- Finland

- /

- Capital Markets

- /

- HLSE:EVLI

3 Top Dividend Stocks Yielding Up To 6.7%

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and consumer spending concerns, global markets experienced volatility, with major U.S. indexes finishing lower despite early gains. As investors navigate these uncertain times, dividend stocks can offer a measure of stability and income potential amid fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.93% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.92% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.05% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.40% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.27% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.90% | ★★★★★★ |

Click here to see the full list of 1995 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

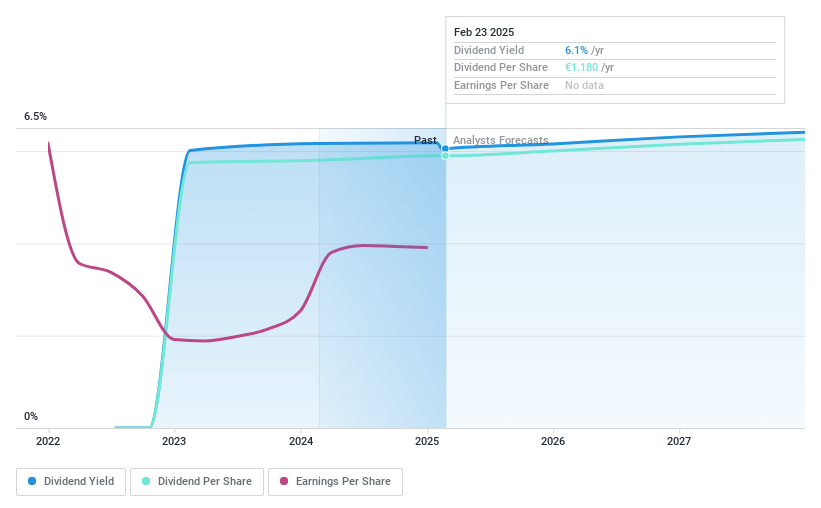

Evli Oyj (HLSE:EVLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evli Oyj, with a market cap of €516.46 million, operates as an asset manager providing services to corporate, institutional, and private clients in Finland, Sweden, and internationally.

Operations: Evli Oyj generates its revenue from three main segments: Group Operations (€20.50 million), Advisory and Corporate Clients (€9.90 million), and Wealth Management and Investor Clients (€96.40 million).

Dividend Yield: 6.1%

Evli Oyj's dividend proposition is notable, with a recent increase to €1.18 per share for 2024, reflecting growth from the prior year. Despite only two years of dividend history, payouts have been stable and are well-covered by earnings (70.1% payout ratio) and cash flows (73.2% cash payout ratio). However, the company faces an uncertain operating environment in 2025, with earnings forecasted to decline slightly over the next three years amidst geopolitical risks and economic concerns.

- Click here and access our complete dividend analysis report to understand the dynamics of Evli Oyj.

- The analysis detailed in our Evli Oyj valuation report hints at an deflated share price compared to its estimated value.

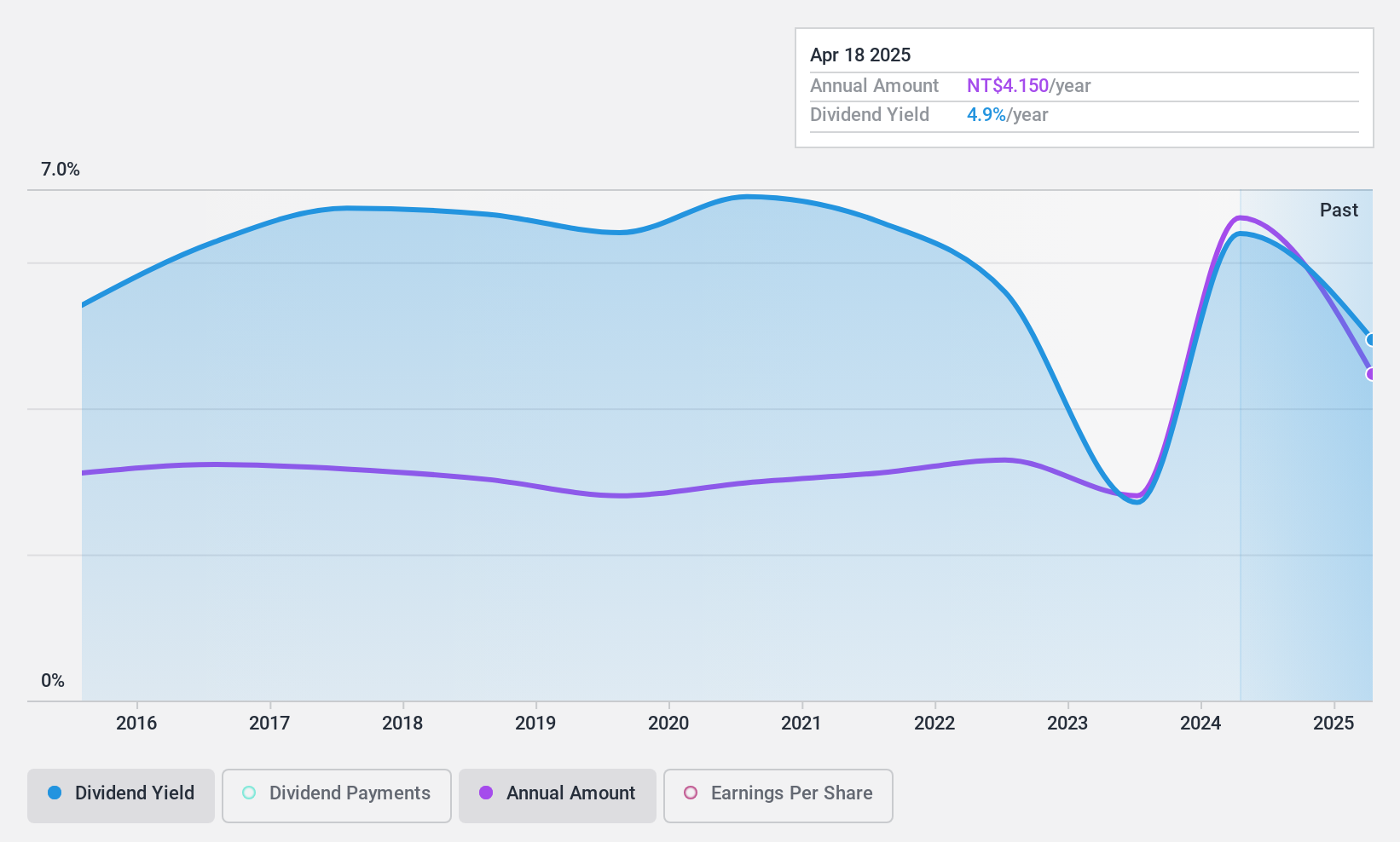

Dynamic Medical Technologies (TPEX:4138)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dynamic Medical Technologies Inc., along with its subsidiaries, specializes in the maintenance and marketing of aesthetic lasers and light-based equipment in Taiwan and Hong Kong, with a market cap of NT$3.32 billion.

Operations: Dynamic Medical Technologies Inc. generates revenue primarily from its Beauty Channel Division, which accounted for NT$231.91 million.

Dividend Yield: 6.7%

Dynamic Medical Technologies offers a compelling dividend yield of 6.71%, placing it in the top 25% of TW market payers. However, sustainability is a concern as dividends are not well covered by earnings or cash flows, with a high payout ratio of 113.3% and cash payout at 236%. Despite this, dividends have been stable and growing over the past decade, supported by reliable payments and consistent earnings growth of 14.8% annually over five years.

- Get an in-depth perspective on Dynamic Medical Technologies' performance by reading our dividend report here.

- Our valuation report unveils the possibility Dynamic Medical Technologies' shares may be trading at a premium.

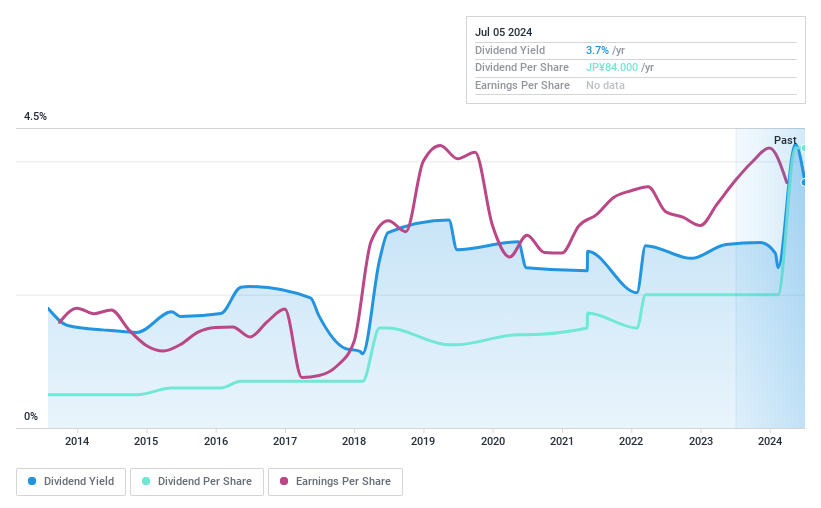

Seibu Electric & Machinery (TSE:6144)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Seibu Electric & Machinery Co., Ltd. manufactures and sells mechatronics in Japan, with a market cap of ¥29.61 billion.

Operations: Seibu Electric & Machinery Co., Ltd.'s revenue segments include the Precision Machinery Business at ¥14.22 billion, Conveyance Machinery Business at ¥10.50 billion, and Industrial Machinery Business at ¥6.66 billion.

Dividend Yield: 4.3%

Seibu Electric & Machinery offers a dividend yield of 4.29%, ranking in the top 25% of Japanese market payers. Despite stable and growing dividends over the past decade, sustainability is questionable since payouts are not covered by free cash flows or earnings. However, with a low payout ratio of 16.8%, dividends are well-covered by earnings alone, though reliance on this factor may pose risks if cash flow issues persist.

- Click to explore a detailed breakdown of our findings in Seibu Electric & Machinery's dividend report.

- The valuation report we've compiled suggests that Seibu Electric & Machinery's current price could be inflated.

Turning Ideas Into Actions

- Explore the 1995 names from our Top Dividend Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evli Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:EVLI

Evli Oyj

Operates as an asset manager serving corporate, institutional, and private clients in Finland, Sweden, and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives