- Japan

- /

- Consumer Finance

- /

- TSE:8508

Top 3 Japanese Dividend Stocks To Watch In September 2024

Reviewed by Simply Wall St

Japan's stock markets have shown resilience, with the Nikkei 225 and TOPIX Index recovering most of the losses incurred earlier in the month. As inflation rises and monetary policy continues to evolve, investors are increasingly focusing on dividend stocks for stable returns. In this context, a good dividend stock typically offers consistent payouts and demonstrates financial stability, making it an attractive option amid market volatility.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.14% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.95% | ★★★★★★ |

| Globeride (TSE:7990) | 4.19% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.74% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.76% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.54% | ★★★★★★ |

| Innotech (TSE:9880) | 4.51% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.04% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.30% | ★★★★★★ |

Click here to see the full list of 436 stocks from our Top Japanese Dividend Stocks screener.

We'll examine a selection from our screener results.

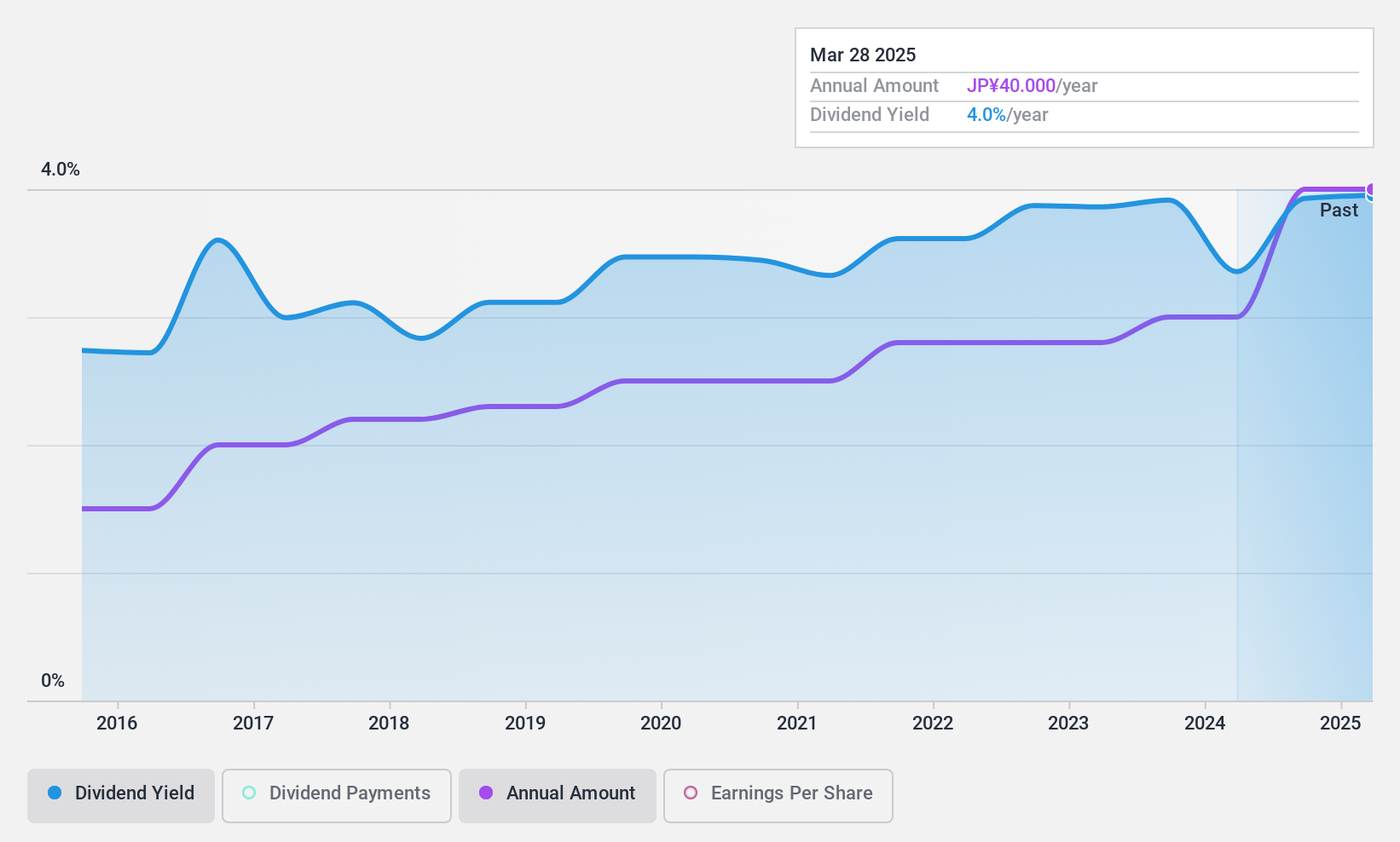

Nippon Air conditioning Services (TSE:4658)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Air Conditioning Services Co., Ltd. (TSE:4658) specializes in providing air conditioning and related services, with a market cap of approximately ¥37.35 billion.

Operations: Nippon Air Conditioning Services Co., Ltd. (TSE:4658) generated ¥59.94 billion from its Maintenance Services and Renewal Construction segment.

Dividend Yield: 3.7%

Nippon Air Conditioning Services offers a dividend yield of 3.69%, which is not well covered by free cash flows due to a high cash payout ratio of 183.3%. Despite this, dividends have been stable and growing over the past decade. The company recently announced an increase in its quarterly dividend to ¥20 per share from ¥15 last year, though it is lower than the previous year's ¥24 per share. Earnings are forecasted to grow by 5.65% annually, with FY2025 guidance projecting net sales of ¥61 billion and EPS of ¥81.48.

- Unlock comprehensive insights into our analysis of Nippon Air conditioning Services stock in this dividend report.

- The analysis detailed in our Nippon Air conditioning Services valuation report hints at an inflated share price compared to its estimated value.

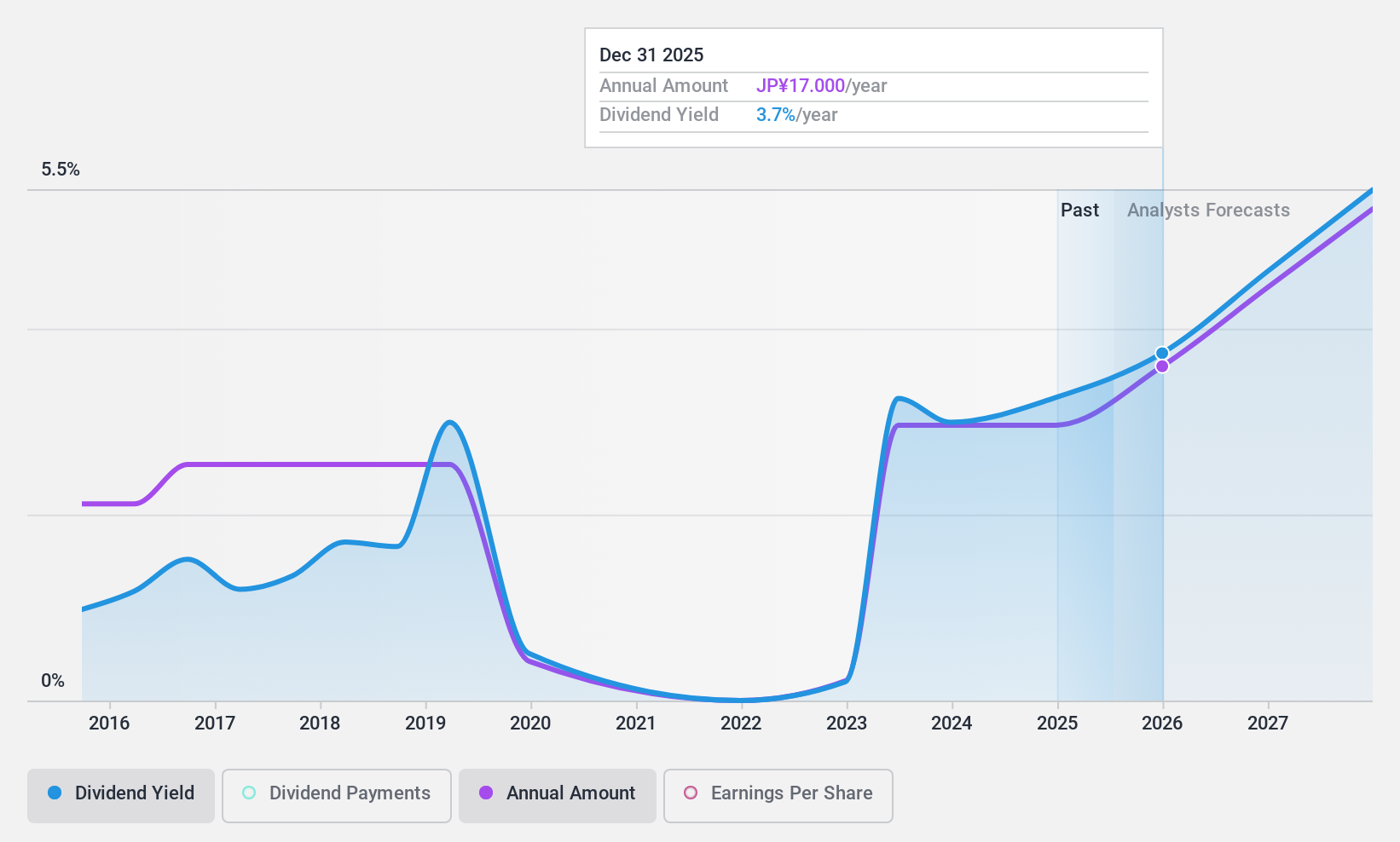

J Trust (TSE:8508)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: J Trust Co., Ltd. provides various financial services in Japan and has a market cap of ¥62.48 billion.

Operations: J Trust Co., Ltd. generates revenue from its Investment Business (¥0.06 billion), Real Estate Business (¥18.38 billion), Japan Financial Business (¥15.33 billion), Southeast Asia Financial Business (¥44.03 billion), and South Korea and Mongolia Financial Business (¥48.13 billion).

Dividend Yield: 3%

J Trust's dividend yield (3.04%) is below the top 25% of Japanese dividend payers, but its low cash payout ratio (9.9%) ensures dividends are well-covered by cash flows. Despite a reasonable earnings payout ratio (53.4%), dividends have been volatile and unreliable over the past decade. Recent buybacks totaling ¥731.84 million for 1,716,500 shares might indicate management's confidence in future performance amidst lower profit margins this year compared to last year.

- Click to explore a detailed breakdown of our findings in J Trust's dividend report.

- The analysis detailed in our J Trust valuation report hints at an deflated share price compared to its estimated value.

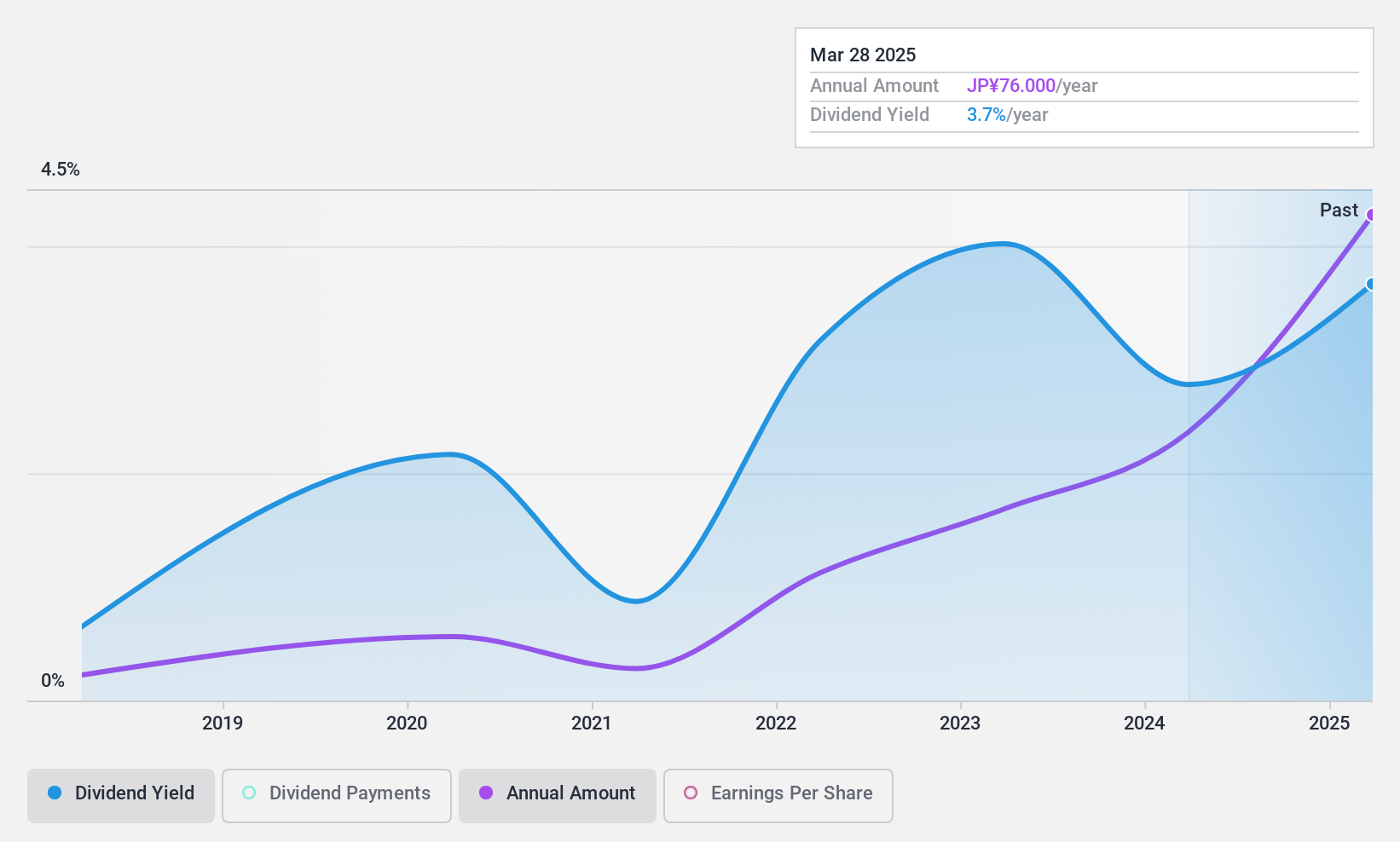

Nippo (TSE:9913)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippo Ltd. and its subsidiaries manufacture and trade industrial materials and plastic molded products in Japan and internationally, with a market cap of ¥19.35 billion.

Operations: Nippo Ltd. generates revenue from several segments, including Mobility (¥16.50 billion), Electronics (¥19.68 billion), and Medical/Precision Equipment (¥6.62 billion).

Dividend Yield: 3.5%

Nippo's dividend payments have been volatile over the past decade, with periods of significant fluctuation. Despite this, the company's dividends are well-covered by both earnings (payout ratio: 47.2%) and free cash flows (cash payout ratio: 28.8%). Trading at 60% below its estimated fair value, Nippo offers a dividend yield of 3.53%, slightly below the top quartile in Japan. Recent shareholder activism saw ESG proposals rejected at their June AGM.

- Navigate through the intricacies of Nippo with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Nippo's share price might be too optimistic.

Summing It All Up

- Discover the full array of 436 Top Japanese Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8508

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion