Odawara Engineering Co., Ltd.'s (TSE:6149) Shares Climb 31% But Its Business Is Yet to Catch Up

Odawara Engineering Co., Ltd. (TSE:6149) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 8.2% isn't as impressive.

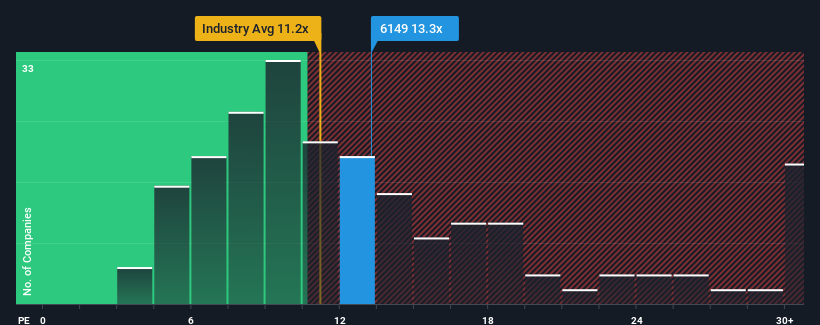

Although its price has surged higher, it's still not a stretch to say that Odawara Engineering's price-to-earnings (or "P/E") ratio of 13.3x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

We've discovered 3 warning signs about Odawara Engineering. View them for free.For example, consider that Odawara Engineering's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Odawara Engineering

How Is Odawara Engineering's Growth Trending?

In order to justify its P/E ratio, Odawara Engineering would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 44%. This means it has also seen a slide in earnings over the longer-term as EPS is down 4.0% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 9.7% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's somewhat alarming that Odawara Engineering's P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

What We Can Learn From Odawara Engineering's P/E?

Odawara Engineering's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Odawara Engineering revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Odawara Engineering, and understanding these should be part of your investment process.

If you're unsure about the strength of Odawara Engineering's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6149

Odawara Engineering

Engages in the design, development, manufacture, and sale of motor and coil winding equipment in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives