3 Japanese Exchange Stocks Trading Up To 30.1% Below Intrinsic Value

Reviewed by Simply Wall St

Japan's stock markets have shown resilience, with the Nikkei 225 Index gaining 0.7% and the broader TOPIX Index up 1.0%, recovering most of the ground lost earlier in the month. This recovery comes amid a volatile economic environment influenced by interest rate changes and currency fluctuations. In such conditions, identifying undervalued stocks that are trading below their intrinsic value can offer significant investment opportunities. Here are three Japanese exchange stocks currently trading up to 30.1% below their intrinsic value, presenting potential for long-term growth amidst market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Densan System Holdings (TSE:4072) | ¥2729.00 | ¥5362.58 | 49.1% |

| Kotobuki Spirits (TSE:2222) | ¥1761.00 | ¥3434.73 | 48.7% |

| Hottolink (TSE:3680) | ¥338.00 | ¥661.95 | 48.9% |

| SaizeriyaLtd (TSE:7581) | ¥5090.00 | ¥10174.80 | 50% |

| Kadokawa (TSE:9468) | ¥2907.50 | ¥5613.02 | 48.2% |

| EnomotoLtd (TSE:6928) | ¥1473.00 | ¥2940.22 | 49.9% |

| Visional (TSE:4194) | ¥8920.00 | ¥17138.61 | 48% |

| Fudo Tetra (TSE:1813) | ¥2447.00 | ¥4670.27 | 47.6% |

| TORIDOLL Holdings (TSE:3397) | ¥3696.00 | ¥7378.82 | 49.9% |

| SBI ARUHI (TSE:7198) | ¥861.00 | ¥1705.31 | 49.5% |

Let's review some notable picks from our screened stocks.

Daiichi Sankyo Company (TSE:4568)

Overview: Daiichi Sankyo Company, Limited manufactures and sells pharmaceutical products in Japan, North America, Europe, and internationally with a market cap of ¥11.64 trillion.

Operations: The company's revenue from its pharmaceutical operations is ¥1.69 trillion.

