Three Undiscovered Gems To Enhance Your Investment Portfolio

Reviewed by Simply Wall St

In the current global market landscape, uncertainty surrounding the incoming Trump administration's policies has led to fluctuations in key indices, with small-cap stocks experiencing notable volatility. As investors navigate this environment, identifying undiscovered gems within the small-cap sector can provide opportunities for diversification and potential growth. A good stock in this context is one that demonstrates resilience and potential for innovation amidst broader economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Infinity Capital Investments | 0.61% | 8.72% | 14.99% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Vivo Energy Mauritius | NA | 13.58% | 14.34% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Saha Pathanapibul (SET:SPC)

Simply Wall St Value Rating: ★★★★★★

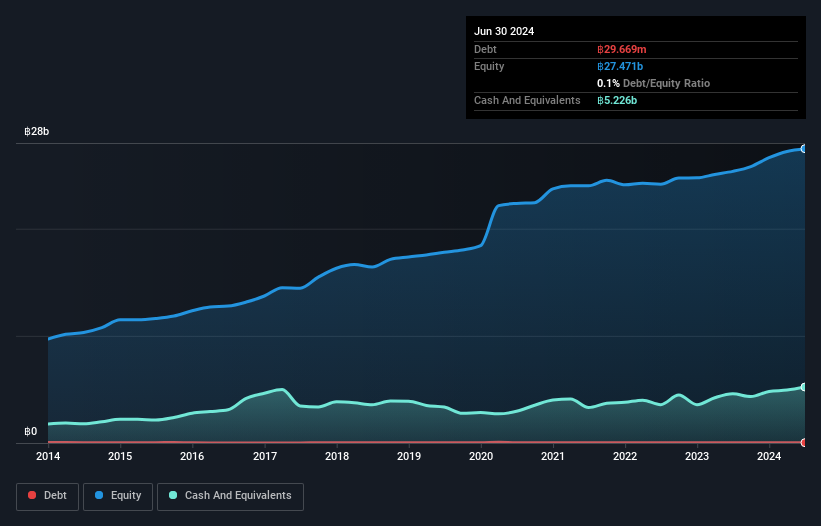

Overview: Saha Pathanapibul Public Company Limited operates in the consumer goods distribution sector both within Thailand and internationally, with a market capitalization of approximately THB19.37 billion.

Operations: Saha Pathanapibul generates revenue primarily from the sales of consumer products, amounting to THB40.27 billion. The company also earns income from office building rentals, contributing THB144 million.

Saha Pathanapibul, a noteworthy player in the retail distribution sector, boasts a price-to-earnings ratio of 7.1x, notably below the Thai market average of 14.6x. This suggests potential undervaluation. Over the past year, its earnings surged by 49%, outpacing the industry growth rate of 2%. The company also showcases high-quality earnings and maintains a stable debt-to-equity ratio at an impressively low level over five years. Recent board decisions highlight strategic focus, such as waiving subscription rights for President Foods Cambodia shares to benefit Thai President Foods, indicating thoughtful resource allocation and partnership strategies moving forward.

- Take a closer look at Saha Pathanapibul's potential here in our health report.

Gain insights into Saha Pathanapibul's past trends and performance with our Past report.

Yamabiko (TSE:6250)

Simply Wall St Value Rating: ★★★★★★

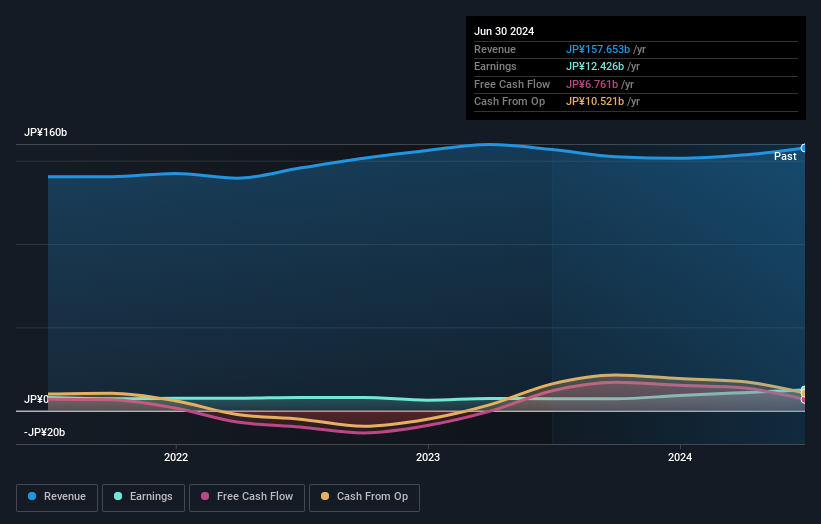

Overview: Yamabiko Corporation, along with its subsidiaries, is engaged in the manufacturing and sale of agricultural machinery across Japan, Europe, the United States, and other international markets with a market cap of ¥104.83 billion.

Operations: Yamabiko generates revenue primarily from the sale of agricultural machinery across various international markets. The company's financial performance is influenced by its ability to manage production costs and optimize its net profit margin, which has shown notable trends over recent periods.

Yamabiko, a promising player in the machinery sector, has shown robust financial health with its interest payments well covered by EBIT at 52.2 times. Over the past year, earnings surged by 73%, outperforming the industry average of 0.8%. The company's net debt to equity ratio stands at a satisfactory 4%, down from 31% over five years, highlighting improved leverage management. With high-quality earnings and positive free cash flow reported recently at ¥17 billion (approx. US$115 million), Yamabiko's price-to-earnings ratio of 8.4x suggests it offers good value compared to Japan's market average of 13.4x.

- Navigate through the intricacies of Yamabiko with our comprehensive health report here.

Evaluate Yamabiko's historical performance by accessing our past performance report.

Great Wall Enterprise (TWSE:1210)

Simply Wall St Value Rating: ★★★★☆☆

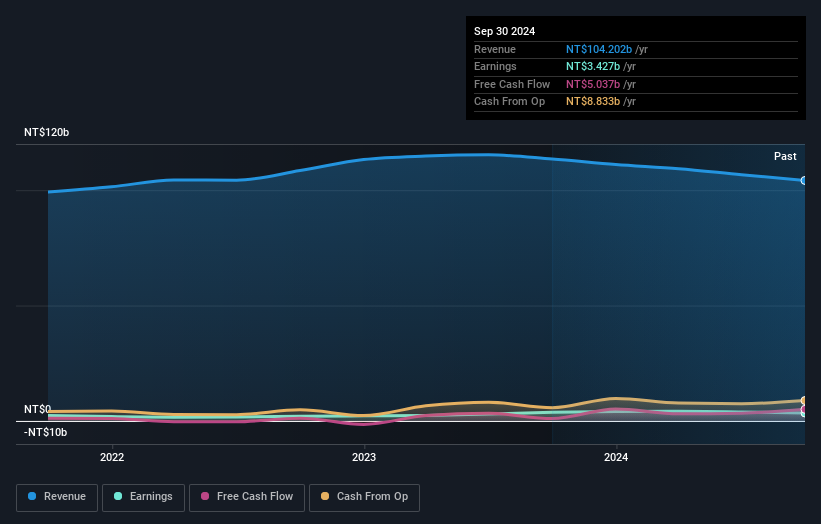

Overview: Great Wall Enterprise Co., Ltd. is involved in the manufacturing and sale of agriculture and grain, meat, and processed food products across Taiwan, China, Vietnam, and other international markets with a market cap of NT$43.55 billion.

Operations: The company's revenue streams are primarily derived from agriculture and grain, meat, and processed food products across various regions. The cost structure involves expenses related to production and distribution in these segments. Gross profit margin trends provide insights into the profitability of its core operations over time.

Great Wall Enterprise, a noteworthy player in its field, recently reported a dip in third-quarter sales to TWD 25.86 billion from TWD 28.34 billion last year, with net income also sliding to TWD 841.8 million from TWD 1.28 billion previously. Although earnings per share fell to TWD 1 from TWD 1.51, the company maintains high-quality earnings and positive free cash flow of over $5 billion this quarter alone, despite the rising debt-to-equity ratio now at 62.7%. While it faces challenges with negative earnings growth of -7.8%, its interest coverage remains robust at an impressive 11x EBIT coverage.

- Click to explore a detailed breakdown of our findings in Great Wall Enterprise's health report.

Explore historical data to track Great Wall Enterprise's performance over time in our Past section.

Next Steps

- Unlock our comprehensive list of 4646 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6250

Yamabiko

Manufactures and sells agricultural machinery in Japan, Europe, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives