- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600729

February 2025's Leading Dividend Stocks

Reviewed by Simply Wall St

In early February 2025, global markets have been grappling with tariff uncertainties and mixed economic signals, as U.S. job growth fell short of expectations and major indexes like the S&P 500 experienced slight declines. Despite these challenges, some regions like Europe saw modest gains, reflecting resilience amid trade policy concerns and fluctuating economic growth rates. In this environment of volatility and uncertainty, dividend stocks can be particularly appealing due to their potential for providing steady income streams. Investors often look for companies with strong fundamentals that can sustain dividend payouts even during challenging market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.03% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.79% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.29% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.52% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.46% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.11% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

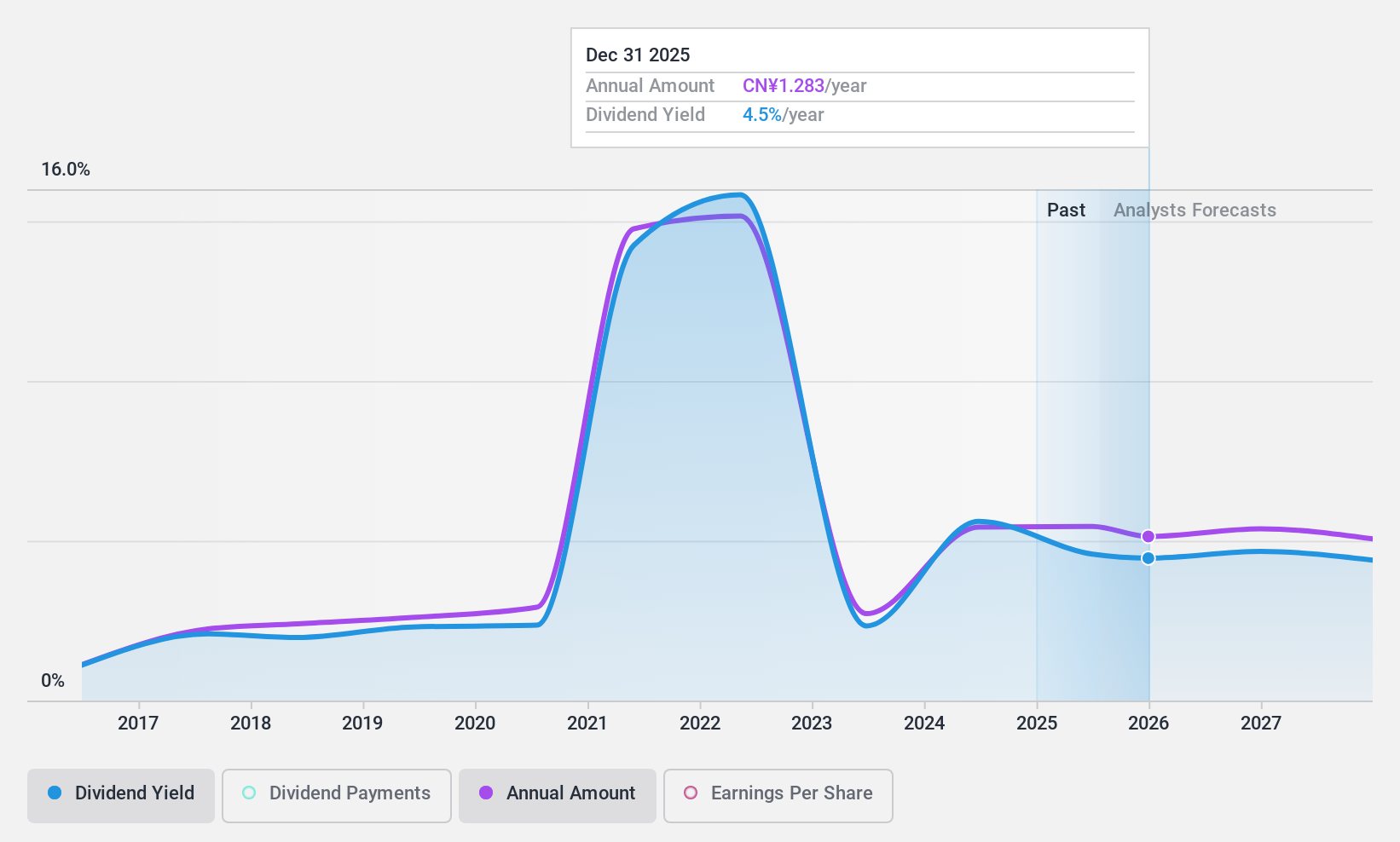

Chongqing Department StoreLtd (SHSE:600729)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chongqing Department Store Co., Ltd. operates department stores, supermarkets, and electrical appliances stores in the People's Republic of China with a market cap of CN¥13.03 billion.

Operations: Chongqing Department Store Co., Ltd. generates revenue from its operations in department stores, supermarkets, and electrical appliances stores within the People's Republic of China.

Dividend Yield: 4.6%

Chongqing Department Store Ltd. offers a dividend yield in the top 25% of CN market payers, with payments covered by both earnings and cash flows, maintaining payout ratios around 49%. Despite its attractive value—trading at 36.2% below estimated fair value—dividends have been volatile over the past decade. Recent earnings show stable net income despite declining sales, indicating some resilience but highlighting potential volatility concerns for dividend reliability.

- Take a closer look at Chongqing Department StoreLtd's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Chongqing Department StoreLtd shares in the market.

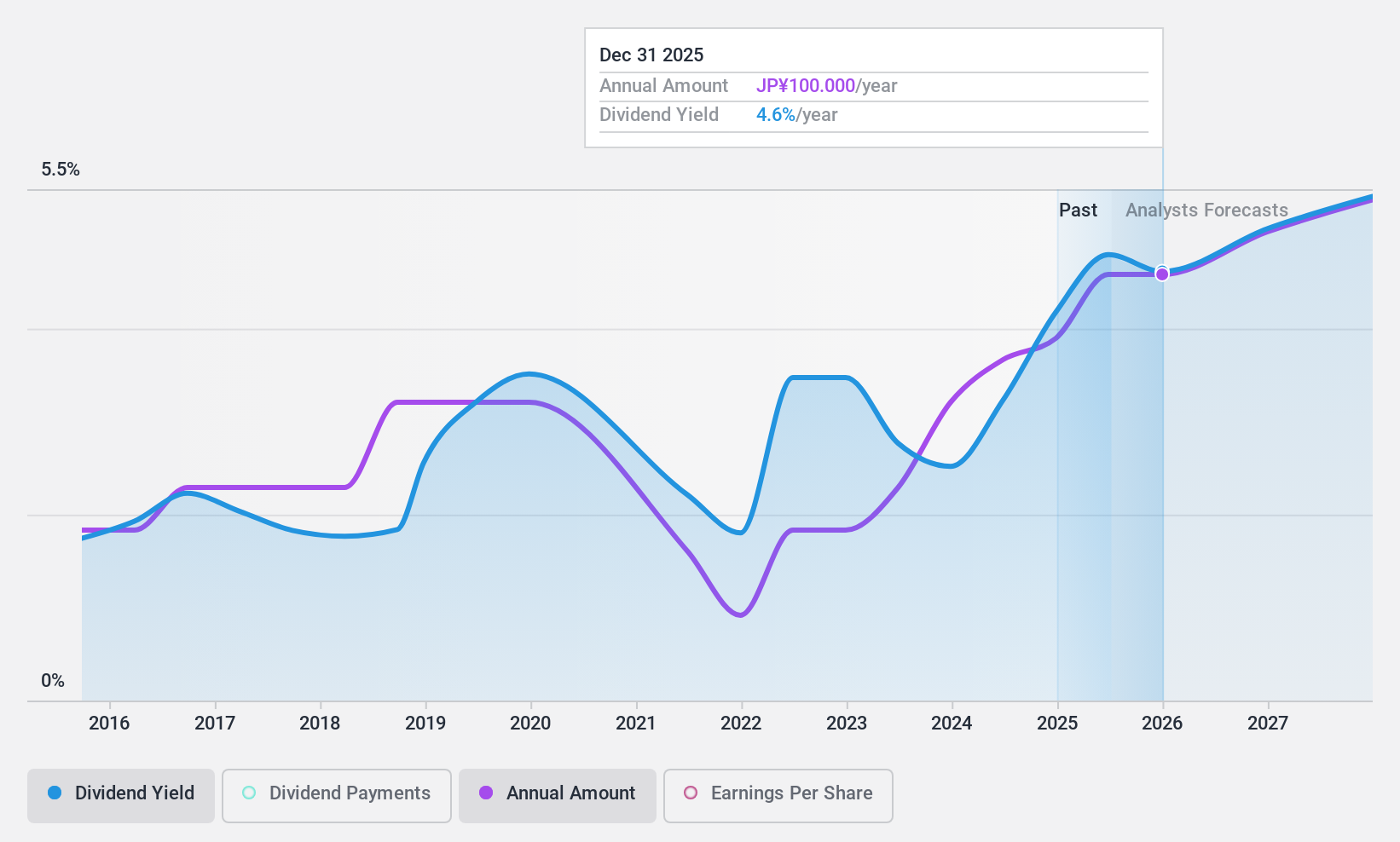

Ryobi (TSE:5851)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ryobi Limited is a die casting manufacturer with operations in Japan, the United States, China, and internationally, and has a market cap of ¥73.93 billion.

Operations: Ryobi Limited generates its revenue from three main segments: Die-Cast at ¥259.87 billion, Printing Equipment at ¥23.68 billion, and Housing Equipment at ¥10.96 billion.

Dividend Yield: 3.7%

Ryobi's dividends are well covered by earnings and cash flows, with payout ratios of 33.2% and 25.4%, respectively. However, dividend reliability is a concern due to volatility over the past decade despite an increase in payments. Trading at 47.3% below estimated fair value suggests good relative value, though its yield of 3.74% is slightly below the top tier in Japan's market. Recent shareholder proposals may impact future dividend policies or strategies.

- Click here and access our complete dividend analysis report to understand the dynamics of Ryobi.

- The analysis detailed in our Ryobi valuation report hints at an deflated share price compared to its estimated value.

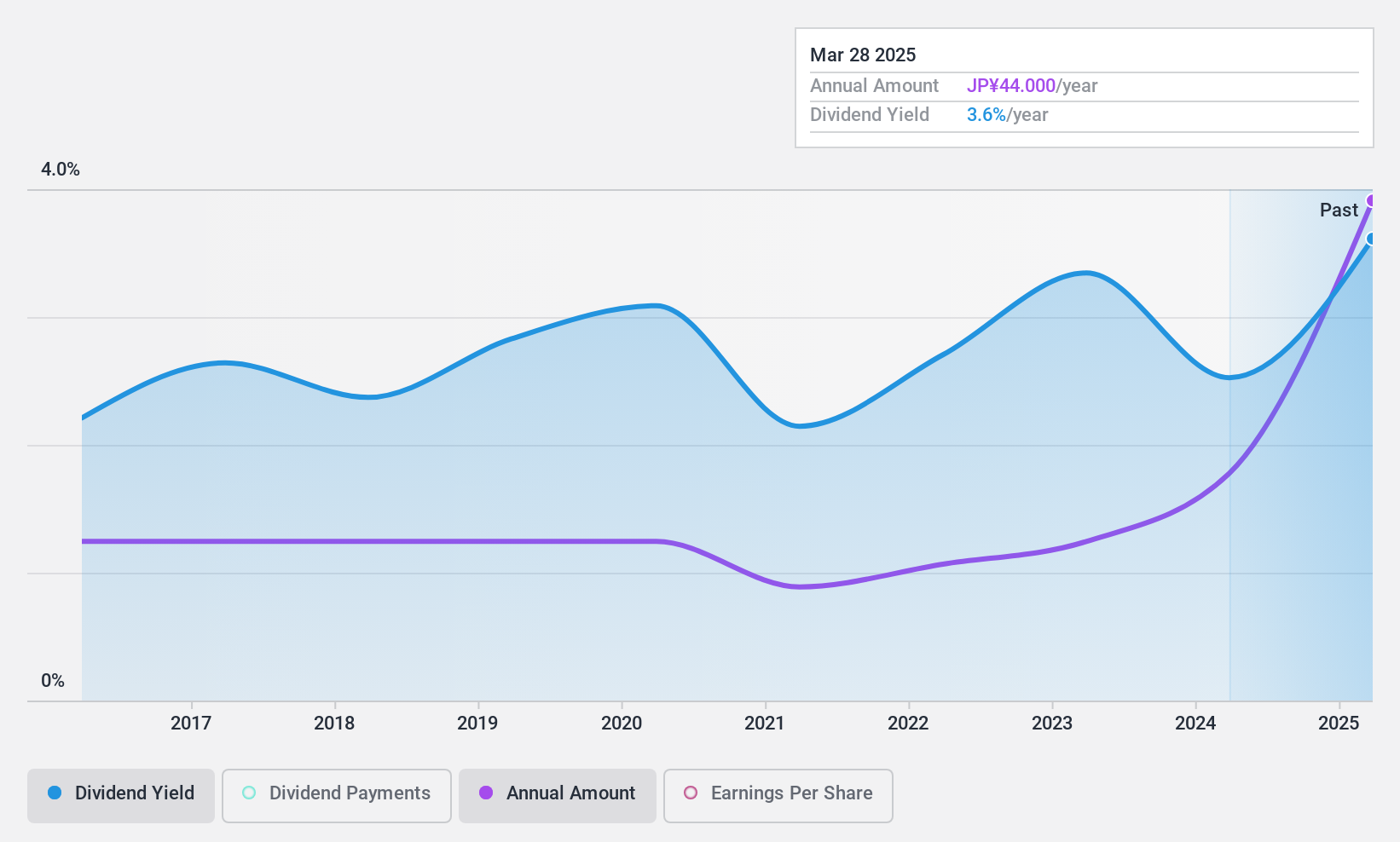

Koike Sanso KogyoLtd (TSE:6137)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koike Sanso Kogyo Co., Ltd. develops, manufactures, and sells gases, welding and cutting machines, and related products for industries processing steel plates, aluminum, and stainless steel both in Japan and internationally, with a market cap of ¥26.31 billion.

Operations: Koike Sanso Kogyo Co., Ltd.'s revenue is primarily derived from its Machinery and Equipment segment at ¥23.98 billion, followed by High-Pressure Gas at ¥19.83 billion, and Welding Equipment at ¥8.42 billion.

Dividend Yield: 3.5%

Koike Sanso Kogyo's dividends are well covered, with a payout ratio of 25.8% and a cash payout ratio of 19.7%, indicating sustainability from both earnings and cash flows. Despite a decade-long increase in dividend payments, their volatility raises concerns about reliability. The yield of 3.64% is slightly below the top quartile in Japan's market, but trading at 75.1% below fair value suggests potential undervaluation for investors seeking dividend opportunities amidst recent financial disclosures.

- Click to explore a detailed breakdown of our findings in Koike Sanso KogyoLtd's dividend report.

- Our valuation report here indicates Koike Sanso KogyoLtd may be undervalued.

Seize The Opportunity

- Click here to access our complete index of 1964 Top Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600729

Chongqing Department StoreLtd

Operates department stores, supermarkets, and electrical appliances stores in the People's Republic of China.

Undervalued established dividend payer.

Market Insights

Community Narratives