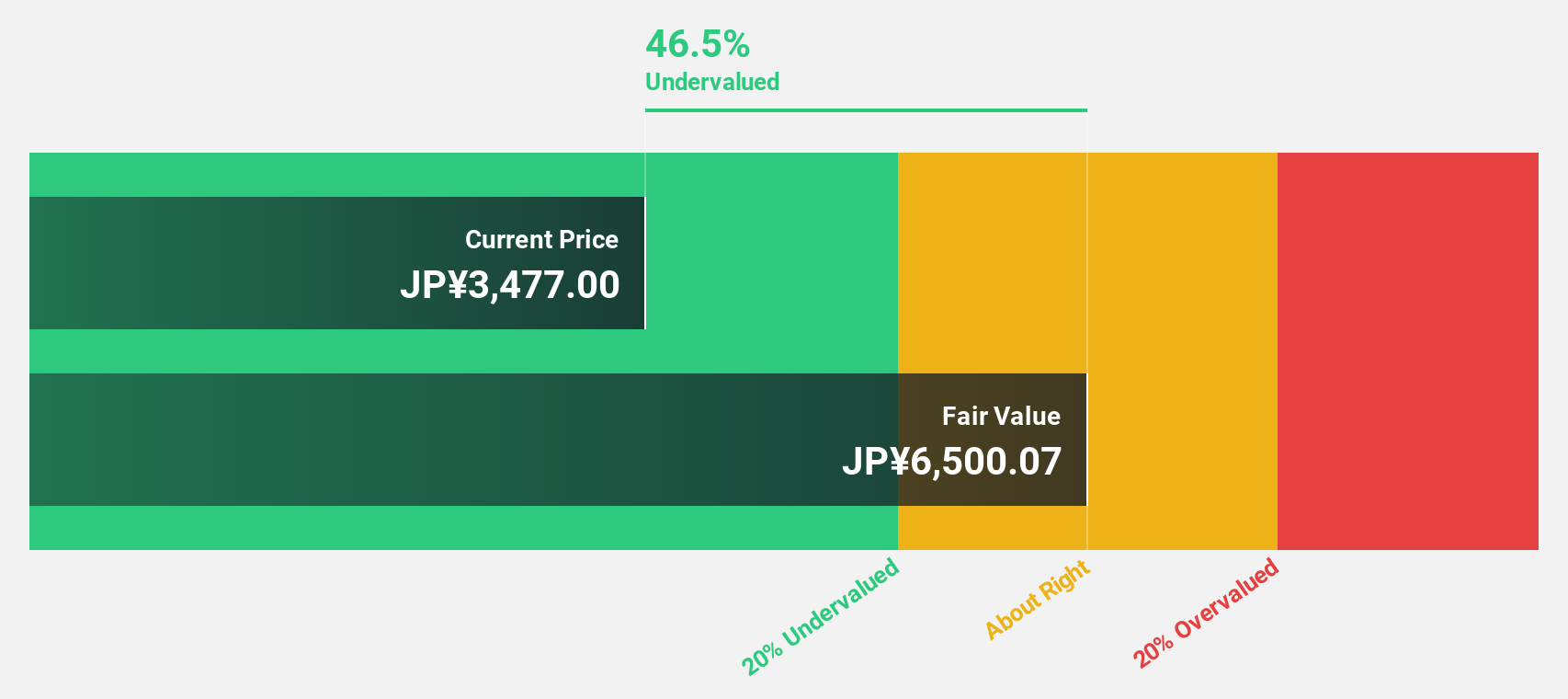

Estimated Discount To Fair Value: 30.1%

Daiichi Sankyo is trading at ¥6108, significantly below its estimated fair value of ¥8740.92. Despite recent legal challenges and mixed product news, the company shows strong potential with forecasted earnings growth of 20.4% per year, outpacing the Japanese market's 8.6%. Revenue is expected to grow at 13.2% annually, faster than the market average of 4.3%. This positions Daiichi Sankyo as an undervalued stock based on cash flows in Japan.

- Our comprehensive growth report raises the possibility that Daiichi Sankyo Company is poised for substantial financial growth.

- Get an in-depth perspective on Daiichi Sankyo Company's balance sheet by reading our health report here.

Trend Micro (TSE:4704)

Overview: Trend Micro Incorporated develops and sells security-related software for computers and related services in Japan and internationally, with a market cap of ¥1.14 trillion.

Operations: Revenue segments for Trend Micro are: Japan ¥84.17 billion, Europe ¥63.59 billion, Americas ¥70.46 billion, and Asia Pacific ¥126.28 billion.

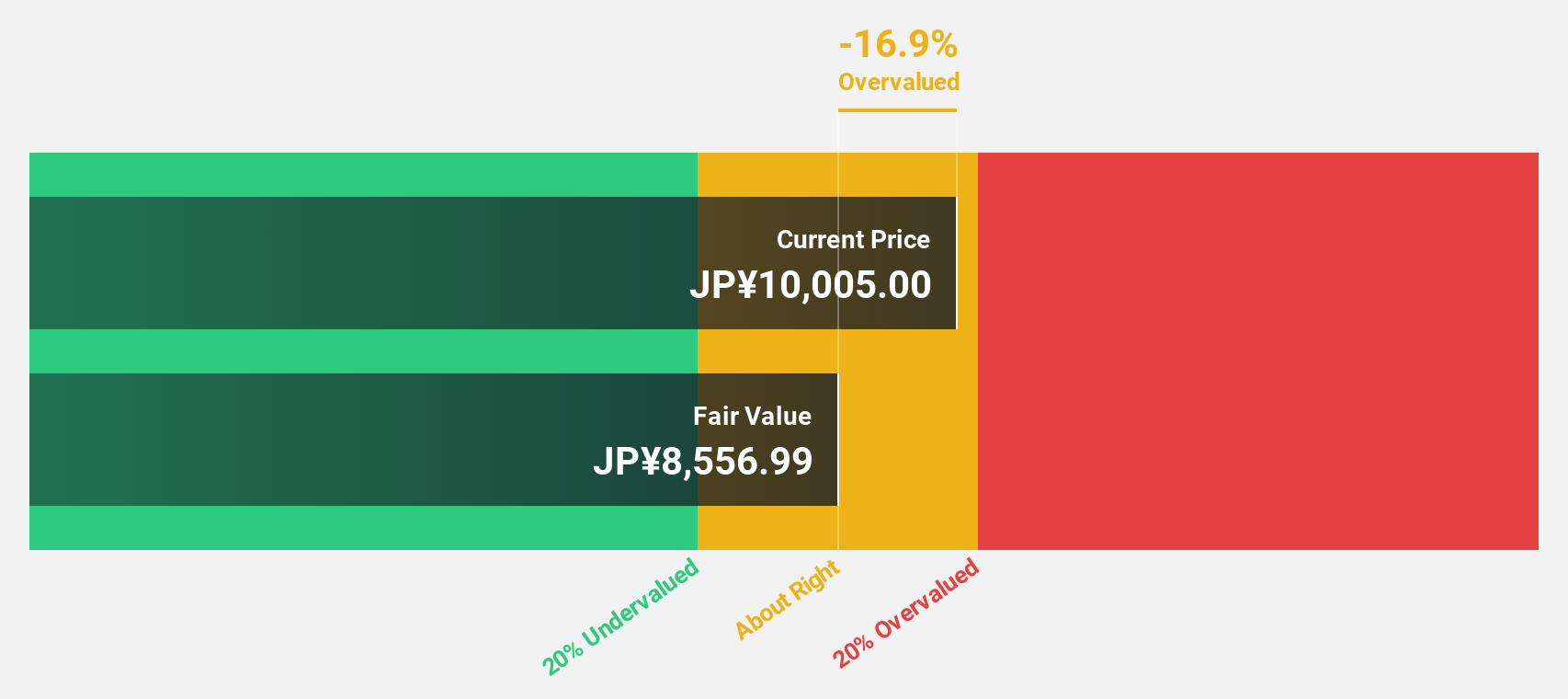

Estimated Discount To Fair Value: 28.8%

Trend Micro, trading at ¥8731, is significantly undervalued with an estimated fair value of ¥12255.6. Despite a recent dip in profit margins from 11.2% to 6.4%, the company's earnings are projected to grow by 21.98% annually over the next three years, outpacing market expectations. Recent M&A rumors and strategic partnerships, such as with GMI Cloud and joining COSAI, underscore its focus on AI-driven cybersecurity innovations and potential for future revenue growth at 6.2% per year.

- According our earnings growth report, there's an indication that Trend Micro might be ready to expand.

- Click here to discover the nuances of Trend Micro with our detailed financial health report.

Union Tool (TSE:6278)

Overview: Union Tool Co. engages in the production and sale of cutting tools, linear motion products, and metal machining equipment in Japan and internationally, with a market cap of ¥101.75 billion.

Operations: Revenue segments include ¥19.84 billion from Japan, ¥15.05 billion from Asia, ¥2.17 billion from Europe, and ¥1.84 billion from North America.

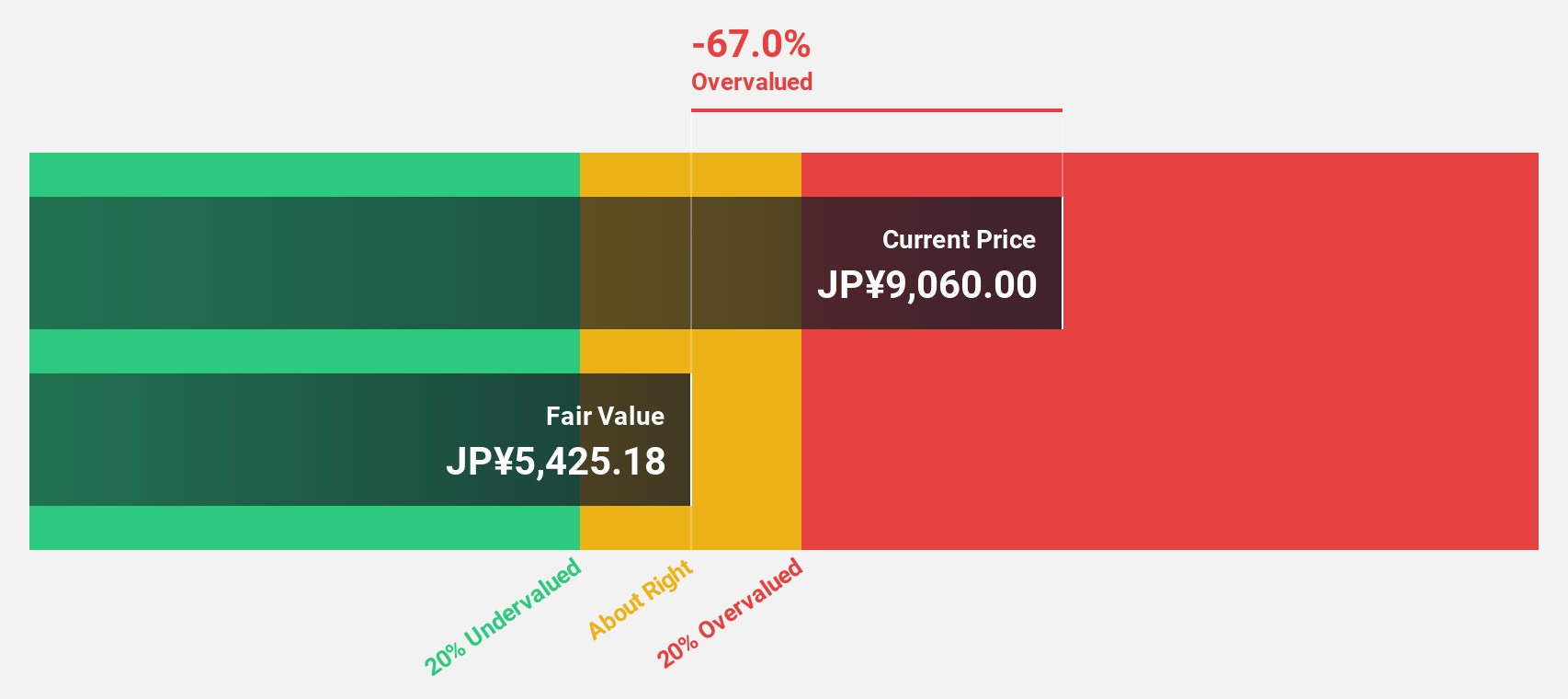

Estimated Discount To Fair Value: 25.6%

Union Tool, trading at ¥5890, is significantly undervalued with an estimated fair value of ¥7912.51. The company’s earnings are forecast to grow 21.45% annually over the next three years, surpassing the JP market's growth rate of 8.6%. Despite recent share price volatility, Union Tool expects net sales of ¥30 billion and operating profit of ¥6.4 billion for FY2024, reflecting robust cash flow potential and a solid dividend increase to ¥45 per share for Q2 2024.

- Insights from our recent growth report point to a promising forecast for Union Tool's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Union Tool.

Make It Happen

- Gain an insight into the universe of 80 Undervalued Japanese Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trend Micro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4704

Trend Micro

Develops and sells security-related software for computers and related services in Japan and internationally.

Flawless balance sheet with high growth potential.