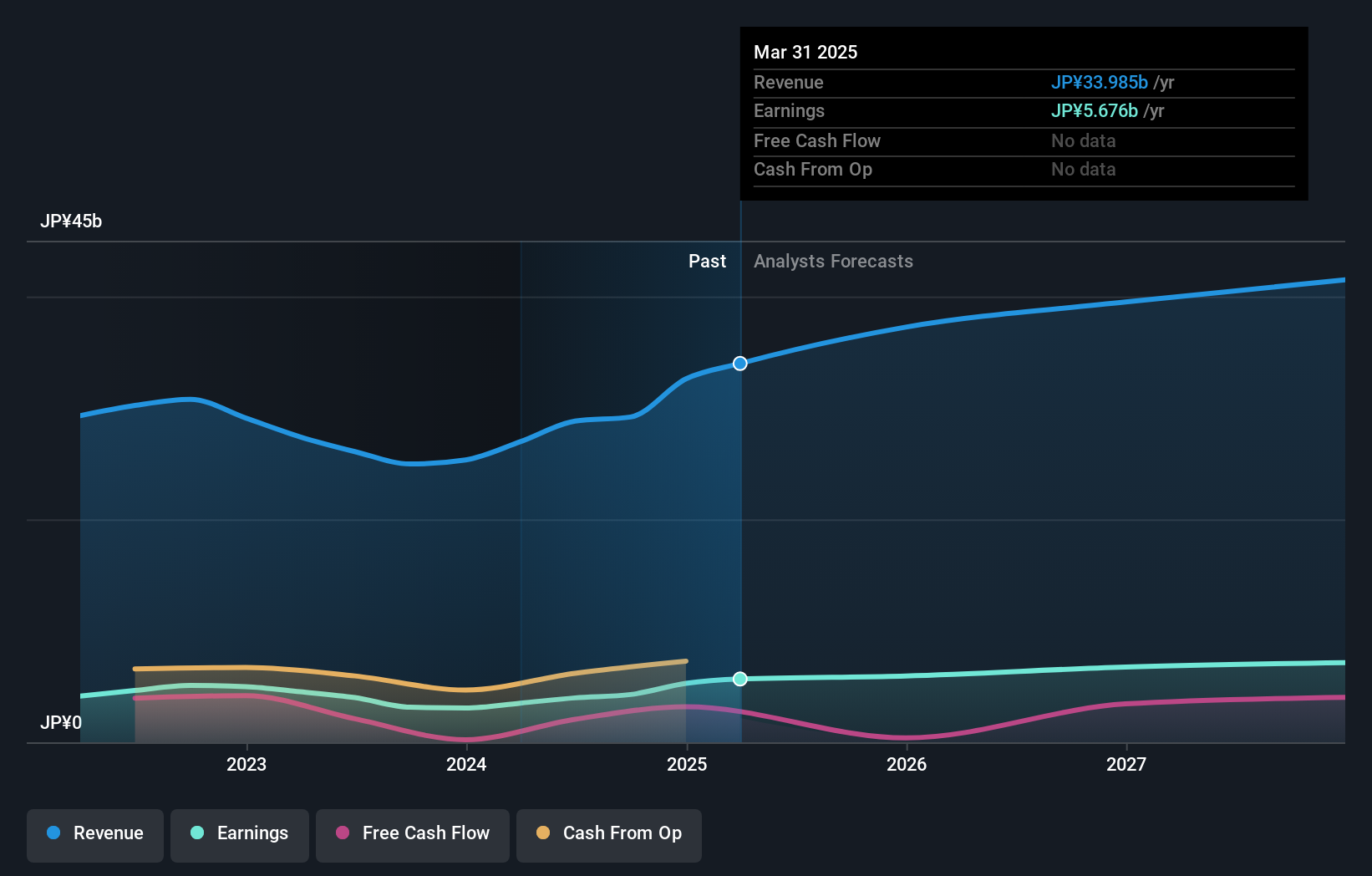

Union Tool, a promising player in the machinery sector, has demonstrated robust earnings growth of 36% over the past year, outpacing the industry average of 6%. Trading at nearly 29% below its estimated fair value suggests potential for investors seeking undervalued opportunities. The company remains debt-free for five years, eliminating concerns over interest coverage and enhancing financial stability. Recent news highlights an increase in dividend guidance to ¥60 per share from ¥45, reflecting confidence in future cash flows. With high-quality earnings and positive free cash flow, Union Tool appears well-positioned for continued success.

- Dive into the specifics of Union Tool here with our thorough health report.

Understand Union Tool's track record by examining our Past report.

TSRC (TWSE:2103)

Simply Wall St Value Rating: ★★★★★☆

Overview: TSRC Corporation operates in the manufacture, import, transport, and sale of synthetic rubber and related products across multiple countries including Taiwan, China, and the United States with a market capitalization of approximately NT$17.75 billion.

Operations: TSRC generates its revenue primarily from the Synthetic Rubber Division, contributing NT$34.75 billion, while the Non-Synthetic Rubber Division adds NT$750.45 million. The gross profit margin shows a notable trend at 8.5%.

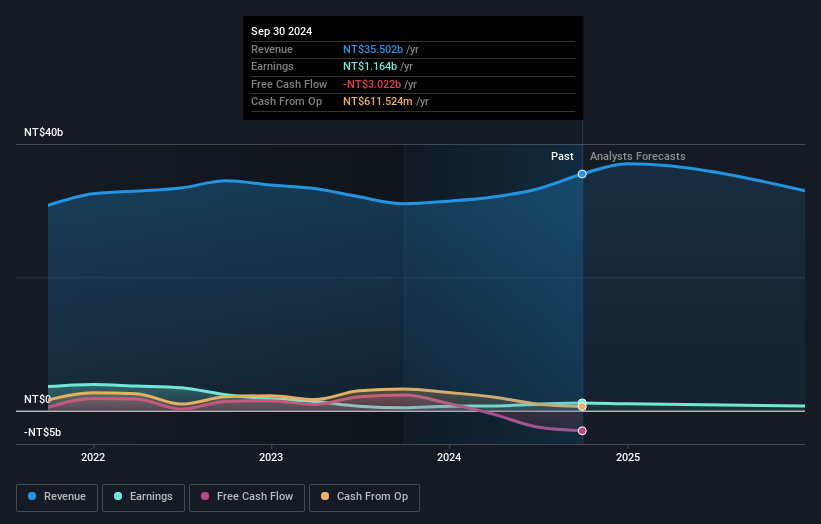

TSRC's recent performance showcases impressive earnings growth of 162%, outpacing the Chemicals industry's 14%. With a price-to-earnings ratio of 15x, it appears undervalued compared to the TW market at 21x. The company's net debt to equity ratio stands at a satisfactory 31%, reflecting prudent financial management. Despite these strengths, future earnings are projected to decrease by nearly 38% annually over the next three years. While interest payments are comfortably covered by profits, free cash flow remains negative. TSRC's board recently convened in Taipei, possibly indicating strategic discussions amidst these mixed signals.

- Get an in-depth perspective on TSRC's performance by reading our health report here.

Assess TSRC's past performance with our detailed historical performance reports.

Make It Happen

- Unlock our comprehensive list of 4701 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6278

Union Tool

Designs, manufactures, and sells of cutting tools, linear motion products, and metal machining equipment in Japan, China, Taiwan, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives