Investors Appear Satisfied With Sodick Co., Ltd.'s (TSE:6143) Prospects As Shares Rocket 26%

Sodick Co., Ltd. (TSE:6143) shareholders have had their patience rewarded with a 26% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 31%.

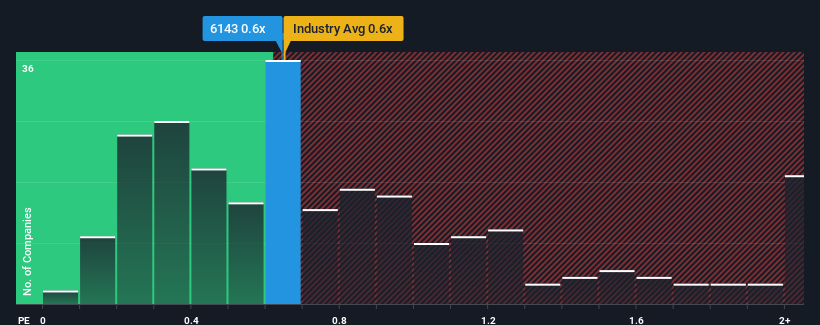

Although its price has surged higher, it's still not a stretch to say that Sodick's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Machinery industry in Japan, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Sodick

How Sodick Has Been Performing

Recent times have been advantageous for Sodick as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Sodick will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Sodick?

In order to justify its P/S ratio, Sodick would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 9.7% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 2.0% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 4.2% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 4.3%, which is not materially different.

With this information, we can see why Sodick is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Sodick's P/S?

Sodick's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Sodick's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Sodick (1 is significant) you should be aware of.

If these risks are making you reconsider your opinion on Sodick, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6143

Sodick

Engages in the development, manufacture, and sale of numerical control electric discharge machines (EDMs) in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives