Investors Give Yamabiko Corporation (TSE:6250) Shares A 35% Hiding

Yamabiko Corporation (TSE:6250) shareholders won't be pleased to see that the share price has had a very rough month, dropping 35% and undoing the prior period's positive performance. Longer-term shareholders would now have taken a real hit with the stock declining 2.0% in the last year.

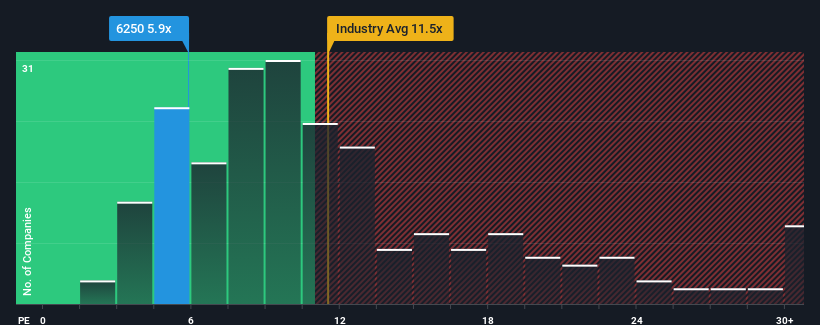

In spite of the heavy fall in price, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 14x, you may still consider Yamabiko as a highly attractive investment with its 5.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been quite advantageous for Yamabiko as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Yamabiko

How Is Yamabiko's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Yamabiko's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 48% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 32% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.8% shows it's about the same on an annualised basis.

With this information, we find it odd that Yamabiko is trading at a P/E lower than the market. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On Yamabiko's P/E

Shares in Yamabiko have plummeted and its P/E is now low enough to touch the ground. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Yamabiko currently trades on a lower than expected P/E since its recent three-year growth is in line with the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching the company's performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Yamabiko, and understanding should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6250

Yamabiko

Manufactures and sells agricultural machinery in Japan, Europe, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.